Car accidents are often unavoidable occurrences that come with severe and life-altering consequences. Studies show that around 1.3 million people die every year due to road traffic collisions, where most of the victims are pedestrians, motorcyclists, and cyclists. Sadly, many of these traffic accidents are a result of careless and reckless driving. It is therefore important that we drive defensively at all times. Here are some safety driving tips to avoid careless driving accidents.

Regardless of how long you’ve been driving, you must obey all traffic laws. In the United States, some driving rules include:

Remember that these traffic rules were made to keep everyone safe, so you must follow them at all costs. Abiding by them can reduce the chance of you being involved in a car accident. In addition, make sure that you and your passengers are always wearing seat belts.

Speeding is one of the usual causes of car accidents. In some cases, It might not always be the primary cause of an accident, but it usually plays a significant factor. If you have an important event or meeting to attend, make sure you allow yourself plenty of time so that you won’t be tempted to drive hastily.

Distracted driving is another common cause of car collisions. Several distractions can keep you from focusing on the road. Avoid texting, eating, changing radio stations, talking on the phone, mindlessly talking to other passengers, applying makeup, and other activities that can impede your concentration. When you are distracted, it is easy for you to violate traffic laws, resulting in a fatal accident. Make sure that whenever you are behind the wheel, your only priority is to drive safely. Never multi-task even if you think you can do it competently.

Always make sure that you keep a safe distance between yourself and the other vehicles on the road. Never tailgate, even if the car in front of you is driving slowly. Keep in mind that you cannot predict what the other driver is contemplating. If they suddenly stop or change lanes, you may not have enough time to react accordingly.

Driving can be stressful, especially if there are aggressive drivers on the road. Do not let anger get the better of you regardless of the situation. Road rage can lead to serious accidents, so always keep your emotions in check. Never yell, point fingers, or threaten other drivers. Remember that you have no control over other drivers, you can only control your own behaviours and actions. In the unfortunate event that you get involved in a car accident and get charged with careless driving, make sure to seek the assistance of an experienced lawyer right away. Your attorney might advise you to file a civil reservation to protect you from serious legal implications.

Always remember that driving is a privilege and not an entitlement. You must exert all efforts in making sure that you drive responsibly to avoid harming yourself and others.

The claim argued that Zoom violated its users’ privacy rights by sharing personal data with Google, Facebook, and LinkedIn, and allowing hackers to disrupt Zoom meetings in a practice known as “Zoombombing”. In the proposed class action, Zoom’s customers would either be eligible for a $25 refund or a 15% refund on their subscriptions to the video conferencing platform, depending on which sum is larger. The preliminary settlement, which was filed on Saturday afternoon, is still to be approved by US District Judge Lucy Koh in California.

Zoom has agreed to improve its security measures, which will include alerting users when other meeting participants use third-party apps. Zoom will also offer specialised training to employees on privacy and data handling. However, in agreeing to settle, the video conferencing platform has denied any wrongdoing, stating that the privacy and security of its users is a top priority for the company.

As demand for video calls increased during the coronavirus pandemic, Zoom has seen profits of around $1.3 billion from Zoom Meetings subscriptions from class members. However, the plaintiffs’ lawyers suggested that a settlement of $85 million was acceptable given the litigation risks. On top of this figure, they will also seek a maximum of $21.25 million for legal fees.

Harriet Murray, Senior Associate, Hunters Law LLP, explores the implications of paying for the coronavirus pandemic with a wealth tax.

Prompted by the exceptional circumstances of the COVID-19 crisis, in April 2020 a Wealth Tax Commission was established. It was composed of two academics and a barrister to assess whether a wealth tax would be desirable and deliverable in the UK. Their aim was "to provide policymakers with a solid evidence base" and "to deliver the first in-depth analysis of a wealth tax in the UK for almost half a century".

The Wealth Tax Commission worked with international experts including tax practitioners, economists and lawyers to study all aspects of a wealth tax including "issues of both principle and practice", and acknowledged funding from the Economic and Social Research Council through the CAGE at Warwick and a COVID-19 Rapid Response Grant, and also a grant from Atlantic Fellows for Social and Economic Equity's COVID-19 Rapid Response Fund.

Some key recommendations were:

It would be payable by anyone resident in the UK for more than four out of the previous seven years, including anyone claiming the status of a "non-dom". Non-residents would pay the wealth tax on any houses and land owned in the UK whether they own it directly or through trusts or companies.The Wealth Tax Commission did not recommend extending the tax to other assets owned by non-residents except perhaps foreign controlling shareholdings of UK private companies.

The Wealth Tax Commission does not make any recommendations on setting thresholds or rates for the wealth tax, since it is their view that this is a decision for politicians. However, the report contains illustrations of potential thresholds and rates, including that of a 5% rate (taxed as an annualised rate of 1% over five years) applied to a series of personal wealth thresholds ranging from £250,000 to £10 million.

A separate report from the Wealth Tax Commission gives detailed modelling of how much could be raised by a wealth tax, and from whom, at different rates and thresholds. A one-off wealth tax on all individual net worth above £500,000, for example, and charged at 1% a year for five years would raise £260 billion. By contrast, at a threshold of £2 million, it would raise £80 billion. As part of these illustrations, the Wealth Tax Commission clarifies that a wealth tax levied at 1% above £500,000 would require a couple to have net wealth exceeding £1 million before any wealth tax would be payable.

