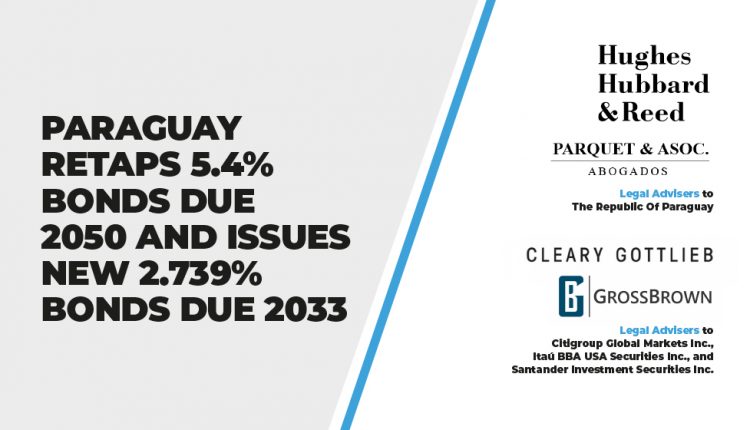

Paraguay retaps 5.4% Bonds due 2050 and issues new 2.739% Bonds due 2033

Gross Brown has advised Citigroup Global Markets Inc., Itaú BBA and Santander

Gross Brown has advised Citigroup Global Markets Inc., Itaú BBA and Santander, as joint book-runners, in the Republic of Paraguay’s (i) USD 225,858,000 principal amount of a further issuance of the Republic’s 5.400% Bonds due 2050, and (ii) USD 600,000,000 principal amount of the Republic’s 2.739% Bonds due 2033, both under, under Reg S/Rule 144A and issued in January 2021. Gross Brown also advised Citigroup Global Markets Inc., Itaú BBA and Santander, as dealer managers, in the repurchase of the Republic’s 4.625% Bonds due 2023 of USD 338,506,000, using proceeds of the aforementioned issuance.

The team was led by Partner Sigfrido Gross Brown, together with Associates Mauricio Salgueiro and Sol Avalos.