A maths teacher has been barred from teaching in England after a misconduct finding linked to possession of hundreds of other people’s bank card and login details.

A teacher who worked in London has been prohibited from teaching after a professional conduct panel considered evidence that stolen bank card and account login details were stored across his personal devices.

Louis Kisitu Ssekabira, born 4 May 1995, was working at Bishop Challoner Catholic Federation of Schools in Tower Hamlets when he accepted a police caution in June 2021.

The caution followed a police search of his home on 5 May 2020, when officers seized a laptop and two phones that later showed more than 260 card details and dozens of login credentials in other people’s names, according to an official decision published on GOV.UK.

The case matters because teacher misconduct rulings can restrict who is allowed to work in classrooms, even when outcomes involve out-of-court disposals such as cautions.

Under England’s teacher regulation system, prohibition orders are used to protect pupils and maintain confidence in the profession, with an appeal route to the High Court set out in law.

The Teaching Regulation Agency (TRA) said its professional conduct panel met virtually on 5 December 2025 and considered the case under its published teacher misconduct procedures.

The panel record states Ssekabira taught mathematics at Droitwich Spa High School and Sixth Form Centre from 1 September 2019 to 31 December 2020, then moved to Bishop Challoner Catholic Federation of Schools from January 2021 until August 2022.

Police seized a MacBook and two iPhones during the May 2020 search. The panel record lists 235 sets of card details on the laptop plus 62 sets of login credentials, and additional card and login details stored on the phones.

It also records that Ssekabira attended a voluntary police interview on 29 October 2020 and accepted a police caution on 25 June 2021.

In its reasoning, the panel rejected an explanation that the data was accidentally discovered on a second-hand computer, citing the presence of similar information on multiple devices.

The TRA decision says the case was reported to the agency on 1 July 2021. The panel concluded the conduct met the threshold for serious professional misconduct and recommended prohibition, with provision for a review after five years.

The decision record also notes concern about how the matter was handled with the employer, describing the importance of honesty and insight when disclosing issues that may affect professional standing.

The Secretary of State’s decision, made on the recommendation of the independent panel, adopted a five-year review period in light of the seriousness of the dishonesty and fraud-related conduct.

No public statement from the school is included in the published panel materials, and the record focuses on the evidence considered by the panel and the public-interest purpose of prohibition.

A prohibition order prevents a person from carrying out “teaching work” in schools and certain other settings in England, and the individual’s details appear on the prohibited list used by employers, according to government guidance.

This is separate from criminal outcomes and can apply where a panel finds unacceptable professional conduct or conduct bringing the profession into disrepute.

For schools, the decision underscores why safeguarding and recruitment checks include verifying whether a candidate is prohibited from teaching.

Government guidance explains that the TRA’s prohibition decision-making is aimed at safeguarding pupils and maintaining confidence, and that it is not intended as a punitive measure alone.

For families, the practical effect is that a prohibited teacher cannot be employed in regulated teaching roles in England unless an order is later set aside after a review process.

Schools and employers can check whether someone is prohibited by using the Department for Education’s Teacher Services (DfE Sign-in) tools referenced in government guidance on prohibition orders.

Those checks are part of standard pre-employment safeguarding practice in education settings.

The law governing teacher prohibition orders in England provides a right of appeal to the High Court within 28 days of service of the notice of the order.

GOV.UK guidance also describes the appeal route as being to the King’s Bench Division under the Civil Procedure Rules.

Bishop Challoner Catholic School is located at 352 Commercial Road, London E1 0LB, according to the school’s published contact information.

The prohibition order immediately bars the teacher from carrying out regulated teaching work in England, in line with government guidance and the national list of prohibited teachers used by employers during safeguarding checks.

The decision remains in force unless successfully challenged.

Under the Teachers’ Disciplinary (England) Regulations, any appeal must be lodged with the High Court within 28 days of formal notice.

A separate review application can only be made after the minimum period set out in the decision, which in this case is five years.

For parents and pupils, the ruling reinforces how safeguarding standards extend beyond classroom conduct and include behaviour that may undermine public trust in the profession.

For schools, it highlights the importance of disclosure, recruitment vetting, and ongoing suitability checks when employing staff. The only confirmed next procedural step is whether an appeal is filed within the statutory timeframe.

In California, punitive damages are a form of compensation not meant to cover a victim's losses but to punish a wrongdoer and deter others from similar conduct.

Unlike typical damages for medical bills and lost wages, punitive damages are only awarded in cases where the defendant's conduct was particularly egregious. To receive them, a plaintiff must prove by clear and convincing evidence that the defendant acted with malice, oppression, or fraud.

The legal standard of "clear and convincing evidence" is a significantly higher burden of proof than the "preponderance of the evidence" standard used for compensatory damages.

While the latter only requires a plaintiff to show that it is more likely than not that their claim is true, "clear and convincing evidence" requires that the evidence be so clear, distinct, and weighty as to make the jury's belief in the truth of the facts highly probable.

This heightened standard is a constitutional safeguard to prevent punitive damages from being awarded in a casual or arbitrary manner.

The concept of punitive damages has a long history in common law, dating back to 18th-century England, where courts sought to compensate victims not just for their injuries but for the indignity and outrage caused by the defendant's conduct.

Over time, the focus shifted from compensation to punishment and deterrence. However, the U.S. Supreme Court has placed constitutional limits on punitive damage awards under the Due Process Clause of the Fourteenth Amendment, to prevent awards that are grossly excessive or arbitrary.

A landmark case, BMW of North America, Inc. v. Gore, established three key "guideposts" for juries to consider when evaluating a punitive damages award:

Unlike many states, California does not have a statutory cap on the amount of punitive damages that can be awarded in most personal injury cases.

However, the constitutional limitations set by the Supreme Court serve as a de facto check on excessive awards.

Punitive damages are typically sought in cases involving drunk driving accidents, elder abuse, sexual assault, and corporate misconduct, such as the knowing concealment of a product defect.

California personal injury law is rooted in the concept of negligence, which requires a victim to prove that the at-fault party breached a duty of care, and that breach caused their injuries and damages.

The state operates under a pure comparative negligence system, which allows an injured party to recover damages even if they are partially at fault.