The Wealth Tax Commission has suggested that if, after an assessment date for the wealth tax has been fixed, someone suffers a drastic fall in their wealth for reasons outside of their control, that it would be possible to provide some relief against the tax due. If an individual genuinely could not pay the tax out of income and savings over the standard period payment of five years, then a "statutory deferral scheme" would apply so the tax could be deferred until there were sufficient liquid funds available. In the report, there is also a tentative suggestion of an indefinite deferral where a person's wealth tax bill was more than 10% of the combined total of net income (after all other taxes) and their liquid assets.

The Wealth Tax Commission cites four reasons for taxing all assets (horizontal fairness, vertical fairness, revenue, and avoidance) but recommends that there should be an exemption for any single item worth less than £3,000 to avoid unnecessary valuations and make filing simpler. It would also mean that for most individuals there would be no need to value any of their ordinary household possessions.

The Wealth Tax Commission suggests a one-off wealth tax arguing that it would be better for the economy than rises in VAT, income tax or National Insurance Contributions.

The Wealth Tax Commission's recommendation for a one-off wealth tax, they explain, is an exceptional response to a specific crisis to raise revenue "without discouraging work or spending". They acknowledge it would not fix the existing problems with inheritance tax, income tax on investment income, council tax or capital gains tax so they recommend that there should be reform of existing taxes on wealth as well.

The purpose of a vaccine passport is to allow governments and private businesses to confirm to what degree a person may be at risk of contracting COVID-19 or spreading it to others around them. In its most basic form, a vaccine passport is a (usually) digital record that confirms whether its bearer has received two, one or no doses of a COVID-19 vaccine. This is the model that the UK’s NHS COVID Pass uses. The EU Digital COVID Certificate (EUDCC) goes a step further by also containing information about its bearers’ recent test results and recovery status from COVID-19.

The EUDCC was implemented on 1 July, allowing carriers – who are either fully vaccinated, have contracted and recovered from COVID-19, or have tested negative for the virus within the past day – to use a digital or printed QR code to travel freely among the EU’s 27 member states. Some of these members have instated their own digital certificates for use within their borders, such as France’s health passport that regulates entry to clubs and (soon) bars, cafes and restaurants.

As of the time of writing, the US has no plans to implement a similar system at the national level, with individual states left to determine whether (and how) they will provide residents with a method of accessing state-verified health records. Meanwhile, the NHS COVID Pass remains an opt-in measure for businesses in the UK, though Prime Minister Boris Johnson has stated an intention to “to make full vaccination the condition of entry to nightclubs and other venues where large crowds gather” by the end of September, necessitating its uptake by the general public.

There are few historical precedents for such large-scale monitoring of a health condition. What legal complications will need to be considered in relation to this drastic measure? We spoke with a range of legal experts to get a sense of what might lie ahead.

There are few historical precedents for such large-scale monitoring of a health condition.

As far as the UK goes, one of the most significant pieces of legislation that vaccine passports must contend with is the Human Rights Act 1988. Article 8 of the Act guarantees the right to a “private and family life”, which is interpreted broadly to include personal identity. As John Szepietowski of Audley Chaucer Solicitors points out, this could be said to extend to one’s medical status as well, though this right may be suspended “in the interests of national security, public safety or the economic wellbeing of the country, for the prevention of disorder or crime, for the protection of health or morals, or for the protection of the rights and freedoms of others.”

Key to the issue here is whether or not the use of vaccine passports is proportionate to the crisis at hand. While necessarily restricting some movement, this would be limited only to specific venues and would not prevent other meetings or social interactions more broadly. By virtue of being so limited in scope, Szepietowski argues, the passports are unlikely to infringe upon Article 8. Other notable Articles of the Act – such as Article 2’s “right to life” or Article 5’s “right to liberty” – may be pertinent to the question of mandatory vaccination, but are sufficiently separated from the issue of passports as to pose little concern in this area.

A key factor that has delayed widespread implementation of vaccine passports has been its lack of availability to younger, less vulnerable adults as vaccinations for the more at-risk have been prioritised. As Szepietowski notes, the creation of a system that tacitly restricts freedoms based on age raises the possibility of discrimination.

“Beyond this, however, there could still be age discrimination because more young people are concerned about the long-term impact of the jab,” Szepietowski continues. “This links to gender discrimination as well, as more women than men have concerns about fertility and the vaccine, and so are less likely to take the vaccine. Likewise, those from Black or Minority Ethnic backgrounds are less statistically less keen on the jab, and so passports could be seen to discriminate against them as well.”

[ymal]

This situation for young people has begun to shift, as all adults in the UK have now been given the opportunity to receive two vaccinations (though not all have yet been able to attend their appointments), but issues of discrimination in other areas, such as race, have risen to the fore. The EUDCC has already come under fire from the African Union for not recognising the Indian Covishield vaccine, which has been distributed to many low- and middle-income countries through the EU-supported COVAX programme, and vaccine uptake among ethnic minorities remains proportionately low.

As age and race are classed as protected characteristics under the Equality Act, there may be a legal basis to claim discrimination here. However, a strong counterpoint exists in the vaccines’ availability to all, with no need to bring an ID or any more personal information to a walk-in vaccination centre other than a name, address and date of birth. Once vaccine rollout programmes in the UK and elsewhere begin to wind down, the state of being unvaccinated is far more likely to come down to personal choice than an act of discrimination against a protected group of people.

Perhaps the biggest challenge standing in the way of widespread vaccine passport implementation is the security risk represented by the data that the passports would be based upon. Any kind of medical data is already valuable due to its personal nature, and its sensitivity only increases when it is relied upon for travel and access to local facilities.

A particular concern raised by Tim Mackey, principal security strategist at the Synopsys Cybersecurity Research Centre, is that of third-party apps – whose use has become widespread in Europe as part of accessing the EUDCC – and the possibility of a bug or an outside attacker disrupting their function. This point ties in with the need to ensure that a digital passport’s authenticity in the first place.

