Understand Your Rights. Solve Your Legal Problems

Legal chiefs say the Government should give EU citizens unrestricted access to UK jobs in post-Brexit Britain and claim that British workers do not lose out to EU migrant labour.

But they agree that the UK Government, not the EU, will now call the shots.

In a comprehensive and easy-to-read legal guide on Brexit, the Bar Council also tells the Government it should defend employment rights of UK workers, make a strategy to keep London as the global centre for financial services, and write up a solid ‘Plan B’ in case no deal is reached with the EU two years after Article 50 is triggered.

Migrant Labour

The Bar Council’s proposals for a worker registration system would allow EU citizens into the UK without a visa, let them seek work without restriction, and give free movement to students, the self-employed, and those with means to be self-sufficient.

Chair of the Bar Council’s Brexit Working Group, Hugh Mercer QC said: “Our post-Brexit immigration policy must be able quickly and efficiently to fill gaps in the labour market, facilitate the supply of services, and stimulate entrepreneurial activity.

“The evidence shows immigration does not reduce the number of jobs available to British born workers, and it doesn’t lower wages, but the big worry for many people is that as a member of the EU, the UK has been unable to set its own rules.

“The Brexit Papers outline a legal scheme that will give the UK complete sovereignty and autonomy over immigration policy and allow the Government to control how EU citizen workers access UK benefits. It will also help the Government to identify the parts of the economy that benefit most from immigration and to set its own rules for refusing or granting admission to the UK where that is necessary.

“This is straight-forward legal solution that is capable of meeting the needs of British business and making sure that, on immigration policy, it is the elected UK Government that makes the rules.”

Protect rights of UK workers

The Brexit Papers also claim that key employment rights currently enjoyed by British workers could be scrapped if the Government does not transfer them when the UK leaves the EU.

Hugh Mercer QC said: “The Great Repeal Bill will bring EU regulations that protect UK workers into UK law, but that is only part of the story. Some employment rights are already part of English Law but have been interpreted in the European Court of Justice, and if we want to give UK workers the same rights as they have now, the effect of the judgments must be incorporated in to UK law too.”

“These include preventing employers from rolling up holiday pay with normal pay, which can discourage workers from taking annual leave. There could also be changes to discrimination law and the rules on compensation for workers who have been discriminated against. At present, EU judgments put an obligation on employers to justify pay gaps between men and women where they do work of equal value, but this too could be at risk.

“We don’t want UK workers to lose out.”

Financial Services

The UK’s top spot as the global hub for financial services is also at risk unless the Government creates a bespoke agreement with the EU to deal with the loss of the financial services “passport”, according to the Bar Council.

Hugh Mercer QC said: “Financial services make up 7% of UK GDP and directly employ 1.1 million people, two-thirds of whom work outside of London. Larger, firms cannot wait until the conclusion of the Article 50 negotiations to know what will happen. Many are in the process of developing their contingency plans on the basis that the UK does not remain a member of the single market and will no longer benefit from the existing passporting regime.

“Other mechanisms used by countries outside the EEA to access financial services markets, such as the equivalence regime and the emergent third country passport, will not fill the gaps created by the loss of the passport, and WTO terms, will not suffice.

“What we need is a bespoke agreement with the EU, replicating the status quo as far as possible and covering the gaps created by the loss of the passport regime.

“Any such agreement must also grant legal and other essential services sufficient rights so that they can continue effectively to support the financial services sector.”

Plan B: The ‘no deal’ scenario

The UK businesses face a cliff-edge if the Government does not agree a deal with the EU before the two-year deadline, the Bar Council warns.

Hugh Mercer QC said: “A ‘no deal’ scenario will have serious consequences for UK citizens and businesses. Legal rights will disappear overnight and it would cause serious economic damage.

“Our trading relationship with the EU would be under WTO terms, which would mean an increase in tariffs on goods and services and uncertainty for millions of UK citizens living abroad about their rights to residency, work, healthcare and state pensions.

“The possibility of a ‘no-deal’ scenario is sufficiently real that we must have a ‘Plan B’.”

(Source: Bar Council)

The House of Lords EU Justice Sub-Committee recently published its report Brexit: justice for families, individuals and businesses?

This House of Lords report finds that:

However, the Committee found that as Brexit takes effect:

Chairman of the Committee, Baroness Kennedy of The Shaws said: "Unless the Government can agree a replacement of the existing rules on mutual recognition of judgments, there will be great uncertainty over access to justice for families, businesses and individuals.

“The Committee heard clear and conclusive evidence that there is no means by which the reciprocal rules currently in place can be replicated in the Great Repeal Bill. Domestic legislation can’t bind the other 27 member states.

“We therefore call on the Government to secure adequate alternative arrangements, whether as part of a withdrawal agreement or a transitional deal."