The state's laws have seen some recent reforms, including a phase-out of the non-economic damage cap in medical malpractice cases and stricter liability for certain distracted driving offenses.

For a more detailed look into these principles, you can read this article.

In California, the statute of limitations is the deadline for filing a lawsuit. For most personal injury claims, this is two years from the date of the injury. However, there are exceptions.

For instance, claims against a government entity often have a shorter deadline, typically six months, to file an administrative claim.

For medical malpractice, the period is generally one year from the discovery of the injury or three years from the date of the injury, whichever is sooner. Failing to file within the correct time frame usually results in the loss of the right to pursue a claim.

California follows a pure comparative negligence rule. This means an injured person can still recover compensation even if they are found to be partly at fault for their own injuries.

However, the amount of compensation is reduced in proportion to their percentage of blame. For example, if a jury awards a plaintiff $100,000 in damages but finds them to be 30% at fault for the accident, their final compensation will be reduced to $70,000.

This system contrasts with states that have a modified comparative fault rule, where a plaintiff may be barred from recovering any damages if their fault exceeds a certain percentage (e.g., 50%).

To win a personal injury case based on negligence in California, a plaintiff must prove four key elements:

Insurance companies are central to the personal injury claims process. They employ adjusters to investigate claims, determine liability, and negotiate settlements.

Their primary goal is to minimize payouts to protect their bottom line. Initial settlement offers are often low, and adjusters may use tactics like requesting recorded statements to find information that can be used to devalue a claim or shift blame.

This is a primary reason many victims seek legal representation to ensure they receive fair compensation.

If a personal injury case goes to trial, a jury is responsible for determining liability and the amount of damages. The jury is instructed on the law by the judge and must follow a specific process:

The concept of duty of care is the foundation of negligence law. It's the legal obligation to act in a way that doesn't cause harm to others.

California law, under Civil Code section 1714(a), states that everyone is responsible for injuries caused by their "want of ordinary care or skill." This duty varies depending on the circumstances.

For example, a driver has a duty to follow traffic laws, while a property owner has a duty to maintain their premises safely for visitors.

Strict liability is a legal doctrine that holds a party liable for harm regardless of fault or negligence. In California, this applies in two main areas:

In these cases, a victim doesn't have to prove the defendant was negligent, only that the defect or bite caused their injury.

The legal landscape is always changing. As of 2025, several new laws have affected personal injury claims:

In a California personal injury case, a victim can recover several types of damages:

Punitive Damages: As discussed earlier, these are awarded in rare cases to punish a defendant for particularly malicious, oppressive, or fraudulent conduct.

Q: How are punitive damages calculated in California?

A: There is no fixed formula for calculating punitive damages. A jury considers the reprehensibility of the defendant's conduct, the ratio of punitive damages to the compensatory damages, and the defendant's financial condition. The U.S. Supreme Court has indicated that a ratio exceeding a single digit is often considered unconstitutionally excessive.

Q: Can I get punitive damages for a car accident in California?

A: Yes, punitive damages can be awarded in a car accident case, but only in specific circumstances. A plaintiff must prove by clear and convincing evidence that the at-fault driver acted with malice, oppression, or fraud—such as in a case involving a drunk driver with a history of DUIs or a driver who intentionally used their car as a weapon.

Q: Is there a cap on punitive damages in California?

A: No, California does not have a statutory cap on punitive damages for most personal injury cases. However, the U.S. Supreme Court's constitutional limitations and the established "single-digit ratio" serve as a legal check to prevent grossly excessive awards.

Q: What is the average personal injury settlement in California?

A: There is no true "average" settlement, as each case is unique. The value of a claim depends on a wide range of factors, including the severity of the injuries, the total amount of medical bills and lost wages, the strength of the evidence of negligence, and the availability of insurance coverage.

A Peruvian man who thought he could scam vulnerable Americans from thousands of miles away is now facing serious prison time. According to the U.S. Department of Justice (DOJ), David Cornejo Fernandez, 36, has pleaded guilty to helping run a $15 million fraud operation that targeted Spanish-speaking consumers across the U.S.

Cornejo, from Lima, wasn’t the one making the threatening phone calls. Instead, he played the role of tech mastermind, setting up fake phone lines, spoofing caller IDs to mimic U.S. agencies, and even recording bogus messages that sounded like real court hotlines.

All of it was designed to trick people, many of them older or less fluent in English, into believing they were about to face legal trouble if they didn’t pay up.

In total, over 30,000 Americans were targeted, many harassed into handing over money they didn’t actually owe. Victims were told they’d be fined, arrested, or deported if they didn’t pay for supposed English-language products or services.

As Assistant Attorney General Brett A. Shumate put it in the official DOJ statement:

“The Department of Justice is committed to protecting vulnerable U.S. consumers from fraud, especially schemes carried out by criminals impersonating U.S. government officials.”

"Those who target American consumers from abroad will be identified, prosecuted, and held accountable for their crimes. We thank the Republic of Peru for their assistance in arresting and extraditing this defendant and others involved in these scams.”

David Cornejo Fernandez was extradited from Peru in late 2024. In court, he admitted not only to providing the tools, but to training scammers on how to sound convincing, as if pretending to be an FBI agent was just another day at the office.

He also rotated fake phone numbers whenever victims caught on, keeping the scam alive far longer than authorities expected.

According to investigators, Cornejo is the 13th person convicted in connection to the multi-million-dollar scam.

Bladismir Rojo of the U.S. Postal Inspection Service summed it up bluntly:

“Setting up fake call centers to harass and intimidate innocent victims, Cornejo and his co-conspirators, crafted a campaign of fear designed to rob people of not only their savings but their peace of mind. If you target Americans, no matter where you are in the world we will find you.”

Now, Cornejo faces up to 20 years in federal prison, with sentencing set for September 25 in Miami.

This case, led by the DOJ’s Consumer Protection Branch and the U.S. Postal Inspection Service, involved cooperation from authorities in both the U.S. and Peru.

The DOJ credited the Peruvian National Police and Prosecutor General’s Office for helping bring Cornejo to justice.

Have You or Someone You Know Been Scammed?

If you’re over 60 or know someone who is and have experienced financial fraud, the National Elder Fraud Hotline is available.