Any kind of medical data is already valuable due to its personal nature, and its sensitivity only increases when it is relied upon for travel and access to local facilities.

“Significant coordination between international entities is required to ensure that the data recorded by the app is correct and complete,” Mackey explains, noting that the act of safely transferring data to the app would be its own challenge. “Once in the app, the data needs to be verifiably secure and stored in a tamper-evident form that itself can’t be modified.

Balfour+Manson chairman Elaine Motion raises further questions regarding how the information pertinent to vaccine passports will be handled by the private sector: “For example, if shown to nightclub personnel, do they store the information and if so how, for how long and who can access that information?” The question of how long a government organisation might retain the data is also unclear. Whatever the case, the implementation of a passport requirement for travel and domestic activity will require intense scrutiny to ensure that the sensitive information at its base is not mishandled.

Potential employment-related issues with the passport system largely intersect with concerns about discrimination based on vaccination status. While most offices have adopted a vaccine-positive mentality, and “no jab no job” policies have been instituted in many areas, a small percentage of the workforce who have voiced opposition to being compelled to be vaccinated will likely oppose the requirement of a passport to verify their medical history as a prerequisite for work. If these employees also belong to a protected group, disciplinary action against them may result in a discrimination claim. The same issue may arise if it is perceived that employees are treated differently based on their vaccination status.

In cases where employees are expected to work with those most vulnerable to COVID, of course, the situation may be different. From October, anyone working in a CQC-registered care home in England for residents requiring nursing or personal care will be required by law to have received two doses of a COVID-19 vaccine unless they are subject to a medical exemption. If any other professions should receive this treatment, however, they are likely to only make up a fraction of the overall UK workforce, however.

A small percentage of the workforce who have voiced opposition to being compelled to be vaccinated will likely oppose the requirement of a passport to verify their medical history as a prerequisite for work.

Furthermore, Katten Muchin Rosenman partner Christopher Hitchins points out that employers would need to comply with GDPR when storing this information, sparking its own host of pitfalls. “According to the UK data protection regulator (the ICO), the reason for recording your employees’ vaccination status must be clear and compelling,” Hitchins notes. “If you have no specified use for this information and are recording it on a ‘just in case’ basis, or if the employer can achieve their goal without collecting this data, they are unlikely to be able to justify collecting it.”

A company that mandates a vaccine passport would therefore do well to ensure that its need is genuine and take all due care to avoid altering its treatment of employees based on their COVID-19 records.

Perhaps the only certain result of the widespread rollout of vaccine passports is the strain that it will place on the affected industries. The travel, hospitality and leisure sectors, already hampered by a year and a half of slackened demand and heightened regulation, will be further pressed by the responsibility to validate these passports and handle situations with customers who feel they ought to be exempt.

Lucy Gordon, Director of the Employment team at Walker Morris, stresses that the added pressure may be too much for struggling businesses to handle. She states: “Employers will need to allocate resources to checking passes, and train staff on what to look out for and how to handle difficult cases. This all comes at a time when the hospitality industry is already strained and suffering additional resource issues due to the “pingdemic”, with staff being forced to isolate or having to stay at home to look after family members.”

It is also unknown for how long the vaccine passport system will last – likely until the WHO declares the pandemic finished, whenever that may be. Until then, we will watch with close interest as the situation develops in the UK and internationally.

Discroll died in September 2016, eighteen months after being diagnosed with ovarian cancer. Her relatives had sought up to $50 million in damages, claiming that Johnson & Johnson knew that both its baby powder and its Shower to Shower products were unsafe. The lawsuit was brought by her niece who oversees Driscoll’s estate.

However, following a three-week trial, jurors in St. Clair County, Illinois, ruled in favour of Johnson & Johnson. Although the company said that the verdict reflected the science and facts of the situation, Johnson & Johnson also expressed their deepest sympathy for anyone suffering from cancer.

In 2020, Johnson & Johnson set aside $3.9 billion for legal expenses, predominantly for talc-related liabilities such as this one. Recently, the company said it faces around 34,600 lawsuits over its talc-based powders. Leigh O’Dell, who represented Elizabeth Discroll’s family in the case, said that there is overwhelming evidence that links genital talc to ovarian cancers.

Irish specialist software integration firm SL Controls was acquired by NNIT Group, one of Denmark’s leading suppliers of IT services in the global life sciences industry. Philip Lee acted for SL Controls on its acquisition by NNIT A/S, while Capital Law CPH and Dillon Eustace acted for the buyer.

SL Controls is an international provider of equipment system-integrated solutions to various world-leading brands in the medtech, pharmaceutical, healthcare and technology spheres, and is expected to meet target revenues of more than €10 million in 2021. Its acquisition is expected to strengthen NNIT’s solutions within production IT and provide SL Controls with new opportunities to continue its global growth.

The deal represents an enterprise value of €16.9 million, comprising an up-front payment of €12.7 million before adjustments with an earn-out element of €4.2 million.

The Philip Lee team included Corporate and M&A team members John Given, Rebecca McEvoy, Rebecca Clabby and Daniel Ryan. The Dillon Eustace team was led by Adrian Benson, Partner in the Corporate and M&A teams, with support from David Lawless, Head of Tax.

Hamilton Beach Brands, Inc, a wholly-owned subsidiary of Hamilton Beach Brands Holding Company, has entered into a strategic partnership with HealthBeacon Limited, a leading developer of smart tools for managing injectable medications at home. The partnership intends to launch a smart Injection Care Management System (ICMS) in the US and Canada under the new brand name Hamilton Beach® Health in the fourth quarter of 2021.

