Understand Your Rights. Solve Your Legal Problems

What crucial regulations must Canadian franchisors ensure they understand?

In Canada, franchising is governed provincially. British Columbia, Alberta, Manitoba, New Brunswick, Ontario and Prince Edward Island have each enacted franchise legislation which aims to, among other things, level the playing field between franchisors and franchisees. This allows franchisees to make informed decisions regarding the purchase and operation of franchised businesses in those provinces.

The most significant obligation of franchisors is the duty to disclose. Franchisors must provide prospective franchisees with a franchise disclosure document (FDD) containing certain prescribed information about the franchisor, its executive team, as well as copies of its franchise agreements. This FDD must be delivered at least 14 days before the signing of any franchise agreement or the making of any payment related to the franchise, whichever is earlier. Certain limited exceptions exist for the payment of deposits and the execution of deposit agreements. Failure to adhere to this cooling-off period gives the franchisee the right to rescind the franchise agreement within 60 days of receipt of the FDD. Only in specific, limited circumstances is a franchisor exempt from this requirement.

Understanding the disclosure obligation is vital to the success of any Canadian franchise system, as failure to provide proper disclosure can result in significant financial losses to a franchise system. Franchisees have a statutory right to rescind a franchise agreement and walk away from the business for up to two years after signing the franchise agreement if an FDD is not provided. If the FDD is provided but does not outline the information as prescribed in the regulations, the franchisee can rescind within 60 days of receipt of the FDD. This does not mean that it is safe to simply provide a deficient FDD and assume the risk of a 60-day rescission. Canadian courts have found that certain deficiencies in an FDD are “fatal”, leaving the franchisee in the position as if they had never received an FDD (and thus providing a two-year rescission period).

The most significant obligation of franchisors is the duty to disclose.

In addition to financial losses, franchisors can suffer damage to its brand by its failure to comply with franchise requirements.

Franchise legislation also imposes upon franchisors and franchisees a positive duty of good faith and fair dealing in the enforcement of franchise agreements and operation of franchised businesses. Franchisors and franchisees in those provinces that have not enacted franchise legislation are also bound by a similar duty of good faith, which the Supreme Court of Canada has imposed on all commercial relationships.

How are franchise agreements enforced?

In all provinces, franchise agreements are enforced privately through the civil litigation process. There is no regulatory oversight or enforcement bodies. Many franchise systems opt for mandatory arbitration proceedings to deal with any disputes relating to the franchise system.

Why is it important for Franchise Disclosure Documents (FDDs) to be continually maintained and updated?

It is vitally important that franchisors maintain and update their FDDs. The risk and cost associated with failing to provide compliant and timely disclosure is high. Therefore, the FDD must be a living document as much of the information provided to prospective franchisees changes over time. In addition to information prescribed in the legislation, franchisors must provide franchisees with “all material facts” about the brand and system that may inform their purchasing decision. As materiality can be subjective, much of the litigation in this area relates to whether a fact is or is not material.

Additionally, as franchise systems evolve the FDD must be updated to reflect new information about the brand and system. For example, COVID-19 has been such a change for franchises. Costs have increased due to new safety protocols and lockdowns and forced closures have had significant negative impacts on certain industries while others have thrived.

What is the Canadian Franchise Association (CFA) and what assistance does it offer to franchisors?

The Canadian Franchise Association (CFA) is a national, not-for-profit association that represents the interests of the franchise industry and franchise owners in Canada through advocacy work and education, as well as networking and lead generation for its members. Members of the CFA include franchisors, franchisees, and services providers within the industry. Membership in the CFA adds a level of legitimacy to a franchise system as it denotes professionalism and credibility. Additionally, in order to be a member of the CFA a franchise system must have prepared an FDD that is compliant with the regulations in the jurisdictions in which it intends to operate.

[ymal]

About Joanne Gilbert-Wiens

What can you tell us about your journey into franchise law?

My journey into franchise law was really a matter of developing my interests and seeing where they led me over time. I always had an interest in studying law and knew that law school would open up opportunities for me, but it was not until I had started law school that I started to envision myself becoming a lawyer. It was as a summer student at KMB Law that I discovered my interest in corporate law. I was fortunate to work for a firm that encouraged me to reflect on what I really wanted for my career and my practice. It was during articling at KMB Law that I discovered my passion for franchise law. I was given the unique opportunity to focus on this niche from the beginning of my career, which has served me well in building my practice and best serving my franchisor and franchisee clients.

How does working with franchise systems differ from other fields of corporate law?

I have always found the practice of franchise law to be rewarding and been truly excited to watch my clients grow in the franchise industry, whether as franchisors or multi-unit franchisees. In my practice, I get to assist new and emerging franchisors with the initial development of their franchise systems, the Canadianisation of US brands, and the growth of their system throughout Canada. Franchise law has also allowed me to assist franchisees to become business owners for the first time, when they might not otherwise have the opportunity or ability to do so. It is a unique and truly exciting experience entering into a relationship with your clients knowing that you are a part of their growth strategy and seeing them accomplish their goals.

What are you most looking forward to for the remaining half of the year?

As we begin putting COVID-19 behind us, I look forward to a return to normalcy. I am eager to meet with my clients face-to-face and have the opportunity to engage with their businesses in a meaningful way. I also look forward to spending time with my colleagues in the franchise industry and continuing to learn and grow in my practice for the benefit of my current (and future) clients.

Joanne Gilbert-Wiens, Lawyer

KMB Law

Tel: (905) 276-0406

Email: jgilbert@kmblaw.com

Website: kmblaw.com

https://www.linkedin.com/in/joannegilbertkmb

Keyser Mason Ball LLP is a fully diversified business law firm with additional expertise in family law, mediation, wills and estates. With over 40 years of experience, KMB Law provides guidance and expertise to its international client base in virtually every area of business law, equipping clients with support to find innovative and cost-effective solutions to achieve their goals.