Call 1-833-FRAUD-11 (1-833-372-8311) for free, confidential help. Reporting scams can help catch criminals and might even recover your money.

(Source: U.S. Department of Justice (DOJ)

The image is etched into our collective consciousness, a ghost in the machine of Silicon Valley lore: Elizabeth Holmes, draped in her signature black turtleneck, eyes a piercing blue, standing on stage, not just promising, but vowing a revolution.

She was Silicon Valley's darling, the brilliant visionary CEO of Theranos, a company poised to transform healthcare for everyone, everywhere, with just a few precious drops of blood.

Bill Clinton Interviewed Elizabeth Holmes and Jack Ma in 2015

Her story, a modern Icarus flight fueled by boundless ambition and a breathtaking capacity for deception, now serves as a cautionary tale for the ages – a compelling true crime narrative woven from soaring dreams, profound betrayals, and devastating consequences.

This long-form exploration will delve beyond the sensational headlines, inviting you to journey through the widely reported facts, but also to truly feel the common narratives that ensnared so many. We'll peel back the layers to investigate the forensic and psychological underpinnings of this monumental fraud, and explore the broader societal and environmental influences that allowed such an audacious illusion to flourish, leaving a trail of shattered trust and ruined lives.

Elizabeth Holmes’s extraordinary journey began in 2003. At the tender, almost impossibly young age of 19, she made the bold decision to drop out of Stanford University, driven by a conviction that felt like destiny.

She founded Real-Time Cures, soon rebranded as Theranos, with a core proposition that was breathtakingly simple yet scientifically audacious: a miniature device, eventually named Edison, that could conduct hundreds of accurate blood tests from a mere finger prick. Imagine the hope, the relief this promised – no more cumbersome venipuncture, drastically reduced costs, and diagnostic testing accessible to everyone, everywhere. It was a vision that spoke directly to a universal human need.

For a decade, Theranos operated in a cloak of extreme secrecy, a meticulously guarded mystery that only amplified its allure. This wasn't just about protecting intellectual property; it was about protecting a developing lie.

The Edison, marketed as a groundbreaking device, promised to run hundreds of tests from a single drop of blood – a vision that captivated investors but concealed a stark reality

By 2014, the company's valuation had skyrocketed to an astounding $9 billion, positioning Holmes, now meticulously cultivating a deep, measured voice and a striking, almost robotic composure, as the youngest self-made female billionaire. She was hailed as the "next Steve Jobs," a moniker she actively embodied, seemingly perfecting the art of the visionary pitch.

Major partnerships with retail giants like Walgreens and Safeway, alongside an influential board boasting figures like former Secretaries of State Henry Kissinger and George Shultz, seemed to provide an impenetrable shield of validation. Hundreds of millions in investment capital poured in, not just for a company, but for a dream. This entire period was a masterclass in orchestrated performance art, a grand narrative meticulously designed to enthrall, to disarm, and to ultimately, to deceive.

The meticulously constructed edifice of Theranos, however, was built on nothing but a whisper of sand. While Holmes spun captivating tales of groundbreaking technology, the stark reality was brutal: the Edison was a commercial failure. It could perform only a fraction of the claimed tests, and even those yielded woefully unreliable, often dangerously inaccurate, results.

To desperately sustain the illusion, Theranos resorted to deeply unethical and perilous practices, secretly shuttling patient samples onto modified, traditional commercial blood analyzers. The very promise of precision became a perilous game of chance with people's health.

The initial cracks in this elaborate facade weren't public exposes; they were the agonized whispers from dedicated scientists and lab technicians working within the company's suffocating walls.

These were individuals who believed in the initial mission, only to witness firsthand the relentless data manipulation, the suffocating pressure to validate utterly inaccurate results, and the overwhelming secrecy that crushed any genuine scientific inquiry. Whistleblowers like Erika Cheung and Tyler Shultz (the grandson of board member George Shultz) lived with the crushing weight of this deception.

Brave former employees like Erika Cheung and Tyler Shultz risked everything to expose the systemic deception at Theranos.

Their courageous decisions to step forward, despite facing immense personal intimidation, aggressive legal threats, and the very real fear of career annihilation, ultimately proved to be the pivotal, human catalysts for truth.

Regulatory bodies, initially appearing somewhat bewildered by the rapidly evolving, secretive biotech landscape, eventually caught up. The Centers for Medicare & Medicaid Services (CMS) issued damning reports in 2016, a bureaucratic hammer blow that declared Theranos's Newark lab posed an "immediate jeopardy to patient health and safety."

Their findings detailed widespread, horrifying deficiencies, including rampant inaccurate test results and dangerously unsafe laboratory practices. The FDA, too, found "uncleared medical devices" and systemic record-keeping failures. These independent governmental investigations didn't just corroborate the whistleblowers' claims; they painted a chilling portrait of a company playing fast and loose with public health.

The final, devastating blow, however, came from the tenacious spirit of John Carreyrou, an investigative reporter for The Wall Street Journal. Beginning in October 2015, Carreyrou's meticulously researched exposés, built on the harrowing testimonies of former employees and confidential documents, systematically, relentlessly, and with irrefutable evidence, dismantled Theranos's every claim.

The meticulous reporting of John Carreyrou in The Wall Street Journal proved to be the beginning of the end for Theranos.

He revealed the company's desperate reliance on traditional machines and the alarming inaccuracies of its proprietary technology. Despite the aggressive legal bullying employed by Theranos's high-powered legal team, Carreyrou's unwavering persistence ultimately dragged the dark truth into the unforgiving, blinding light of public scrutiny.

The cascade of devastating revelations led inevitably to criminal charges, a dramatic turning point from corporate intrigue to undeniable true crime. In June 2018, the shoe finally dropped for Elizabeth Holmes and Ramesh "Sunny" Balwani, her former romantic partner and the company's COO. They were indicted on multiple counts of wire fraud and conspiracy to commit wire fraud. Their respective trials, separated due to pandemic delays and strategic legal considerations, became gripping spectacles, captivating audiences far beyond the legal world.

Sunny Balwani, central to Theranos's operations, was convicted on all counts, cementing his place in the scandal's fallout.

