Freshfields Bruckhaus Deringer has advised M&G plc on a new long-term strategic partnership with Dai-ichi Life Holdings, Japan’s largest listed life insurer.

As part of the agreement, Dai-ichi will acquire a roughly 15% stake in M&G, aligning the two firms for future collaboration across asset management and life insurance.

Under the terms of the deal, M&G will become Dai-ichi’s preferred asset management partner in Europe. The partnership will focus on expanding distribution, developing new products, and driving growth across both companies.

Over the next five years, the alliance is expected to channel approximately $6 billion into M&G-managed funds, with at least half directed toward M&G’s high-alpha strategies across public and private markets.

Tetsuya Kikuta, President and CEO of Dai-ichi Life Holdings, said:

“Dai-ichi Life Holdings is delighted to enter into a strategic alliance with M&G, a highly regarded global player in the insurance and asset management industries, to collaborate and develop capabilities together in multiple areas, especially in Europe.”

Andrea Rossi, CEO of M&G, added:

“The strategic partnership with Dai-ichi Life Holdings and the associated c.15% investment is recognition of M&G’s strengths and clear confidence in our leadership, strategy and long-term prospects.”

“It will enable us to further capitalise on the significant private market opportunities across Europe and enable even greater access to the Japanese and Asian market where we will benefit from Dai-ichi Life Holdings market-leading expertise.”

M&G’s in-house legal team was led by General Counsel Charlotte Heiss, along with Group Legal Director Robyn Butler-Mason and M&A Legal Counsel Georgina Burrow.

The Freshfields team advising on the deal included M&A partners Claire Wills and Michael Black, with partner Piers Prichard Jones.

They were supported by senior associate Bethan Rodden and associates Ciara Cosgrave and Miya Modhvadia. Regulatory and competition matters were handled by partners Martin McElwee and James Smethurst.

M&G plc is a leading savings and investment company with a long-term outlook, dedicated to helping individuals grow and manage their savings. With a heritage dating back over 170 years, M&G has consistently sought to democratize wealth by making financial products accessible to a broader audience. The company offers a diverse range of asset management capabilities, providing customers with various savings and investment solutions tailored to their risk appetite. M&G's purpose is to give everyone real confidence to put their money to work, combining asset management expertise with capital management to align solutions with customer needs.

Freshfields is a global law firm with nearly 300 years of experience, renowned for partnering with industry leaders to navigate complex legal challenges and seize opportunities. With over 5,700 professionals across 33 offices worldwide, the firm offers deep expertise in areas such as M&A, antitrust, litigation, and regulatory matters. Freshfields is committed to responsible business practices, including pro bono work, community engagement, and environmental sustainability. The firm fosters a culture of inclusion and collaboration, empowering its people to thrive and deliver exceptional client service.

How Power Is Checked When the Stakes Are Highest

When a president declares a national emergency, it can feel like the government suddenly shifts into a different gear — fast-moving, far-reaching, and often difficult for the public to fully see. Many people assume those powers keep running unless the White House decides otherwise. But the American system was never designed to hand sweeping authority to any single branch without a meaningful check.

In fact, Congress has a structured, legally defined way to question, review, and even vote to end a national emergency. The process isn’t flashy and rarely dominates headlines, but it reflects a deeper truth about how the Constitution expects power to behave during extraordinary moments: nothing runs on trust alone.

A past example helps illustrate this. Years ago, the House used a brief procedural resolution to guide debate over whether an emergency should continue. It wasn’t the sort of thing that lights up cable news, but it showed how Congress can set the ground rules, take up a termination measure, and force a public conversation about the limits of presidential power. And that quiet process tells us something essential about the balance built into U.S. law.

Emergency powers in the United States don’t come from thin air. They come from statutes — around 120 of them — that Congress has enacted over decades. The National Emergencies Act (NEA), found at 50 U.S.C. §§ 1601–1651, is the governing framework that ties all of these authorities together.

The NEA recognizes that emergencies sometimes require swift action. But it also embeds an assumption: extraordinary authority should never become permanent or unexamined. So Congress reserved the right to step back in and ask a simple but powerful question:

Does this emergency still make sense?

This check isn’t symbolic. It reflects the reasoning that underpins the entire statute:

presidents may act quickly,

but Congress must be able to reassess gradually,

especially once the urgency fades and long-term consequences become clearer.

The Congressional Research Service (CRS), in multiple nonpartisan reports, has consistently emphasized that congressional review is a core safeguard intended to prevent emergency authority from becoming a substitute for regular lawmaking. That context matters because it explains why review procedures exist at all.

The first step is surprisingly straightforward: a member of Congress introduces a joint resolution asking whether the emergency should remain in place. This is the formal mechanism the NEA provides.

Because the resolution has the force of law, it must pass both the House and Senate. If it reaches the president’s desk, the president can sign it or veto it. Congress can override the veto with a two-thirds vote in each chamber, but that threshold is rarely met.

This tug-of-war isn’t a flaw; it’s the design. The system forces both branches to defend their interpretations of necessity, legality, and proportionality.

Before the House can debate the resolution, it typically adopts a short procedural measure laying out how the discussion will unfold. In the past, these rules have included time limits, equal debate opportunities for both parties, and streamlined procedures so lawmakers can vote without procedural gridlock.

Think of these rules as the House deciding, collectively:

If we’re going to debate ending emergency powers, let’s do it carefully but efficiently.

This kind of procedural structure ensures that debates about major national authority remain focused, transparent, and accessible to the public.

The NEA also requires that Congress periodically consider whether any active emergency should continue. Scholars who study administrative law, including experts cited in Government Accountability Office (GAO) analyses, often note that this built-in review reflects a philosophy of “trust, but verify” when it comes to executive power.

In practice, Congress does not always hold these sessions as rigorously as the statute imagined. But the authority exists — and it remains one of the clearest demonstrations that emergency power is never meant to drift forward untouched.

