Understand Your Rights. Solve Your Legal Problems

mmadigital was launched in 2016 and uses proprietary technology to source and qualify personal injury and clinical negligence leads for UK law firms. It currently boasts more than 70 law firm clients. This new investment comes as it looks to further its technology and infrastructure investment and boost its market position through acquisitions and organic growth.

Since its founding, Rockpool Investments has provided equity and loan financing to SMEs in the UK and has invested more than £500 million into the UK private equity market. By funding mmadigital, Rockpool makes its first investment in the legal services market.

onefourzero advised Rockpool on the investment.

Lawyer Monthly had the pleasure to speak with Jennifer McNamara at onefourzero to give us some further insight into this transaction:

onefourzero provides data-led commercial due diligence. Drawing on a broad range of best-in-class datasets, combined and analysed using proprietary tools and methodologies, onefourzero provided a view on market size, share and growth, alongside a commercial assessment of the target asset and recommendations for post-sale growth.

onefourzero specialises in using myriad, complex data sets robustly triangulated to answer commercial questions. In this case, we combined internal data from MMA with external datasets to understand the broader market and the asset’s performance. By understanding the entire landscape, onefourzero can make post-acquisition growth recommendations with a basis in absolute growth headroom. While these methodologies can be applied to online and offline businesses, the wealth of data available and the in-house digital expertise was a natural fit for this transaction.

onefourzero specialises in using myriad, complex data sets robustly triangulated to answer commercial questions.

The digital landscape in the legal sector is particularly complex due to restrictions on advertising in some areas. There is the presence of online-only / virtual providers alongside traditional firms with varying levels of an online presence. Consumer (e.g, search) behaviours also needed to be considered as they straddle sourcing of online and offline providers. By creating an image of the audience using digital activity as a proxy, onefourzero isolated the most relevant audiences and channels to assess the business fairly. onefourzero could then evaluate the effectiveness in delivering leads based upon the true available market drawn from the data. It also helped to understand the sectors’ overall growth trajectory to provide reassurance to our client.

Celonis SE are an international leader in EMS, having pioneered the process mining category 10 years ago by developing the ability to automatically x-ray processes in order to find inefficiencies. Its acquisition of Lenses.io is expected to enable the combined group to create a stronger platform with real-time data for large-scale customers with multi-tenant environments.

The Memery Crystal team was led by chair Lesley Gregory and director Karen O’ Grady with input from the firm’s corporate, commercial, IP and technology (CIPT) and employment and employee incentives teams. Director Karen O’Grady handled the corporate aspects of the transaction with assistance from associate Alex Stanciu and paralegal Priya Morzeria. Partner Jonathan Riley led the CIPT team alongside solicitor Kasia Reda and trainee Sylvia Muller. Senior associate Mark Rose and solicitor Alfie Bright handled the employment aspects with consultant Euan Fergusson advising on employee incentives aspects.

Other firms, including Foley Hoag in the US, Jones Day in Germany and Zepos & Yannopoulos in Greece, also advised on the deal.

Lawyer Monthly had the pleasure to speak with Karen O’Grady, Director at Memery Crystal to give us some further insight into this transaction:

The team comprises individuals with a wealth of experience acting on mid-market M&A transactions for large corporates looking to make strategic acquisitions, which means that we have legal and commercial expertise to draw upon on all aspects of a transaction of this nature.

In this case, our Corporate team’s experience acting on international transactions with teams in multiple jurisdictions as well as our strong sector knowledge and expertise stood us in good stead and meant we were able to really deliver for our client. We have a reputation for getting deals done and this transaction was no exception.

[ymal]

We are fortunate in having a strong and established working relationship with Foley Hoag, having worked on a number of transactions with them in the past. Here, both firms were able to leverage this relationship to the benefit of our mutual client.

Given the complexities of the transaction, communication was key to ensuring our clients’ priorities and the risks of the transaction were appropriately addressed. We were able to quickly establish and maintain open and frequent lines of communication and a clear division of labour as between all firms. All advisers maintained a flexible and accommodating approach which meant that any changes to the transaction as it progressed could be quickly and effectively dealt with between us.

Delivering the commercial outcomes Celonis wished to achieve in a manner that complied with the laws of various jurisdictions presented challenges at times, but we were fortunate to be working with lawyers across the jurisdictions who were willing to take the time to fully explain the nuances of the applicable laws in their respective jurisdictions and work with us to find workable solutions to any potential issues. For our team, staying at the centre of the conversations on these issues, irrespective of the legal jurisdictions which they impacted, meant we were able to maintain a holistic understanding of the transaction and reflect this in our approach to the transaction documents and negotiations.

Over 1,600 Co-op employees have taken action against the company over complaints that they are being paid less than their colleagues at Co-op’s distribution centres.

The complaint is from mostly female shop-workers who argue that they should receive pay similar to their predominantly male colleagues in the company’s distribution centre, who receive up to £3 more per hour.

The Co-op has now submitted a “comparability concession”, bringing the company a step closer to officially recognising that the different roles are equally valuable.

Tom Hewitt of solicitors Leigh Day, which is representing the workers, said, “Leigh Day is delighted to be able to tell Co-op staff that they have cleared the first hurdle in their claims for equal pay.”

“We hope that Co-op recognises that they can no longer deny that the work store workers do is of equal value to that of their distribution centre colleagues."

A number of law firms that had scheduled widespread returns for late January and February, including Paul, Weiss, Rifkind, Wharton & Garrison and Morrison & Foerster, have now confirmed they will further postpone their return to offices by an additional few weeks.

In the United States, new coronavirus infections have decreased week-over-week in the regions of the nation that were initially hit hard by the new variant. However, other areas of the US, such as the Midwest, have once again seen cases begin to climb.

Morrison & Foerster has previously set February 14 as its official office return date. However, has since decided to keep office attendance voluntary until at least March 1. Like Morrison & Foerster, many law firms in the US have allowed staff into the office through the Omicron spread, though have not demanded their in-person person.