The prosecution's case against Holmes was built on a mountain of damning evidence, meticulously pieced together to demonstrate a clear and deliberate intent to defraud. They unveiled chilling internal communications, including text messages between Holmes and Balwani, that laid bare their explicit awareness of the technological failures and their concerted, cynical efforts to conceal them from unwitting investors.

Detailed financial records exposed not just inflated revenue projections, but phantom partnerships that existed only in their fabricated narratives. Most powerfully, former employees, the very people who had once believed in the dream, provided firsthand, often emotional, testimony of the dysfunctional labs, the intense pressure to falsify data, and the active, conscious deception of patients and partners.

One particularly chilling anecdote emerged: an investor was allegedly told by Holmes that Theranos's technology was already being deployed by the U.S. military in Afghanistan – a lie so audacious, it underscored the depths of their deceit.

Holmes's defense, while acknowledging the company's ultimate, undeniable failure, sought to paint a very different picture. Her legal team centered on two primary arguments. First, she claimed a good-faith belief in the technology, attempting to portray herself as a naive, ambitious entrepreneur who simply "failed to make it" in a cutthroat, unforgiving industry.

The high-stakes federal trial brought Elizabeth Holmes's carefully constructed empire crashing down.

Second, and more controversially, she accused Balwani of a horrific pattern of emotional, psychological, and sexual abuse, arguing that his coercive control utterly diminished her capacity to form the necessary criminal intent. This "abuse defense" sparked widespread, often visceral, debate, contrasting sharply with her previously cultivated image of an independent, powerful, and utterly self-possessed female leader.

On January 3, 2022, after a tense deliberation, a jury delivered its verdict: Elizabeth Holmes was found guilty on four counts related to defrauding investors. She was acquitted on charges pertaining to defrauding patients, and the jury deadlocked on other counts.

In November 2022, the full weight of her actions manifested in her sentencing to 11 years and three months in federal prison. Balwani, tried separately, was found guilty on all 12 counts of fraud and conspiracy in July 2022 and received a longer sentence of 12 years and 11 months. Both have now seen their appeals, including desperate requests for rehearing by the full Ninth Circuit Court of Appeals, unanimously denied as of early-to-mid 2025. Their only remaining, highly improbable recourse is a petition to the U.S. Supreme Court, marking the virtual, crushing end of their long legal battles.

While endless words have been spilled about Holmes's meticulously crafted persona, a deeper psychological analysis of the Theranos saga suggests a far more complex interplay of traits and vulnerabilities. Many commentators point to strong narcissistic characteristics within Holmes: an exaggerated sense of self-importance, a striking lack of empathy for the lives impacted, and an unwavering, almost pathological conviction in her own infallibility.

This could have fueled a profound cognitive dissonance, where she masterfully rationalized her relentless lies as simply necessary, temporary steps towards an inevitable, greater success. The intense adulation she received, particularly in those dazzling early days, could have tragically created a "reality distortion field" around her, reinforcing her own self-belief and cruelly insulating her from any dissenting voices or uncomfortable truths.

Was she a cold, calculating master manipulator who knew exactly what she was doing every step of the way, or did she genuinely fall victim to her own grand delusions, a "messiah complex" where the ultimate good she envisioned justified any present deceit? The unsettling truth likely lies in a murky gray area, a gradual, imperceptible descent into self-deception that became utterly indistinguishable from calculated, criminal fraud.

Former Theranos CEO Elizabeth Holmes

Her defense during trial, foregrounding claims of horrific abuse and manipulation by Balwani, introduced a profoundly disturbing layer to her psychological profile. This intense, isolated dynamic between Holmes and Balwani could also be viewed as a destructive folie à deux, a shared delusion that mutually reinforced their isolation, their unwavering commitment to the fraud, and their distorted reality.

Balwani's own past business ventures, including a spectacular dot-com bubble flameout, might have made him particularly susceptible to, and an eager enabler of, Holmes's ambitious but ultimately hollow vision. It was a partnership of mutual reinforcement, spiraling into shared ruin.

Beyond individual psychology, the Theranos saga offers a compelling and chilling case study in sociological dynamics. The powerful "cult of personality" that surrounded Holmes was terrifyingly amplified by Silicon Valley's unique, often uncritical, ecosystem.

The industry's celebrated "disruption at all costs" ethos, coupled with a pervasive culture of aggressive risk-taking and a crippling "fear of missing out" (FOMO) among investors, created incredibly fertile ground for unverified, audacious claims. Experienced venture capitalists who typically demanded rigorous scientific validation often passed on Theranos, their caution ignored.

Instead, high-profile private investors, star-struck by the compelling narrative and the board's illustrious names, poured in hundreds of millions with startlingly insufficient due diligence. This exposed a systemic vulnerability where the intoxicating allure of a "unicorn" company tragically outweighed rational skepticism and ethical responsibility.

The extreme secrecy employed by Theranos, while outwardly justified as intellectual property protection, functioned as a powerful, insidious mechanism of control. It ruthlessly compartmentalized employees, stifled any genuine collaborative problem-solving, and actively, aggressively suppressed any internal dissent.

Whistleblowers faced a barrage of intimidation and legal threats, transforming the company into an almost cult-like environment where unquestioning loyalty to Elizabeth Holmes superseded ethical considerations, scientific integrity, and even basic human decency.

Today, Elizabeth Holmes, now Inmate #24957-111, is adapting to a starkly different reality at FPC Bryan. Reports from an interview given to People Magazine (via a third party) indicate she is teaching French, counseling survivors of abuse, and even reportedly drafting new patents – a testament to her seemingly undiminished ambition and a potential strategic move to shape her post-prison narrative. Her projected release date, adjusted for good conduct time and First Step Act credits, is August 16, 2032. Sunny Balwani continues to serve his sentence at FCI Terminal Island in California, with his appeals exhausted, the legal avenues now definitively closed.

The profound impact of the Theranos scandal, however, reverberates far beyond the confines of a prison cell. It stands as a stark, undeniable testament to the very real dangers of unchecked ambition, unfettered hype, and systemic ethical blindness in the biotech sector. Regulatory bodies, once perceived as slow and cumbersome, have been forced to become more proactive and rigorously discerning in their oversight of novel health technologies.

