Understand Your Rights. Solve Your Legal Problems

ONS Migration Statistics Quarterly report for the period January 2016 to March 2016 showed that net migration to the UK has not changed significantly, at 327,000. The figure for EU-only net migration is 180,000. These figures are to be expected and it is strong evidence of the growing fear among EU citizens, leading up to the EU referendum, that the UK door could close on them soon - a fear that still remains.

Such concern is being felt by organisations as well as individuals. During the same period as the ONS migration figures - January 2016 to March 2016 - our firm saw a three-fold increase in EU citizens and UK organisations seeking Permanent Residency and British Nationality status for themselves and their staff as the UK headed towards an EU vote.

The Government's plans to seek curbs on free movement rules is a worrying one for many, as industries like engineering, IT, construction, hospitality, rely heavily on skills from outside the UK. The free movement rules currently give EU nationals the right to live and work in other member states. For particular sectors and skills, the Government will have to seriously consider free movement to some extent, in exchange for diminished access to the EU’s Single Market, or face the prospect of these industries in the UK, declining or relocating.

Even if the Government triggered Article 50 tomorrow and stated an effective "cut-off date" for when EU citizens will be granted a right to stay in the UK, this growing rise in EU citizens entering the UK will continue, along with applications for Permanent Residency and British Nationality as it could take years for any deals and changes to the immigration rules to be refined and implemented.

Nonetheless, with the uncertainty set to continue, we're advising EU citizens currently living and working in the UK and who are classified as a 'qualified persons' (i.e. you’re working, studying, self-employed, self-sufficient or looking for work) to apply for a registration certificate to prove their right to live or to work in the UK. If you're a 'qualified person' having been in the UK for at least five years (or three if you are the spouse of a British citizen), then you can also apply for permanent residency and then, 12 months after, British Nationality. Applications can take up to six months to be decided. With the Home Affairs Committee warning of possible fresh delays and backlogs in the immigration system as more people enter the UK and no date as yet set on changes to the immigration rules, we're advising organisations with EU workers and citizens themselves, not to delay their applications.

Migrate UK is a law firm specialising solely in immigration law for organisations and individuals. Jonathan Beech has over 20 years' experience in the immigration sector. Prior to setting up Migrate UK in 2004, he gained extensive experience working and consulting in UK immigration for the UK Border Agency and two of the ‘Big Four’ global advisory firms, Ernst & Young and KPMG.

(Source: Jonathan Beech, Managing Director of Migrate UK)

With the dust settling on the UK’s decision to leave the EU, Blacks Solicitors’ Phil Gorski takes a closer look at the impact this will have on cybersecurity and intellectual property for businesses.

How Brexit will affect data protection in the UK?

UK businesses have for some time now been thinking carefully about what they will have to do to comply with the EU’s General Data Protection Regulation (GDPR). Brexit has not made their deliberations any easier.

Data protection law in the UK, as with many of our laws, is based on legislation which originates in the EU. The GDPR is a modernisation of the current, slightly rusty, regime, put in place by the Data Protection Act 1998. It introduces new and stricter obligations and a system of increased fines to go with them and is due to come into force, this time without the need for any enacting UK legislation, on 25 May 2018.

The obvious question facing businesses, following the result of the referendum last month, is whether the GDPR will come into force in this country at all. The most likely answer is that it will. As everyone will by now know, the exit clock formally starts ticking once the UK gives notice of its intention to leave the EU under Article 50 of the Lisbon Treaty. As Article 50 provides a minimum two year period for formal exit negotiations to take place, even if notice had been provided immediately, the GDPR would still come into force.

Whether the GDPR remains in the long term, however, depends on what alternative relationship with the EU is eventually put in place. It is the uncertainty here that makes planning for the future difficult.

It is difficult to predict what obligations either would impose on businesses. A system which provides an adequate level of protection could take a number of forms and it is almost impossible to know which parts of the GDPR might be retained.

What does all this mean in practice?

Phil Gorski, a lawyer specialising in IP at Blacks Solicitors says: “Businesses should work on the basis that the GDPR will come into force in May 2018 and that it will stay in force for some time afterwards.