Joanne Gilbert-Wiens is a Lawyer in KMB Law's Franchise, Retail & Distribution and Corporate/Commercial practice groups. She is also a registered Canadian Trademark Agent.

Joanne’s corporate/commercial practice covers a wide range of corporate and commercial matters including mergers and acquisitions; negotiation and preparation of commercial agreements, including shareholders agreements, customer agreements, supplier agreements, sales agreements and terms and conditions; and assisting start-ups and family-owned businesses with incorporation and start-up.

As a member of the Franchise, Retail & Distribution Group, Joanne has extensive experience assisting business owners across a wide range of industries with the creation of franchise systems; review, negotiation and compliance with disclosure requirements; preparation of franchise disclosure documents and franchise agreements; assisting foreign franchisors with expansion into Canada; and negotiating and documenting the purchase and sale of franchised businesses. She also assists franchisors with their ongoing franchise needs, including the maintenance and delivery of franchise disclosure documentation, and correspondence with franchisees and enforcement of franchise agreements.

Joanne also assists franchisees with disclosure and franchise agreement review and negotiation, as well as the negotiation and documentation of franchise resale transactions.

What has changed in Brazil’s economy since the inauguration of the new government?

The new government was elected promising economic liberalization and deregulation. After a long debate in Parliament, Law 13874 was enacted in September 2019, with a ‘Declaration of The Rights of Economic Freedom’ imposing new rules for the protection of free enterprise and the free exercise of economic activities.

In accordance with this law, the bases of banking and insurance supervision were reassessed. Their control is no longer total and comprehensive and has been directed to those who most need it. In the financial area, digital banks and the open banking scheme were permitted, as well as new remote means of payment (e.g. WhatsApp). In the insurance area, only individuals and small-sized companies will be covered by state supervision. Medium and large companies should deal directly with insurers about their insurance coverage needs. In addition, a regulatory sandbox has been created, opening the way for new and creative digital insurers to assess the market without major demands.

What is the most impactful measure for insurance and reinsurance?

The measure with the greatest impact was the freedom the regulatory body granted to underwriting large risks insurance policies (oil, engineering, banks, aeronautics, maritime, nuclear and credit). Insurance from any branches (including performance bands) can also be released as long as they are contracted by legal entities under certain minimum requirements. In all these cases, insurance contracts shall be governed by contractual conditions freely agreed between insurer and insured.

In the insurance area, only individuals and small-sized companies will be covered by state supervision.

However, there are advantages and disadvantages to this. First, the insurance contract loses its characteristic of adhesion contract, where the interpretation of any ambiguity will be made in favour of the insured (Civil Code,art. 423). On the other hand, as the contracts will be unique and personalised, the insured will need to understand the options of coverage existing in the market, the values of respective premiums, and the risks and needs of insurance litigation. In this sense, insurance brokers can help a lot. Moreover, reinsurance cessions tend to be more complex and time-consuming, given the need to study each case, delaying the beginning of contractual coverage.

What role will performance bonds insurance play in public bids?

A new public bids law was also issued, where performance bonds insurance became the main guarantee to be offered by the contracted builder or supplier. In normal contracts of building works and services, the insurance guarantee will be between 5% and 10% of the insured contract value. In the case of major engineering works and services (over USD 40 million), the insurance guarantee will be up to 30% of the insured contract value. The great innovation in these bigger cases is that the bid may function as an insurer´s obligation to assume the execution and complete the object of the contract of works and services in case of default by the insured contractor.

Luis Felipe Pellon, Founder and President

Pellon & Associados Advocacia Empresarial

Address: Rua Desembargador Viriato 16, CEP 20030-090, Altavista Building, Rio de Janeiro, Brazil

Tel: (55) (21) 38247821

Cel: (55) (21) 993392323

Email: lfpellon@pellon-associados.com.br

Website : www.pellon-associados.com.br

Luis Felipe Pellon

I have worked in insurance and reinsurance matters for 30 years, covering all its legal and operational aspects. I deal with contracts, claims, lawsuits, arbitration, product development, corporate, tax and governmental issues. My education took place mainly in Brazil, plus four years in Germany in the Insurance legal department of Hamburg University and in the Max Planck Institute for Comparative and International Private Law. There I studied contractual and regulatory aspects in insurance and reinsurance, both in Germany and in the European Community. I live in Rio de Janeiro but I work all over the country and abroad. I also work with industry associations, especially AIDA WORLD, of which I am a member of the Presidential Council.

My firm, Pellon & Associados, has a long and special relationship with the insurance market, as a leading law office in this area in Brazil with over 100 lawyers distributed among our offices in Rio de Janeiro, São Paulo and Vitoria. We have employ correspondent lawyers in all other main Brazilian cities and abroad. The firm renders a full range of services to insurers, reinsurers, brokers and agents, from consultation to court litigations and administrative proceedings, in all jurisdictions. We also conduct arbitrations and mediations, either independently or through arbitration chambers.

The term “Regulatory Sandbox” has seen global embrace in the past five years, inspiring recent initiatives such as the World Bank’s 2020 Report of Regulatory Sandboxes(1) and the FCA’s 2021 Digital Sandbox pilot(2). For those unfamiliar with the concept, a Regulatory Sandbox is a platform where regulators allow technology solutions – mostly in the fintech space – to be tested without having to fit into an existing regulatory framework.

A Sandbox can reduce or remove regulatory parameters for test purposes and even the eventual permanent removal of the requirements should the platform be approved for future use. The test environments typically have limits on the number of customers that are part of the test, maximum timelines on testing, risks to clients (i.e. minimal capital requirements of testing entity) and require testing under the regulator’s supervision. Sandbox applicant approval in most jurisdictions include criteria such as the benefit to consumers, the risks to the overall financial system and the degree of innovation the final platform can provide.