For instance, there's been a critical increase in emphasis from the FDA on pre-market approval for laboratory-developed tests (LDTs), a direct response to the Theranos debacle. Investors, too, are now demanding more robust scientific advisory boards and independent third-party validation studies earlier in the funding cycle for health tech startups, a hard-learned lesson in verifiable data over charismatic narratives.

The very notion of Silicon Valley's "fake it till you make it" mantra has faced unprecedented public scrutiny, fostering a renewed, albeit fragile, emphasis on ethical conduct and transparent accountability.

While some might argue the "Elizabeth Holmes effect" has, perhaps unfairly, made it harder for all female founders to secure funding, it has undeniably spurred more nuanced and critical conversations about supporting diverse entrepreneurs while universally holding them to the highest, uncompromised standards of scientific and corporate integrity.

The story of Elizabeth Holmes and Theranos is more than just a case of corporate malfeasance; it's a modern Greek tragedy, a compelling and cautionary blend of soaring human ambition, fatal flaws, and systemic vulnerabilities.

It serves as a haunting, unforgettable reminder that in the relentless, often dazzling pursuit of innovation and wealth, the seductive allure of a compelling narrative must never eclipse the fundamental pillars of truth, transparency, and scientific integrity. The blood and the lie of Theranos will forever remain a chilling, permanent fixture in the annals of true crime, forcing us all to constantly question the perilous line between visionary aspiration and criminal deception.

Elizabeth Holmes Appeals Court Ruling Denies Overturn of Conviction

Elizabeth Holmes Shares Her Daily Life in Prison

NEW YORK – Seven men from Long Island have been charged in a $20 million money laundering and fraud scheme that tricked over 1,800 victims—many of them elderly—into purchasing Home Depot and Lowe’s gift cards under false pretenses.

Authorities say the suspects used the stolen gift cards to buy construction supplies, which they later resold for profit. The elaborate scheme involved 6,000+ fraudulent transactions across 45 states, making it one of the largest fraud cases in recent years.

According to prosecutors, the defendants used computer-based scams to deceive victims. Some were falsely told that their personal information had been linked to child sexual abuse material, a fear tactic that pressured them into buying gift cards to "clear their names."

Once the suspects obtained the fraudulently purchased gift cards, they redeemed them for high-value construction supplies, including:

✔️ Copper pipes

✔️ Steel cables

✔️ Hot water heaters

These products were then resold to local plumbing and home improvement businesses for significant profit.

Authorities revealed staggering numbers behind the fraud scheme:

📌 1,800+ victims in 45 states

📌 6,000+ fraudulent transactions

📌 $20 million in total losses

📌 $50,000 worth of pipes purchased in a single day using 50+ gift cards

📌 $100,000 in cash recovered, along with luxury jewelry and handbags

The fraud ring conducted thousands of transactions at 80+ Home Depot and Lowe’s locations in New York State alone.

When police arrested the suspects, they discovered stolen construction supplies, large sums of cash, and luxury items in their vehicles.

All seven suspects pleaded not guilty and face up to 15 years in prison if convicted.

However, a controversial decision to release six of the defendants on cashless bail has raised concerns among law enforcement officials.

"We have thousands of victims out there. If we’re going to be able to prosecute them, we have to keep them where they belong—and that’s in jail."

— Nassau County Police Commissioner Patrick Ryder

Officials are warning the public to stay vigilant against phone scams and online fraud. Red flags to watch out for include:

❌ Calls from someone claiming to be a government official, bank employee, or software company representative

❌ Urgent requests for payment using gift cards or wire transfers

❌ High-pressure tactics using fear or legal threats

Nassau County District Attorney Anne Donnelly issued a strong warning:

"If someone calls you and identifies themselves as a government employee, a bank representative, or a representative of an internet or software company and asks you for money, I’m telling you—hang up the phone."

This case highlights the growing threat of sophisticated financial scams, particularly those targeting elderly and vulnerable individuals. With $20 million stolen and thousands of victims nationwide, authorities continue their investigation.

As concerns rise over bail policies for financial crimes, the question remains: Will justice be served?

Let us know your thoughts in the comments below. 🚨

Gary Nelson, 48, a builder who charged a woman £31,190 for a poorly constructed, unfinished extension, has been sentenced. The work was meant to provide a wheelchair-accessible space for a man with Parkinson's disease and a chronic back condition but ended up causing significant financial strain on the family.

The extension, built at an Ingleby Barwick home in 2021, was riddled with defects and failed to meet building regulations, prompting a contravention notice.

The victim was forced to pay an additional £37,500 to rectify the damage caused by Nelson’s substandard work, ultimately leading to a court case and sentencing.

The victim, who had hired Nelson to build the extension, was devastated by the result. She had to work two more years than intended to cover the repair costs.

The judge remarked on the significant toll Nelson’s actions took on her life, highlighting that the costs of fixing the poorly executed work were far greater than the initial £31,190 payment.

In January, Nelson, of Redland Close, Stockton, admitted to charges of fraud and unfair trading. The court learned that work began late in 2021, but significant problems surfaced, including delays, unfinished work, and issues with elements like flooring, tiles, and dampness. Nelson even threatened to walk off the job unless paid £5,000 upfront.

Some of the 'shoddy work' by builder Gary Nelson on a home in Ingleby Barwick (Photo: Stockton Council)

Although Nelson claimed he acted fraudulently due to the pressures of the Covid pandemic and bad weather, his defense did not absolve him of the consequences.

At Teesside Crown Court, Judge Simon Batiste addressed the shoddy nature of Nelson's work, emphasizing that the builder failed to meet agreed schedules, and the quality was subpar.

The judge also noted that Nelson did not comply with building regulations, which forced building control to intervene.

Despite Nelson’s acknowledgment of the poor work, the judge opted for a suspended two-year prison sentence, citing rehabilitation prospects and the impact imprisonment would have on his employees.

Instead of prison, Nelson received a suspended sentence, coupled with 150 hours of unpaid work and 10 days of rehabilitation.

As part of the ruling, Nelson was ordered to pay £31,190 in compensation to the victim and cover £9,063 in legal costs. Judge Batiste expressed his desire to ensure the victim received compensation, noting that the situation had become “an expensive failure” for Nelson.