Within the report the Committee consider examples of how EU regulations work in everyday situations:

Case Study 1: An unmarried couple are living in Wales with their four-year old daughter. The father has parental responsibility. The relationship breaks down and the couple split up, One day, the mother fails to return the child to the father when expected. It is discovered that the mother has fled with the child to Poland with her new partner. Having failed to persuade the child’s mother to return the child, the father knows that he needs to go to court to get his daughter back to Wales—but which court to go to and what is the most effective route to use?

Case Study: A clothes manufacturer in Manchester orders and pays for cotton from a supplier in Greece. When the order arrives, the manufacturer discovers that the quality of the cotton is not of the standard agreed in the contract. The supplier refuses to accept any liability and the manufacturer decides to seek redress through the courts. Where should the case be heard?

It is expected the Committees will complete this work in early 2017, ahead of the Government’s potential triggering of Article 50 of the EU Treaty, which would signal the start of the formal negotiations on UK withdrawal from the EU.

(Source: House of Lords)

Almost half of UK voters believe that the European Union will collapse if France votes in a right-wing Government later this year that takes the country out of the EU, according to a YouGov poll conducted on behalf of BE Offices, a leading independent serviced offices provider.

The survey polled a representative sample of 2060 people across a range of voting habits, age, gender, class and region.

In addition to the 49% of those polled that believed the EU would collapse in these circumstances , a further 29% felt that, although the EU would survive, there would be sweeping changes made to the organisation. Only 5% thought that the EU would survive in its present form.

These results form part of a wide ranging poll that sought the views of the British electorate on the likely impact of a hard Brexit as well as people's views of the Trump administration and its policies.

The poll demonstrates very clearly that almost four out of ten people (37%) believe a hard Brexit will have a negative effect on the UK economy with only one in five (21%) believing it will have a positive effect. A further 16% felt a hard Brexit would have neither a positive or negative effect and the remaining 25% didn't know.

As might be expected, almost one in seven "Remainers" (69%) regarded a hard Brexit as likely to have a negative effect on the economy along with 55% of Labour voters and 54% of LibDems . While 51% of the 18-24 age category also believed that a hard Brexit would be detrimental.

The broad consensus among those who believed a hard Brexit would negatively impact the economy, said: prices and inflation would rise; we would lose manufacturing jobs as companies moved operations away from the UK and into Europe to access the single market; and, Sterling would fall as the UK struggles to conclude advantageous trade deals with other countries.

One respondent commented: "we lose access to the single market and customs union. We also have to negotiate many bilateral trade agreements, taking an unknown time to conclude.

"We may lose the interest of big businesses in investing in our country, with London potentially losing its status as a financial hub of the world. This is not helped by Theresa May's poor handling of Brexit negotiations so far. It does not look good for our country at the moment."

There was also genuine concern that Britain would lose its ability to bring in the necessary migrant labour to fulfil the many low-paid and unskilled jobs in sectors such as agriculture. It was also felt that it would negatively impact on Britain's ability to attract highly skilled people.

Those believing a hard Brexit would have a positive effect on the economy generally felt, as might be expected, that we would have greater control over our economy through the freedom to negotiate trade deals with other major countries.

Freedom was a constant theme among respondents, whether it was the ability to establish our own trading partners, create our own rules and be free of perceived restrictive practices imposed by the EU.

Many thought a hard Brexit would be good for jobs and create greater opportunities for business.

As one respondent commented: "A hard Brexit will remove red-tape and allow the UK to negotiate trade deals without having them first agreed by 27 other nations. By leaving the EU there will be money saved through not paying a EU contribution and investing it in the UK.

"The EU is a failing, undemocratic and corrupt behemoth and it can only benefit the economy if we remove ourselves from it."

Saving money was a prominent thread in people's views on the positive impact of a hard Brexit. Some respondents regarded EU payments as little more than welfare support for poorer member states.

Interestingly, almost 6 out of 10 respondents (58%) stated they had a good understanding of what the term "hard Brexit" with less than one in three (27%) saying they had a bad understanding of the term.

Perhaps not unsurprisingly understanding was high among UKIP voters (73%) and men generally (70%). It was lowest among women (47%) and 18-24 year olds (48%). Among the older age group category (65+) almost two-thirds claimed a good understanding of what a hard Brexit meant.

People were also fairly dismissive of President Trump's policies with 56% declaring that they were wrong for the US with only one in five (20%) believing they were good for the country. Interestingly 80% of those who voted Remain thought they were wrong for the US as opposed to only 33% of "Brexiteers" and 76% among 18-24 year olds.

When asked whether people thought Trump's policies would be right or wrong to implement in the UK nearly two-thirds (63%) thought they would be wrong although it was even higher among "Remainers" (86%), Labour voters (79%) and 80% among 18-24 year olds.