Federal courts play a more limited role than many expect. Judges typically defer to the political branches, especially when national security, foreign affairs, or classified information are involved. Legal challenges usually succeed only when a specific statutory limit is clearly violated or when individual constitutional rights are harmed.

The Supreme Court itself has long recognized what it calls the “political question” doctrine — the idea that some disputes, particularly those involving national emergencies, are more appropriate for elected officials than for courts. That’s why congressional action is often the most realistic path for revisiting an emergency declaration.

Even if you’ve never tracked an emergency declaration, you’ve likely felt the effects of past ones. Emergencies can impact public health regulations, financial restrictions, border operations, telecommunications policy, military construction, and more. Some allow the government to redirect funding; others authorize sanctions or asset freezes.

But the public rarely sees how these powers are reviewed — or whether they’re reviewed at all.

Congress’s oversight process protects the idea that emergency authority must be:

temporary,

justified,

proportionate, and

subject to democratic input.

It prevents extraordinary powers from becoming the quiet background noise of government.

A few years ago, Congress attempted to end a presidential border emergency through a joint resolution. Both chambers approved it. The president vetoed it. Congress didn’t have the votes to override, so the emergency continued.

Even though the effort failed, it demonstrated something important: the legislative branch retains real power, and it can force public accountability even when the executive branch resists.

Legal scholars often point to this moment as a modern example of Congress exercising its supervisory role exactly as the NEA envisioned.

You don’t need to be a constitutional lawyer to understand why this balance matters. Emergencies can reshape policy overnight, and they often expand executive authority in ways the public doesn’t immediately see.

Congress’s ability to question and revisit these declarations protects democratic stability. It ensures that no president — regardless of party — can rely indefinitely on emergency authority to bypass normal legislative processes.

The principle is simple, but vital:

In the United States, extraordinary power must remain exceptional.

Yes. Congress can pass a joint resolution terminating an emergency under the National Emergencies Act. The president can veto it, and Congress may override the veto with a two-thirds vote. While this is difficult, the mechanism firmly exists in law.

A presidential veto keeps the emergency in place unless Congress overrides it. Courts generally step in only when a declaration violates specific statutes or infringes on constitutional rights.

Not by themselves. The impact depends entirely on which statutory authorities the president activates. Some affect financial transactions or federal contracting; others relate to defense, foreign policy, or transportation.

The Federal Register maintains an updated list of active national emergencies and the statutory powers tied to each. It’s an official, public record accessible to anyone.

Several factors get in the way: political incentives, divided government, competing legislative priorities, and the sheer complexity of emergency-related powers. Oversight requires deliberate action, which doesn’t always rise to the top of the congressional agenda.

Mondelēz International (commonly referred to as Mondelez International), maker of Oreo, Nutter Butter, and Chips Ahoy! has filed a federal lawsuit against grocery retailer Aldi.

The complaint, filed on May 27, 2025, in the U.S. District Court for the Northern District of Illinois, accuses Aldi of selling private-label products under its Benton’s brand that imitate the distinctive packaging of Mondelez’s best-known cookies.

According to the lawsuit, Benton’s Original Chocolate Sandwich Cookies use a similar bright-blue package design, layout, and cream-filled cookie imagery that consumers associate with Oreo.

Likewise, Benton’s Peanut Butter Crème cookies allegedly mimic the red and yellow branding of Mondelez’s Nutter Butter product line.

Mondelez argues that these similarities are not incidental but form a deliberate attempt to mislead consumers into believing they are purchasing nationally recognized brands.

The company further alleges Aldi had been notified about similar packaging concerns in the past and made only superficial design changes while continuing to sell lookalike products.

The case hinges on the legal doctrine of trade dress, which protects the visual appearance of a product’s packaging when it serves as a source identifier.

To prevail, Mondelez must prove that Aldi’s packaging is likely to cause confusion among consumers and that its design elements have acquired distinctiveness in the marketplace.

Commenting on the broader legal issue, trademark attorney Josh Gerben, who is not involved in the case, noted:

“I can go to the store and reasonably assume that I recognize the name, and that’s who I’m buying from,” he said. However, he added that some consumers “think that they might be buying something from the Oreo brand or Wheat Thins, but they’re actually getting a substitute.”

Mr. Gerben reflects a growing concern in trademark law: the risk of consumer confusion stemming from increasingly sophisticated store-brand packaging strategies.

Mondelez is asking the court for monetary damages and injunctive relief to halt the sale of the allegedly infringing products.

It is also seeking a court order requiring Aldi to redesign the packaging of the contested Benton’s items and remove them from its store shelves.

Aldi has not yet issued a formal response or public comment on the lawsuit.

The outcome of this case could have wide-reaching implications for how private-label packaging is regulated under U.S. trademark and trade dress law.

With store-brand products now claiming a larger share of grocery sales, national brands are taking a more aggressive legal stance to protect their visual identities.

If the court rules in favor of Mondelez, the case may encourage other consumer goods companies to pursue similar actions against retailers using lookalike packaging as part of their competitive strategy.

Mondelēz International, Inc. is a global snacking leader based in Chicago, operating in over 150 countries. Formed in 2012 after splitting from Kraft Foods, the company owns iconic brands like Oreo, Ritz, Cadbury, and Chips Ahoy!. With over $36 billion in annual revenue, Mondelēz focuses on biscuits, chocolate, gum, and candy, and is committed to sustainable and responsible snacking worldwide.

Holland & Knight Adds Real Estate Partner J. Pieratt in Austin

Gainey McKenna & Egleston Files Class Action Lawsuit Against Fortrea

Baker McKenzie Advises Izdihar Fund on GEMS School Acquisition

Holland & Knight is continuing to grow its footprint in Texas with the arrival of John “J.” Pieratt, who joins the firm’s Austin office as a partner in the Real Estate Section. He comes from DLA Piper, where he was also a partner.