In a bid to get lawyers back into offices, many firms, including Morrison & Foerster, are requiring Covid-19 vaccinations and are strongly encouraging uptake of the booster shot.

In this feature, Lawyer Monthly hears from Alexandra Marks on the purpose of the BBRS and the organisations that may find its service relevant.

Walker conducted a comprehensive analysis of the scale and complexity of banking complaints from SMEs, particularly in the wake of the 2008-09 financial crisis. His Review was published in 2018 and focused on disputes that remain unresolved despite the SME raising a complaint with their bank yet may be unsuitable for court processes.

Walker found that there was no evidence of “systemic malpractice” by banks during the crisis. However, he stated that “individuals and units within certain banks, responded to the crisis in an ad hoc manner which was sometimes unreasonable and panicked, occasionally reprehensible, and almost always distressing for those affected.”

Walker made a number of recommendations on how to move forward, with particular emphasis given to the need for complaints to be reviewed on the basis of what is fair and reasonable in the circumstances. This is due in part to the fact that courts have often found banks not to have acted unlawfully.

In response to the Walker Review, the seven UK banks operating in this market agreed four proposals. The creation of the BBRS addresses points two, three and four:

The BBRS has been designed by the seven participating banks, in partnership with SMEs and UK Finance, to meet small businesses’ needs in seeking to resolve disputes with their banks. We offer an alternative to litigation, removing the cost and stress of going to court for SMEs. My judicial experience has shown me that the fabled ‘day in court’ is often a disappointment for parties hoping to tell their story. We offer a much richer opportunity for individuals to give their account in their own words, which we believe can offer a better route to closure.

The BBRS has two schemes: one for contemporary cases and one for historical cases, with slightly different eligibility criteria. Broadly speaking, we are able to assist UK-registered businesses, trusts, charities, friendly societies and co-operative societies which have an unresolved complaint against one of the banks participating in the BBRS. A customer must first have complained to their bank and given them the opportunity to resolve the issue prior to bringing it to the BBRS.

My judicial experience has shown me that the fabled ‘day in court’ is often a disappointment for parties hoping to tell their story.

Our contemporary scheme covers cases for the period from 1 April 2019 onwards: it is for businesses with a turnover of less than £10 million per annum and a balance sheet of less than £7.5 million. The complaint must not be, or have been, eligible for the Financial Ombudsman Service.

As we have been carefully designed to dovetail with the Financial Ombudsman Service, the applicable criteria for the historical scheme, depend on when the alleged act or omission by the bank occurred:

The BBRS’s criteria do not include employee numbers, but as the Financial Ombudsman does take this into account, SMEs with complaints made on or after 1 November 2009 and a turnover and annual balance sheet each of less than €2 million may also be eligible for the BBRS if they employed 10 or more persons.

The BBRS is unique in several ways, but perhaps most interesting is its concessionary case process. This process means that we may, in some circumstances, be able to look at complaints even though they are technically ineligible for the scheme. Broadly speaking, this would apply to cases that fall slightly outside our eligibility criteria but we consider worthy of attention and so ask for the relevant bank’s consent to do so, or to cases that have already been through independent review schemes but have new evidence which was not previously considered.

Our eligibility criteria are far from straightforward, and we would advise anyone with clients who could be eligible to register them for the service. Solicitors are valuable intermediaries for us, and we have already seen a number of customers with representation.

The service has been designed to be easy to access, empathetic and flexible in its approach. Each business using the BBRS will be assigned a Customer Champion, who will act as a single point of contact and offer practical support throughout the business’ journey through the BBRS process.

We use a variety of alternative dispute resolution (ADR) techniques to settle unresolved complaints, including mediation and conciliation as well as full adjudication if necessary. We make decisions based on what is fair and reasonable in the circumstances and seek to inspire confidence through the consistency of our approach.

The service has been designed to be easy to access, empathetic and flexible in its approach.

In assessing this, the BBRS will consider all available evidence, taking into account relevant law and regulations; regulators’ rules, guidance and standards; codes of practice; and (where appropriate) what the BBRS considers having been good industry practice at the relevant time. Our scheme rules make clear that we are not looking for pleadings, so it is worth noting that lawyers need not provide these for their clients.

Our jurisdiction is much broader than the courts; this is key, as many of the issues we have seen are not complaints about the banks doing something unlawful, but have been about banks treating customers poorly from the perspective of what would have been fair and reasonable.

There are a number of benefits of using ADR. Crucially, ADR focuses on reaching an outcome which both parties are comfortable with – making the BBRS not only a mechanism for dispute resolution, but also for rebuilding trust between banks and businesses. Evidence shows that mediation often offers a more satisfactory outcome because the parties are involved in shaping it and can be creative about the solution to their dispute.

As Chief Adjudicator I have overall responsibility for dispute resolution, investigation and adjudication within the BBRS.

I oversee the review of complaints and appeals handled by the BBRS. Working with the Customer Champions and Case Assessors, and within the Scheme Rules, I determine eligibility and the appropriate approach for handling complaints. In addition, I oversee decision-making and the appeals process.

Throughout my career I have been interested in the ‘David vs Goliath’ dynamic in the search for justice. It was that, coupled with my passion for social justice, that drew me to the BBRS. I am also an accredited mediator and believe that the ADR techniques used by the BBRS offer great benefits. I very much hope that we can demonstrate these benefits over time and encourage the wider use of ADR to resolve this kind of dispute.

[ymal]

The focus of the BBRS for the foreseeable future will be on delivering fair and reasonable outcomes for eligible SMEs. One of the main challenges we face is getting the word out to SMEs, particularly those eligible for our historical scheme, which has a deadline of 14 February 2023 for registrations.

Although it is clear the banks have learnt many lessons from the financial crisis in 2008-09, I suspect we will see a rise in cases for our contemporary scheme in the future as the full impact of COVID-19 on our economy, and particularly SMEs, emerges.

