How Is Clean Energy Investment Performing?

This article, written by Karun Harrar, touches on how the sector performed in 2018 and gives insights into how clean energy is being perceived in the M&A sphere.

The renewable energy industry took the stock market by storm back in 2006/7, with many renewable energy companies going through high profile IPOs capitalising around USD 1 Billion on the market. In less than two years, there were at least 160 publicly traded renewable energy companies that were generating greater than USD 100 million.

This spike of interest into the sector wasn’t a temporary hype and with pressing concerns for mother Earth and the environment, we thought it would be interesting to see how the clean energy sector is doing. Are companies still interested in renewable energy? Should you be keeping an eye on solar energy and is it worth investing in?

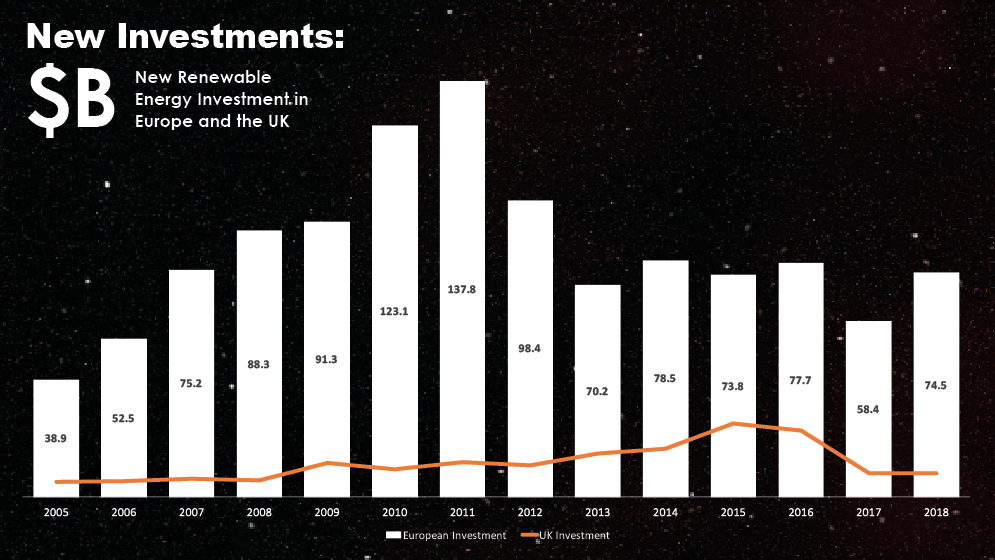

Despite current levels of investment being lower than in 2017, the USD 332.1B worth of clean energy investment in 2018 proves that the renewable energy industry is a force to be reckoned with, with Europe carving ahead with the largest increase in investment globally of 27% in 2017.

Europe’s contributions to the global clean energy investment scene were characterised primarily through the financing of five offshore wind projects, each of which were multibillion-dollar projects.

Clean energy is a business opportunity that creates profitable ways of investing in protecting the earth.

Offshore wind projects alone had attracted USD 25.7B of investment, a 14% increase from 2018. This is a reflection of steadily increasing focus on the offshore wind sector in recent years and driven, in part, by the increasing number of investment access points. This has enabled offshore wind projects to take-off efficiently and much quicker than equivalent solar projects.

Whilst solar projects attracted USD 130.8B in investment, this figure was in fact 24% lower than the USD 172.1B seen in 2017. Multiple variables including changes to tariffs and, in the UK in particular, government schemes, are thought to have had an effect on this decline.

Venture capital and private equity investment allow entry before project initiation. This type of investment amounted to USD 9.2B in 2018 – a 127% increase to that seen in 2017. The top venture capital deal executed in 2018, led by Softbank, was US-based View Inc’s USD 1.1B Series H.

The variety of financial investment tools, such as asset financing and green bond options is likely to have a multiplier effect on the level of available funding for offshore wind projects and other renewable projects alike. In 2018 Amundi and IFC launched the largest green-bond investment vehicle to date. In June 2019, Glennmont Partners, a London-based investment firm with over EUR 1.3B of assets under management (AUM) is set to announce the largest renewable energy fund in Europe.

Investment Vehicles

Clean energy is a business opportunity that creates profitable ways of investing in protecting the earth.

There are various methods by which an investor can get involved, with options available throughout the stages of the supply chain.

Venture Capital & Private Equity

Global venture capital and private equity investment reached USD 9.2B in 2018, a 127% increase on the previous year’s figure. However, in 2008 this value was placed at over USD 10B, six times the value seen in 2017. In more recent years, the R&D lies more and more with large manufacturers, hence as the sector matures, the rate of early-stage investment is likely to fall.

As the majority of currently used energy technologies are well understood and efficient as they can be, the drive to improve them is principally assumed by large manufacturers with sufficient resources. With the exception of certain boutiques, smaller companies would find it hard in a sector dominated by large manufacturers to both develop and commercialise any particular technology on their own.

Considering M&A activity by sector, wind saw a decline of 12% in M&A activity between 2016 and 2017, however, it continues to dominate the renewable energy M&A landscape at USD 62B.