“J. is a highly esteemed member of the Austin real estate legal community. As we continue to focus on growth in Texas, his addition will significantly enhance the opportunities for our practice in the region.”

“We are thrilled to welcome him to our team and are confident that he will be an excellent cultural fit.” said Joe Guay, who leads Holland & Knight’s Real Estate Section.

Mr. Pieratt has built a broad real estate practice representing investors, developers, lenders, and businesses involved in commercial property transactions throughout Texas and beyond.

John Pieratt advises clients on everything from acquisitions and development to leasing, financing, and sales. His background also includes work with private equity, asset management, and tech-sector real estate deals, covering office buildings, retail centers, and mixed-use spaces.

His move comes shortly after another key hire Partner Kate Pennartz, joined the firm’s Dallas office in May, highlighting a clear trend of momentum for Holland & Knight across the state.

“Holland & Knight has seen remarkable growth in Texas over the past several years, and joining the Firm presents an exceptional opportunity to expand my practice to the benefit of my clients,” said Mr. Pieratt.

“I am eager to leverage the Firm's outstanding resources and look forward to working with my new colleagues."

Mr. Pieratt earned his law degree from SMU’s Dedman School of Law and holds a bachelor’s degree from The University of Texas at Austin.

Holland & Knight LLP is a global law firm with over 2,200 attorneys in 35 offices across the U.S., Latin America, Europe, and North Africa. The firm offers full-service legal support across key sectors, including real estate, litigation, corporate law, and public policy. Known for its collaborative culture and deep industry focus, Holland & Knight is consistently ranked among the top law firms in the U.S.

FBI Arrests DC Teacher for Alleged Payments to Minor via Cash App

New York Worker Safety Laws Get 2025 Update from Gov. Hochul

Governor Kathy Hochul is putting the spotlight on workplace safety by declaring June Worker Safety Month, just as three important new laws take effect.

The Retail Worker Safety Act, the Fashion Workers Act, and the Warehouse Worker Injury Reduction Program are now officially on the books, each designed to make thousands of jobs across New York safer and more respectful for the people doing them.

“Our workers are the lifeline of the state and deserve to have a safe and secure work environment no matter the job,” Governor Hochul said.

"With new safety enhancements and health programs in place, workers across the state will have the tools and resources necessary to ensure their safety while in the workplace.”

The new laws are aimed at three industries where workers have long faced unsafe or unfair conditions: retail, warehousing, and modeling.

Each law includes clear steps that employers must take to protect the people they hire, from proper training to physical safety tools to accountability policies.

Under the Retail Worker Safety Act, any retail business with 10 or more employees must now offer training to prevent violence, threats, harassment, or abuse in the workplace.

Companies with 500 or more employees have to go a step further, they’ll be required to provide silent alert buttons (either wearable or mobile-based) by early 2027. These tools will let workers quickly call for help in an emergency.

To help businesses meet these new requirements, the state’s Department of Labor has released step-by-step guides and bilingual training videos. There’s also a social media campaign launching soon to spread the word about the new rules.

“Retail workers and shoppers will both be safer thanks to this law,” said RWDSU President Stuart Appelbaum. “Retail workers should not have to go to work every day in fear; and this law goes a long way towards ending that.”

Warehouse jobs have been linked to high injury rates, especially where speed quotas are pushed hard. The Warehouse Worker Injury Reduction Program will require some distribution centers to create safety plans, check for injury risks, train supervisors and staff, and make sure proper medical help is available on-site.

This effort is part of a larger law, the Warehouse Worker Protection Act, which also forces companies to disclose any productivity quotas and protects workers from being punished for taking legally allowed breaks.

“Behind every paycheck, there’s a life worth protecting. Our fight for the Warehouse Worker Injury Reduction Program and the Retail Worker Safety Act reflects our commitment to ensuring that every New Yorker goes home safe, every shift, every day." said State Senator Jessica Ramos.

Starting June 19, agencies representing fashion models will have to follow a new set of guidelines. The Fashion Workers Act says these companies must:

Put their clients’ best interests first

Keep the workplace safe and free from abuse

Offer written agreements with pay details before a job begins

Be upfront about any financial ties with clients

Set clear policies and systems for reporting misconduct

Assemblymember Harry Bronson, who helped lead the bill, said the law brings long-overdue structure to an industry where many workers operate without basic protections.

“As we recognize Worker Safety Month, it's important we make sure policies are in place so when a New York worker leaves for work, they will return home to their family safely."

"The Warehouse Worker Injury Reduction Act, which I sponsored in the Assembly and will take effect during Worker Safety Month, ensures that warehouses enact safety measures that put the health of our workers above profits. As Assembly Labor Chair, I will always fight for the protections our workers deserve.”

In addition to the three new workplace laws, the governor’s new budget includes stronger protections for highway and road workers. That update follows several tragic losses this year, including the death of a DOT supervisor in a work zone crash.

“We’ve lost 59 of our own since the department began,” said NYSDOT Commissioner Marie Therese Dominguez. “Pay attention, put your phone down and please, slow down and move over in a work zone — lives are at risk.”

From labor leaders to lawmakers, there’s strong support for these new protections. Many pointed out that these victories didn’t come out of nowhere, they’re the result of years of organizing and persistence from workers and their allies.

AFL-CIO President Mario Cilento said the laws are a step toward safer conditions for all New Yorkers.

Teamsters Joint Council 18 President Tom Quackenbush praised the warehouse law as a badly needed fix for an industry where injuries have soared.

ALIGN’s Theodore A. Moore called the moment a huge win but stressed the need for follow-through: “Passing the law is step one, now we have to educate workers and enforce it.”

The Department of Labor also reminded businesses about a little-known resource that’s been quietly making a difference for years.

It’s called the On-Site Consultation Program, and it offers small and mid-sized companies in high-risk fields a free, private way to improve safety without the fear of penalties. Over the last 50 years, this program has helped businesses avoid thousands of injuries and major costs.