The primary driver of the Regulatory Sandbox concept is the realisation that traditional regulations and regulatory processes cannot keep up with the speed of today’s business demands for technology. Another major impetus for the Regulatory Sandbox is globalisation – where the right regulatory environment can invite investment in technology development in your country that can then be sold globally.

The Regulatory Sandbox has also been referred to as “agile regulation”, but that requires an “agile” regulator. As was cleverly captured in the US Nevada state Regulatory Sandbox proposal, you can only be as innovative as your least innovative regulator! Studies globally have concluded that governments play an essential role for innovation to happen.

A Regulatory Sandbox is a platform where regulators allow technology solutions – mostly in the fintech space – to be tested without having to fit into an existing regulatory framework.

A country’s regional regulators may also ultimately dictate a technology company’s ability to compete globally as we step into the 4th Industrial Revolution. Prime examples are the states of California and New York, which have an important impact within the US economy and conduct business globally. They are, however, two of most heavily regulated states and have seen an exodus of both people and businesses during the pandemic. There are a number of reasons contributing to this population shift; as an attorney who has worked with regulators in both these states, I would suggest that while the large populations and business concentrations have invited regulation, the heavy regulatory regimes may be a contributing factor to the exodus as innovative companies seek more accommodating geographies.

While Advanced Economies (AE) launched the concept like the UK’s FCA “Project Innovate” in 2016, Emerging Markets and Developing Economies (EMDE) are becoming quick followers, which we will speak to further as we unfold the World Bank Group study.

We need to give credit to the tech industry for introducing the Sandbox concept long before regulators adopted it. The term was first used to describe a testing environment that enabled users to run programs without adversely affecting the bigger application environment on which they ran. The technology sandbox concepts of testing with safety, visibility and accountability are also the foundation of Regulatory Sandboxes.

One of the most current global-reaching studies on Regulatory Sandboxes was released in November 2020 by the World Bank (WB). The mandate was a global review of digital financial service accessibility, with one of the objectives being to understand how fintechs and Regulatory Sandboxes could bring digital services to underserved populations. One especially revealing lens of the study was the “Type of Economy”, which they put into two categories: Advanced Economies and Emerging and Developing Economies. While there are many types of Sandboxes from medtech to envirotech, the WB study focused on fintechs. Its primary purpose was to explore how to leverage technology for consumer-centric products, offering alternatives to previously underserved populations.

The study determined that 57 countries worldwide were currently operating 73 Fintech Sandboxes. AEs were day one leaders in launching Regulatory Sandboxes, with the UK being one of the first countries to invite technology participants in 2016, but the EMDEs are quickly catching up. While the Sandbox concept took on a more global footprint in 2018-2019, driven by the opportunity to leverage fintechs, the COVID landscape has served to both invite and push the concept further as commerce and government adapt to meet societal needs in an emergency environment. COVID has forced regulators to respond by adaptive regulation in real time, even if on a temporary basis, enabling technology to benefit consumers – not just the institution using it to accommodate a changed business delivery model. This may be one upside to COVID!

While the WB report had many findings and recommendations, the three that jumped out for this writer were National Financial Inclusion Strategies, the different types of sandboxes and the surge of the sandbox in emerging markets and developing economies.

National Financial Inclusion Strategies (NFIS) have become an important part of many countries’ Sandboxes, including Bahrain, Malaysia, Sierra Leone and India, while others have made Sandboxes part of their NFIS, like Jordan and Mexico. These countries also include a mandate to improve the digitisation of government services in ways that will improve the lives of their citizens. The utilisation of technology to present business opportunities is not the focus but rather accommodating technologies that improve financial inclusion and access to government services. The first NFIS was launched in 2010, and by 2019 over 45 countries had launched one, with 39 others in the process of doing so. These strategies have all looked to fintechs and digital financial services as a way to further NFIS goals. In the WB study it was discovered that the 90 plus countries with NFIS all encouraged the use of fintech to achieve NFIS goals. While Regulatory Sandboxes have many purposes depending on the country and entity leading them, financial inclusion has found its way to being a key driver in EMDEs.

The WB study classified Sandboxes into four types: (i) policy focused; (ii) product or innovation focused; (iii) thematic, and (iv) cross-border. Policy focused Sandboxes use the process to evaluate specific regulation types or policies. Innovation Sandboxes encourage innovation by lowering the cost of entering the regulated marketplace, allowing firms to test the market viability of new business models. A thematic Sandbox’s objective is to accelerate the adoption of a specific policy or innovation, or products aimed at specific population sectors. Cross-border Sandbox objectives are to improve cross-border harmonisation and the fintechs’ ability to scale more rapidly on both a regional and global basis. These findings provide a very helpful starting point and potential road map for countries or regulatory bodies contemplating a Regulatory Sandbox.

While Regulatory Sandboxes have many purposes depending on the country and entity leading them, financial inclusion has found its way to being a key driver in EMDEs.

While AEs were the first countries to embrace the Sandbox, EMDEs are catching up with 70% of the open and active Sandboxes in 2020. The reasons behind this are not conclusive, but there are two emerging themes – these countries are highly committed to better NFIS or interested in encouraging investment more generally in their economy, with fintechs being a priority invitation. This could be done by regulation providing a clear but flexible path on government expectations. How ironic that regulation could be a tool to promote investment!

The Regulatory Sandbox is a wake-up call for the legal industry. The legal profession has for centuries protected individuals’ rights and served justice, going back to 41 AD when Roman Emperor Claudius first permitted fees to be paid to “advocates”. Today’s legal profession in most countries, while well intended to protect those seeking legal counsel, has professional and regulatory requirements that result in cost structures which discourage individuals from pursuing justice and protection. A recent response to alleviate this unintended consequence is the emergence of the Regulatory Legal Sandbox.