The ICMS will include a new Smart Sharps™ Bin from Hamilton Beach® Health powered by HealthBeacon. The system, together with its companion app, provides medication management reminders, tracks adherence, and facilitates the safe and convenient disposal of used sharps through the US Postal Service’s approved mail-back program. Hamilton Beach Brands will be the exclusive marketer and distributor to the retail and direct-to-consumer channels in the US and Canada, in addition to providing the brand identity. HealthBeacon will manufacture, activate the technology, manage data and security, and collect and replace disposal bins.

Philip Lee, led by John Given and Ronan Dunne, advised HealthBeacon on the partnership.

An Interview With John Given & Ronan Dunne at Philip Lee

What expert knowledge did your team bring to this deal?

Philip Lee has specialist expertise in the areas of life sciences, medtech, international trade, and regulation and compliance. In addition, we have a first class commercial contracts unit.

Working closely with the HealthBeacon team, we were also able to liaise collaboratively with our US-based colleagues to ensure a timely, seamless and expert output within a very ambitious time frame.

What could potentially go wrong when negotiating partnerships like this? How do you prevent this from happening?

It is very important that the commercial principles underpinning deals such as this are agreed upfront and comprehensively. Once this is done, the legals should not pose any problems or present any surprises, but it is also important to make sure that the principals are aware of the many ‘second order’ issues that are likely to arise within the legal process which had not previously arisen in the commercial forum. Once there is a high level of coherence and good communication between the various stakeholders, problems will certainly be avoided.

There is always the risk that cross-border commercial deals, particularly within regulated areas and with a good deal of complexity, can get bogged down in irrelevant minutiae and process. A key role for the lead advisors, again working closely with the project owners, is to project-manage the transaction so that these types of issues do not arise.

Did you encounter any significant challenges while working on this partnership? If so, how did you work around them?

The key challenges were all related to ensuring that the commercial intent of the parties could be achieved within the respective legal and regulatory frameworks of both the US and Ireland. We were pleased that, due in no small part to the high level of collaboration and communication between all stakeholders in the project, these challenges were identified and navigated successfully and without difficulty.

Hence, we are launching a new monthly feature on legal marketing designed to guide you through the law marketing landscape and help you to gain a better understanding of how to effectively market your business. This month, we begin with the question of how much money you should spend on your law marketing budget.

Deciding your budget should be the first thing you do before you make any other decisions on your legal marketing strategy. Without knowing your budget, you will not be able to measure your success, which could lead to a marketing strategy that is operating blindly and does not deliver. Measurement is the key to a successful marketing strategy and the budget is the start point for that process.

In short, there is no one figure that you should spend. According to recent American Bar Association reports, fewer than half (46%) of law firms have a marketing budget, and only 14% of solo law practices have a defined budget. It seems that relying on word of mouth and referrals is still the preferred method of attracting new clients. However, doing this could mean that your law firm is missing out on a lot of potential clients and revenue.

Most law firms that do have marketing budgets spend between 2 and 15% of their revenue on their marketing output, with the majority of outlays skewing more towards the lower end of those figures. But if you are a smaller firm spending at that lower end, the odds are that your marketing might not deliver the results you desire. Effective legal marketing budgets should be based on your individual law firms and a variety of factors. It is also vital to remember that a smaller marketing budget well spent is better than a bigger marketing budget used poorly.

Most law firms that do have marketing budgets spend between 2 and 15% of their revenue on their marketing output.

This guide will go through the best steps to create your law firm’s marketing budget to maximise your return on investment and win you the most new leads.

In the last few years, the legal marketing landscape has changed significantly; the days of simply providing a good service and relying on the wheels of the referral network to turn are over. Now everything is more sophisticated, more strategic and more connected both within the online sphere and outside it. As legal marketing becomes more prevalent, marketing budgets have risen, with law firms slowly realising they need to increase their marketing outlay in order to develop their business. This year it has been reported that 62% of legal businesses are looking to increase their focus on marketing efforts and business development – a figure surely inspired by the fact that 41% of law firms that have increased focus and expenditure in marketing have reported it as the single factor that has been most effective in driving new business.

It is these figures that have led to a huge increase in legal marketing. According to the 2018 legal report by the Legal Marketing Association and Bloomberg Law, the world’s largest law firm by revenue – Kirkland & Ellis, who earned $4.1 billion dollars in 2019/2020 – will be among those spending 2.67% of their revenue on marketing, which equates to an eye-watering $84.5 million dollars. Whether or not your law firm earns thousands, millions, or indeed billions, the simple truth is that you need to know how to create an effective budget for your marketing. But it is not quite as simple as just throwing money at a problem.

This year it has been reported that 62% of legal businesses are looking to increase their focus on marketing efforts and business development.

The report from the Legal Marketing Association and Bloomberg also contained some very revealing statistics regarding the expectations and realities of lawyers and attorneys when discussing marketing. Nearly half (48%) of respondents felt that their rivals were doing better marketing than their law firms and 91% of lawyers relied on marketers (both in-house and external) to deliver marketing and business services, yet only 19% of those lawyers believed that the size of the budget had hindered growth. But could this reluctance to invest in the right way be why half of their rivals are outperforming them?

Simply put, there is no one rule for what your law budget should be and there is no one figure. The truth is that each law firm should have its own budget based on its goals at that particular time; so while the top 200 law firms in the US and UK spend between 2.67% and 4% on their marketing budget, that does not necessarily mean that you should follow suit.