“There are a number of ways that businesses can protect their online data, the most basic of these being: making sure company’s anti-virus software is up to date and that all staff are correctly trained in online security and data protection.”

For more information about what Brexit will mean for data protection in the UK, read Phil’s latest blog post here.

(Source: Blacks Solicitors)

Responses from over 600 participants from 180 sectors revealed that almost 50% fear the biggest risk post-Brexit is added costs through duties or taxes, followed by customers and suppliers having a potential negative view of the UK (19%) and exchange rate issues (18%).

The Institute of Export (IOE) - the only professional body in the UK offering recognised, formal qualifications in International Trade - invited members, established exporters and importers and trade association members to take part in a post Brexit questionnaire and help shape how future trading should work.

Further results show that nearly 54% of those surveyed expect their business growth to remain the same with almost 47% projecting growth to shrink in the medium term - and over 42% forecasting a long-term growth decline.

Almost 47% of recipients say the current UK and EU customs procedures are suitable for UK traders. When asked what changes and developments they required in their respective business sectors, responses spanned free movement of goods between countries, financial support for new and established exporters - and clear information about regulations.

Nearly half rated continued access to the EU single market for goods and services as 10 on a scale where ten is most important.

When asked how UK export controls and licensing procedures can be made more user-friendly for their businesses, most said they were content with the current system and hoped the arrangements could remain on an EU-wide basis. However, there were calls to streamline the UK's system - with either IT enhancements or additional support making license application faster and more efficient. The need for help to navigate the procedures was also voiced.

On transit and security arrangements, the importance of any deal negotiated with the EU not having clauses that could delay shipments was also expressed. If the government failed to achieve this, the feeling is that it must proactively prevent UK exporters losing out by committing extra resources to lessen the impact of the new rules and speed up the process.

There was a noticeable difference between the needs of SMEs and larger organisations when it comes to the support they require. SMEs find it harder to access the resources needed to deal with the unavoidable administrative processes necessary to international trade. It is therefore the SMEs, who are the life-blood of UK business, who will feel the hardest impact of any increased financial or administrative burden imposed on the UK as a result of negotiations with the EU.

Additional results highlighted that in the medium term, almost 88% saw resolving the UK's trade relationship with the EU as a priority and that this should be dealt with before trying to enter into any new agreements with other nations or trading blocs.

Thereafter, Free Trade Agreements with USA (77%), Canada (62%), China (61%), Australia (57%) and India (51%) were seen as important medium term objectives.

When asked the same questions about the longer term perspective, India came out on top (61%) followed by Australia (56%), China (52%), Canada (48%), USA (44%) and the EU (42%).

IOE Director General, Lesley Batchelor OBE, said: "The results of the survey will inform and influence government and civil servants and we urge businesses to harness trade associations and business groups to continue to make their voice heard, tell them what they need to ensure that they can compete effectively in the global market - and let them know which regulations are stopping them from doing it properly or are impeding their companies' growth.

"While our relationship with the EU won't change overnight - and Brexit could now be delayed until 2019 - there is no time to waste as fallout from the vote won't wait for us to invoke Article 50. For example, many EU clients have profound fears and will need reassuring, while a number of other immediate uncertainties could bring benefits or extra costs - for example, short-term currency fluctuations.

"It is vital that businesses are aware of all this so they can resolve problems quickly and capitalise on opportunities."

(Source: Institute of Export)

In the aftermath of the vote for Brexit, it transpires that there is actually no such thing as a Brexit, but potentially a number of Brexits that we could end up with.

In theory we could negotiate a Brexit where the UK leaves the EU but does not sever its ties to the EU’s ‘four freedoms’. By retaining its commitment to the freedom of movement of capital, goods, services and people, the UK could become a member of the European Economic Area (EEA). We could have the same status as Norway, Iceland and Liechtenstein as non-EU members that are able to access the EU’s single market.

However as reducing immigration played such a large role in the recent Leave campaign it is likely the Government will attempt to restrict free movement of people in its negotiations with the EU. This seems like a sensible assumption especially in light of Theresa May’s recent comment that there would be no attempt to re-join the EU by the back door. This means the prospect of the UK joining the EEA is likely to be off the table from the outset.