To learn more or request a consultation, visit the NYSDOL website.

| Law | Who It Affects | What’s New |

|---|---|---|

| Retail Worker Safety Act | Retail employees | Training, panic buttons, stronger anti-violence policies |

| Warehouse Injury Reduction | Distribution center workers | Injury prevention plans, staff training, medical access |

| Fashion Workers Act | Models, agencies | Contracts, safety policies, pay transparency |

If you’re a worker: Ask your employer what safety programs are now in place. You have the right to know.

If you’re an employer: Use the Department of Labor’s guides and videos to stay on track with the new rules.

If you’re a driver: Be mindful in work zones. Put the phone down, slow down, and move over. It could save someone’s life.

Baker McKenzie Advises on GEMS Education’s Dubai Expansion Deal

FBI Arrests D.C. Teacher Accused of Paying Minor via Cash App

The law firm Gainey McKenna & Egleston has filed a securities class action lawsuit on behalf of investors who purchased shares of Fortrea Holdings, Inc. (NASDAQ: FTRE) between July 3, 2023 and February 28, 2025.

The lawsuit claims Fortrea misled shareholders about its post-spin-off financial health and future earnings.

Filed in the U.S. District Court for the Southern District of New York, the complaint alleges that Fortrea made overly rosy statements about expected revenue and cost savings - projections that later proved unreliable.

According to the filing, Fortrea gave investors the impression that its transition after the spin-off was on solid financial footing.

The complaint outlines several key concerns:

The company allegedly overestimated how much revenue would come from inherited “Pre-Spin Projects.”

Fortrea also downplayed the true costs of exiting its Transition Services Agreements.

As a result, the company’s 2025 EBITDA targets were inflated, giving a misleading picture of future performance.

These issues, the lawsuit says, made Fortrea’s overall business outlook appear stronger than it really was.

Shareholders who bought Fortrea stock during the Class Period may be eligible to join the case.

Those interested in leading the lawsuit have until August 1, 2025 to file a motion to become lead plaintiff.

Investors seeking more information or wanting to discuss their legal options are encouraged to contact Thomas J. McKenna, Esq. or Gregory M. Egleston, Esq. at Gainey McKenna & Egleston. The firm can be reached by phone at (212) 983-1300, or via email at tjmckenna@gme-law.com or gegleston@gme-law.com.

Fortrea Holdings Inc. (NASDAQ: FTRE) is a global contract research organization (CRO) specializing in clinical trials and drug development. Spun off from Labcorp in 2023, Fortrea operates in over 90 countries and supports biotech and pharmaceutical companies with Phase I-IV trial services, regulatory consulting, and post-approval solutions. The company is headquartered in Durham, North Carolina.

Gainey McKenna & Egleston is a nationally recognized law firm with offices in New York and New Jersey, specializing in complex civil litigation. With nearly three decades of experience, the firm focuses on class action lawsuits representing investors, consumers, and small businesses. Their practice areas include securities litigation, shareholder derivative actions, consumer fraud, ERISA, and employment law. The firm is adept at handling multi-district litigation and is well-versed in the procedures outlined in the Manual for Complex Litigation, particularly regarding class certification. Gainey McKenna & Egleston is committed to aggressively advocating for their clients, utilizing all necessary resources to achieve favorable outcomes.

Baker McKenzie has advised Bank Muscat’s Izdihar Real Estate Fund on its acquisition of the site for the upcoming GEMS School of Research and Innovation, an ambitious new educational development in Dubai.

The school is set to open its doors in September 2025 and will follow the British curriculum. It’s being described as one of the most advanced learning institutions of its kind, featuring a unique rooftop football field that also functions as a helipad, a professional-grade auditorium with 600 seats, and an Olympic-sized swimming pool.

With construction costs approaching $100 million, the school aims to offer a premium academic experience and by the final year, tuition fees are expected to exceed AED 200,000 per student.

Leading the transaction for Baker McKenzie were Keri Watkins, Partner and Co-Head of the firm’s Real Estate and Hospitality Practice in the Middle East, and Patrick McGregor, a Senior Associate focused on Corporate and M&A.

Keri Watkins commented on the project:

"We are proud to have supported the Izdihar Real Estate Fund on this landmark transaction in partnership with the GEMS Group."

"This project exemplifies the region’s growing commitment to world-class educational infrastructure and innovative real estate development. We are proud to have been at the forefront of an exceptional transaction in the education sector."

Patrick McGregor added:

"This acquisition marks a pivotal step in enhancing educational infrastructure in Dubai, reflecting both Bank Muscat’s and GEMS’ commitment to excellence and innovation in the education sector. We look forward to the successful opening of the school and to supporting our clients on other strategic partnerships in this space."

The partnership between Izdihar Fund and GEMS Education marks a major commitment to enhancing social infrastructure across the Gulf.

Khalifa Al-Hatmi, Deputy General Manager of Investment Banking and Capital Markets at Bank Muscat, said:

“We take pride in partnering with GEMS Education, a recognized leader in private education sector through this investment in GEMS School of Research and Innovation, Dubai. "

"This investment aligns with Izdihar Fund’s long-term strategy of supporting essential community infrastructure and generating sustainable value for our investors. We are thankful to the entire Baker McKenzie team for their support and guidance in executing this landmark deal."

From the GEMS side, Dino Varkey, Group CEO shared his comment:

“We are delighted to welcome Bank Muscat's Izdihar Real Estate Fund as a strategic partner in this landmark project. Their investment underlines the strength of our education platform, our continued focus on high-quality infrastructure, and confidence in Dubai as a leading global education hub."

Izdihar Real Estate Fund was created in 2015 and is regulated by the Financial Services Authority in Oman. It was the country’s first real estate investment trust and has grown into one of the largest, with more than $230 million in managed assets.