The example above highlights what Kirkland & Ellis are spending as a percentage of their revenue, but it is important to remember that your law firm might not be competing with Kirkland & Ellis. Your law firm might serve a different location, a different customer and be at a different stage of your business life than Kirkland & Ellis and these factors will determine what your budget should be, not what the other law firms are doing.

[ymal]

So how do you decide what you should spend on law marketing? Below, we will outline the best practice for creating your own bespoke law budget for your business. A marketing budget that is tailored to your business and that will help you achieve your goals. Let’s take a look at the various factors you need to consider when creating your marketing budget.

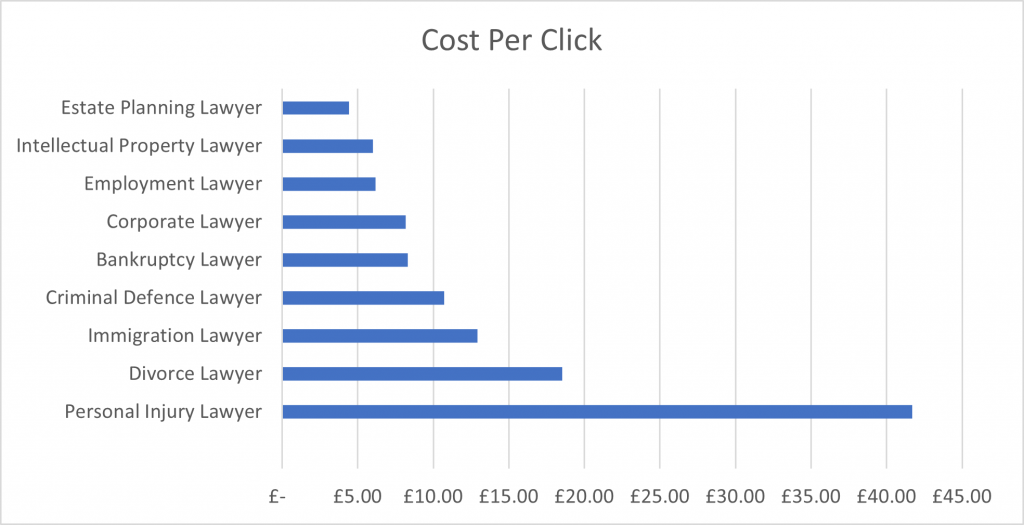

Different types of law cost different amounts to market. For example, in paid search engine marketing, personal injury lawyers cost four times as much to advertise as criminal defence lawyers. You can see from the chart below how the different types of law that you practice will have an effect on your budget.

For example, a personal injury law firm will need to allow more budget for marketing than an estate planning firm because the market is that much more competitive and therefore expensive to market in. By utilising this chart as a guide, we can easily calculate the increase or reduction in budget depending on your business’s area of legal practice.

Within this area, another factor you need to consider along with the type of law you practice is whether you serve business clients or if you are B2C (personal injury lawyer, divorce lawyer, etc.), because this too will have a bearing on your budget. Traditionally, any industry serving the B2C market is more expensive to market to, so if you are a commercial litigation lawyer, your advertising spend is likely to be less than a firm of divorce lawyers.

If you want to work off the old-fashioned marketing budget calculation and fall in line with what the bigger law firms are spending, then all you need to do is take your revenue – either existing or desired for the year – and work out 3% of that figure. For example:

Yearly gross revenue £100,000 X 0.03 (Your marketing budget percentage based on top law firms)

= Your yearly marketing budget (£3,000)

This may not seem like a lot to you. That is because one of the reasons that the top law firms spend a small percentage on marketing is because, as a proportion of their revenue, the figures are a lot bigger due to the size of their revenue (and, crucially, their profit margins – more margin means more money for marketing). For a company that turns over £100,000 annually, a mere £3,000 for the year is probably not going to serve you very well in a competitive marketing environment.

Your marketing budget needs to reflect your revenue and your goals. If you look at the marketing spend of the top law firms, you will spot a pattern:

Top Law Firm Marketing Spends

So as the revenue decreases, the marketing spend as a percentage of revenue increases with it.

It would also be worth mentioning that, from a marketing perspective, law firms spend very little compared to other industries. In fact, across sectors, the average SME spends around 11% of its revenue on marketing. But law firms that are prone to relying on referrals still spend very little by comparison.

My tip would be to treat your law firm like an SME in another sector and ignore what the other law firms are doing. If 41% of legal businesses are driving more leads as a result of increased marketing spend, then surely it would make sense to allocate more budget and use it well in order to get more customers?

If you did this and used the same calculation as shown above, your legal marketing budget would increase to £11,000, and with a good marketing strategy you could be very confident of earning a very significant ROI (return on investment) with that budget.

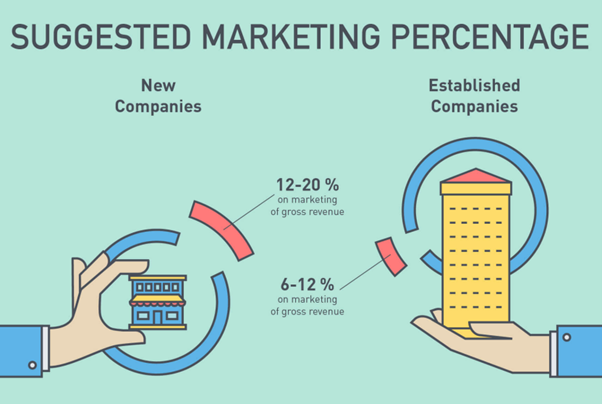

Another important element to consider is the current position of your law firm. We have touched upon the top law firms and the amount they spend, and one of the factors driving those proportionally low expenditures being the sheer size of their balance sheet, which allows them to spend vast amounts on marketing. However, another facet of those law firms that spend a low percentage of their revenue is that they have something in common: they are well established, large law firms. Those types of firms have gained such a reputation that clients will actively seek them out, not the other way around. Your law firm may not have that advantage – yet.