Nelson's defense highlighted that he was still running a profitable business and was involved in two large-scale projects. The court heard that his firm was financially stable, and compensation could be paid, though the judge stressed the importance of balancing the punishment with the firm’s survival.

Councillor Norma Stephenson, Stockton Council’s cabinet member for community safety, welcomed the sentence. She stated that it should serve as a warning to others in the construction industry who engage in fraudulent practices.

Stephenson emphasized the council’s commitment to protecting residents and stated, “We will always work hard to address people who flout the law in order to protect our residents.”

Anyone with concerns about fraudulent trading can contact the Stockton Trading Standards team for help at 01642 526560 or by email at trading.standards@stockton.gov.uk.

Lisa Jeanine Findley—a Missouri woman arrested for attempting to sell Elvis Presley’s famous Graceland property—has pleaded guilty to mail fraud. Findley, 54, of Kimberling City, Missouri, was involved in an elaborate scheme to defraud the Presley family by attempting to auction off the iconic Memphis estate. A judge intervened and blocked the fraudulent sale before it could go through.

The plot was uncovered in August 2024, when federal authorities arrested Findley on charges of mail fraud and aggravated identity theft. Investigators allege that Findley used multiple aliases to falsely claim that Lisa Marie Presley, Elvis’s daughter, had used Graceland as collateral for an unpaid loan. She fabricated documents to back up her story and even went so far as to announce a public foreclosure sale of the estate in Memphis.

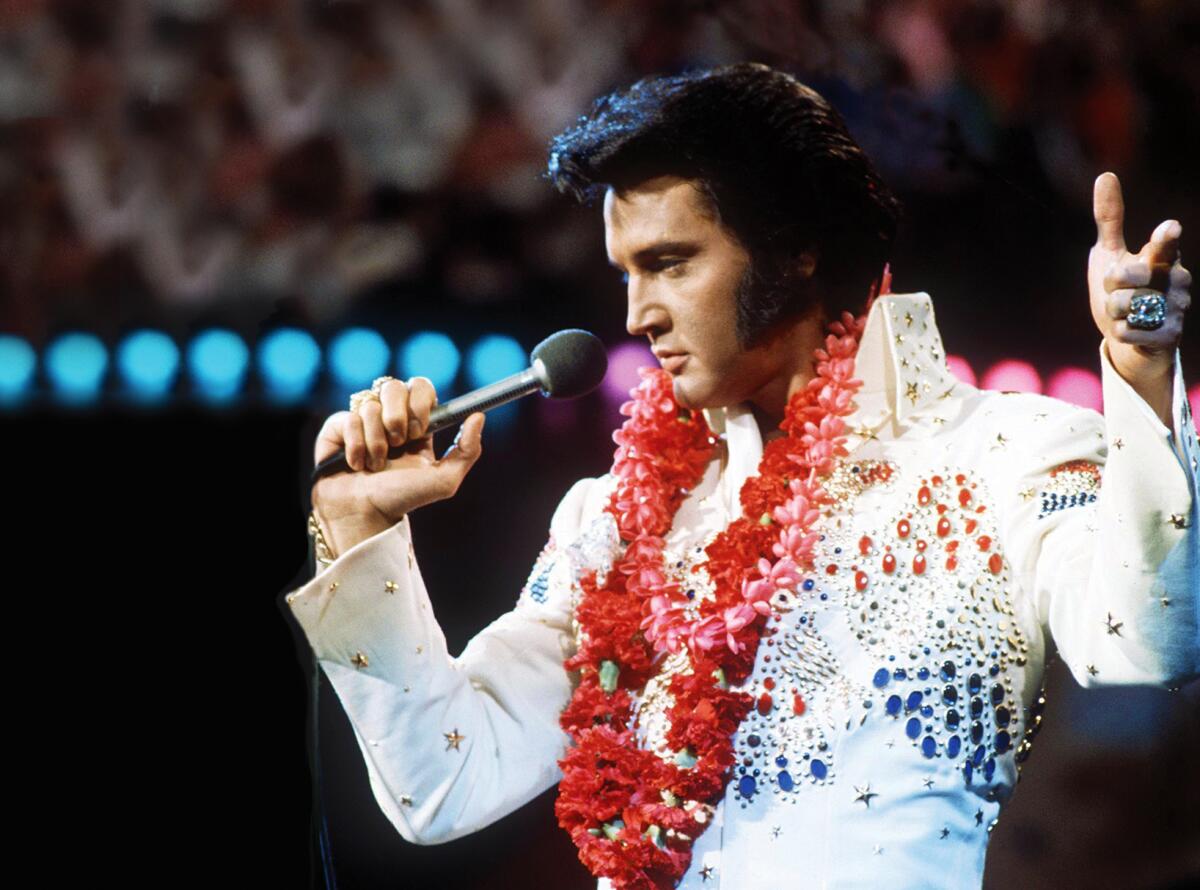

Elvis Presley

The scheme included multiple falsified loan documents, forged signatures, and a fraudulent foreclosure notice that was published in a local newspaper. Findley was also accused of submitting fake court filings in an effort to solidify her fraudulent claim on the property. In a twist, after the plan attracted media attention, Findley allegedly attempted to cover her tracks by falsely accusing a Nigerian identity thief of being behind the scheme.

Findley recently pleaded guilty to mail fraud in a Memphis courtroom. In exchange, federal prosecutors agreed to drop the charge of aggravated identity theft. The Missouri woman is scheduled for sentencing on June 18, 2025, and could face up to 20 years in prison. However, her plea deal suggests she may serve a significantly reduced sentence.

The case has been heavily scrutinized, and many are questioning how such a high-profile scheme was able to get as far as it did.

The story took a personal turn when Riley Keough, Elvis’s granddaughter and the heir to Graceland, stepped in to prevent the fraudulent sale. Keough, who has expressed deep concern over the sale, filed a lawsuit in May 2024 to stop the foreclosure auction. The actress condemned the attempted sale, calling it “fraudulent,” and sought a legal injunction to block it.

RELATED: Elvis Presley’s Alleged Secret Grandchild in Florida Amid Priscilla’s $1 Million Lawsuit

Keough’s filing pointed out that Findley’s company, Naussany Investments, appeared to be a sham operation—and she took legal action to prevent Graceland from being sold off.