David Saul, Managing Director of BE Offices, commented: "This survey demonstrates that perception of the EU among Britons is that it has probably reached a tipping point and a successful election campaign by the right-wing in France could topple it over the edge, or at best could force sweeping changes in its structure and powers.

"The survey, I believe, also highlights the fears held by many in the UK that a hard Brexit will have a seriously damaging impact on our economy with rising costs, higher inflation and job losses and that it may take much longer to negotiate trade deals with other countries than we think.

"On the other hand, those believing a hard Brexit will have a positive impact on our economy point to a reduction in red tape, the ending of EU payments and regaining our sovereignty as being the key issues going forward.

"However I am not sure the Government appreciates the depth of feeling in the country for the impact of a hard Brexit and all that it entails."

(Source: BE Offices)

The House of Lords Constitution Committee recently proposed new measures to safeguard the rights of Parliament as the process of Brexit gets underway. The report argues that Parliament should make sure the Government does not use delegated powers in the forthcoming ‘Great Repeal Bill’ as a way of changing the law in areas currently governed by the EU, without proper parliamentary scrutiny.

The Committee, which rarely considers Government Bills before they are published, considers the issues likely to be raised by the Bill to be exceptional, for which exceptional scrutiny measures will be required.

The Committee considers that, given the deadlines imposed by the timing of the UK’s exit from the EU, the Bill is likely to include wide-ranging delegated powers. These will permit the Government to make a broad range of changes via secondary legislation to the body of EU law in preparation for its conversion into UK law. These powers will be required both because of the sheer number of changes required and the uncertainty as to what exactly the process of converting EU law into UK law will eventually entail. The Government will also need to be able to amend that law at short notice to take account of the outcome of Brexit negotiations.

The Committee draws a distinction between, firstly, the conversion of EU law into UK law, a process which will be facilitated by the ‘Great Repeal Bill’, and, secondly, a subsequent discretionary process in which the Government and Parliament choose which bits of EU law to keep and which to replace or modify. The ‘Great Repeal Bill’ should not be used as a shortcut by the Government to pick and choose which provisions of EU law it wishes to keep and which to lose. If the Government wants to change the law in areas which currently fall under the authority of EU as, just to give one example, it has said it intends to do on immigration, it should do so via primary legislation which is subject to full Parliamentary scrutiny.

The Committee argues that Parliament should seek to limit the scope of the delegated powers contained in the Bill, and develop several new processes within Parliament to ensure that the Government is using the delegated powers it acquires under the Bill appropriately.

Firstly, the report states that Parliament should limit the scope of delegated powers in the ‘Great Repeal Bill’ so that they can be used only:

Secondly, the Committee recommends that enhanced scrutiny processes should be created for secondary legislation laid under the ‘Great Repeal Bill’. These include, among others, a requirement that a Minister sign a declaration in respect of each statutory instrument affirming that it does no more than necessary to translate EU law into UK law. In addition, the Explanatory Memorandum accompanying each instrument should explain what the EU law in question currently does, the effect of any amendment and why such amendment is necessary. This will allow Parliament to have a proper say on this important legislation, rather than simply being limited to approving or rejecting it as is now the case.

The report also considers the impact of repatriating EU laws in the devolved administrations. The UK Government should consider carefully and make clear the role it sees for the Scottish, Welsh and Northern Irish Governments in preparing to incorporate EU law in areas that will, following Brexit, fall within their authority.

Commenting Lord Lang, Chairman of the House of Lords Constitution Committee, said:

"The ‘Great Repeal Bill’ is likely to be an extremely complicated piece of legislation. It will bring into UK law legislation that is not currently on our statute book but that is directly applicable to the UK. It will also provide for the amendment of literally thousands of pieces of EU law that will need to be adapted to make sense in a post-Brexit UK. No one should underestimate the challenge of that process.

"The intention should be to convert the existing body of EU law into UK law with as few changes as possible. The Government may need to be granted wide-ranging powers to accomplish that task. Those powers should not, however, be used to pick and choose which elements of EU law to keep or replace—that should be done only through primary legislation that is subject to proper Parliamentary scrutiny.

"Scrutiny must not be side-lined. There must be: a clear limit on what the delegated powers in the Bill can be used to achieve; a requirement for Ministers to provide Parliament with certain information when using those powers; and enhanced Parliamentary scrutiny of the exercise of those powers. Use may need to be made of sunset clauses to ensure that after Brexit the laws brought over from the EU are reviewed and, if necessary, amended without undue delay rather than being left to drift into permanence.

"We feel that, taken together, these measures should ensure that the cry of the Brexit campaign in the referendum, that the UK Parliament should ‘take back control’, isn’t lost before the UK has even left the EU."

(Source: House of Lords)

Chancellor Philip Hammond delivered his 2017 spring budget this afternoon, claiming it will be providing a ‘strong, stable platform for Brexit’. Among his proposed plans are: increasing national insurance for the self-employed, rising personal tax-free allowance, rates for businesses losing existing relief will be capped at £50 a month, and having an extra £2 billion for adult social care.