A good way to think of this is that, if you are an established company, you can probably afford to spend a little less than a brand new law firm. As a general rule across business (if we ignore the legal marketing averages, which we know are quite low), it is commonly accepted that established companies will spend between 6-12% of their gross revenue, and new businesses will spend significantly more (between 12-20%) to allow them to gain a foothold in the market and become an established brand.

Although this might seem like a lot to spend in comparison, if you are new to proceedings then it is a solid strategy to follow this rough outline. Remember that the number is a only a guide.

An essential tip would be to consider your company standing from a customer perspective and not your own. If you have already got a good marketing presence (such as a good website, a content strategy, Search Engine Optimisation, social media etc.), then you could class yourself more in the ‘established’ category even if you are a law firm that has only been open for a few years. But if you have none of those things and your marketing amounts to very little, even if your law firm was founded in 1862 you must class yourself as one of the new guys in the marketing world, because while others in the legal profession may know your name, it is highly likely that – without any previous marketing – your target audience will not.

This is an often overlooked element of creating your legal marketing budget. As I have stated previously, there is not and should not be a one-size-fits-all budget for a law firm and the location of your business is hugely important in determining how much you need to spend. It is well known that there are some locations with more law firms, attorneys and lawyers than others, so we can deduce that if you are operating in one of those areas you will need to spend more than someone with a law firm in a small town. Take a look at the numbers below:

New York City

Law Firms – 9,877

Attorneys – 105,559

Dallas, Texas

Law Firms – 3,286

Attorneys – 18,809

As you can see, there are three times as many law firms in New York than in Dallas, and over 80% more attorneys in practice – many of whom are vying for the same customers as your law firm. You need to consider how this impacts your budget, because it is clear that a law firm in New York is going to have to spend more than one operating in Dallas due to the competition already present in the area.

This needn’t be as childish as finding out what your competitors spend and then adding 10% on top of that figure, but it is very useful to benchmark by making yourself aware of your competitors’ marketing practices and working out roughly how much they are spending. Assuming their marketing is good, if they are spending £10,000 a year on marketing and you are spending £2,500, who do you think will be getting more leads and securing more new customers?

Although as mentioned previously a smaller budget spent well can outperform a larger budget spent poorly, it is likely that if your competitors will be able to reach more customers if they are spending significantly more than you on marketing. The best practice here is to try and stay at least on a par with your five closest competitors. For example, one competitor might have the following in their marketing canon:

We can surmise that if the website and PPC campaign look good, they are likely to be spending at least £16,000 on marketing in a year. If you do not benchmark against your competitors and you are not aware of this, you probably will not be in a position prepare to compete with them. It does not matter if you do not necessarily spend the same; just make sure you include it as a factor when you are building your budget. This also works both ways, so if all your competitors’ marketing is non-existent, then to capture a larger share of the market you can get away with a smaller budget.

Here is a tip for existing law firms, or new ones with a good grasp on current client sales and value: part of your budget needs to be tailored to your target customers and current clients.

If your average customer spends £2,000 and never returns to do business with you again, you will not have much money left over for marketing and will need to cut your cloth accordingly. However, if your average client spends around £10,000 per case, and they work with you twice a year on average for 5 years, then that means your average customer value is £100,000. That is likely to increase your profit margin greatly per client, allowing you to spend more on marketing.

If your clients fall into the latter category, it would also be good practice to increase your marketing budget, because higher value clients tend to need more convincing to go to a new law firm, and marketing can be an excellent way to begin and build your profile with them and eventually welcome them on board as a new customer.

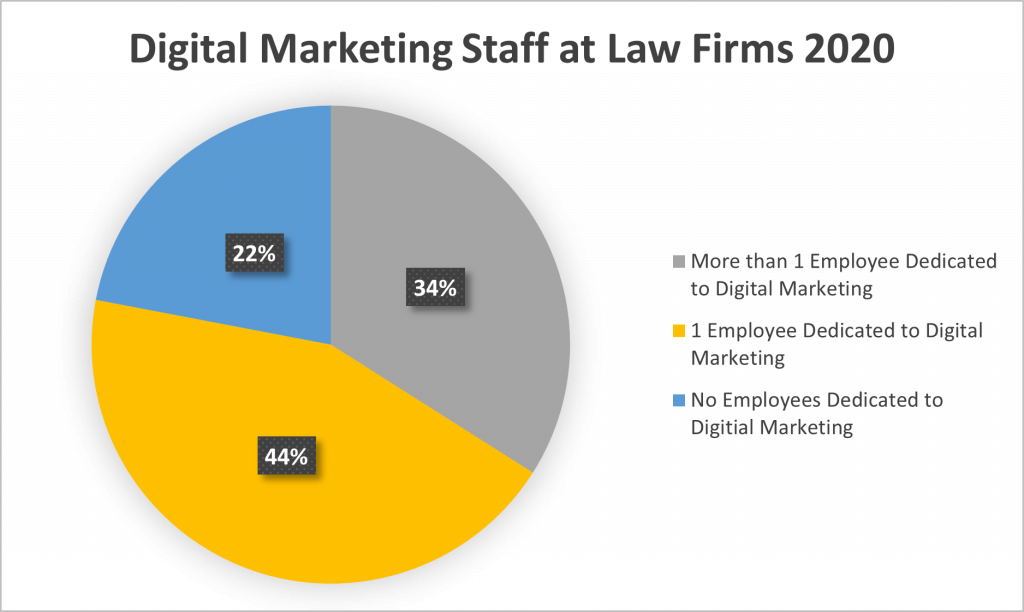

The last point to bear in mind is your current marketing status and infrastructure. If you are new to the marketing side of the legal world, then you might not have any dedicated resource for marketing, which will become a factor in your marketing budget. In fact, in a recent ABA survey, 97% of firms with over 100 staff reported having a marketing team, whereas in firms with under 49 employees and solo law firms that figure falls to just 37%. Only a year or so ago, 66% of law firms stated that they had either only one full-time member of staff or none dedicated to digital marketing, which is the largest growth area across all marketing.