According to federal authorities, Findley was able to create false documents to back her claims, including a fake loan agreement that allegedly showed Lisa Marie Presley borrowing $3.8 million. Findley then attempted to extort $2.85 million from the Presley family as a settlement.

Findley’s actions not only impacted the Presley family but also brought a national treasure into the spotlight. The Graceland estate, now a beloved historical site and museum, was nearly sold in a public auction, which would have been a devastating blow to the Presley legacy.

Federal prosecutors are committed to holding fraudsters accountable, as this case clearly illustrates the dangers of identity theft and financial manipulation. U.S. Attorney Kevin G. Ritz emphasized that the Department of Justice will aggressively pursue those who attempt to profit from fraudulent schemes—especially when they target historic properties like Graceland.

The public outcry surrounding the fraudulent Graceland sale was immense. Local residents and Elvis fans rallied behind the Presley family, with many expressing outrage that such a scheme could even be attempted on such a historic site.

Protesters gathered outside Graceland to show their support for the Presley family, further highlighting the national significance of the case. This legal drama surrounding one of the world’s most famous estates continues to captivate the public and raises questions about how such large-scale fraud can occur in the first place.

As the case moves toward sentencing, all eyes are on Findley’s June 2025 court date. Will she face a lengthy sentence? Or will the plea deal result in a reduced term behind bars? The legal drama surrounding her case continues to unfold, and the Presley family’s fight to protect Graceland is far from over.

Kofi Amankwaa, a former Bronx-based immigration attorney, has been sentenced to 70 months in prison for orchestrating an extensive immigration fraud scheme. The scheme involved submitting fraudulent petitions under the Violence Against Women Act (VAWA) to unlawfully help clients gain U.S. immigration benefits. The sentence comes after Amankwaa pleaded guilty in September 2024, and it highlights the severe consequences of exploiting vulnerable individuals seeking legal immigration status.

From September 2016 to November 2023, Amankwaa and his associates engaged in a widespread fraud operation. They instructed clients to sign false Form I-360 VAWA Petitions, which were falsely claiming that the clients had suffered abuse from their U.S. citizen children. These claims were made under penalty of perjury, with Amankwaa himself signing the petitions as the attorney preparer.

Amankwaa’s fraudulent filings didn’t stop there. He also used the submitted VAWA petitions as a basis to obtain advance parole travel documents for his clients. These documents, which allow individuals without legal status to temporarily travel abroad and return to the U.S., were then exploited by Amankwaa to further his scheme.

Amankwaa’s scheme relied on systematically misleading his clients. He instructed them to sign petitions claiming domestic abuse that had never occurred, with the intention of falsely securing lawful permanent residence for them. The fraudulent applications resulted in a string of denied immigration requests, leaving many clients with their hopes dashed and their money wasted.

For each fraudulent immigration case, Amankwaa charged his clients between $3,000 and $6,000, in addition to various administrative fees. He failed to disclose to his clients that the petitions were based on fabricated claims of abuse, making them unwitting victims of his fraudulent practices.

The actions of Amankwaa have not only caused personal harm to his clients but have also undermined the Violence Against Women Act (VAWA), which is a critical law designed to offer noncitizen victims of domestic abuse a pathway to legal residency. Amankwaa’s actions mocked the very purpose of the law by exploiting the immigration system to profit from fraudulent claims.

Matthew Podolsky, Acting U.S. Attorney for the Southern District of New York, expressed the gravity of Amankwaa's actions, stating:

“Kofi Amankwaa, a former immigration attorney, made a mockery of the U.S. immigration system and VAWA — a law that provides noncitizen victims of domestic abuse a path to lawful permanent residence status — by filing thousands of immigration documents falsely alleging that his clients were victims of abuse by their children or other family members. Amankwaa repeatedly filed these false applications without telling his clients that he was doing so, and pocketed thousands of dollars from each client he victimized. Amankwaa now faces a significant prison sentence for his crimes.”

In addition to the prison sentence, Amankwaa faces financial penalties. He has been ordered to forfeit a substantial sum of $13,389,000 and will also be required to pay $16,503,425 in restitution to the victims of his fraudulent scheme. These penalties serve as a reminder of the consequences of exploiting the U.S. immigration system for personal gain.

Furthermore, following complaints from numerous clients regarding fraudulent activity, Amankwaa’s law license was suspended in November 2023, and he was disbarred in August 2024, marking the end of his legal career.

The case of Kofi Amankwaa serves as a warning to immigration professionals about the importance of ethical conduct in the legal profession. It also emphasizes the need for individuals seeking immigration assistance to be cautious and aware of potential fraud.

Amankwaa’s illegal actions not only caused emotional distress to victims but also led to broader consequences for the immigration system. His fraudulent scheme exploited a law meant to protect vulnerable individuals, and the penalties he now faces are a stark reminder of the severe repercussions for those who manipulate the system for financial gain.

The sentencing of Kofi Amankwaa is part of a broader effort to crack down on immigration fraud within the United States. Fraudulent practices within immigration law are a growing concern, as they undermine public trust in the system and harm vulnerable individuals seeking legal status.

As immigration laws become more complex, it’s crucial for legal professionals to operate with the highest standards of honesty and integrity. Victims of fraud, such as those taken advantage of by Amankwaa, are left in difficult situations. Therefore, the government’s pursuit of justice in these cases is essential for maintaining confidence in the immigration system.

Kofi Amankwaa’s 70-month prison sentence, along with his financial penalties, marks the culmination of a long-running fraudulent scheme that exploited vulnerable individuals seeking to navigate the U.S. immigration system. His case underscores the critical need for vigilance and integrity within the legal profession, particularly in sensitive areas such as immigration law.

As the victims begin to receive restitution and the legal system takes steps to prevent future fraud, this case serves as a pivotal reminder of the importance of maintaining trust in the U.S. immigration process. Ethical conduct is paramount, and those who fail to uphold it will face severe consequences, as demonstrated by Amankwaa’s sentencing.

In a shocking case of corporate fraud, Norman Gray, the founder and CEO of a biomedical company (the “Biomedical Company”, has been sentenced to 10 years in prison for defrauding investors out of more than $13 million.