Its backers include major institutional investors, from sovereign wealth and pension funds to corporates and family offices. Since its launch, the fund has consistently delivered strong returns, paying out average annual dividends above 7%.

Baker McKenzie brought together a diverse, cross-border team for the project. In addition to Watkins and McGregor, the advisory group included:

Andrew Hope and Jack McCaw (Senior Associates, London)

Amir Ali, Jana Al-Afoo, Anna George, Owen Etwaroo, Razan Obeidat, and Mohammed AlZibdeh (Associates, Dubai and Bahrain)

Together, they provided end-to-end guidance across corporate structuring, real estate law, construction matters, and financing.

Baker McKenzie is a leading global law firm founded in 1949, with a presence in over 40 countries. With a team of 13,000 professionals, the firm advises corporations, governments, and institutions on complex legal matters across corporate law, litigation, tax, and more. Renowned for its cross-border capabilities and innovative approach, Baker McKenzie has handled over USD 600 billion in M&A transactions in the past five years, more than 65% of which span multiple jurisdictions. The firm is also recognized for its commitment to diversity, inclusion, and sustainable business practices.

FBI Arrests D.C. Teacher Over Payments to Minor via Cash App

Bronstein Gewirtz & Grossman Files Suit Against MicroStrategy

Kirkland & Ellis has advised Bernhard Capital Partners in its latest move to strengthen U.S. infrastructure, an acquisition of TechServ, a trusted name in utility engineering and telecom support services.

The deal marks the creation of a new platform under Bernhard Capital’s wing, one aimed at helping power and telecom providers modernize and expand their networks in response to surging demand for electricity and data.

TechServ, which got its start in Tyler, Texas back in 1992, has grown into a significant player in the utility services space.

With a footprint in 21 states and a team of more than 850 employees, the company works closely with utility and telecom providers on everything from construction oversight to engineering design, joint use coordination, and storm response.

“We are proud to partner with TechServ to build a best-in-class platform that will meet the growing needs of utilities and telecom providers across the country, driven by the rapidly rising demand for power and data.”

"The company’s safety-first culture, leading technical capabilities, client-focused business model, and experienced leadership team make it an ideal platform investment aligned with BCP’s blueprint for investing in essential infrastructure services.” said Mark Spender, Partner at Bernhard Capital.

TechServ CEO Randall Wisenbaker said:

“Our team has always focused on building a strong reputation for our commitment and service to our clients. Partnering with BCP will allow us to reinforce that commitment while accelerating our growth and expanding our capabilities."

"This partnership positions TechServ to lead in a rapidly evolving infrastructure landscape, and we are excited to begin this next chapter of growth.”

The Kirkland & Ellis team advising Bernhard Capital included corporate attorneys Bill Benitez, Alec Manzer, Brennon Nelson, and Dakota Priest. Tax guidance was provided by Mark Dundon and Grace Nielsen, while Lucas Spivey, Charles Martin, Kirby Swartz, and Chris Ooley handled debt finance matters.

Bernhard Capital Partners is a private equity management firm specializing in services and infrastructure investments. Established in 2013 and headquartered in Baton Rouge, Louisiana, the firm focuses on acquiring, operating, and growing middle-market businesses critical to infrastructure sectors. With over $4 billion in assets under management, Bernhard Capital Partners leverages its operational expertise to create sustainable value across its portfolio companies.

Kirkland & Ellis is a leading global law firm known for its excellence in M&A, corporate law, litigation, intellectual property, and private equity. With offices in key financial centers worldwide, the firm advises clients across a broad range of industries. Recognized for its work on high-stakes transactions and disputes, Kirkland delivers innovative legal strategies backed by deep industry knowledge. Its focus on complex deals and cutting-edge solutions positions it as a trusted advisor in the global legal market.

Full Name: Joseph Fidler Walsh

Net Worth: Roughly $75 million

Born: November 20, 1947

Birthplace: Wichita, Kansas, USA

Height: 5 ft 10 in (1.79 m)

Best Known For: The Eagles, the James Gang, “Life’s Been Good”

Spouse: Marjorie Bach (married since 2008)

Children: 3 (including musician/actress Lucy Walsh)