This leaves the UK with a couple of other possibilities. Switzerland’s relationship with the EU is a possible example of what a post Brexit UK-EU relationship could look like. However this model is also fraught with problems. Switzerland currently has access to the European single market as a result of a series of bilateral agreements with the EU which include unrestricted immigration for EU nationals which it has recently attempted to renegotiate. Switzerland has been warned by the EU that it will lose access to the single market if it goes ahead with any limitations. This does not bode well for any UK advocates of this scenario.

However all is not lost as there is a precedent for a free trade agreement that gives access to the EU single market without full adherence to the principle of free movement in the shape of the bilateral free trade agreement between Canada and the EU (CETA). The agreement has been cited as an example of what future UK-EU trade relations could look like by both Boris Johnson and the new Brexit minister David Davis.

Canada’s international trade minister Chrystia Freeland has stated that she expects the new CETA deal to come into effect in early 2017. The implementation of CETA would mean that all tariffs on industrial products will be lifted between Canada and the EU as will nearly all tariffs on agricultural products. To secure this deal Canada has agreed to accept free movement of people between itself and most of the EU member countries; Bulgaria and Romania are excluded.

However Canada’s access to Europe’s single market of course falls far short of the access that the UK currently enjoys as a member of the EU. For example, the CETA agreement only grants limited access for the Canadian financial services industry. Considering how reliant the UK is on its own financial services industry (with the UK exporting over £22 billion worth of financial services to the EU in 2014) a similar deal is far from ideal for the UK economy.

Although the CETA negotiations were concluded in 2014, its implementation has been put at potential risk by Bulgaria and Romania’s announcement that they would be vetoing CETA. The UK, if it chooses to go down this route, could risk finding itself in a similar position down the line. One member state could object during the ratification process and potentially scupper the whole deal.

Ultimately what may help the UK negotiate itself a better deal than Canada is the fact that the UK’s economy is more integrated into the European economy than Canada’s. The UK currently absorbs a huge 16% of the EU’s exported goods. Furthermore 1.2 million British people live or work in the EU and over 3.3 million EU citizens live or work in the UK.

Clearly whichever path the UK takes, the economic needs of both Britain and the EU will have to be fully considered in any future negotiations. Any bad moves on either the principle of the free movement or restricting the UKs access to the single market risk hurting both the UK and Europe in which case no one wins.

(Source: Caron Pope, Managing Partner at Fragomen)

The average number of new tax cases sent to the Court of Justice of the European Union (CJEU) has risen by a fifth since the credit crunch, as more businesses and other taxpayers use the court to challenge the actions of national tax authorities, says Pinsent Masons, the international law firm.

Pinsent Masons says that between 2005 and 2010, pre-credit crunch, there were 50 new tax cases per year on average brought to the ECJ. Between 2011 and 2015, this rose to 61 per year, an increase of 22%.

Pinsent Masons explains that since the credit crunch, national tax authorities across Europe have been under intense pressure to increase revenues, leading many to levy extra charges and ensure they maximize tax take wherever possible. Businesses and other taxpayers who believe they are being taxed unfairly in the process, contrary to principles of EU law, can bring a challenge to the CJEU.

Pinsent Masons explains that the CJEU has ruled in favour of business claimants against national tax authorities in several high-profile cases, enabling millions in overpaid tax to be re-claimed.

Andrew Scott, Director at Pinsent Masons, the international law firm, comments: “The reach of EU law has widened considerably and continues to do so, with the result that an increasing amount of UK tax law is affected. More businesses and other taxpayers have therefore managed to find grounds for challenging UK tax law.”

“EU law has been used to contest a range of taxes levied by member states. EU anti-discrimination rules were used to over-rule the UK’s tax treatment of dividends paid by foreign subsidiaries of UK companies, for instance. It was argued that, in contravention on EU single market rules, they were being taxed more heavily than dividends from UK subsidiaries.”

Brexit vote result could mean further rush of tax cases to CJEU

Pinsent Masons says that the prospect of withdrawing from the EU, following the result of the EU referendum, means that more claimants may want to commence their proceedings while it is clear that EU law still applies in the UK.