Alexandra Marks, Chief Adjudicator

Business Banking Resolution Service

C/O Legalinx Limited, Tallis House, 2 Tallis Street, Temple, London, United Kingdom, EC4Y 0AB

Tel: +44 0345 646 8825

Alexandra Marks has over 35 years of experience as a lawyer. For the past 15 years, she has sat as a part-time judge in the Crown Court, High Court and First-tier Tribunal. Before that, she was a partner at Linklaters and an accredited mediator. Alexandra is also deeply involved in human rights and social justice organisations. She was Chair of Amnesty International for 10 years and has been a Council Member of JUSTICE since the 1980s.

The Business Banking Resolution Service (BBRS) is s a non-profit organisation set up to resolve disputes between eligible larger SMEs and participating banks. To find more information about the service and discover whether it could be relevant for clients, free resources can be found on the BBRS website or by emailing the organization at hello@thebbrs.com.

This month we hear more perspectives on the topic from Pillsbury partners Deborah Ruff, Charles Golsong, Julia Belcher and associate Charlotte Stewart-Jones. What are the pros of the idea, and is there any way they can outweigh the cons?

There are two ways in which mediation of a dispute can be made compulsory. The first is a matter of contract, in which the parties include in their dispute resolution clause a multi-step process which obliges them to go to mediation as a precondition to commencing litigation or arbitration. The second is legislation requiring all or certain cases to go to mediation before or at an early stage of litigation.

There are several advantages of mediation but one of its key features is that, if successful, the parties will have found a mutually acceptable solution to a dispute rather than going through a lengthy and usually costly and combative process to obtain a decision from a judge or tribunal.

In mediation, the parties control the process and may be able to reach more tailored solutions than those that would be ordered by a court: for example, agreeing that a payment by one party under the current dispute will be offset by increased future orders. Mediation facilitates direct communication between the parties, which can help preserve commercial relationships that are likely to be damaged by the inevitably adversarial process of litigation or arbitration.

If a settlement is achieved at an early stage, there can be significant savings of time and costs and, even if a settlement is not reached, the process may help to narrow the issues between the parties. If attempted at an early stage, mediation may also prevent parties from becoming entrenched in their respective positions. Even at a later stage, mediation can give the parties a fresh perspective and an opportunity to reconsider the merits of their respective cases and save the costs of a full trial or hearing.

In mediation, the parties control the process and may be able to reach more tailored solutions than those that would be ordered by a court

Despite the merits of mediation and increased awareness of the process among the legal community, there is still a perception amongst non-lawyers that mediation is an alternative adjudicatory process to litigation rather than a potentially useful part of the overall dispute resolution process. There is, however, no obligation (even in mandatory mediation) to reach a resolution of the dispute. All parties need to accept any proposed solution; otherwise the adjudicatory process (whether litigation or arbitration) will proceed.

The skill of the mediator is to help the parties find common ground. The mediator will encourage the parties to consider not only the strengths and weaknesses of their cases from a legal perspective, but also the risks of proceeding to trial and the costs they may incur, both their own irrecoverable costs and potential adverse costs orders. Even if the parties attempt bilateral negotiations, they may not consider these types of issues sufficiently. Even reluctant parties to mediation may be surprised by the progress they are able to make when they have an opportunity to speak freely in a confidential setting, assisted by a talented and experienced mediator. Anecdotal evidence suggests that around 50% or more mediations do result in a settlement being reached, either at the mediation itself or thereafter.

However, mediation is not always the answer.

Mediation only succeeds if there is a genuine attempt to settle on both sides. If a party has been compelled to mediate against its will, it is quite likely to fail to participate fully in the process, thereby wasting both its own and its opponent’s time and costs. As mediation is confidential, so long as a party “shows up”, it will be almost impossible for a judge or arbitrator to take obstructive behaviour in the mediation into account when considering how to allocate costs if the dispute does not settle. Similarly, if compulsory mediation becomes seen as a “box-ticking” exercise, the parties may not put in the effort and preparation required to achieve a successful outcome.

There is still a perception amongst non-lawyers that mediation is an alternative adjudicatory process to litigation rather than a potentially useful part of the overall dispute resolution process.

Timing is also an important consideration. If the parties are required to mediate before issuing a claim or at a very early stage, they may feel they have not had adequate time or information to assess the merits of their respective cases. Rightly or wrongly, litigants frequently believe that the disclosure process, in which each party has to provide to the other adverse documents, will result in the disclosure of a “smoking gun” that will tip the merits of the case in the favour of the party seeking disclosure, and they may therefore be unwilling to engage in any meaningful way until after disclosure. Indeed, there are some types of case, such as actions for breach of intellectual property rights, where it would be very difficult for the claimant to make its case without disclosure of the other party’s documents. Furthermore, in complex, high-value cases, parties may not feel equipped to mediate until after factual or even expert evidence.

Certain types of disputes are also less well suited to mediation, particularly those in which a monetary remedy is not sought, such as applications for declaratory relief where parties need the clarification which only a judgment or award can provide. Furthermore, where a dispute involves a long outstanding debt, then the debtor may simply see mediation as a way further to delay judgment against it.

In addition, multi-party cases may be more difficult to mediate, as there may well be “sidebar” disputes between the defendants as to which is likely to be found liable and for what proportion.

Finally, if mediation fails, then it has merely added an extra layer of cost to the dispute. For very small disputes in the courts, where there may be provision of “fixed fee” mediation, and where recovery of costs may be limited in any event, this is not likely to be a significant consideration. In very high-value cases, the cost of mediation may be a fraction of the overall costs of fighting a dispute to the end, so that it would be worth the risk of additional costs. However, in “medium-sized” cases, particularly where the contract makes mediation a mandatory precursor to commencing proceedings but does not include a pre-agreed mediation process, mediation costs might end up representing a significant percentage of the total costs if the parties become enmeshed in “satellite litigation” over the choice of mediator or the details of the mediation agreement and end up producing lengthy “mediation statements” which are nearly as detailed as pleadings, but still fail to settle.

[ymal]

There are clear potential advantages of mediation in many cases, whether litigation or arbitration. However, as regards litigation, civil lawsuits are not all the same and a “one size fits all” approach that requires all litigants to engage in a particular form of mediation at a specific point in the procedural timetable, or as a condition precedent to commencing proceedings, is unlikely to work in practice.