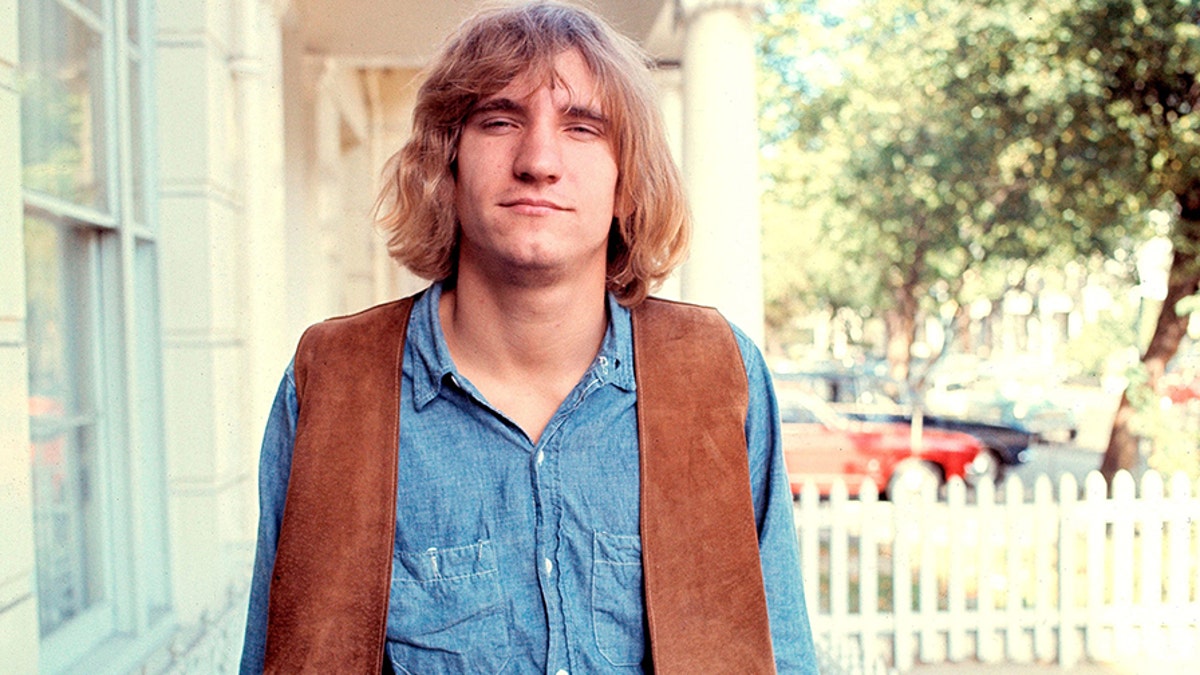

Joe Walsh was born into music—and a little chaos. Born in Wichita, Kansas, in 1947, he lost his biological father, a flight instructor, in a tragic plane crash when he was just a baby. His mom, Helen, a classically trained pianist, filled their home with music. That stuck.

Joe bounced around growing up—Ohio, Chicago, New York—and by 10, he had a guitar in hand. He could already play "Walk Don’t Run" by The Ventures. Later, in Montclair, New Jersey, he played oboe in his high school band. Yes, oboe.

He studied English at Kent State, minored in music, and was there the day of the 1970 Kent State shootings. That moment stuck with him—and pushed him away from college and straight into rock ‘n’ roll.

Eagles' Joe Walsh

Joe’s first big break came when he joined the Cleveland-based James Gang in 1968. He didn’t know it then, but the band’s sudden shift to a trio would make him a star. He had to do it all—rhythm, lead, vocals—and somehow made it look easy.

“Funk #49” and “Walk Away” didn’t just rock—they ripped. His playing caught the ears of gods like Jimmy Page and Eric Clapton. That’s not hype. Clapton once said, “I don’t listen to many records, but I listen to his.”

Still, by 1971, Walsh was itching for change. Creative limits were closing in. He walked.

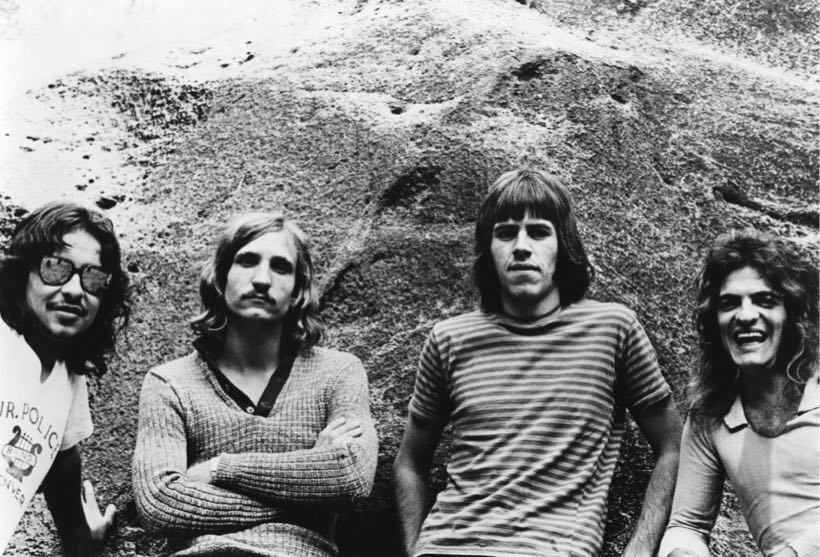

James Gang - Yer' Album (1969)

Joe bolted to the Colorado Rockies and formed Barnstorm. Picture this: a mountain town, a new studio (Caribou Ranch), and a guy figuring it all out with his guitar. That first album? Kind of a hidden gem. But the second? The Smoker You Drink, the Player You Get—and boom, “Rocky Mountain Way” exploded.

Latest: Bruce Lee Net Worth 2025: A Deep Dive into the Life, Legacy, and Wealth of a Global Icon

By 1974, he was back in LA, hanging with Glenn Frey, Jackson Browne, and Dan Fogelberg, crafting songs and raising hell. He dropped So What and the live album You Can’t Argue with a Sick Mind. The man had found his groove—and his audience.