Andrew Scott adds: “Although it’s business as usual at present, Brexit means that the power of the CJEU over UK law will end but at an unknown time in the future. UK claimants will therefore be considering whether to launch proceedings now so as to increase the likelihood that their claims are protected as and when the UK does leave the EU.”

“UK claimants might be concerned that, once it is out of the EU, the UK government will attempt without notice- as they have in the past- to remove the ability to bring a claim based on EU grounds even where EU law applied at the relevant time.”

(Source: Pinsent Masons)

Under new data protection regulation, consumers will have increased rights to object to processing of their personal information. Mark Fairbairn, Head of Retail at Equifax, explains what this could mean for retailers and both their online and offline marketing strategies.

“The EU’s new General Data Protection Regulation (GDPR), designed to protect consumer privacy and data usage, is due to come into force in 2018. While Brexit brings uncertainty over the UK’s implementation of this regulation, companies should press ahead with preparation for change. The UK government will have to decide whether it implements the new EU rules as planned, or develops alternative regulation. For UK businesses to continue to operate in the EU any alternative regulation must be palatable to European regulators. This means that whichever route the UK government takes the direction of travel will not change, although the end regulation may not look identical to the GDPR.

“So what does this mean for retailers? The UK’s retail sector leads the way in the development of digital commerce through personalised customer strategies. The key to this sophistication is found in mobilising customer data, and retailers are concerned about how changes to data protection could affect growth in this area.

“The new regulations refer to ‘unambiguous’ consent, a stricter definition than used today. Companies must ensure that they employ clear and transparent language in gaining consent from consumers to use their data in order to satisfy the new tighter definition.

“Exactly what this means in a digital context, for example when it comes to cookies, remains unclear. The Direct Marketing Association (DMA) has drawn attention to what is and is not considered ‘personal data’ in this instance. A cookie placed by a service provider who knows the individual, will generate ‘personal’ data about that individual’s behaviour, whereas an online advertiser cannot link such behaviour to a particular person – so that data would probably not be considered personal.

“When it comes to non-digital marketing, data protection rules still require that anyone processing personal data must have a ‘legitimate interest’ for doing so. While under the EU regulation data processing for direct marketing continues to be considered a legitimate interest, to ensure lawful processing, marketers need to carefully assess the relationship between their company and the consumer. Under the new law, consumers will have increased rights to object to any processing of their personal information, including profiling, at any time, free of charge. While unsubscribe/opt-out methods may continue to satisfy non-digital marketing performed under legitimate business interests, the right to unsubscribe/opt-out must also be highlighted during the first communication with the consumer, and should be clearly and separately stated.

“Much of the detail needs to be worked through over the coming months and years. The Information Commissioners Office (ICO) pledged in its 2016-2019 plan to work closely with the Department for Media, Culture and Sport to balance the interest of protecting the public and supporting economic growth. Co-operation across policy makers and industry players will become all the more important as Brexit negotiations commence and the UK shapes its future data protection laws.”

(Source: Equifax)

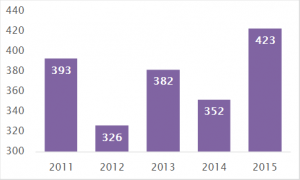

An increasing number of commercial and business-related disputes are being heard by the European Court of Justice (ECJ) up 20% in the last year to 423, compared to 352 in 2014, according to research from the Legal Business of Thomson Reuters, the world’s leading source of intelligent information for businesses and professionals.

However, the Brexit vote has brought into question the access of UK businesses and individuals to the ECJ to resolve legal disputes, pursue damages or challenge government decisions that might impact their profitability.

Thomson Reuters says that the significant increase in usage by businesses of the ECJ is being driven by businesses being more willing to make use of the European Courts as a tool to achieve commercial aims, particularly if they fail to get matters satisfactorily resolved at national level.

Thomson Reuters adds that the strengthening economic recovery has brought more financial firepower to many businesses to pursue claims all the way to the ECJ, which can be extremely expensive and time-consuming to do.