As regards arbitration, where both the arbitration itself and any precursor mediation must be a matter of party consent, parties should consider carefully whether they want to make mediation a pre-condition to arbitration and, if so, whether for all types of contract or only some. If they do choose to include mandatory mediation then careful drafting is needed to avoid both costly disputes over whether the dispute resolution clause is valid or whether mediation is or is not mandatory, and to minimise later “satellite disputes” over the mediation process.

Deborah Ruff, Charles Golsong, Julia Belcher and Charlotte Stewart-Jones

Pillsbury Winthrop Shaw Pittman

Tower 42, Level 21, 25 Old Broad Street, London, EC2N 1HQ UK

Tel: +44 20 7847 9528

E: deborah.ruff@pillsburylaw.com

Pillsbury Winthrop Shaw Pittman LLP is an international law firm with a particular focus on the technology & media, energy, financial, and real estate & construction sectors. Recognised as one of the most innovative law firms by Financial Times and one of the top firms for client service by BTI Consulting, Pillsbury and its lawyers are highly regarded for their forward-thinking approach, their enthusiasm for collaborating across disciplines and their authoritative commercial awareness.

Below, Lawyer Monthly hears from Shakespeare Martineau CEO Sarah Walker-Smith on the outcomes of the pandemic and how adaptable law firms can seize the opportunity to ready themselves for the future.

Over the last couple of years, the business world has had to adapt to a brand new way of working, and the legal sector is no different. For most law firms, this has meant accelerating plans for remote working and improving flexibility, but we are missing a trick if we fail to capitalise on the additional opportunities this now presents.

One of the main challenges at the start of the pandemic was the acceleration of digital agendas. Depending on the size of the business, this could have meant getting hundreds, even thousands, of employees working remotely within days. While some firms already had remote working in place, enabling the entirety of their business to work from home without issue, not all would have had the resources secured and ready to go.

With the sensitive nature of the legal sector, it was not just purchasing and distributing the equipment that was a challenge. Behavioural habits needed to change too. Many lawyers were still largely paper-based with physical files, and even when firms had navigated their own processes, courts and clients were not always able to meet them on the same digital platforms.

Cybersecurity also played an important role in this transition, especially as we moved to remote working models. Ensuring remote databases and systems were secure was vital, allowing people to work anywhere without compromising their clients’ privacy. Overall, coordinating the switch was a considerable administrative task, and one that had to happen practically overnight. Huge credit must be given to the often unsung legal IT teams.

Ways of working in general have also had to change. Now that remote working has proven to be successful, employees expect a level of flexibility as standard – choosing where they work, how they work and when they work, so that they can fit their jobs around their lives rather than the other way around. Introducing principles, such as Shakespeare Martineau’s ‘empowered working’, which are founded on a basis of trust and support people to work in a way that suits them, whilst still looking after clients and team needs, can be a good place to start. Firms that fail to embrace this will struggle to retain and recruit in what is already a challenging market.

Overall, coordinating the switch was a considerable administrative task, and one that had to happen practically overnight.

Regarding recruitment, remote working has allowed firms to expand their talent pool, focusing more on values and cultural fit rather than whether a person lives close enough to commute. As a result, taking a more flexible approach benefits not only employees, but employers too.

Following the implementation of the more ‘practical’ elements of change, the focus now needs to switch to cultural transformation. By reviewing business strategies, firms may find that the long-term plans they had before the pandemic are no longer relevant. Whether they need a few tweaks or a complete overhaul, the focus should always be on people (both clients and employees), including their wellbeing and development. There is no such thing as B2B; P2P (people to people) is even more relevant now than it was before the events of the last two years.

When adapting a business strategy, strength will come from the core values that are weaved throughout. Trust and collaboration have become particularly important over the last couple of years, so ensuring these values are part of the firm’s long-term plans is essential.

Sustainability is another priority that many people have rightly started to focus on. Remote working has enabled many companies to lower their carbon footprint, with reduced commutes and consumables like power and paper, and less travelling to see clients. Sustainability must remain at the top of the agenda, enabling firms to build on the progress they have already made. Not only will this help the environment, but it will also resonate with a growing number of their people. It is no use simply talking about sustainability; action must be taken, whether that is through the creation of green initiatives or by taking the next step up and seeking B Corp status to hold themselves accountable, as we are doing.

There also needs to be a change in the legal sector’s approach to profit. Long-term success has to be the goal. Firms often obsess over the simple annual figure of profit per equity partner (PEP). When investing in a business’s future, profits could take a hit for a short period of time. We need to find a more balanced set of measures which incentivise both short and long-term considerations, creating sustainable value. Not only will this benefit the business, but also clients, investors and local communities.

When adapting a business strategy, strength will come from the core values that are weaved throughout.

Effective leadership is core to all of these changes. For too long, leaders in the legal sector have been invisible to the majority of employees. Simply being a figurehead is no longer enough; teams must be able to see that the person in charge cares about the future of the firm. Listening is a key part of this, so leaders should consider how they can ensure every voice is heard, from top to bottom. The creation of a shadow board, reverse mentors and frequent surveys are just some of the ways to bring people together over ideas and strategy, leading to positive change for all.

Undoubtedly, there are a number of challenges that need to be overcome to successfully continue to transform our sector. First of all is the fact that change takes time to get right. Firms must be willing to continuously improve their processes through constant review, addressing any issues that arise. Getting feedback from its people is essential to this, as they are the ones who are experiencing the changes most.

Being willing to adapt ensures team members are not left behind during the transformation process. Remote working in particular has raised concerns around collaboration, with some people in the office and others at home. It could be easy to forget to include those at home in discussions that can happen around a desk in the office, but leaders cannot let this happen. Remote workers are as much a part of the team as everyone else, so effort must be taken to promote collaboration virtually as well as in person.

[ymal]

Measuring engagement by adding ‘collaboration’ to leaders’ objectives, as well as holding them accountable for the engagement of their teams, can help to identify any problem areas. Anonymous surveys can also be a useful way to gain honest feedback from the wider firm.