He spoke on how debt rose this year but will aim to fall in 2021-22, how the UK is the second-fastest growing economy in the G7 in 2016 and how a further 650,000 people are expected to be employed by 2021.

With a variety of sectors being affected by the budget, Lawyer Monthly reports on the effect it will have on certain sectors by hearing from a range of experts on the matter.

The Chancellor talked of a “strong, stable platform for Brexit” and it is Brexit that continues to dominates the indirect tax landscape. That said, today’s Budget speech contained mention of several changes to the VAT rules, the most notable being an ‘easy-win’ of collecting VAT on mobile phone roaming by UK residents outside of the EU. Changes to the penalty regime should allow HMRC to continue to reduce the tax gap so are welcomed with ‘cautious optimism’ although the detail will be important in understanding how far these powers extend.

Rob Marchant, VAT Partner at audit, tax and advisory firm Crowe Clark Whitehill, commented on this:

“The Chancellor talked of a “strong, stable platform for Brexit” and it is Brexit that continues to dominates the indirect tax landscape. That said, today’s Budget speech contained mention of several interesting changes to the VAT rules:

Finally, the Budget Notes highlight two further areas where consultation over future VAT rule changes will take place:

Richard Flax, the Chief Investment Officer at digital wealth manager Moneyfarm commented on the budget in relation to those trying to maximise their ISA:

“This wasn’t a Budget for savers who are facing rising inflation and record low interest rates. In the absence of real returns on many cash savings products, investments in financial markets are now a more attractive option for savvy Brits.

“The Chancellor’s continued clampdown on tax avoidance in today’s Budget suggests that Brits will be best served by continuing to focus on simple and transparent investment solutions like Stocks and Shares ISAs.

“Particularly given the more than 30% increase to the annual ISA allowance from £15,240 to £20,000, which is coming in to effect in April. Today’s Budget provides a timely reminder for people to maximise their ISA, both before this year’s allowance expires on 5 April and also to get a plan in place for next year.

“The government has now placed the onus on the individual to make the most of allowances available to them.”

SMEs have been concerned over today’s Spring Budget announcement, with many feeling that they would not be a priority for the government.

Many SMEs are facing business rates increases as part of the revaluation announced for April, and although the £300m fund for those hit by rate increases is a step in the right direction, SMEs are continuing to face cashflow balances outside of their control. Aamar Aslam, CEO of Funding Invoice, the invoice trading platform, commented on the changes in business rates, as outlined in the Spring Budget 2017:

“The Chancellor announced today that business rates revaluation will take effect from April 2017 across England, along with a planned discretionary fund of £300m for local authorities to support businesses hard-hit by business rates, which will undoubtedly be welcome news for businesses across the country facing closure as a result of these revaluations.

For SMEs, however, business rates can provide an unwanted burden on cashflow. A number of SMEs are relocating outside of the big cities as a result of rising commercial rents, but they will still face business rate burdens, particularly those with several property outlets. Whilst this £300m fund is a step in the right direction, small businesses are continuing to suffer from cashflow imbalances outside of their control, and require support from Government to resolve these issues and keep the economy afloat.”

Holly Cudbill, Associate Solicitor at Coffin Mew speaks on the impact on the self-employed and gig economy:

“Today’s announcement is good news for the country’s coffers, but not for the tens of thousands of people whose only source of income is in so-called gig economy work where they have no choice other than to accept the self-employed description imposed on them.

“As we know from the recently well-publicised cases, companies like Uber and Deliveroo are happy to fight their drivers and delivery people in the courts to try to maintain the company’s position that those individuals are self-employed.

“In these companies, if the drivers are employees, or workers, they would have a number of additional rights, including paid holiday, the right to the national living wage (which the Chancellor confirmed today will be increasing) and protection for discrimination. Many of the drivers lack the resources, confidence or desire to take on these massive international organisations and so have no choice other than to agree that they are ‘self-employed’. These people tend to be the lowest paid and will see their earnings take a further hit as the national insurance contributions they have to pay are increased.”

Nick Gross, Chairman at Coffin Mew, speaks on the impact on the transport sector:

“While, as budgets go, Phillip Hammond’s 2017 Budget appears fairly tame, there are a number of points of interest for those involved in the transport and logistics sector.

“A freeze on vehicle excise duty for hauliers and HGVs will, I’m sure, be welcomed by many, as will plans for a £220 million transport fund for national roads and a £690 million fund to tackle urban congestion.

“Mr Hammond further announced an additional £270 million for disruptive technologies, such as robotics and driverless vehicles, something that further cements the government’s intention of keeping Britain at the forefront of developing driverless technology.

“Finally, it is also important to note what was not mentioned. Specifically, Mr Hammond made no comment on the expected introduction of a diesel scrappage scheme. Whether this means that the idea has been parked, or not, we will have to wait and see.”