Areas which have seen significant increases in the number of cases heard by the ECJ include:

Examples of businesses involved in recent cases in the European Court include:

“The European Commission has been going through a more active period in terms of competition investigations, creating more cases for the ECJ.” says Professor Laurence Gormley, Professor of European Law at the University of Groningen and a member of the editorial board for the European Law Review, published by Thomson Reuters.

“One area of particular attention is the internet sector where there is a strong tendency for markets to develop into monopolies. Google and Amazon are just two players on which the EC has set its sights.”

As technological innovation gathers pace, the scope for IP-related disputes increases as firms seek to exploit intellectual property assets, and ground-breaking developments encourage more me-too competitors looking to seize market share.

Public procurement claims emerge as a growing area for litigation

Public procurement cases have also emerged as a growing area for litigation - with 26 cases in 2015 compared to zero in 2010. The cases are brought by businesses who believe they have unfairly missed out in a tender process run by a local government or public sector body.

Thomson Reuters says that this suggests that private companies are becoming more aggressive over litigating over public sector contracts.

It adds that despite some EU member states beginning to ease austerity measures, resulting in more public procurement projects coming on stream, competition for project tenders remains tough. This could increase the potential for disputes over the way contracts are awarded and handled.

It points out that despite the public purse strings loosening slightly as critical infrastructure projects get the go-ahead after years on hold, budgets remain very tight and governments and local authorities want to see real value for money.

Number of commercial cases heard by the ECJ continues to rise

*Data from European Court of Justice – year 1 January to 31 December

(Source: Thomson Reuters)

The Chairman of the Bar, Chantal-Aimee Doerries QC, has invited Hugh Mercer QC to chair a Bar Council working group to consider the ramifications for the profession of Brexit.

The Brexit working group’s first step will be to host an open forum for barristers to raise topics and issues which they would like to consider. Thereafter it will review the consequences of Brexit for the profession as a whole, for certain practice areas, for chambers and entities and for the justice system more broadly.

Chairman of the Bar, Chantal-Aimée Doerries QC, said: “Barristers practising in other EU countries may well be wondering what the future holds.

“It is fair to say that Brexit has created a great deal of uncertainty, but one thing we can be sure of is London’s position as the transaction and dispute resolution centre of Europe. The Bar, the judiciary, our world class commercial court infrastructure and our system of common law all contribute to making the UK an attractive destination for business and investment. The UK is the jurisdiction of choice for parties from all over the world.

“Top of the working group’s agenda is securing free movement for lawyers within Europe and other jurisdictions where barristers have benefitted from European trade agreements. This will allow legal professionals throughout the EU to continue providing the advice and legal representation that is vital to their clients’ business and economic interests, and to stability and growth across a range of sectors.”

The working group’s focus will be to evaluate the implications of Brexit and produce guidance for the profession. Its remit does not include seeking to influence the Government’s decision to leave or remain in the European Union, on which the Bar Council has maintained, and continues to maintain, a politically neutral position.

(Source: UK Bar Council)

In the wake of Brexit, the Bank of England is predicted to cut interest rates for the first time in seven years tomorrow. Kevin Ross, at Brown Turner Ross solicitors, predicts that this can only be a good thing for the property market and help keep the economy buoyant:

A cut in the interest rate may affect the mortgages that will be on offer to buyers, with some very attractive offers becoming available. It would also affect those current borrowers that are on variable or discounted rates.

The impact is even bigger if the borrower has an interest-only mortgage, although these have largely disappeared since the credit crunch.

If you are on a fixed rate mortgage then your rate is pegged until the fixed rate expires so there will be no change for you. However, people looking to buy in the near future should expect some very attractive deals in the next few weeks if the rate is cut.

We would not expect all lenders to pass on the full extent of the cut and of course many banks have still not reduced their standard variable rates (SVRs) to anywhere near the 0.5% base rate.

Post-Brexit, there has been much talk of falls in house prices with some experts predicting that house prices would drop nationally by 10%, and more in London. We have heard that some buyers have pulled out of deals. At Brown Turner Ross that has not been our experience from dealing with transactions across the country.

Overall we feel that the shortened process to appoint a new Prime Minister and an interest rate cut may stabilise the market, with nervous buyers happier about going ahead and there being greater confidence generally.