A bigger challenge comes in the form of future economic crises. Even at present, inflationary pressures are weighing heavily on many businesses, highlighting the need for agility in the current market. While the country appears to be going in the right direction regarding COVID-19 figures, the economic turmoil that the pandemic has created is unlikely to ease anytime soon.

Although it is difficult to think about, law firms must be prepared should an event such as another pandemic occur. Another slowdown of the economy on the back of the current turbulence would be a problem for many firms due to the transactional nature of the sector. Planning for the short-term as well as the long-term can help businesses to stay flexible and adapt their processes as needed, minimising the impacts of an economic downturn.

The future of the legal sector will be defined by its approach to change management. Historically, transformation has been a slow process, but the pandemic has changed this. Of course, it is still important to ensure that teams are fully informed and have a say in the alterations being made, but recent times have proven that improvements can be made quickly and successfully. The sector must not waste the opportunities that the pandemic has provided to benefit both business processes and our people.

Sarah Walker-Smith, CEO

60 Gracechurch St, London EC3V 0HR

Tel: +44 0121 237 3013

E: sarah.walker-smith@shma.co.uk

Sarah Walker-Smith is the CEO of law firm Shakespeare Martineau and professional services group Ampa. She was the first female non-lawyer CEO in the legal top 50 and was recently named as the UK’s most influential legal leader on social media. Sarah is also a governor at Nottingham Trent University, a member of the Society of Leadership Fellows at St George’s House and is on the board of the West Midlands CBI Council, as well as non-exec chair of Radikl, a scale-up business supporting female entrepreneurs’ growth and success to investment funds.

Shakespeare Martineau is a full-service UK law firm with more than 900 staff across its offices in Sheffield, Lincoln, Nottingham, Leicester, Birmingham, London, Milton Keynes, Stratford-upon-Avon, Solihull and Glasgow. The firm provides legal services to companies, organisations, government departments, families and individuals in life and in business.

Paul Furiga, president at WordWrite, explores the essence of what this story is and how it can be used to empower a firm and its image.

There may be a practitioner somewhere who entered law to accumulate case citations and professional certifications. But most lawyers I have worked with over three decades view their career as an opportunity to make a difference for clients. Some of the most engaging conversations I have had with master practitioners trace the tales that led them from taking on dire legal challenges to delivering results for clients.

So why do so many lawyers (and law firms) focus their marketing to prospective clients on obscure case citations and professional certifications?

Face it: the people who actually sign the cheques to engage law firms are rarely as excited by case wins or certifications as the firms they hire. In fact, most organisations hiring outside counsel consider requisite experiences and certifications to be table stakes. In other words, if the firm did not have the right credentials, it would not be considered for the work.

In my years working with law firms to propel their growth, a few themes emerge repeatedly in my conversations with firm leaders:

What is the result of failing to address these issues? Predictably, growing a firm becomes more about happenstance than effective positioning. This is frequently when firms engage us — because they are experiencing inconsistent, unpredictable growth. They are often, quite simply, stuck.

The people who actually sign the cheques to engage law firms are rarely as excited by case wins or certifications as the firms they hire.

We have learned in working with law firms that there is no reason to be stuck. There is no reason to fall back on table stakes when seeking to grow the firm. That is because every firm owns an asset that no competitor can claim, regardless of whether they boast similar certifications and experiences.

That asset is the firm’s unique story. We have come to call it your ‘Capital S Story’ because it rises above all the other stories a firm or practitioner may share. Your Capital S Story stands above because it answers these critical questions: why someone should hire you, work for you or partner with you.

The answers to these questions define the very character and nature of the firm. Few lawyers I have met would consider their firm a carbon copy of a competing firm with similar credentials. Yet instead of focusing on their firm’s most unique asset, the only one that no competitor can claim, they fall into the trap of comparing experiences and certifications.

Once, it was all too easy for logically minded professionals, including lawyers, to dismiss storytelling as some sort of marketing gimmick that had no place in growing a firm.

However, functional MRIs and similar tools have demonstrated convincingly in the last two decades that the human brain is hardwired for story. In my book, 'Finding Your Capital S Story', I relate an experiment by Dr Uri Hasson at Princeton University, who captured the brain activity of a storyteller and then proved that when more than 30 listeners heard the story, their brain activity mirrored that of the storyteller. This is a phenomenon known as neural coupling and it is essential to engaging any audience, including law firm prospects. It is essential to differentiating your firm from competitors.

Your Capital S Story stands above because it answers these critical questions: why someone should hire you, work for you or partner with you.

Biology is not the only scientific proof of storytelling; the famed psychotherapist Carl Jung learned the power of stories while practicing in Switzerland during World War I. During that war, Switzerland was a neutral country. As a diaspora of refugees entered Switzerland, Jung worked with a great variety of patients. Regardless of language, economic attainment or personal experiences, he found his patients told the same stories over and over again, which led him to the concept of what he termed “the collective unconscious.”

In a similar fashion, the mythologist Joseph Campbell, by studying the stories told around the world in various cultures, came to the conclusion that there are a set of archetypal stories that we humans tell ourselves over and over again. Campbell is best known for developing what he called the Hero’s Journey, a story archetype that is at the heart of many great films and books.

There are hundreds of variations of archetypal stories. These lie at the heart of success for organisations that sell complex services, which surely describes law firms. For instance, if you tell a prospect that your firm is a David and Goliath story, your prospect does not need to be a Biblical scholar to understand that you are an underdog firm whose place in the legal marketplace is to take on established firms.

Yet the David and Goliath example is not quite enough. This is where the firm’s experiences actually do matter — the firm’s specifics must be married with a memorable and widely understood archetype to describe your firm’s unique, compelling and memorable Capital S Story.

Functional MRIs and similar tools have demonstrated convincingly in the last two decades that the human brain is hardwired for story.

Recently, our team worked with a mid-sized law firm in a major US city. At 75 lawyers, the firm was one of ten similar firms competing for the same work in its region, and its 75 lawyers were telling 75 different stories to gain clients. The firm wanted those stories to fit within an overall narrative that uniquely described the firm.