As technology, software and creative medias take the world by storm, intellectual property remains at the centre of many ever-evolving spheres, developing therein and increasingly affected by change. Below Lawyer Monthly gains expert insight from Mark O’Halloran, Partner at Coffin Mew, on the IP developments to look out for this year, which will undoubtedly take IP progress to the next level.

It’s easy to imagine, with all the political noise and uncertainty since the start of the year, that world affairs and global business are in a state of suspense, wondering about the next steps. The truth, of course, is that major developments already in play continue to unfold and, for the most part, are unlikely to be disrupted. This is certainly the case in the sphere of intellectual property which underlies so much of the modern economy.

Two big cases which continue their stately progress through the legal system on both sides of the Atlantic may well come to a conclusion in 2017 and establish new parameters for the design-savvy and content-hungry consumer sectors.

Apple’s long-running complaint that Samsung infringed its design patent for the iPhone originally went Apple’s way with a jury award of $399 million in damages. However, Samsung appealed to the US Supreme Court on the basis that, even if it had infringed the outer design, it should only pay damages on the profit value of the infringing component, not the entire device. The Supreme Court has agreed this is arguable and instructed the initial Federal Court to have a re-think. The final decision will be significant. If the initial jury award is confirmed, we may see device manufacturers more cautious in following design trends set by market leaders.

A good-looking device is one thing, but consumers also continue to want ready access to content without having to pay for it. Peer-2-Peer website, The Pirate Bay, has been the flagship for years in providing a platform through which users can share content, whether it’s their own or someone else’s. It has even inspired the Pirate Party which took Iceland’s election by storm late last year and was asked to form a government. But the tide has been relentless against The Pirate Bay itself with multiple shutdowns and even criminal convictions. The hole below the waterline may have been struck in early February this year in Stichting Brein v Ziggo BV and another before the CJEU.

An initial opinion by the Advocate-General determined that, once Pirate Bay were aware that users were sharing infringing material, the continued provision of the platform constituted a “communication to the public” for the purposes of copyright law, entitling the complaining rights holders to obtain injunctions against the platform itself. The final decision will be taken by the Court of Justice although, as usual, it is expected to follow the Advocate-General’s line.

Design and copyright protection isn’t just a concern in Europe and North America. Economies from Asia to Africa are also taking huge strides to develop the legal infrastructure necessary to encourage investment in home-grown IP and discourage abuse of overseas IP.

In January this year, Beijing launched the China Internet Enterprises IPR Protection Strategic Alliance with a mission statement reading “Communication and Promotion, Utilization and Protection, Innovation and Development.” The primary aim of the Alliance is to implement the government’s National IPR Strategy by helping develop laws to protect intellectual property whilst educating businesses about the importance of respecting other companies’ IPR. This will be welcome to many UK businesses which currently outsource manufacturing to China and encouraging to those businesses looking to do so.

Emerging economies continue to gear up to compete better in an IP-driven global market. The African Regional Intellectual Property Office (ARICO) will gain three new members this year (Mozambique, Zambia and Gambia) and has also joined forces with the International Confederation of Societies of Authors and Composers (ICSAC), to launch joint projects to bolster copyright protection, education and training to ensure rights holders benefit from growing demand for their content. The Brazilian National Institute of Industrial Property meanwhile expects to start reaping the benefit of recent investment in staff and procedures with a greatly accelerated process for innovators to obtain trademark and patent protection.

So, with all this activity, what’s going on with the UK and what are the implications of Brexit?

First thing to note is that the UK has announced it will ratify the Unified Patent Court Agreement following Italy’s ratification this month and possibly before German ratification later in the year. There have been rumours that Germany would refuse to ratify as a bargaining chip in the Brexit negotiation but these have been downplayed.

The government’s recent White Paper - 'The UK’s exit from and new partnership with the European Union' - gave few clues as to the direction of IP law after Brexit although indications late last year from Baroness Neville-Rolfe (then UK IP Minister) were that the UK would seek to remain a member of the system after Brexit. It may be that the government thinks the subject is too dry and technical to be of much immediate interest to the general public so there was no need to go into detail.

Many businesses will hope this is the case and, indeed, that the UK will negotiate continued participation in the EU Intellectual Property Office to protect UK participation in the system which enables EU Trade Mark and Community Registered Design systems. Some others, particularly in the biotech sector, may be less eager.

Late last year, the PM Theresa May announced an additional £2bn of government funding each year for biotech research and development and it has certainly been the aim of successive governments to make the UK a global centre for the industry. But a recent decision by the current European Patent Court that animals and plants obtained from bio-engineering cannot themselves be patented may give our Brexit negotiators pause for thought. In such a contentious and cutting-edge area, the UK may find its best bet is to go it alone. Whether that is cherry-picking too far remains to be seen.