(Source: Brown Turner Ross)

Jane Crosby , specialist in commercial litigation and employment law at Hart Brown, outlines how employment law could be affected by the UK leaving Europe

When the UK went to the polls on June 23rd, few people predicted the outcome that arose, with the Leave campaign scoring a shock win and a slender majority of the UK public voting to leave the European Union.

In the time since the result was revealed, there has been much speculation and debate over what the decision means for the UK in various sectors. But what is important is that the nation starts to look to the future and prepare properly for what lies ahead, be it in property sales, finances, or indeed employment law.

As the UK prepares to activate Article 50 and signal its intention to leave the EU, employers need to start to look at their next steps, and that includes being aware of what the Brexit decision means, and how this will shape the world of employment law when negotiations come to an end in around two year’s time. So what should employers be expecting to see change in terms of employment law in the next couple of years?

Change in the law?

In the main, experts have suggested that there’s not actually all that much to worry about when it comes to changes in employment law but time will tell.

There are a number of areas of law which are enshrined in UK law such as discrimination rights, transfer of undertaking regulations, working time regulations and collective consultation.

Contrary to popular belief, many of the beneficial employment regulations, both on the side of employee and employer, were brought about by UK governments and not the EU, so if and when Article 50 is activated, these would not change.

On top of this is the simple suggestion that EU law is so integrated and ingrained in the minds and practices of the UK employment sector that there would be no real appetite for change, at least in the short term. And that’s not to mention the fact that companies and employees alike have enjoyed the benefits of European regulations for so long that to make an attempt to unravel them and replace them with new legislation would be little more than a time consuming exercise.

It’s also highly probable, the CIPD claims, that although the UK will not be forced to adopt any new EU regulation after it has ceased to be a member of the Union, that it will remain bound by precedents set by the Court of Justice of the European Union (CJEU) and European Court of Justice (ECJ), which would mean there would be little in the way of worries surrounding large changes in the law.

Immigration

Without a doubt the biggest impact of the Brexit decision, British employers will need to be aware of how leaving the EU will affect immigration. Many British firms across a range of sectors employ EU migrants who have the freedom to work in the UK indefinitely, but after Brexit, this could be muddied somewhat.

Experts are somewhat split on what the move will mean for EU workers in the UK, with many believing those who are already in the UK will be given leave to stay without question, and others suggesting that EU migrants will thereafter have to satisfy similar immigration credentials as non-EU residents do at present.

There could also be an agreement as part of the UK’s negotiations around leaving the EU that sees trade agreements put in place that also protect the freedom of movement EU nationals currently enjoy, allowing them to work in the UK after Brexit with little change.

Equality and rights

Most of the equality laws that we enjoy in the UK were, contrary to popular belief, in place long before the EU membership, which means that the illegal status of discrimination of workers based on race, sex and disability will be unaffected once we have left the EU. It is difficult to imagine that the government will repeal the Equality Act 2010.

What may change, however, is the rate of compensation that people can receive in discrimination claims against employers, which could face a limit under UK law.

Holiday allowance

The holiday allowance that UK-based workers enjoy at the moment is as a result of the EU Working Time Directive, which sets out exactly how many days of holiday someone is entitled to based on their contract of employment.

Many experts expect to see changes in this area, with Frances O’Grady of the Trade Union Congress recently having stated that the six million workers who enjoyed the benefits of the Working Time Directive are likely to be worried.

The main changes in terms of holiday allowance are likely to come in the shape of changes to how holiday pay is calculated and rules over opting out of the 48-hour working week, although it remains to be seen what we will actually see when push comes to shove.

Transfer of undertakings

The Transfer of Undertakings (Protection of Employment) Regulations 2006 TUPE was first implemented in 1981.

This piece of legislation protects employees’ rights connected to their contracts of employment when there has been a transfer of undertakings or a service provision change.

Generally it has not been a popular piece of legislation with UK businesses. It is difficult to predict what would happen to this legislation but the government may take the opportunity to make changes to help businesses.

In general there may not be radical changes for businesses in the short term but they will need to keep updated to ensure they comply with the ever changing landscape.

(Source: Hart Brown)