The UK has been a leader in this movement with the Solicitors Regulation Authority’s launch of “SRA Innovate” in 2018(3) to improve access to justice by making legal services more affordable. Other countries are embracing a similar approach by permitting the leverage of technology in delivering traditional legal services. This could be through a specific technology platform or by permitting the ownership of law firms and the delivery of select legal services by non-lawyers. The goal is to provide access to traditional legal services in a more financially and technology efficient way. North America has been a loud voice of late in this space formally embracing the Legal Regulatory Sandbox in the US and Canada. In the US, California just announced its “Closing the Justice Gap”(4) and Nevada’s Supreme Court introduced the Legal Services Sandbox(5) in 2021 – both with the purpose of increasing access to affordable legal services. Canada’s Law Societies in Ontario(6) and British Columbia(7) have also announced Legal Regulatory Sandbox pilots in the past six months. These are wake-up calls for our profession.

While the values of affordability and inclusion have been drivers of Regulatory Sandboxes, keep your eye on technology companies. Regulators are being forced to respond to what is emerging from technology companies. The real regulator may be technology itself.

References

Stephen Cheeseman is a Toronto-based lawyer admitted to practice in Canada, the USA and England and has advised on transactions across the globe. With added credentials in Anti-Money Laundering, Privacy and Cybersecurity, he is a frequent and passionate speaker on the intersection of technology and regulations. He has held legal and compliance roles in the delivery of financial services for global companies that include Foresters Financial and HSBC. In his current role as VP of Legal and Compliance for Canada Protection Plan he is providing leadership in the life insurance space with a focus on digital initiatives.

From 1 January 2021, the rules of jurisdiction set out in the Brussels I Regulation ceased to be applicable. What were the most imposing changes that needed to be prepared for?

I believe this will mean furthering collaboration with specialists in other jurisdictions as we will have lost an acquired certainty for an inevitable uncertainty. The UK has become a third state for the purposes of Brussels I Regulation and as such, we cannot assume the same fluidity and recognition regarding enforcement.

Enforcement out of the jurisdiction will depend on a variety of factors which will need to be considered on a case-by-case basis. The situation will hopefully become clearer through legislation and development as issues arise.

A short-term effect is that practitioners involved in cross-border disputes with a UK/EU element will need to rely on the relevant provisions, treaties and domestic legislation and on the timing of the legal proceedings in question. It will be imperative to add clear jurisdictional clauses, especially in this initial phase and until clear precedents are set. Finally, we need to hope that the Ayala court understanding will be echoed by the EU courts. Early signs to that effect are mixed.

What needs to be shown in order to obtain permission to serve out of the jurisdiction?

The 10,000 feet rule is that documents must be served within the jurisdiction, i.e. England and Wales. There is no absolute right to serve a claim form out of the jurisdiction without the permission of the Court. Again, a clear service clause in an agreement could be of great assistance to avoid costly debates and cost of service.

The ability to serve a claim outside England is based on the fact that the court has jurisdiction to determine the dispute between the parties. Consideration needs to be given to the possible jurisdictional challenges, a good practice in any event. It will not sit well with the client to be turned down at this stage of the proceedings.

In determining the application, the court will need to be satisfied that three requirements have been met: whether there is a serious issue to be tried, whether there is a good arguable case and whether the court is the appropriate forum.

What role does the Hague Convention on Choice of Court Agreements 2005 play here?

A great role indeed! The position of the UK is that the application of the Convention vis-a-vis the UK will continue without interruption. It should be noted that the EU Commission has recently taken a different approach from the UK as to whether the Convention applies to exclusive jurisdiction clauses in favour of the courts of England and Wales that were entered into prior to 31 December 2020.

The Private International Law (Implementation of Agreements) Act 2020 received royal assent on 14 December 2020 and achieves the domestic implementation of the Hague Conventions. Therefore, service using this mechanism is available as it was before Brexit took place, and is of greater importance now as other avenues may no longer be available.

Post-Brexit, enforcing English judgments throughout the EU may be marginally more difficult than it currently is under Brussels Recast. What difficulties may be presented here?

From 1 January 2021 onwards, parties with an English judgment wishing to enforce within the EU will no longer be able to rely on direct recognition and enforcement, which was previously afforded to them under the Recast Brussels Regulation. Therefore, added difficulties arise in determining under which mechanism enforcement will be recognised. Options to be considered include the Hague Convention, bilateral treaties and local laws of the specific EU Member State.

In a nutshell: we will need to have local specialist knowledge in each jurisdiction in which we are attempting enforcement. This may affect times and costs for the clients and will likely also add an element of uncertainty increasing perceived resolution of the matter. Last month we had a valid order to execute in France and the French court requested additional documents to be translated, at great cost to the client, to rule that they needed more time to consider. In the meantime, the French entity we attempted to enforce upon entered administration, putting us in a queue of creditors as the French Court had not yet validated the UK order. Luckily with some persuasion, reason prevailed for the client, but it is certainly a sign of things to come.

In a nutshell: we will need to have local specialist knowledge in each jurisdiction in which we are attempting enforcement.

What factors may ameliorate these difficulties?

Being strategic from the start of the matter and ideally from the contractual phase. Having a good team of Strategic Alliance Partners in the local jurisdiction will certainly be advantageous, saving costs and time for the client. We have focused the development of ASV Law to that effect and early signs that it was the accurate move are already showing. A deeper understanding of the client’s real goal will help in defining where to start proceedings, as sometimes it may be worth bypassing the UK Courts altogether to secure execution if we identify a risk factor, such as administration or weak economic position of the defendant. Winning a case and not being able to execute the order is great for the lawyers (a win is a win) but often pointless to the clients!

Simon Vumbaca

ASV Law

Address: 1 Knightsbridge Green, London, SW1X 7QA

Tel: (+44) 020 7993 5450

Email: info@asvlaw.com

Website: www.asvlaw.com

ASV Law was established by Simon Vumbaca in 2011 and is an international law firm based in Knightsbridge, London. It delivers corporate, commercial and litigation advice to global clients, bringing parties together to facilitate settlements and mediation.