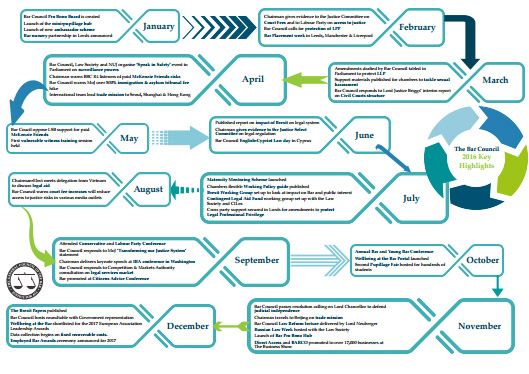

2016 has been a challenging year for the legal sector, with increasing court fees threatening the access to justice, and the Brexit vote introducing uncertainty. However, the Bar Council continued to campaign assiduously on behalf of the Bar, and to support the profession in delivering specialist advice and advocacy.

From establishing a Brexit Working Group, which lobbies on behalf of the profession for the free movement of lawyers, to campaigning for the independence of judiciary, or launching Wellbeing at the Bar, a website dedicated to supporting the profession on wellbeing and mental issues, the Bar Council was able to represent the Bar efficiently. You can see below our timeline for 2016, with some key examples of this work.

Click below to see the full highlights infographic.source: http://www.barcouncil.org.uk

There’s no need to make a tedious link between how Brexit is a divorce itself, between the UK and the EU. The fact of the matter is that when the UK does leave the EU it will have many legal implications.

Divorce is one of the most common reasons many people in the UK seek legal help, so any ways that Brexit may affect this procedure needs to be known and understood by those seeking a divorce in the future. These are a few ways it could have an impact once Article 50 has been triggered.

Legal Changes

Once Brexit has been finalised, the UK will no longer have to abide by or incorporate any EU laws into its legal system. This was one of the main reasons a lot of people wished to leave, believing the EU had too many rules and regulations that were made abroad and cost the economy millions every week to enforce, wishing the UK to take full control over its legal system.

However, Parliament will still be able to decide if it wants to keep any of the existing laws or get rid of them. There isn’t one specific divorce law, instead many different ones make up this area. So, depending on which EU laws are kept and abolished, divorce could be affected in any number of ways.

Human Rights

A big cause for concern for a lot of people is how rescinding EU membership will affect human rights legislation. There are a number of protections in place under EU law which have been included in UK domestic law around human rights, which can be involved in many aspects of divorce.

The UK also has obligations under the European Convention on Human Rights (ECHR), which will remain as this agreement does not originate from the EU. However, Prime Minister Theresa May has made it clear that she also wishes the UK to leave this as well. Instead the rights it decrees would be transferred into British law and applied by the Supreme Court. It would change divorce proceedings in certain cases, depending on the specifics.

Family Law

Family law is the most important legislation that presides over divorce. Brexit is expected to have a big effect on this, especially as the UK has many families where at least one parent is from a different EU nation. Issues such as the enforcement of maintenance, financial orders and more may change.

This could become particularly complicated when trying to put into practice enforcement arrangements from one EU country to the UK, once Brexit has gone through. Family law is linked to human rights and many other legal areas, so the bigger picture will need to be examined when leaving the EU.

Assets in Europe

At the moment, British expats can choose to divorce using the English courts. When the UK has left the EU though, this may no longer be the case, especially if things such as access to the single market are rescinded. Most other countries have a requirement that one half of the couple must be habitually resident in that country.

This could become the case for the UK in the near future. While it also remains unclear how it will work for couples who own property abroad in other EU countries when it gets down to sorting out financial arrangements.

The UK is currently viewed as the divorce capital of the world, thanks mostly to its relatively generous divorce laws. Therefore, it seems likely that the government will do all it can to keep this status by keeping existing rules and legislation as close as they can to what they currently are.

Around 83% of conveyancers predict Brexit will significantly affect the UK property market in 2017. They place Brexit as one of the top three factors to have a significant influence on the UK property market in 2017, with almost half (48%) putting it first, according to new research released from Groundsure. Changes to Stamp Duty Land Tax ranked second on the list, followed by a shortage of housing stock.

Other significant factors predicted to influence property buying in 2017 include the election of Donald Trump, increasing consumer demand for digital solutions, continued uncertainty around the HS2 rail route and VAT introduction on CON29 searches.

Anecdotally, respondents spoke of “a possible rise in interest rates” and “cyclical economic uncertainty” as further additional issues that are likely to have an impact in the year ahead.

Dan Montagnani, Managing Director at Groundsure said: “The past year has been one of political and economic turbulence, with the UK witnessing some major changes, many of which will have a potential impact on the conveyancing trade. Whilst Brexit appears to have had a negative impact on house prices, particularly in London, monthly statistics do not appear to support the theory that this has adversely impacted transaction volumes. However, transaction volumes have been consistently below expectations since April 2016 and I believe this is due to Stamp Duty Land Tax changes that came into effect at that time.