If you fall into the 66% category, then realistically you will need to consider this when creating your budget, as it is a resource that you currently do not have but almost certainly need. You do not necessarily have to employ more people; it may serve your law firm better to use an external legal marketing agency to help you with your marketing, which can keep time, costs and administration lower for your business.

If you already have an entire marketing team in place, then you should naturally be able to minimise this part of your budget.

If we start at an absolute minimum of 3% of revenue as the least your law firm will be spending on marketing, we can amend and adapt this figure based on the factors previously mentioned. Start with a blank piece of paper, write down your own responses to each one, and then you can begin to make informed decisions about your budget. Once you know these factors and you have made a note of them, you can define your goals and set yourself a measurable, specific budget aligned to these goals.

If your goal is the most common in legal marketing, which is lead generation and more customers, then you can calculate your budget based on the above factors to give you a bespoke budget that will work best for your law firm. See the example table below for a fictional personal injury lawyer in London.

| Budget Factor | Current Status | Budget Impact |

| Type of Law | Personal injury. Exclusively B2C Clients. | Increase. Personal Injury is the most expensive type of law to market and B2C is more expensive than B2B. |

| Company Revenue | £250,000 | Using revenue calculation, the lowest figure to spend (3%) should be £7,500, and the highest figure (20%) should be £50,000. |

| Company Standing | Firm opened in 2018. Marketing presence minimal. | Increase. New companies should move into the 12-20% of revenue range. |

| Location | London | Increase. There is a large volume of personal injury law firms in the area. |

| Competitors | Large volume. Several with sophisticated marketing strategies. | Increase. The firm needs to move closer to competitors’ marketing spends to compete. |

| Customer Value | Average fee £5,000. Customer lifetime value average £15,000. | Decrease. This is a fairly low average fee for location and a small lifetime value of customer. |

| Current Marketing Status | No marketing staff or external agency. Website created in 2018. No blog function and limited website appearance, functionality and Search Engine Optimisation. | Increase. The lack of a current marketing resource needs to be addressed in order to create and implement a successful strategy. |

| Proposed Marketing Budget | £37,500 - £50,000 (Between 15-20% of revenue) |

Using the above table, if you are a new law firm starting out in London that works exclusively B2C with clients who have a lot of competitors, you know that your marketing budget will need to be higher at somewhere around 15-20% of your projected revenue. If in the table above we used an established law firm working in estate planning with few competitors in a small town, you could realistically look to spend between 6-10% of your annual revenue, or potentially less if your marketing strategy was well implemented.

The key when preparing your marketing budget is to consider all the factors to create your own bespoke budget rather than using an arbitrary figure that Google told you. The creation of a budget for your legal marketing is the start of your law firm’s marketing journey and it deserves time and attention. If you follow this legal marketing budget guide, you are far more likely to succeed in growing your business and winning more customers.

Richard Mabey, CEO and co-founder of Juro, explores five common problems that in-house legal teams face with contracts.

In-house legal teams at fast-growing businesses naturally have a lot on their plates - serving a business that may double or triple in headcount, while legal resources remain more or less the same. In this kind of environment, more than most, efficiency is key; legal wants to avoid the common misconceptions around their function being boring, risk-averse, a department of “no”, and so on.

Juro speaks to lawyers every day, and one of the most common pain points is around contracts. The contract process is manual, time-consuming, and painful for everyone; deals may stagnate because legal teams are caught up in back-and-forth contract negotiations, or a new joiner might take longer to accept the role because signing the contract involves the use of a printer, wet signature, and a scanner.

Contracts are the lifeblood of every business - so legal needs to improve the end-to-end process and enable teams and help get signatures on dotted lines faster. Here are five problems in-house counsel (and the wider business) face when it comes to contracts - and five fixes that can improve how legal adds value to the company.

In the earlier stages of a business, before a dedicated legal function exists, teams will use whatever they can to get contracts over the line. This often means that old versions of routine contracts, like NDAs or order forms, are copy-pasted and edited slightly to include the right details - and as a result, there’s no standardisation.

The sole counsel coming into a business must contend with multiple versions of the same contracts, all living in different areas of the business and including slightly different terms. They might be saved on personal desktops, in shared folders, or as attachments in email chains. This is a problem because:

How can legal fix this? By creating templates for routine contracts and automating them, so that colleagues can self-serve on their own documents, with key terms still controlled by the legal team. Updating these contracts will also be much easier - legal only needs to amend the template, so every contract that template generates will have the updated terms and conditions.

Contracts aren’t usually designed with the end-user in mind; most documents are full of impenetrable jargon that only lawyers could understand. They’re difficult to read, and often hide key details behind lengthy, archaic legal jargon that slows down the time it takes to get signatures on dotted lines.