We collaborated with firm leadership in our trademarked StoryCrafting® process to uncover and develop the firm’s unique archetype and story. We learned that the firm targeted middle-market US companies seeking outside counsel. In interviews, partners told us the firm wanted to be the first call from company leadership when encountering a legal problem the company had never seen before.

In aligning the experiences, leadership and capabilities that the firm wanted to grow with archetypes that would resonate with clients and prospects, we settled on the firm’s archetype as legal pathfinder. In other words, when facing a legal problem they had never encountered before, a prospective client would want to engage the firm because its lawyers knew the way and would ensure that the company did not step on any legal landmines.

When we presented the archetypal story to the firm leadership, one of the most successful partners got the idea immediately: In his client conversations he said, he often talked about himself as a cartographer, a legal expert who could help draw the map of success for his clients. When we work with clients such as this firm, the key messages from the archetypal story are flowed into broad firm marketing and become standardised for lawyers doing their own marketing as well.

[ymal]

Uncovering, developing and sharing your firm’s Capital S Story is a fruitful exercise that involves much more than this article can provide. I do hope that this article has intrigued you to explore these fundamental questions about your firm:

If you would like to explore the answers to these questions in depth, our firm website contains several downloadable tools you may find useful. Here’s to great success sharing your firm’s most important story: Its own!

Paul Furiga, President and Chief Storyteller

611 William Penn Pl #501, Pittsburgh, PA 15219, United States

Tel: +1 412 246 0340

E: paul.furiga@wordwritepr.com

Paul Furiga is president and chief storyteller at WordWrite. A former journalist, he wrote and edited over 20,000 stories over a two-decade career before applying his experience to PR. His focus is on identifying and sharing firms’ stories, and he has written a book on the topic: ‘Finding Your Capital S Story, Why your Story Drives your Brand’.

WordWrite is an award-winning storytelling PR agency in Pittsburgh. WordWrite helps providers of complex services uncover, develop and share their Capital S Story, the most important marketing tool they own, to reveal why someone would do business with them, partner with them or work for them.

Below, Miguel Leyva explains the history of asbestos use in the United States and ongoing legislative efforts to ban the practice entirely.

Many people in the United States assume that asbestos was entirely banned decades ago. Sadly, the reality of legislation around this dangerous carcinogen is much more complicated. Even though asbestos is no longer mined in the United States and its usage has decreased dramatically, asbestos-containing construction materials such as gaskets and roofing materials can still be found in the US.

Companies continue to legally import hundreds of tons of raw asbestos as well as contaminated roofing products, gaskets, and friction products that contain asbestos. It can still be found in homes, schools, and workplaces. In fact, according to the research published in 2021 by the United States Geological Survey (USGS), while asbestos imports into the United States have declined dramatically since the 1980s, there has been almost a 74% spike in imports between 2019 and 2020.

Between 1990 and 2019, more than 1 million people in the United States were harmed or died due to asbestos-related illnesses, which included lung cancer, laryngeal cancer, ovarian cancer, and mesothelioma, the most well-known and deadly asbestos-related cancer and most challenging to detect.

Considering the hazardous risk that asbestos imposes, it is impossible not to ask what is being done and, most importantly, if we can expect to live in a completely asbestos-free nation in the future.

Asbestos's fireproofing capabilities made it indispensable in various sectors, including the automotive, construction, manufacturing, power and chemical industries. Additionally, the US Army has used asbestos to prevent fires in virtually all military branches, especially in the Navy.

Many people in the United States assume that asbestos was entirely banned decades ago.

Increased consumption occurred in the US due to the population's rising desire for cost-effective, mass-produced construction materials. Asbestos goods met that requirement. The US swiftly became the world leader in asbestos use, aided by a regular supply from nearby Canada. Although the outbreak of World War I, followed by the Great Depression, briefly curbed the exponential expansion of the asbestos business, World War II re-ignited that expansion. By 1942, the United States' use of asbestos had climbed to around 60% of global output.

Consumption of asbestos in the US peaked in 1973 at 804,000 tons. Although medical proof linking asbestos exposure to various cancers was discovered as early as the 1930s, the federal government did not enact regulations restricting exposure until the 1970s.

Toxic asbestos, a carcinogenic mineral that has been widely utilised since the early 1900s, is one of the significant health risks that Americans have been exposed to for decades. Science has demonstrated for years that no quantity of asbestos is safe to be exposed to but, nonetheless, banning asbestos in the US has proven to be a difficult task. By the end of the 1970s, the call for stronger laws and change in the asbestos industry only became louder as the link between asbestos exposure and lethal illnesses became increasingly evident.

Before the 1989 partial asbestos ban, government authorities tried multiple times to curb its usage. The US government created the EPA to officially classify asbestos as a toxin, and the agency worked rapidly to allay public concerns about asbestos safety.

The first actions Congress took on the EPA's advice were:

The EPA took a bold step in 1989 by implementing the Asbestos Ban and Phase-out Rule. The verdict would have gradually phased out all asbestos usage in the US. However, in 1991, under pressure from the asbestos industry, a federal court reversed this ruling, leaving only the portions that maintained the prohibition on all new asbestos products.

Toxic asbestos, a carcinogenic mineral that has been widely utilised since the early 1900s, is one of the significant health risks that Americans have been exposed to for decades.

Over 60 nations and territories have outlawed asbestos, but the business sector has consistently thwarted efforts to prohibit it entirely in the US. Although asbestos mining was forbidden in 2002, when the last asbestos mine in the US officially closed, it is still lawful to import and utilise tiny amounts of this toxic substance. Due to the lack of a comprehensive prohibition, certain items may legally contain up to 1% asbestos.

The EPA implemented the Significant New Utilize Rule (SNUR) in 2018, enabling businesses to use new asbestos-containing goods on an individual basis. Simultaneously, they released a new paradigm for evaluating chemical risk. However, the review method does not consider the possible consequences of exposure to chemicals in the air, ground, or water. The SNUR does not extend to new applications of asbestos, only to those that were allowed before 1989. It essentially stipulates that businesses may begin reusing asbestos in specific ways, but must first obtain clearance from the EPA.