“Adjustments in the value of the pound and weaker London property prices, of course, make property more attractive to overseas investors and this may be a contributory factor for the lack of evidence in overall transaction volume decrease since Brexit,” added Montagnani.

(Source: Groundsure)

Bridging the gaps between the oceans, globalisation has arguably been the pinnacle of global development and has enabled the human race to rapidly advance and work together to achieve what once was deemed impossible. The vital component of achieving such advancement came from the age-old practice of trade. International trade has allowed the globe to shrink and unite, however, with Brexit and the new US presidency, we are expected to witness change in the scope of international trade.

This month, we speak with Lesley Batchelor OBE, the Director General of the Institute of Export & International Trade. She sheds light on what to expect in the trading world and how businesses can stay on top of all these changes.

What are your predictions for British exports post-Brexit – how do you see the UK changing globally in regards to being internationally competitive?

During the run up to the referendum the Institute of Export & International Trade found itself being ignored and, indeed, issues around trade were often shouted down in favour of less tangible, often emotive, issues. The UK has always been able to trade internationally. Nothing has been stopping us from trading with the rest of the world and the EU was an enabling force - not a restricting one. That being said, any predictions for the UK since deciding to leave the EU would simply be like quicksand and it is clear that much change is required. Interestingly, there are larger arguments now being raised around globalisation and the success or failure of world trade.

Although the UK has a long tradition of trading internationally, much of it has been lost in the ease of the trading with the EU. To succeed we will need to re-learn how to trade and ensure our businesses are not thinking in silos but in terms of a holistic approach to the skills needed. They should be sending out sales people who know how to negotiate on price and know the cost of collecting money or selling in the local currency - people who understand the culture of the local business environment and market according to their needs. Sales need to reflect the complexity of logistics and possible compliance issues in terms of both standards or technical certification, along with compliance with paperwork needed to claim preferential duties or simply enter another country. Finally, as you all will know, they should understand when they have a contract or not. All these potential costs make up an international trade deal.

What should new and upcoming businesses take into consideration when regarding exporting?

Any business should look at exporting as a natural progression of searching for new markets. That being said, there are quite a few steps to getting it right and these should be followed to ensure a first venture into world trade doesn’t finish in disaster. Like all journeys, there are a few routes to get to the destination and each business needs to look at what suits them and where the destination should be. Ask questions until you are happy that you understand the best route for the business. The Department for International Trade has advisers across the country to help. Also, look at www.opentoexport.com – which highlights useful considerations on what can be a treacherous journey.

You believe that transactions should be dealt with by a qualified international trade specialist; what do you think businesses should be looking for if they needed guidance/ support with trade?

The Institute must declare a vested interest here as we have a full programme of qualifications in international trade from a basic young international trader at level 1, to an MSc at Warwick University. This is all delivered using a digital platform and expert tutorial support which allows those studying, a flexible approach and time to work at their, and their employers’, convenience. International trade unfortunately doesn’t only happen during college opening time! It is a strange thought that if we want our books to go to HMRC we go to a qualified accountant. We wouldn’t dream of going to court without a qualified lawyer - however, we feel it is perfectly acceptable for millions of pounds of goods to travel the world without a hint of a qualified or skilled person in charge! The Institute is committed to bringing professionalism to the industry and ensuring that businesses are not operating on a ‘we’ve always done it like this’ basis but adopt a fully informed and current approach to global trade. Companies should be looking for staff that understand world trade and show commitment to staying ahead in a constantly changing environment. This is what the Institute specialises in.

What are the key things businesses should look out for in regards to international trade? And how do you think this will change post-Brexit?

One of the key elements that has been missed in this Brexit debate is that for over 40 years it has been very easy to trade with our neighbours. This ease has led to a relaxed attitude to world trade and even a complacency that led to our EU exit. Leaving the EU will mean that all businesses moving any goods or services will automatically become an exporter. Being an exporter requires good record keeping, more specific accounts of your goods’ final destination, what they were used for in some cases of dual use export controls - and taking vicarious responsibility for the action of your agents or third parties in markets around the world. This is the case for all external markets outside the EU and now will be the case for all exports.

How do you think businesses should prepare for these changes?

Learn how to export properly. It will save time and energy in the long run and prepare you for all aspects of exporting. Looking for short cuts is simply counterproductive - get it right first time and visit www.export.org.uk/qualifications or undertake short one day courses at www.export.org.uk/training.

Einstein tells us to ‘first learn the rules of the game; then go out and play it better than everyone else.’

With the result of the US presidential election alongside Brexit, how do you think trade will alter internationally and how do you think it will affect the UK?