Simon Vumbaca is an award-winning lawyer with over 25 years of international experience and a reputation for delivering substantial corporate and commercial sector success. Qualified in multiple jurisdictions, Simon offers international clients strategy-led complex cross-border litigation and arbitration advice with great success.

Could you give a basic overview of the oil and gas sector in Libya and the role of the National Oil Corporation of Libya?

The major oil discoveries in Libya were made under the Petroleum Law No. 25 of 1955 which introduced two contractual models: The Preliminary Reconnaissance Permit (which is merely a seismic option) and the Deed of Concession. The Law authorised the Minister of Petroleum to issue Petroleum Regulations implementing the provisions of the Petroleum Law and detailing its various aspects. Nine regulations were issued. The only ones still in force today are Regulation 1 dividing the country into four petroleum zones, Regulation 8 on Conservation of Petroleum Resources and Regulation 9 on Financial, Administrative and Technical Control for the Preservation of Oil Wealth. Other forms of contracts such as the joint Venture Agreements and the Exploration and Production Agreements were introduced by Law 24 of 1970 establishing the National Oil Corporation and decree 10/1979 Re-organising the National Oil Corporation.

Oil and gas is the biggest sector of the Libyan economy, accounting for 60% of its GDP. What legal issues often arise in bidding for contracts in this area?

Since Libya abandoned the direct negotiations for awarding petroleum licenses in 2005 in favor of public bidding rounds, the legal issues were reduced to compliance with the pre-qualification requirements, including the form of the bidding bond and the formation of consortium among the bidders. The applicability of Libyan law, including Petroleum Law, as the governing law of the agreement was also of concern to new participants.

What advice do you often give to companies bidding for Exploration and Production Sharing Agreements (EPSAs)?

The advice we often give to companies bidding for EPSAs is to be transparent in dealing with NOC and avoid any irregular ways and means throughout the process, in particular in collecting technical data on the blocks offered in the relevant bidding round.

Your firm has been advising exploration and production companies for three decades. How has the legal landscape of the oil and gas sector changed during that time?

One major change since 1990 was the abandonment of the direct negotiations in awarding exploration and production licenses and adoption of public bidding instead. This change introduced a high degree of transparency to the process and heightened the competition among the international oil companies, including the medium-sized ones.

The advice we often give to companies bidding for EPSAs is to be transparent in dealing with NOC and avoid any irregular ways and means throughout the process.

What do foreign companies often fail to understand about negotiating contracts in Libya’s oil and gas sector?

Since the introduction of the bidding rounds there are no negotiations of the contractual terms, as the model contract is attached to the bidding documents with no possibility to change its provisions. NOC conducts clarification rounds to answer questions on technical, financial and legal issues. From our experience, we can say that among the common legal issues that companies request clarification on is the following:

What provisions of the Petroleum Law and the Petroleum Regulation would apply to the EPSA? This question arises because the Petroleum Law deals mainly with the deed of concession. However, a few provisions continue to apply to the EPSA. Among them: a) Article 12 regulating the use of excess capacity in pipeline and terminal facilities; b) Article 16 on the exemption from certain import and export duties and c) Article 22 imposing certain penalties on violation of the law, especially in the events causing loss or dissipation of hydrocarbons or causing damages to petroleum reservoir as a result of failure to observe the provision of this Law and regulations issued thereunder. Most of the clauses of Regulation 8 are applicable to the EPSA. Some clauses of Regulation 9 also apply, such as the Clause introducing the formula of the pipeline and terminal tariff for use of surplus capacity and the Clause defining the operating and administrative expenses.

Abdudayem Elgharabli, Partner

MKE Lawyers

Address: Mukhtar, Kelbash & Elgharabli Attorneys-at-Law, Magta Alhajar Street, Dahra / PO Box 1093, Tripoli, Libya

Tel: (+218) 21 333 2665

Fax: (+218) 21 333 1650

Email: info@mkelawyers.com

Website: www.mkelawyers.com

The Tripoli-based Libyan law firm Mukhtar, Kelbash, Elgharabli & Abdulaziz ("MKE") was established in the early 1990s by Mahmud Mukhtar and Bahloul Kelbash following the liberalisation of private legal practice in Libya. The firm's partnership was further widened with the addition of Abdudayem Elgharabli in 1992 and Ahmed Abdulaziz in 2014. MKE provides legal support to Libyan and foreign clients in the areas of oil and gas, corporate, litigations and international commercial transactions involving Libyan interests, Labour Law, Civil Law, Commercial Law and Administrative Law.

Abdudayem Elgharabli is a Partner at MKE Lawyers and carries a wealth of experience in Petroleum Law. Between 1978 and 1992 he served as Senior Advisor and later General Counsel to the National Oil Corporation of Libya. He has also provided legal support to major international investors as well as oil and construction companies looking to begin projects in Libya.

What are the major differences between the EPO and USPTO approach to patenting and how can you develop global portfolios despite them?

The US is actually becoming more like the EPO in its approach, but differences still exist, particularly in software, AI and medical devices. Leaving aside minor differences in claim form, the key point is to make sure there is a story that can be told which will work in each jurisdiction, and that each specification has enough of the right “hooks” to let it be told without unhelpful components. We often work with US attorneys to reshape and remove red flags for Europe before they file their international applications. Going the other way, it is important to know what you can try that you cannot in Europe or the UK and be bold.

How long can the patent application process take? Does it vary significantly between the US and EU?

The process can take 3-4 years but there are ways to accelerate it, particularly in Europe and the UK, and at a cost in the US if you set out to do so. There is variation between technologies. However, because we are all experienced practitioners, we are happy to pick up the phone to examiners – many of whom we have got to know over the years – and this can cut times and costs compared to the traditional approach of having associates crank out serial form responses.

What are the common pitfalls that patent applicants encounter?