This sentence was handed down by U.S. District Judge Paul A. Engelmayer following Gray's conviction on charges of wire fraud. The scheme involved a web of lies, fabricated documents, and fictitious ventures that led to substantial financial losses for his victims.

Matthew Podolsky, the Acting United States Attorney for the Southern District of New York, described the fraudulent actions of Norman Gray as an elaborate betrayal of trust.

"Norman Gray preyed upon people who wanted to invest in developing life-saving medicine for children with a rare and generally fatal disease," Podolsky stated. "Gray gained his victims’ trust by lying about everything from his educational background and supposed access to offshore trusts to submitting false patent applications and creating fake mortgage companies."

Gray, who falsely claimed to have a Ph.D. from MIT, pretended to be a billionaire scientist behind a biomedical company he asserted was poised to revolutionize medical treatment.

He fabricated a success story about a prior company he allegedly sold for nearly a billion dollars, even claiming that he was using profits from this non-existent sale to fund his new venture. In reality, Gray had no such educational background and was in deep financial debt by 2020.

Gray's biomedical company, headquartered in Hamden, Connecticut, attracted numerous investors by promising groundbreaking treatments for diseases like MVID (a rare, generally fatal disease affecting children).

However, the flagship medication was a complete fabrication, as was a supposed treatment program in Saudi Arabia that Gray claimed was saving lives. Victim-2, one of Gray's investors, sent $200,000 to continue funding the nonexistent program.

The scheme didn’t end there. Between 2018 and 2020, Gray convinced Victim-2 to invest a staggering $7.6 million in the Biomedical Company, using wire transfers to accounts under his control.

In addition to misrepresenting the company’s financial status, Gray used fabricated documents to lure investors into a fake PPE venture during the COVID-19 pandemic. Victim-2 sent over $1.75 million to Gray, only to later discover that the PPE was defective and could not be sold.

Gray's manipulative tactics continued to escalate, as he convinced another victim, Victim-1, to send $250,000 for an alleged equity investment in his company.

Instead of investing the funds, Gray used nearly all of it to cover his personal debts and even bought a $1 million home and a $50,000 luxury SUV. He went so far as to create a fake mortgage company to further deceive Victim-1 into believing that the investment was legitimate. When the fraud began to unravel, Gray promised to return the stolen funds but never did.

In addition to his 10-year prison sentence, Gray was ordered to pay $1,467,000 in forfeiture and $1.5 million in restitution to Victim-1. He will also serve 3 years of supervised release upon completion of his prison term.

Podolsky praised the collaborative effort between the Special Agents of Homeland Security Investigations, New Haven Police Department, and law enforcement agencies in the United Kingdom and Spain. Their investigative work was key in uncovering the extent of Gray's fraudulent activities.

Assistant U.S. Attorneys Benjamin A. Gianforti, Vladislav Vainberg, and Jessica Greenwood played pivotal roles in prosecuting the case, which was handled by the Office’s Illicit Finance and Money Laundering Unit.

The case of Norman Gray serves as a sobering reminder of the risks involved in biomedical and healthcare investments, especially in the emerging tech and pharmaceutical sectors. Fraudulent schemes like these not only impact investors but can also erode trust in industries that are vital for public health and innovation. As healthcare investments continue to grow, it’s crucial for investors to remain vigilant and conduct thorough due diligence to avoid falling victim to such schemes.

Gray’s conviction highlights the importance of regulation and oversight in the biomedical industry. As new medical technologies and treatments are developed, it is critical that both investors and consumers can rely on accurate information and legitimate business practices. Financial oversight, transparency, and accountability must be at the forefront of efforts to prevent similar frauds from taking place in the future.

Saad Enterprises Agrees to $3 Million Settlement Over False Claims Act Violation

Saad Enterprises Inc., operating as Saad Healthcare, has agreed to pay $3 million to resolve allegations that it violated the False Claims Act by knowingly submitting fraudulent claims for hospice care in Alabama. The claims in question were for patients who were not terminally ill and thus did not meet the eligibility criteria for Medicare's hospice benefit.

Hospice care is a specialized form of end-of-life support, aimed at providing comfort to patients with terminal illnesses. For Medicare patients to be eligible for hospice care, they must have a life expectancy of six months or less due to their terminal condition. Patients in hospice forgo traditional treatments meant to cure their illness and instead receive care focused on alleviating symptoms and stress.

"Respectful and appropriate end-of-life care is the crux of the hospice benefit under Medicare,” said Principal Deputy Assistant Attorney General Brett A. Shumate of the Justice Department’s Civil Division. “The Department will hold accountable those who exploit this benefit for their own gain.”

The settlement resolves claims that, between 2013 and 2020, Saad submitted or facilitated fraudulent claims for 21 patients who did not qualify for the Medicare hospice benefit. These patients were not terminally ill as defined by the law and regulations governing Medicare hospice care. Saad was fully aware that these patients did not meet the eligibility requirements for hospice benefits.

Acting U.S. Attorney Keith A. Jones for the Southern District of Alabama added, "Caring for terminally ill people is a responsibility the United States and the Medicare program take seriously. Patients and taxpayers deserve not to be cheated, and the Department of Justice will continue to protect them."

The settlement stems from a whistleblower lawsuit filed under the False Claims Act, allowing private citizens to bring claims on behalf of the United States and share in any recovery. The lawsuit, United States ex rel. Wolff & Sims v. Saad Enterprises, Inc., was filed by former Saad employees Melissa Wolff and Whitney Sims. As part of the settlement, the two whistleblowers will receive $540,000.

This case highlights the ongoing efforts by the U.S. Department of Justice to protect Medicare beneficiaries and prevent fraud that exploits vital healthcare programs meant to support vulnerable individuals.

Saad Healthcare, founded in 1967 by John and Dorothy Saad, began with a simple mission: to provide quality healthcare to the people of Mobile, Alabama. Over the years, Saad Healthcare grew from its humble beginnings to become one of the largest healthcare providers on the Gulf Coast, employing a significant number of professionals dedicated to delivering compassionate care.

The company offers a range of healthcare services, including hospice care, a specialized form of end-of-life support that focuses on symptom management and comfort for patients with terminal illnesses. Saad Healthcare's commitment to high-quality patient care has established it as a trusted name in the region.