The rhetoric of the Candidate Trump was certainly very isolationist and his first act appears to be to halt the negotiations on Trans Pacific Partnership (TPP) which would have created a trading union in the southern hemisphere between the USA and many pacific markets - easing trade between them all. This is part of his America First strategy that won a lot of popular support. The USA is our next biggest trade partner after the EU and the largest if we consider exports on a country by country basis, Germany being the next.

The Transatlantic Trade & Investment Partnership has been floundering for some time and it was more ambitious in scope for the EU and USA to form a trading union that would represent more than 43% world GDP and create a shift in power away from the Asian markets. The new president has a lot of ideas on how to build America into a greater country and we all need to be watching the White House for news in the coming months. The ‘special’ relationship has never carried boundaries or clarity on what it covers so we may see a new relationship grow that includes trade - but not as we know it today. This goes back to the many countries who have benefited from globalisation beginning to question it’s its validity in harder times. Facing the fact that we are all operating in a globally flat world economy may be hard, but it is the truth. We want to empower emerging countries to feed themselves and support themselves however, without external trade, this will become increasingly difficult.

As we reduce one economic factor another increases and the balance of world trade will turn into aid support for the Organisation for Economic Co-operation and Development (OECD) least economically developed countries. This will affect the UK one way or another and so the only certainty is that we are not in complete control of our own destiny.

Are there any specific regulations you think businesses should keep an eye on, if they are subject to change?

The world of trade is constantly changing and the specifics of regulation have been outlined a little in this article. The only specific regulation is the regime reflected in ‘rules of origin’ – the basis for all tariffs’ agreements. These change slightly depending on the agreement and lead us neatly to the issue of record keeping and compliance. If a business is importing raw materials from countries worldwide, this will have an impact on the country of origin declared by the manufacturer. This becomes a complicated calculation for a car manufacturer but simpler for most others.

What policies and regulations do you hope will change; or, if you could alter regulations, what would you change?

World trade has been operating for many centuries; Queen Elizabeth I was responsible for many laws that still make the cogs of industry and shipping turn smoothly today. Some regulations appear difficult, but to change one in isolation would be hard - like taking one stitch from a knitted sweater which would unravel the pattern. The introduction of customs schemes and regulations in many cases increases security for the trader and customer - however, it is very heavily reliant on paperwork. The World Trade Organisation (WTO) is looking at Trade Facilitation to reduce the onerous levels of paperwork but is forced to move at the rate of the slowest member states in terms of electronic data interchange and border controls at crossings. Even in the UK people cannot rely on their internet connection, so imagine how difficult it is in some of the emerging markets.

Which regulation do you think will become most imposing and problematic for businesses exporting internationally?

The recurring theme of record keeping and understanding which records are needed for compliance and taxation issues. Most imposing will be HMRC - both in terms of VAT and customs duties that will be collected - and any tax exemptions only against evidence of shipment out of the country. This will require businesses to examine current records more closely and what may need to change in order to stay on top of the needs of the HMRC. Starting a dialogue with HMRC about any new activity is a wise move and will enable your business to get it right and trade with confidence in any new market.

What factors do businesses undermine/dismiss when regarding trade?

New or inexperienced exporters tend to try and operate in a similar way to their UK operations and this includes setting the price. Using a simple cost plus basis to create an export price demonstrates a naivety around the actual costs that may be incurred and can be potentially damaging in making or losing money and also in terms of reputation in the market. Setting a price is hard but putting up a price is harder still, often involving clever positioning in the market, new collateral and finessed PR activity – all of which costs money and effort that should have been used to set the right price before launching.

Can you offer any other advice for UK businesses trying to trade abroad and for businesses wanting to trade with the UK?

There is a wealth of information out there and help in many areas. The new State Department for International Trade has a team of International Trade Advisers who are all members of the Institute of Export & International Trade and follow our CPD programme to ensure they are up to date and current with all the changes, or as many as humanly possible.

The Institute offers a business membership which has a helpline support that proves invaluable time after time to businesses needing the basics at a very competitive price and also runs Brexit Workshops to help companies understand the implications for their own businesses. Many businesses will be aware of their local chamber of commerce and some forget there is a proliferation of bi-lateral chambers based in the UK to help with specific markets.

There is a huge amount of help for anyone embarking on this journey. Getting exports right is not a fluke. Having a stab at exporting will not always produce results but treating it as a part of your long term strategy and finding skilled people to help will make the journey enjoyable and profitable, possibly leaving time for you to play golf or take an afternoon off?

Is there anything else you would like to add?

The Institute recognises that not everyone is selling a physical product and that a huge percentage of trade is in skills and services. Services represent over 70% of trade and need to be encouraged not halted. The need to recognise movement of people as part of those sales will play a key role in how we all develop our businesses over the coming years. In recognition of the challenges of selling skills or IP overseas, we have developed a diploma in Selling Services, Skills and Software Overseas.