Since 2016, the EPA has conducted asbestos risk assessments under the TSCA's risk assessment methodology. Numerous legal challenges derailed the procedure, which put the status of asbestos risk evaluation in limbo for most of 2020. On 22 December 2020, a court in the Northern District of California ordered the EPA to close asbestos reporting "loopholes" in the CDR Rule and collect additional data on current asbestos usage.

Very little new legislation in this area has been enacted into law in the last decades. Unfortunately, bills to outlaw asbestos use in the US have likewise been voted down. Several provisions of the proposed legislation would have provided funds to assist persons suffering from asbestos-related ailments and to fund scientific studies that would further look into the link between asbestos exposure and cancer.

At the end of 2020, Congress appeared to be on the verge of accomplishing what the Environmental Protection Agency (EPA) had refused to do: pass the Alan Reinstein Ban Asbestos Now (ARBAN) Act, groundbreaking bipartisan legislation supported by nearly 70 co-sponsors, 18 attorneys general, and more than 30 trade unions and organisations that would have prohibited the commercial importation and use of all asbestos-containing products in the US once and for all. However, the measure was never permitted to pass through.

Very little new legislation in this area has been enacted into law in the last decades.

The EPA's Final Risk Analysis for asbestos was scheduled to be completed by 2020. Still, the agency only issued the first portion, addressing 16 situations of asbestos use that include occupational or consumer exposure. This initial section does not address the issue that asbestos is still present in residential and commercial structures after decades of use. To this purpose, the EPA indicated that the second part of the preliminary study would be released in mid-2021 and will examine the problem of legacy asbestos and associated disposal. So far, only ‘Draft Scope of the Risk Evaluation for Asbestos Part 2: Supplemental Evaluation Including Legacy Uses and Associated Disposals of Asbestos’ has been made available. The EPA is required to publish a final Part 2 Risk Evaluation for Asbestos on or before 1 December 2024.

Also, in 2021, a federal judge ordered the EPA to adequately gather statistics on the quantity of asbestos utilized, manufactured, and imported into the US. The EPA and its administrator, Andrew Wheeler, were sued by the Asbestos Disease Awareness Organization and the State of California, respectively over their decision back in 2017 which stated that reporting is not needed for “naturally occurring chemical substances”. In refusing a petition to fix the loophole, the EPA stated that it is "informed of all existing asbestos usage" and that stronger reporting regulations would not yield new information. The court ordered the EPA to fix reporting loopholes and apply its enforcement powers against corporations who fail to record their asbestos use appropriately.

[ymal]

The future of the asbestos ban in the US is still uncertain. Representatives from Congress and other government leaders frequently speak about safeguarding our children and advancing environmental justice, but while raising awareness is good, action is more valuable. To do both, it is necessary to prioritise public health before private profit, address legal loopholes, and implement a full asbestos ban urgently.

Miguel Leyva, Case Manager

16835 W Bernardo, Dr #215, San Diego, CA 92127

Tel: +1 619 330 7482

Miguel Leyva manages hazardous tort claims at Atraxia Law. In this role, he aids asbestos-related injury victims. Miguel helps people with lung cancer and other serious illnesses obtain and organize vital information to support their claims.

Atraxia Law is a personal injury firm based in San Diego, California. The firm has historically obtained over $5.7 billion worth of payouts for injured parties and their family members.

This month we hear from Cormac Leech and Diana Pupkevic of AxiaFunder, who outline the latest developments in litigation funding and how they stand to benefit lawyers and the wider rule of law.

“Funding is the life-blood of the justice system” - Lord Neuberger, President of The Supreme Court

Rising litigation costs have made access to justice expensive and prohibitively so for many individuals and small businesses. Many claimants are often forced to abandon or prematurely settle what are often, in our view, clearly meritorious claims. The relatively nascent but growing litigation funding sector helps to mitigate this lack of access to justice. We believe more corporate lawyers need to take the same approaches that have enabled the global stock and bond capital markets to thrive, and apply them to their own backyard — litigation.

That commercial litigation suffers from a lack of capital is evidenced by strong double-digit portfolio returns achieved by the listed litigation funders, net of losses and fees. More competition over time will increase the supply of capital and drive investor returns down to the benefit of claimants and, of course, lawyers.

There are many benefits associated with the use of litigation finance. Litigation is often stressful for individuals and small companies both financially and emotionally. As soon as a claimant chooses to pursue litigation, they are inevitably taking on financial risk. This relates to both the irrecoverable costs of the litigation (i.e. ongoing legal fees) and the risk of having to pay the defendant’s costs if the claim fails (i.e. the adverse cost risk).

Litigation funding can shift these risks to a third-party funder that has a diversified portfolio of cases and underwriting expertise and, as a result, is in a far better position to carry on these risks in the first place. Non-recourse litigation funding allows claimants to pursue valuable claims without risking their own balance sheets.

A funder performs a thorough due diligence for each case by assessing many different factors (e.g. legal merits, case economics and enforceability, among others). Thus, by agreeing to provide funding, a litigation funder directly signals to the defendant that an independent party also considers the merits of the claim to be strong. Once there is a credible threat, the defendant is typically much more willing to engage in settlement discussions. According to data from Solomonic, around 80-90% of such cases settle pre-trial. Even if a litigation funder chooses not to fund a case, the claimant and their legal team may well gain some useful feedback regarding the weaknesses of the claim.

More competition over time will increase the supply of capital and drive investor returns down to the benefit of claimants and, of course, lawyers.

Litigation funders might also be able to assist the lawyers and claimants in managing the litigation, including assisting in strategic and tactical decisions by bringing a highly commercial and objective perspective to assessing a claim. The funder’s role can assist in the efficient management of a claim by ensuring that the focus is kept on the real issues in dispute and by seeking to avoid time and costs being spent on the pursuit of claims that are weak or unnecessary.