Often there is not a realistic appreciation and communication of what might be granted of commercial value. Searching is never easy or cost-effective and a lot of advisors are reluctant to speculate what might be out there if a client does not tell them, often leading to unrealistic claims that set off on the wrong path or run out of fallback positions. It is important for the patent attorney not to take an academic approach but a commercial one.

How has the patent application process changed during the pandemic?

An obvious change is the move to hearings by videoconference, which has had some pushback in contentious matters which some may have been following, and IK-IP has filed an amicus brief at the EPO Enlarged Board of Appeal which has attracted support. Other than that, it is largely business as usual and there are happily not the significant delays there might have been. Offices have generally responded well and pragmatically to the challenge.

It is important for the patent attorney not to take an academic approach but a commercial one.

You have a great deal of EPO opposition experience – can you tell us what value they have for clients?

An EPO Opposition is a great way to keep your competitors’ IP in trim and stop it encroaching on your territory. Patents in particular can be filed anonymously and there is little downside as opponent, importantly with no link to infringement. The cost is a fraction of that of litigation, perhaps as little as £5-10k to file one. Conversely as a patentee faced with an opposition, it is really important to be strategic, particularly with changes in appeal procedure, and not treat it simplistically as errors or omissions may be hard or impossible to recover on appeal.

Ilya Kazi

IK-IP Limited

Address: 201 Borough High Street, London SE1 1JA

Tel: (+44) 020 3805 7765

Email: ilya@ik-ip.com

Website: ik-ip.com

IK-IP was founded in 2020 to offer what observation suggests works best in IP. They benefit greatly from an experienced strategist to foresee latent problems and appreciate the business relevance and value of IP assets even for apparently routine matters. IK-IP’s ethos is to work collaboratively and is happy to dovetail with other law firms, whether in the UK or overseas, to bring specialist expertise to bear to complement existing capabilities.

Ilya Kazi has been practicing as a UK and European Patent attorney for nearly 30 years and he is a qualified litigator. After a brief spell in a Silicon Valley firm, he oversaw the growth of a small UK firm to approximately 200 people, winning numerous awards and being personally involved in over 4,000 patent applications as well as numerous oppositions, appeals, and litigation.

What is the value of having a trademark registered in Australia?

When I am looking for something in a crowded online market or at a physical store, I look for the brand I know and trust, and purchase it. Simple, reliable, repeatable.

Trademarks (brands) are essential marketing tools and your business’s identifier in the marketplace. Consumers use brands to identify your offerings against those of your competitors, with the expectation of consistent quality. Brands are hugely valuable assets and can ultimately be worth billions of dollars.

Many businesses over the past year have had to dramatically pivot their offerings and move to, or ramp up, online selling. But the importance of registering a trademark has not waned and arguably has increased.

A registered trademark gives the exclusive right to use, licence and sell or transfer the trademark. The ® symbol used for registered trademarks gives notice that you have the right to use that trademark for the goods or services covered to the exclusion of others and acts a strong deterrent against would-be infringers.[1] Trademark registration also gives you a powerful tool to stop would be copycats encroaching on your territory.

It is possible to carry on your business without registering your trademark. However, relying on an unregistered trademark carries greater risk. Your rights are not located on a searchable register, meaning that another company may build their own rights in the trademark. When it comes to stopping them, you have to be able to establish a superior reputation against this other party by gathering evidence of your use over a long period. A trademark registration eliminates the need to provide that evidence and offers much greater certainty.

Trademarks (brands) are essential marketing tools and your business’s identifier in the marketplace.

The costs to file a trademark application are nominal compared to rebrand and relaunch costs.

Once your trademark is registered, and provided you keep using it, it is renewable every 10 years for as long as you want it.

When should I look at registering a trademark?

You should look at trademark protection early in the process of a new product or offering. A clearance search to check that your brand is available to use and register prior to launch gives a very good level of comfort about your ability to use the trademark and allows you to strategise to achieve registration of the brand. Being ahead of the curve and proactive can make life much easier and save on potential rebrand costs and the marketplace awkwardness of having to withdraw a brand after launch.

What should I be protecting as a trademark and how?

We often think of trademarks as words or logos, but trademarks have far more reach than that. Trademarks can also be colours, shapes, aspects of packaging, movement or animations and even sounds (think jingles) or scents. In Australia, if consumers associate any of these signs with your business, they can be protected as a trademark for your goods and services to the exclusion of others.

At a minimum, protecting your house brand is paramount. Registering trademarks for your main product and services lines is also important. Ask yourself: "If my competitor started using or registering that brand, would it bother me"? If yes, the brand likely warrants trademark protection.

We often think of trademarks as words or logos, but trademarks have far more reach than that.

A trademark registration does not protect the brand for all goods and services but covers certain goods and services nominated at the time of filing the application. There are 45 classes of goods and services to choose from. It is essential (though not always straightforward) to get the correct goods and services specified, because:

What if I see someone else using my trademark, including online?

This is where the importance of a trademark registration comes to the fore. If you see unauthorised use of your trademark in relation to goods or services covered in your registration, you are in a strong position to ask them to stop. Letting someone know you have a registered trademark is often enough to get them to cease their activity. However, if they do not stop, you can take the matter further.

Also consider the forum of the unauthorised use. If it is on social media, search engines, or an eCommerce website, you may be able to make a complaint on that platform to immediately remove the conduct. You need to have a registered trademark to do this.

What about protecting my trademark overseas?

In most cases, trademarks are national (per country) rights.[2] A trademark which is used or protected in one country does not enjoy protection in another country. However, the protection for a registered trademark can be extended to other countries by filing national applications in those countries or filing an International Registration via Madrid Protocol, designating countries who are members of the Madrid Protocol.

You can also claim priority and benefit from your Australian filing date (say 1 June 2021) if you file overseas within 6 months (on or before 1 December 2021). If someone else files an intervening trademark overseas between those dates, you can trump them with your earlier filing date.