Barnstorm & Joe Walsh

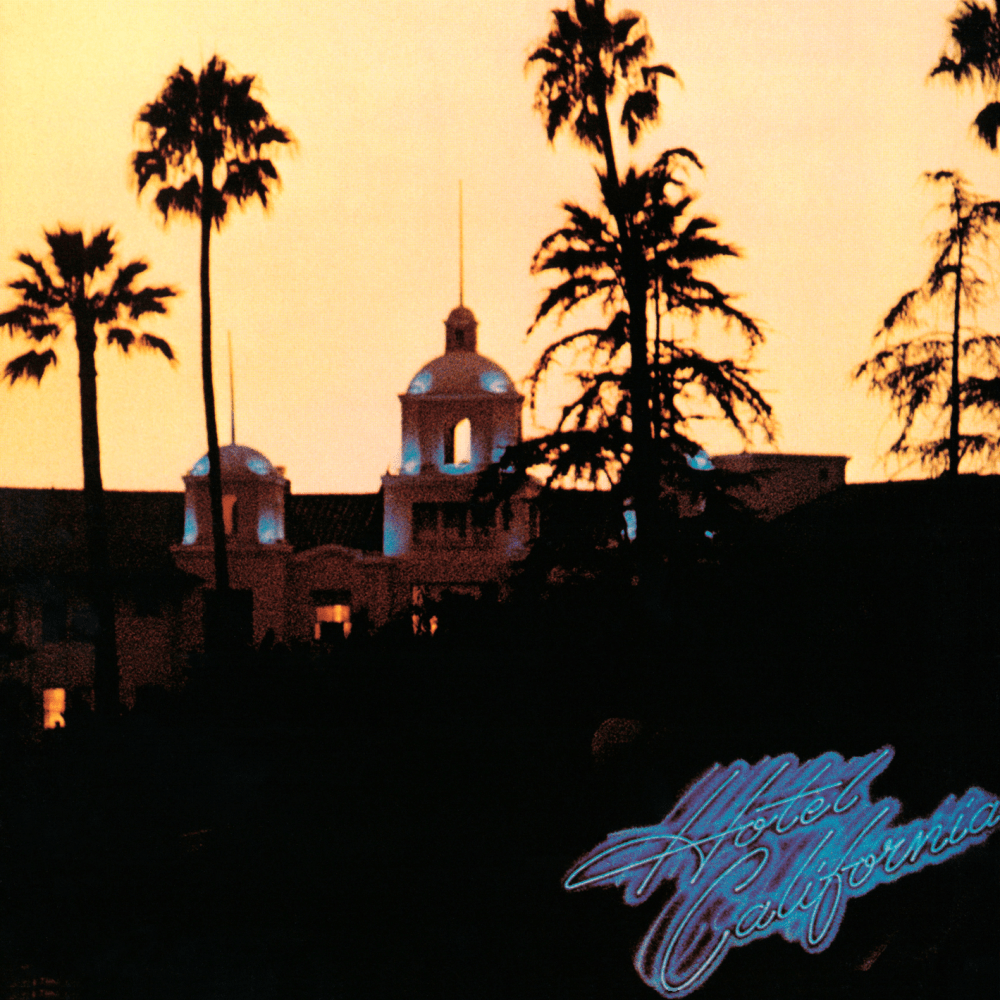

In 1975, Joe joined the Eagles. Just in time, too—Hotel California was on the horizon. He brought a rock edge that punched up the band’s soft-country vibe. And it worked. His riff on “Life in the Fast Lane”? Born during a Corvette ride with a drug dealer. No joke.

“The next thing I know, we’re doing 90. I say, ‘Hey man!’ He goes, ‘Life in the fast lane!’ And I thought—now there’s a song title.”

Walsh and Don Felder built those iconic twin solos on Hotel California in a jam session, bouncing off each other like jazz musicians. Pure instinct.

The album sold over 30 million copies. And while fans were loving the sound, things behind the scenes weren’t exactly peaceful. Tensions brewed. Songs sparked turf wars. By the time The Long Run came out in 1979, the fuse was lit. The Eagles called it quits in 1980.

Joe Walsh and The Eagles

Joe didn’t stop. Not even close.

He dropped There Goes the Neighborhood in 1981, including “A Life of Illusion,” and kept rolling through the '80s with albums like You Bought It – You Name It and The Confessor. But the decade wasn’t all guitar solos and studio time. His addictions were catching up.

Even through the fog, he kept playing—solo tours, All-Starr Band gigs with Ringo Starr, and a string of collaborations that spanned from the Beach Boys to Michael McDonald.

By 1994, the Eagles were ready for a comeback. Hell Freezes Over sold out stadiums. Joe had been sober since 1995, and for the first time in a long time, things felt steady.

Paul McCartney, Bruce Springsteen, and Joe Walsh

In 2012, Joe released Analog Man, his first solo album in two decades. He played the Grammys with Paul McCartney and Bruce Springsteen. He showed up on the Foo Fighters’ Sonic Highways. He was everywhere.

Then in 2017, he launched VetsAid, a nonprofit and annual concert to support U.S. veterans. The cause is personal—Joe’s a Gold Star family member—and as of now, the initiative has raised over $1.15 million.

You might’ve caught Joe in The Blues Brothers, RoboCop, MADtv, The Drew Carey Show, or The Voice. He even ran a fake presidential campaign in 1980, promising free gas for everyone. Not a bad platform.

And yes, he’s joked about running for Congress for real. Honestly, who wouldn’t vote for him?

Joe has been married five times. His current wife, Marjorie Bach, is the sister of Barbara Bach—Ringo Starr’s wife. They married in 2008.

He has three daughters. His eldest, Emma Kristen, was tragically killed in a car accident at age three. It’s something he’s never forgotten. His daughter Lucy is a musician and actress. Another daughter, Alden, lives a more private life.

Walsh has been clean since 1995. He’s spoken about it openly, and it’s a big part of who he is now.

Joe Walsh and Marjorie Bach

Joe Walsh now calls Sherman Oaks home—a quiet corner of Los Angeles where, in 2023, he picked up a cozy-yet-classy bungalow for just over $2.3 million. It’s not huge by rock star standards (about 2,400 square feet), but it’s got the goods: a pool, home theater, three bedrooms, and even a tucked-away vegetable garden.

Joe Walsh's California Bungalow

That last part? Pure California. Over the years, Walsh has bounced between some seriously prime real estate—he once owned a 20-acre spread in the Beverly Hills Post Office area, grabbed in 2008 for $4.5 million. Before that, he spent decades in a Studio City place he eventually sold in 2018. Oh, and let’s not forget the Montecito farmhouse, which hit the market later for $7.65 million. If nothing else, the man knows how to live well—and live privately.

Beverly Hills Post Office estate: 20 acres, bought in 2008 for $4.5 million

Studio City home: longtime residence, sold in 2018 for $1.9 million

Beverly Hills hills property: purchased in 2013 for $3.95 million, listed later at $5.3 million

Sherman Oaks bungalow: snapped up in 2023 for $2.345 million—includes a hidden garden and home theater

Joe Walsh's former home - the Beverly Hills Post Office villa

1971 Asylum Records deal: 9% royalty rate (pretty typical back then)

2007 Wal-Mart exclusive: Long Road Out of Eden—backed by a $40 million campaign

2023 publishing deal: Signed with Reservoir Media for full catalog management; no public figure, but comparable deals hit $100M

When Hotel California hit shelves in 1976, no one could’ve predicted just how massive it would become. The album has since sold more than 42 million copies worldwide, including 26 million in the U.S. alone, putting it among the top three best-selling albums in American history. If you do the math—using a rough average of $10 per album—that’s somewhere in the ballpark of $420 million in physical sales.