The problem is that the end-user is often not a lawyer - so getting to grips with contract terminology can be daunting, frustrating, and oftentimes detrimental to the business, especially when deals or new hires are on the line.

How can legal fix this? Simply redesign your contracts to consider the end-user. There are several ways legal teams can achieve this:

We all know the story: the contract process involves marking up a document in Word; getting caught in back-and-forth email chains; redlining with tracked changes (and sometimes without tracked changes); saving as a PDF; signing via an electronic signature (or worse, by printing, signing and reuploading); and emailing the signed document to its signatories to be saved on personal desktops, or in a shared drive.

The process is manual, time-consuming, and involves a range of systems. This means there’s rarely a point where each party has visibility on the contract, and there’s certainly no audit trail of views or amendments. Post-signature, there’s no way to keep track of contracts that don’t involve manually inputting details in a spreadsheet and setting calendar reminders for automatic renewals.

How can legal fix this? Automating the process can help teams maintain visibility on the end-to-end contract process. It also ensures that contracts are created, negotiated, agreed, managed and tracked in a unified workspace, so getting a contract from the first draft to a ‘signed’ status doesn’t involve leaving the browser to move between different systems.

At the crucial point where parties are ready to sign, relying on printers, scanners and emailed PDFs can slow down momentum and delay the process.

How can legal fix this? eSignature platforms can help speed up the signing stage, but another option is automating the entire workflow with a contracts platform that has a native, in-built eSignature tool. eSignature has many benefits of being:

When contracts are stored as PDFs in shared drives, or as hard-copy printouts:

How can legal fix this? Legal can manually input information into a spreadsheet, so the data is accessible - but this is not a great use of an expensive lawyer’s time. Implementing a tech solution that has an automated ‘reminders’ feature is the best way to digitise the process and ensure that legal is always one step ahead.

With a limited budget and resources, improving the efficiency of the legal function can seem challenging. But it doesn’t take much to make a big difference - and resolving these important issues in the contract process is a great first step towards legal becoming better strategic partners to the business.

Many have been flocking to Cornwall and Devon – and rightly so. But with masses of people there, it has been hard to find an idyllic coast staycation. I decided to opt for something a little different; something more laid back, trendy and progressive. Yep, you’ve probably already guessed it: Brighton.

It may have been luck of the draw as I stumbled across the pebble beach on a rare, warm UK day, but the British breeze was very much appreciated as I took in the sounds of the relaxing waves, hearing the distant laughter coming from the pier. There’s something different about Brighton – it has a very chilled out and welcoming vibe and is home to an electric range of people, from avid rollerbladers to children taking their first steps.

Aside from the range of seafront restaurants and rollercoaster rides, Brighton offers the right amount of thrill, excitement and fun. But other than people watching or skimming pebbles into the sea, what can those who just want to relax and unwind do? The key here is finding a good place to stay (and maybe a good, hidden-away cocktail bar, too).

A stone’s throw away from the sea sits The Grand, Brighton: a sumptuous Victorian-style building that stands tall and elegant, greeting the coast. Enclosing thousands of memories, the 156-year-old walls hold 201 beautifully designed rooms stretching over seven floors and set around the original dramatic sweeping staircase. Evoking memories from the past, with thoughtful modern design touches, the interiors of The Grand offer an array of delightful surprises and luxuries.

There’s something different about Brighton – it has a very chilled out and welcoming vibe

It has a history worth boasting about, too. Holding more than two centuries’ worth of stories – from the birth of a Royal baby to ABBA's famous stay after winning the 1974 Eurovision song contest – The Grand has been featured in several TV adverts, documentaries, films and television shows, such as Only Fools & Horses.

As fantastic as its history is, the truly showstopping element is in the experience itself. The Grand experience is built on making memories to last a lifetime, and the memory of staying there is one to cherish. Escaping for the night amidst a pandemic is a weird experience, but the warm staff that feel strangely like family make it a break you won’t forget.

The bedrooms are the star of the show. Inside you'll find beds fitted with divine Egyptian cotton linen, a range of pampering toiletries from Noble Isle and fluffy Grand robes and slippers, alongside all of the essentials a modern traveller might need. Plus, many also boast seafront balconies complete with sustainably sourced outdoor furniture – and with views all the way from the palace pier to the beautiful wreck of the old West pier, there really is no better front-row seat in the city.

From a truly Grand breakfast to an unforgettable dinner, dining is at the heart of the Grand experience. The chefs have created sensational menus – which are dietary requirement-friendly(!) - and are crafted around fabulous seasonal flavour combinations and the finest locally sourced produce, fish and meat. Speaking with their culinary expertise, the chefs know what they are talking about, but if you have no idea, the friendly waiters will be sure to help.

[ymal]

Whether you'll be spending most of your time discovering colourful corners of the bustling city, sampling some of the fabulous local food and drink, or enjoying a serene and well-earned rest by the seaside, a beautiful Grand bedroom is a perfect place to retire to in the evenings. If you’re heading out to explore Brighton, The Grand is just a stone’s throw from the famous West Pier and the i360, and a 10-minute walk from the iconic Royal Pavilion, the lanes, or all the fun of Brighton Pier.

If you fancy staying in, however, you can pass time scanning the Grand Moments plaques with QR codes, where you can scan to reveal the fascinating stories and moments from by-gone eras that have unfolded in each area.

It’s all in the name. The Grand Brighton sits majestically and independently on the seafront, in a prime location at the centre of an iconic city revered the world over. You can watch amateur basketball players shoot hoops from the window of your room at The Grand, or choose to join in with them. What you decide to do at The Grand is up to you, but it is sure to be a rejuvenating stay.