First-to-file countries are important to identify early. In those markets, such as China, if someone files a trademark application before you (even if you have been using there) that application / registration can block not only a later application from you but also your use in that country – effectively blocking you out of the market.

What extra steps can I take to protect my trademark rights?

Once you have your trademark registered, you can build on your activities to maximise your investment by:

So you can get the best value out of your brand by registering it as a trademark. This offers more certainty, avoids unnecessary costs down the track, allows you to gain better value from your investment and protect this essential marketing tool to the exclusion of others.

[1] If your trademark is not registered, you can still use the ™ symbol to show you are using the brand as a trademark.

[2] Compare an European Community Trademark, which gives trade registration in all 27 member countries.

Elizabeth Godfrey, Principal, Trademarks Attorney

Davies Collison Cave

Address: Level 15, 1 Nicholson Street, Melbourne VIC 3000

Tel: +61 (3) 9254 2777

Fax: +61 (3) 9254 2770

Email: egodfrey@dcc.com

Davies Collison Cave is a leading Australian intellectual property legal practice that consistently files more patent applications than any other firm in the country. They provide expert services in the areas of patents, trademarks, trade secrets, copyright and design protection, licensing, litigation and related legal and commercial matters.

Elizabeth Godfrey specialises in all aspects of trademark protection including selecting, searching, applying for and prosecuting trademark applications both local and international. She has an extensive opposition and non-use practice and exceptional knowledge and expertise in running opposition matters.

EIP's George James and Monika Rai, European Patent Attorney and Partner, offer Lawyer Monthly their insights into the patent landscape of microbes and food.

Microbes present in food and drink, which have a functional effect on the health of the digestive tract, are popular with consumers and common on supermarket shelves. These products include those containing specific beneficial microbes (probiotics) and those containing ingredients that promote the growth and maintenance of healthy gut microbes (prebiotics).

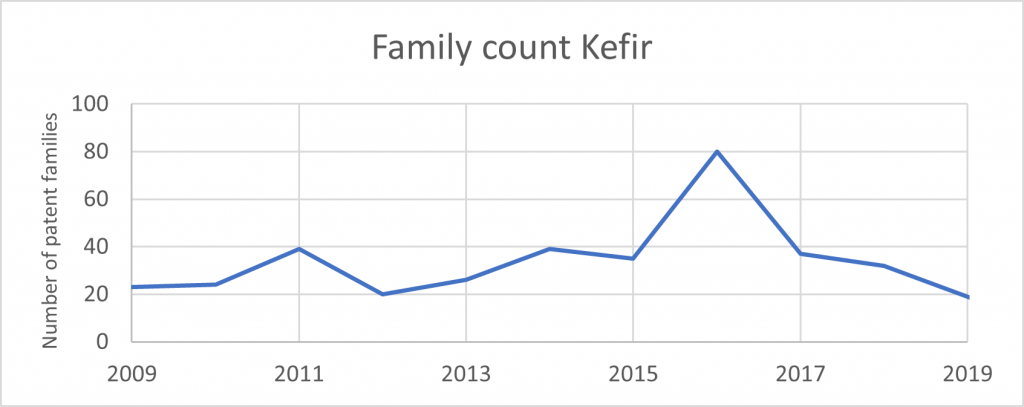

Products such as kefir have recently seen a surge in popularity as consumers become more conscious of the benefits of maintaining a healthy microbiome. This is reflected by patent filing trends, where the number of patent families worldwide containing the word “kefir” boomed in 2016.

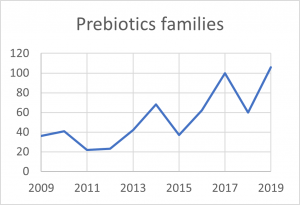

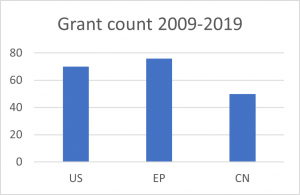

To investigate recent trends (2009-2019) in the microbes in food and drink landscape, we searched online patents databases, using the search and analytics tool Patently®. As an initial strategy, we focused on patent classification codes relating to probiotics and prebiotics in food that have a functional effect on the health, including humans and animals. Our initial search encompassed a broad range of products from probiotic pet food for small dogs[1] to probiotic supplements for metabolic health[2]

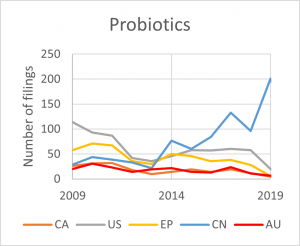

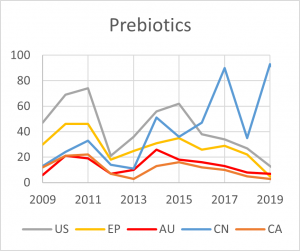

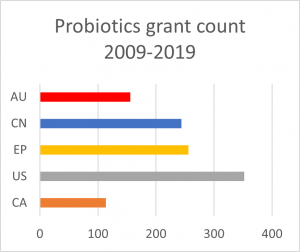

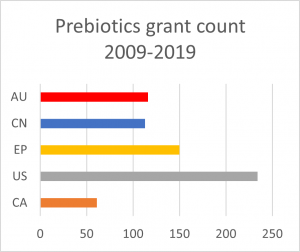

Our search highlighted that most top offices, including the European Patent Office (EPO), have not seen an acceleration in filing activity for food probiotics and prebiotics between 2009-2019. Conversely, China (CN) has seen a definitive increase in such filings, suggesting that they are currently at the forefront of such research, perhaps replacing the US.

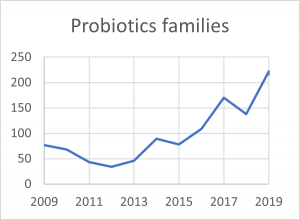

Indeed, the number of probiotics and prebiotics patent families has seen a general increase worldwide, likely due to the recent surge in Chinese filings over the last 5 years.