And that’s just the base figure. Add in decades of digital downloads, constant streaming revenue, and all the times it’s been used in movies or TV, and you're easily looking at over half a billion dollars in lifetime revenue. Not bad for a record born in the hazy chaos of 1970s L.A.

Latest: Billy Joel Net Worth 2025: From Suicide and Scandal to a $250 Million Legacy

Joe collects vintage cars. He flies his own planes. He messes with audio gear for fun. His lifestyle screams "legend," but these days, it’s less about partying and more about legacy—and peace.

Joe Walsh's powerful Ford Mustang: supercharged V8 engine and 500 horsepower

Joe Walsh's Favorite Ever Car. Joe owned the 1962 Maserati 5000GT. Only 34 units were ever built.

For someone who's spent more than 50 years in the spotlight—and in a band as famously dramatic as the Eagles—Joe Walsh has kept a pretty low profile when it comes to legal trouble.

One of the few times his name popped up in legal headlines was back in 2010, when his team sent a cease-and-desist letter to a politician (also named Joe Walsh) who had used the song “Walk Away” in a campaign ad without permission. It wasn’t a nasty lawsuit—more of a cheeky reminder not to mess with copyright, even if you share a name.

He also found himself on the periphery of a legal mess in 2001 when fellow Eagle Don Felder sued Don Henley and Glenn Frey, claiming they pushed him out of the band unfairly. That fight played out behind the scenes and was eventually settled out of court. For a guy who's lived through rock’s wildest decades, Walsh’s rap sheet is practically spotless.

🎸 Ranked #54 in Rolling Stone’s 100 Greatest Guitarists

🏆 5-time Grammy winner

🎼 Rock and Roll Hall of Fame inductee (1998)

🎶 "Hotel California" solo voted best of all time by Guitarist magazine

👏 Admired by Clapton, Page, Townshend—basically the guitar gods

What did Joe Walsh do with the Eagles?

He joined in 1975, pushed them toward a rockier sound, and helped make Hotel California legendary.

Why did Joe Walsh quit the Eagles?

He didn’t. The band broke up in 1980, came back in 1994—and he’s been part of every phase since.

What year did Joe Walsh come out?

He first hit national fame in 1969 with the James Gang, and then solo in 1972.

What happened to Joe Walsh's daughter Emma?

Emma Kristen died in a tragic car accident at age 3. It changed Joe forever.

Joe Walsh isn’t just a rock star. He’s a survivor, a comedian, a craftsman, a father, and an icon who somehow keeps finding new ways to stay relevant. Maybe it’s the music. Maybe it’s the soul. Either way, he's not done yet—and thank God for that.

Global law firm Clifford Chance has advised Pemba Capital Partners on its acquisition of Hunter Premium Funding, Allianz’s insurance premium funding business in Australia and New Zealand.

The firm also provided comprehensive legal counsel on the associated financing arrangements, regulatory approvals, and co-investment structures.

"This deal involved the implementation of a complex multi-party transaction structure and engagement with FIRB and the ACCC. We are delighted to have supported our client Pemba Capital Partners in this important and complex transaction." said Mark Currell, Managing Partner of Clifford Chance in Australia.

This transaction further strengthens Clifford Chance’s longstanding relationship with Pemba Capital Partners, including advising on their previous acquisition of SuperConcepts, a leading self-managed superannuation fund administration and software business acquired from AMP.

“We are excited to announce our partnership with Hunter,” said Robert Haybittel, Managing Director at Pemba Capital Partners.

“Hunter is a well-established brand with a strong reputation, and we see tremendous potential for growth and innovation. Our focus is on building upon Hunter’s solid foundation, working closely with their talented team to expand capabilities and deliver even greater value to brokers and customers.”

The deal team was led by Mark Currell, with key contributions from senior associates Rob Colemeadow and Ffion Williams, and associates Suryansh Gupta and Bridget Clarebrough on M&A and co-investment matters.

Debt finance advice was provided by Elizabeth Hundt-Russell (partner), Isabella Bogunovich (counsel), and Amy Pham (associate). Elizabeth Richmond (partner) led on competition and regulatory aspects, supported by senior associates Angel Fu and Sam Frouhar.

Hunter Premium Funding is a leading provider of insurance premium funding solutions in Australia and New Zealand. Established in 1977 and operating under the Hunter name since 1992, the company enables businesses to manage their insurance premiums through regular instalments, enhancing cash flow and financial flexibility. With a dedicated team of 60 professionals, Hunter delivers over 90,000 funding solutions annually. The firm is an accredited member of the Australian Finance Industry Association (AFIA) Insurance Premium Funding Code of Practice, underscoring its commitment to industry standards and customer service excellence.

Pemba Capital Partners is a Sydney-based private equity firm established in 1998. The firm specializes in partnering with founders and management teams of high-growth, entrepreneurial businesses across Australia and New Zealand. Pemba provides not only capital but also strategic support to help businesses scale and achieve sustainable growth. With over 25 years of experience and more than $2 billion in funds raised, Pemba has completed over 200 transactions, focusing on sectors such as business services, healthcare, financial services, and technology.

Clifford Chance is a global law firm with over a century of history and a presence in 23 countries through 34 offices. A member of the prestigious Magic Circle, the firm is recognized for its deep expertise in banking, corporate law, finance, dispute resolution, and tax. It advises a broad spectrum of clients, including multinational corporations, financial institutions, governments, and not-for-profits by combining international best practices with local market insight. Known for its collaborative culture and forward-thinking approach, Clifford Chance delivers innovative, high-quality legal solutions across every major industry and sector.