Effective rule of law creates many benefits to a society – it helps to tackle corruption, poverty, and helps to protect people from various injustices. Without the rule of law, individuals and businesses cannot enforce contract, secure property rights or obtain effective redress against other individuals, enterprises, or the state. Inadequate enforcement of regulations, high presence of corruption, insecure property rights, and ineffective means to settle disputes destabilise legitimate business and discourage both domestic and foreign investment. The rule of law can thus have a deep impact on the fairness and prosperity of a society.

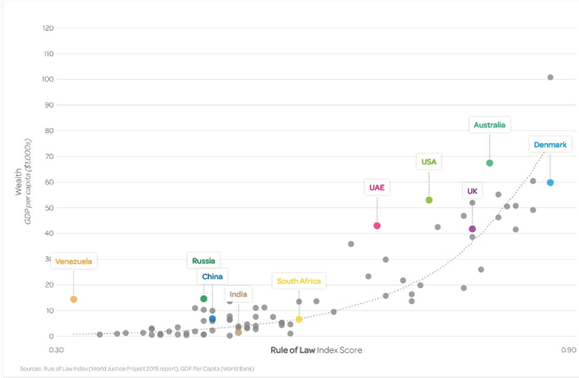

The graph below confirms that there is a strong positive relationship between GDP per capita and the rule of law index, which is based on factors related to constraints on government powers, absence of corruption, open government, fundamental rights, order and security, regulatory enforcement, civil justice, and criminal justice.

The rising costs of litigation has made such access to justice excessively expensive for many claimants. Cuts to legal aid have worsened the picture. Litigation funding helps to improve access to justice and ensure the rule of law.

There is considerable innovation within the funding sector. While large litigation funders are typically backed by institutional capital and are thus forced to adhere to strict investment criteria, platform-centric litigation funders (such as Lexshares and AxiaFunder) source capital from a large pool of professional, high-net-worth retail investors and are thus able to offer a more flexible low-cost funding solutions to both claimants and solicitors. This is possible since platforms offer more risk-sharing across a wider number of investors – just as the valuation of a company on the stock market will tend to increase as the investor base becomes more diversified.

Platform funders can also be more flexible when it comes to the case selection process itself, potentially funding higher-risk claims or claims that might take longer than usual to resolve, such as cases in international jurisdictions, as long as the transaction pricing is attractive to platform investors.

Many lawyers, often considered to be a relatively cautious group, have been slow to embrace litigation funding and in particular a platform funding approach. This is not without justification; litigation often revolves around sensitive and privileged information. Platform funders need to ensure that investors sign NDAs and confirm that they are not conflicted in a way that could prejudice the claimant.

Litigation funding helps to improve access to justice and ensure the rule of law.

Also, while investor demand for litigation assets on platforms is typically very strong, there is a degree of uncertainty regarding whether the funding will be successfully sourced and how long it will take. Some platforms have addressed this by putting backstop underwriting capital in place, much as an investment bank will sometimes underwrite a company IPO.

Funding a case via a platform or otherwise has another dimension. While the details of the case are typically kept confidential, for some cases it may be appropriate to use the funding process to apply reputational pressure on the defendant. Clearly the platform model has an advantage in this respect.

Funders today can profitably fund smaller cases by taking advantage of the latest digital collaboration tools and the trend towards decentralised working that accelerated during the COVID-19 pandemic. Evidencing this, at one point last year our own small team was collaborating very effectively while distributed in the UK, Spain, and Greece.

In addition, traditional litigation funders typically restrict their activities to funding legal costs only. New funders are often able to provide funding for a more flexible use – for example, preliminary or seed funding to claimants (e.g. to obtain a legal opinion), providing working capital and/or to reimburse previously incurred costs.

In the longer run, it seems inevitable that the blockchain and NFTs (Non-Fungible Tokens) will grow rapidly, with litigation funding a clear use case. Law coin and Liti Capital are examples of two companies focused on this. We also expect litigation funding to evolve into more of a stock market model, whereby law firms with meritorious cases can structure them with external assistance, into an investable security – in effect IPO-ing the litigation funding opportunity. This can be done on a single-case basis or in a portfolio format. The result will be a larger pool of available capital.

[ymal]

Despite the benefits, we are in the early innings for the sector and litigation funders are still not perceived positively in many countries. In France, for example, litigation funders are seen as greedy capitalists. In Ireland and many US states, litigation funding is perceived as a perversion of the legal system. This stems from behaviour in medieval times where feudal lords would fund many frivolous cases to upset a rival.

Nevertheless, litigation funding is likely to become more conventional as the market continues to grow and develop. In countries where the litigation funding market is more developed, an increasing number of market players and competition between them results in more competitive pricing for claimants. In the very long run, just as a police force can boost law and order, the presence of funding capital will make deep-pocketed defendants think twice before acting in a way that leads to litigation, which is clearly a positive outcome for society in general.

Cormac Leech, CEO

Diana Pupkevic, Investment Analyst

AxiaFunder, 184 Shepherds Bush Rd, London W6 7NL

Tel: +44 203 286 5922

Cormac Leech has focused on the alternative finance space for the past seven years. He was closely involved in raising over $2 billion for direct lending funds as a founder and director of the Liberum Alternative Finance, and also incubating several fintech startups. He has also been a senior consultant to private equity groups including VPC after spending a number of years in strategy consulting at McKinsey.

Diana Pupkevic has previously completed internships at ING and British Business Bank supporting the organisation’s strategy in reducing regional imbalances in SME access to finance. Diana holds an MA in Comparative Business Economics from University College London and a First-Class Honours degree (BA) in Business Economics from University of Greenwich. She is also fluent in both Russian and Lithuanian, and has volunteered for a year at XLP, a mentoring project working with young people in disadvantaged communities in London.

AxiaFunder is a UK-based litigation funding platform which offers investors direct access to pre-vetted commercial litigation investment opportunities that it expects to offer attractive risk-adjusted returns. Similarly, claimants with meritorious claims can access capital through the AxiaFunder platform, enabling their cases to progress.