Further analysis indicates that more patent applications in this field are concluding in grant by patent offices in the US and at the EPO, as compared to cases being granted in China, for example. However, many of the applications more recently filed in China will likely still be undergoing examination, thus China could soon see a large increase in the number of granted applications.

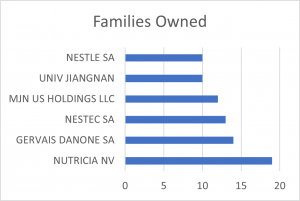

We next performed a targeted search to investigate filings relating to probiotics beneficial to the digestive system and dairy products. Some of the world’s largest nutrition companies appear to be dominating this field. Ownership analysis of our data indicates that French multinational Danone, along with its subsidiary Nutricia, appear to be leading the way; each holding a significant number of patent families. Danone’s position is perhaps unsurprising, considering the popularity of its probiotic products Actimel® and Activia®.

Similarly to our broader search, analysis of our probiotics in dairy data also revealed that the EPO is a top office for granting applications in this field from 2009-2019, outperforming the US.

We identified over 70 European patents specifically directed towards dairy products containing living probiotic bacteria that have an effect on the digestive tract, which protect compositions, bacterial strains and uses thereof in treating disorders and maintaining a healthy gut. For example, see Danone’s patent for a fermented dairy product comprising a Streptococcus thermophilus strain, for increasing or maintaining a Faecalibacterium prausnitzii population, the most abundant bacterium in the intestine of a healthy adult, which plays a vital role in the gut microbiota[3].

Probiotics are also now frequently found in dried foods such as cereal and muesli, and some patents and applications identified in our above searches overlap with these food groups. Despite the growing demand, a targeted search identified very few patents specifically directed towards probiotics in cereal and muesli, suggesting that this remains a relatively nascent area for patenting.

Many product/composition claims granted by the EPO in this field are restricted to a specific deposited microbial strain[4] unless breadth of protection has been achieved by also claiming mutants of specific deposited strains in combination with a functional requirement. For applicants seeking protection before the EPO for such inventions, specific provisions relating to biological deposits must be complied with.

At the EPO, claims that cover methods of medical treatment or therapy are excluded from patentability under Article 53(c) EPC[5], even if the invention also has non-therapeutic effects. However, where these effects can be properly distinguished and the therapeutic effect is not inevitable, a method claim may be allowed. In some cases, it is not possible to distinguish between therapeutic and non-therapeutic effects and it would be preferable to frame the method in terms of a “product for use”, to avoid objections. Our specialist European Patent Attorneys have significant experience of advising on patent strategies in this field.

[ymal]

[1] EP3554268 A1 by Nestle seeking protection for a method of increasing amino acid absorption in a small dog

[2] PCT application WO2020084051 A1 by Novozymes

[3] EP3394294 B1 claiming Streptococcus thermophilus CNCM I-3862 and a fermented dairy product comprising the same.

[4] Danone’s patent EP3394294 B1 (also discussed above) claiming a Streptococcus thermophilus strain deposited at the CNCM under reference number I-3862.

[5] Danone’s patent EP3166619 B1 claiming “Lactobacillus paracasei CNCM 1-3689, for use in treating an Enterococcus faecalis infection in the intestinal microbiota of a subject having an antibiotic-induced dysbiosis.”

International law firm DLA Piper has launched a six-year apprenticeship programme aimed at training school-leavers to become qualified solicitors.

The new apprenticeship will commence from September 2021 and be based in DLA Piper’s Manchester office. It will offer school-leavers the opportunity to earn while working towards a law degree and the Solicitors Qualifying Exam (SQE).

The apprenticeship will comprise four days of on-the-job work experience and one day allocated for study each week, the firm has stated. Apprentices will rotate through DLA’s practice groups and sectors for 6- and 12-month periods, with client and international secondment opportunities to become available as they progress.

Upon completion of the programme, apprentices will qualify as solicitors with a level 7 degree apprenticeship.

DLA Piper has yet to publicly reveal details of its SQE training partner. Also notable is that the new solicitor apprenticeship will run in parallel to the firm’s existing training contract scheme, which focuses on graduates.

[ymal]

Earlier this year, DLA Piper announced an update to its diversity and inclusion goals. The firm intends to reach a global female partnership of at least 35% by 2025, building on its present 21% female partnership. It expects to double this to 40% by 2030.

The European Parliament has backed the Brexit trade and security deal, a key step in ensuring that tariff- and quota-free trade between the UK and EU continues.

The Trade and Co-operation Agreement (TCA), which has been operating provisionally since January, was approved with 660 MEPs in favour and 5 against, with 32 abstentions. However, in an accompanying resolution the chamber described the 23 June 2016 Brexit referendum result as a “historic mistake”.

Lord Frost, the UK’s chief negotiator, said that the vote “brings certainty and allows us to focus on the future”.

Michel Barnier, Lord Frost’s opposite number in the Brexit negotiations, was less enthusiastic. "This is a divorce. It is a warning, Brexit. It's a failure of the European Union and we have to learn lessons from it," he told the European Parliament.

The deal does not address all the tensions that remain in the wake of Brexit. Northern Ireland trade remains covered under a separate protocol defining it as part of the EU’s single market, meaning that goods shipped to the country from the UK must undergo Eu checks.

While the TCA covers trade in goods between the UK and the Eu, it does not cover services – which make up the bulk of the UK economy. Other areas not covered by the TCA include foreign policy, financial services and student exchanges.

[ymal]

The UK’s exit from the EU at the start of the year prompted a record loss in trade between the two blocs, with UK exports to the continent falling by 40.7% and imports falling by 28.8% in January. Though trade volumes have since increased, they remain below pre-Brexit levels.