Cases of fraud have been growing rapidly in volume as well as, cost and complexity. Fraudsters are finding more complex and stealthy ways to commit the crime.

AI is being used by the fraudsters as well as the victim using it as a defence. SEON reported that 87% of fraud experts predict an increase in fraud for 2024 as in 2023 fraud in the UK had more than doubled.

Reported cases rose by 18% and high value cases which are those over £50m rose by 60% in 2023.

Why are they rising?

The use of technology gives people access to far more people from all over the world making it easier to reach more people at once too. Online scams are prevalent and in 2023 Barclays reported that 70% of scams were on social media. The use of AI makes these scams far more believable and the fraudsters can be smarter by impersonating a trusted organisation.

Phising has become a popular technique, using emails to pose as a reputable company to gather personal details such as passwords, credit card information or addresses.

The cost-of-living crisis has made individuals and businesses more desperate and provides an incentive to commit fraud.

The cost of fraud on England

“Fraud accounts for around 40% of all crime in England and Wales, with an estimated 3.2 million offences each year.”

The Crime Survey of England and Wales has found the estimated cost of fraud to society is £6.8 billion.

High Value cases

High value cases of fraud rose by 60% in 2023, usually meaning a business or wealthy individual has committed fraudulent acts.

- Bernie Ecclestone, a former F1 boss pleads guilty to fraud in 2023. Reported by Sky Sports Ecclestone was failing to declare £400 which was held in a trust in Singapore to the government. He was found guilty and given a fine of £652.6m to pay to the HMRC as well as a suspended 17-month jail term.

- Entain Plc, the gambling company was found out to be failing to prevent bribery at its former Turkish subsidiary. BDO, the financial firm inform us that an investigation by HMRC and the Crown Prosecution Services took place and Entain Plc agreed to pay a financial penalty of £585m which also included disgorgement of profits made from the act. This represents the second biggest penalty agreed by British Courts since DPAs were introduced in 2020.

Types of fraud

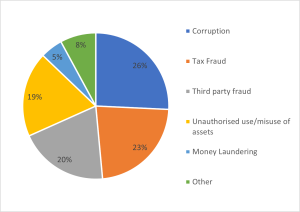

BDO conducted a study to discover which types of fraud are currently the most common by value.

- Corruption fraud manages to obtain the highest value which in 2023 was £593m.

- Cybercrime is also rising and targets internet users in business as well as consumers. Ispoof, a fraud website which managed to trick thousands of people by impersonating trusted organisations. They would use calls to trick people into giving away personal information. The founder was eventually convicted and it was found that the UK loss was £43m and global losses were £100m showing how successful the website had been.

How the Government is working to prevent fraud

The Government have now launched their campaign to prevent fraud, “Stop! Think Fraud.”

This campaign will spread awareness so people can be better protected from fraud. The Government is working with banks and organisations such as Barclays, Google, TikTok, The National Crime Agency and more so they can spread the message and be there to prevent and support.

Next month we can expect another strategy commitment to be delivered as the Home Secretary will welcome interior ministers from international partners to London where they will host the first ever Global Fraud Summitt.

Fraud in 2024

The UK making legislative changes could drive up the statistics as they work to bring down the cost of the courts.

-The Economic Crime and Corporations Transparency Act’s new “failure to prevent” fraud offence is going to hold companies liable for any offences committed by an associate to benefit the organisation. If they can prove that they had reasonable fraud prevention procedures in place the charges could be dropped. This could add to the value of fraud cases despite the regulation being there to hold those accountable.

- Banks regulations are changing so that the banks will have to reimburse victims of APP frauds. This will add to the reported cases statistics.

It is likely that fraud will continue to increase in volume and value as strategies can become smarter and more efficient with the use of technology.