2018’s top venture capital deal was a USD 1.1B Series H for View Inc, specialists in the manufacture of smart windows. Other major deals executed in 2018 include a USD 585M investment into Guangzhou Xiaopeng Motors Technology and USD 795M early stage venture capital investment into the Chinese electric vehicle manufacturer, Youxia Motors. Four out of the top five deals executed in the year 2018 were Chinese companies manufacturing smart energy technologies, at a combined total value of USD 2.35B.

Mergers & Acquisitions

Whilst data for 2018 has yet to be released publicly, acquisition activity in 2017 was valued at USD 114B, a 1% drop seen after seeing four years of growth. USD 87.2B of this was related to the purchase of assets and refinancing deals. Corporate M&A activity, on the other hand, fell in 2017 to USD 14.3B, a 52% decline from the value seen in the previous year. Swimming against the tide, however, was private equity buy-outs which, at USD 11.2B, was four times greater than that seen in the previous year.

23 of the top 30 M&A deals executed in 2017 were wind related – highlighting its potential over other clean energies to consistently dominate the M&A segment in the years to come.

Considering M&A activity by sector, wind saw a decline of 12% in M&A activity between 2016 and 2017, however, it continues to dominate the renewable energy M&A landscape at USD 62B. Whilst Europe and the United States both saw refinancing deals totalling USD 37.2B and USD 30.8B respectively, the largest gains were in fact made in the developing regions of Brazil (112% increase to USD 6.1B) and India (323% increase to USD 1.3B).

Of the USD 62B of M&A activity, wind was dominated by offshore projects in the North Sea with the largest M&A deal made between LM Wind Power Holding and General Electric valued at USD 1.65B in Denmark. 23 of the top 30 M&A deals executed in 2017 were wind related – highlighting its potential over other clean energies to consistently dominate the M&A segment in the years to come.

The net effect of this would mean less responsibility (and hence lower energy bills) on the bill-paying consumer to financially support the operation and maintenance of the renewable energy source.

Green Bonds

Climate awareness bonds issued in 2007 by the European Investment Bank were the first of their kind. Since then the green bond market has experienced massive growth in the last 10 years, with the annual issuance having risen to USD 155B globally in 2017.

Almost a decade ago, green bonds were unheard of. Now they are a key private sector solution which enables the finance of projects, simultaneously benefitting investors. Investors are now looking for smart initiatives that exhibit suitable risk-reward profiles, meeting specific criteria for tenor, yield, geographic diversity and rating, and often projects are looking for alternatives to funding from pension funds and insurance companies which are available in the global capital markets.

A brief history of the green bond shows just how rapidly the market is growing.

Throughout 2017, new green bond issuance grew by 78% to over USD 155B globally and is expected to reach USD 250B in 2018 according to Climate Bonds Initiative. In emerging markets, the majority of green bonds were issued in China and India. However, experts have identified other developing countries to be potential bond-hotspots in the green bond market. Brazilian Development Bank BNDES procured USD 1B in May 2017, in what was at the time the single largest green bond issuance in Latin America, with the cash being directed to the financing of a range of Brazilian solar and wind projects.

A brief history of the green bond shows just how rapidly the market is growing. A USD 440M climate awareness bond was issued by the World Bank in 2008 and four years later the annual global green bond issuance reached USD 2.6B in 2012. IFC issued a USD 1B green bond in 2013, the largest bond benchmark up to date. Only one year later, a USD 36.6B annual issuance was set by the Green Bond Principles in 2014. The then world’s largest green bond at USD 4.3B was set by China’s Bank of Communication in 2016 and the annual issuance was raised to USD 155B in 2017.

In 2018, Europe’s largest asset manager Amundi joined forces with IFC and launched the largest green-bond investment vehicle to date. The Amundi Planet Emerging Green One (EGO) fund is aimed at emerging markets and closed at USD 1.4B. As the earnings are deployed over the next seven years, it is predicted to pump USD 2B into the targeted emerging markets.

Renewable Energy Asset Finance

The top asset finance deal executed in 2018 was the USD 3.34B debt transfer of the Moray Firth Offshore Wind Farm (950MW) in the UK. Additionally, the second highest valued asset finance deal was also in the UK; Triton Knoll Offshore Wind Farm (860MW) was subject to a debt transfer of USD 2.59B in 2018.

In third, fourth and fifth place were the NOORm Midelt Solar Portfolio in Morocco, Borssele III & IV Offshore Wind Farm in the Netherlands and Guangdong Baolihua New Energy Shanwei Lufeng Houhu Offshore Wind Farm in China respectively. Each with a capacity of over 500MW and each valued at over USD 1.4B.

The NOORm Midelt PV Portfolio is the only and largest solar energy project to feature in the top five asset finance deals executed in 2018. Whilst this was also a transfer of debt, the latter two were characterised by a transfer of equity in the projects.

With the global investment in clean energy reportedly exceeding USD 300B in 2018 alone, the 2019 investment scope in this area remains to be ever-complex and interesting. With investment vehicles enabling investors to be more serious when it comes to placing monetary interest into a project, there has been growth in the renewable energy sector, as well an increase in M&A activity in this area. One to keep an eye on, for sure.

Contact

Karun Harrar – R&D Tax Analyst

07789 785 111

Karun graduated with a Masters in Aeronautical Engineering from Loughborough University and more recently gained experience in the Renewable Energy and Finance sectors. His work is focused on developing a network in the Investment industry within Green Energy, specialising in research & development.