Understand Your Rights. Solve Your Legal Problems

Following the referendum, Brexit is about to become a reality. Myriad negotiations will ensue to determine how a future trade between Britain and the European Union might work once the Lisbon treaty is invoked. In parallel, there is another trade deal under review that has renewed importance for a newly independent Britain: The Transatlantic Trade and Investment Partnership, better known as TTIP.

Talks between the EU and US began on the proposed transatlantic trade deal in June 2013, resulting in a prolonged series of (mostly private) negotiations to finalise terms. Now that Britain is set leave the EU, the dynamics have changed completely.

As originally conceived, TTIP aims to cut tariffs in transatlantic trade and to harmonise regulation between the US and the EU in sectors such as energy, pharmaceuticals and textiles. Arguably, the mutual benefits are significant with strong evidence that it would boost economies on both sides of the Atlantic.

According to independent studies, the deal would add up to £75bn to the US economy while the annual benefit for the UK would mean an extra £10bn going into the domestic economy – equivalent to £400 per family.

Despite multiple negotiations, strong political opposition has caused repeated delays in reaching an agreement. Significantly, the British government has been one of the deal’s strongest supporters, and in recent weeks, David Cameron and Barak Obama have both restated their ambition for TTIP to be realised by the end of the year. Now that we will no longer be part of the EU, Britain will have to renegotiate with the US on its own TTIP terms.

But is TTIP completely dead from a UK perspective? Certainly some fear that if implemented it will weaken consumer protection. Political opposition to TTIP has some unlikely bedfellows. Jeremy Corbyn, for example, has promised to scrap it - a position also adopted by the SNP, a number of Tory Eurosceptic MPs, and even Donald Trump.

Beyond the perception that various elements of the NHS may be privatised, there is further concern over the ability of companies to use Investor-state dispute settlements (ISDS) via a supranational court as a means of settling international trade disputes and potentially, to sue governments. Some argue that this is an indirect means by which TTIP might undermine national sovereignty while giving US multinationals the right to sue the UK government.

Much of the discussion has failed to acknowledge that TTIP is as much about UK investment in the US as the other way round. Few would disagree however, that trade barriers and tariffs have a negative impact on the volume and value of cross-border trade.

TTIP’s removal of trade barriers will dramatically open up the US market for British companies, in turn increasing demand for their products. Last month, the government announced that the NHS will be excluded from the TTIP talks. Other concerns are not insuperable. Examination of the American experience over the last 30 years suggests that ISDS judgments are fair, and not anti-democratic, as some suggest.

The key issue in international trade is fair competition. TTIP will undoubtedly help a newly independent UK to compete more effectively with the US, which means more trade. However, trade agreements are complex. Although the UK could negotiate with the EU to remain a party to TTIP, politically, it is hard to envisage the Brexiteers, and whoever replaces David Cameron as Prime Minister, nailing their masts to TTIP because they will inevitably want to emphasise our separation from the EU. We are therefore likely to see the birth of the progeny of TTIP and a British Transatlantic Trade & Investment Partnership (BTIP).

But even before this, the government will almost certainly have to prioritize its efforts on re-defining our new trading relationship with the EU first of all. This could take several years. So while the TTIP or BTIP opportunity is there, we will have to wait and see what timetable emerges for initial trade discussions with the EU in the coming weeks. However, before we can enter into any serious discussions with the US about a trade deal we have to wait for the US Presidential elections in November, and a new president taking office in January 2017. Therefore, any detailed discussions are not likely to commence before the middle of next year at the earliest.

Written by Anthony Robinson & Peter Rawlinson, Solicitors at Excello Law.

(Source: Excello Law)

Simon Hunt, UK head of banking and capital markets at PwC, commented:

"The UK is one of the world’s leading financial centres. The banking sector plays a major part in generating exports of £23bn to the EU, which helps to drive an overall trade surplus in financial services of £20bn. Retaining this position is the challenge that banks and all stakeholders may now have to consider.

“One of the most significant benefits of EU membership to the banking sector is the ability to access the Single Market via the passporting regime and the loss of passporting benefits would have an impact on the ability of banks authorised in the UK to offer products and services for EU clients.

"This impact will not be limited to the UK headquartered banks but will also impact non-EU headquartered banks who have used the UK as a base for their European operations.

"Overseas banks currently using the UK as a base for accessing the EU market and employing an estimated 115000 staff are likely to be looking closely at their operations in the UK in the context of the leave vote.

"The result of the vote does not represent the end of the debate that has impacted markets in recent months. Months, and possibly years, of negotiation will now follow before banking organisations will have clarity on what access UK-based FS organisations will have to EU countries or the rules they must comply with to secure this access.

"We are already starting to see the short-term impact on the market as efforts are made to reinforce confidence in the UK banking sector. However, history has taught us that UK business is adaptable and the banking sector is one of our strongest industries and will continue to make a major contribution to the UK economy. Collectively, the financial services sector accounts for 8% of total UK economic activity and directly employs 1.1 million people - around 3.6% of the total UK workforce, generating income, investment and exports.

“This result could be taken as a major opportunity for banks to work with regulators, investors and clients in order to shape a new rulebook fit for the new climate."

Steve Davies, EMEA fintech leader at PwC, commented:

"London is emerging as the fintech capital of the world. This is in part because of the UK's relationship with the EU which looks set to change fundamentally.

"While the uncertainty is over, it has been replaced with fresh concerns around what happens with regulation, business and investor confidence and access to global talent pools. Quick and decisive actions in these areas would be much welcomed by the fintech community."

(Source: PWC)

The wife of an imprisoned Chinese dissident has called on the international community to urge China to allow her husband to receive life-saving medical treatment.

Writer and 'barefoot lawyer’ Guo Feixiong (Yang Maodong) had been active in a range of pro-democracy and anti-corruption campaigns and had called for the Chinese Government to meet the standards for civil and political rights set by international law. As a result he has been locked up for almost three years, charged with the absurd crimes of ‘gathering a crowd to disturb public order’ and ‘picking quarrels and stirring up trouble’.

In a statement delivered to the UN Human Rights Council today, Yang's wife, Zhang Qing, explained that when her husband fell ill earlier this year he was refused independent medical attention.

'This is a life and death situation. At this time, I believe international awareness and attention can save his life. This case is so bad and representative, but it is only one case. Over the past few years, there have been so many human rights abuses in China,' said Ms Qing.

Like many Chinese human rights defenders in prison, Mr Zang is at particular risk of poor medical care and inhumane or degrading treatment. Initially Mr Zang was told he would only be taken to the hospital if he lost consciousness. When he was eventually seen by a doctor – an employee of the prison – he was subject to a forced rectal exam which was filmed and the guards said they would post the video online.

Sarah M Brooks, the Asia programme manager at the International Service for Human Rights (ISHR) who delivered the statement to the Human Rights Council, said that Ms Zhang's frustrations with the opaque Chinese legal system are common and that increasingly seeking the influence of the international community is a last resort for victims and their families looking for justice in China.

‘Sadly, Guo Feixiong’s experience of being locked up simply because of his work to defend human rights, even where the government has agreed to those respect those rights, is not an isolated one,’ said Ms Brooks.

Ms Brooks said the use of the Council as a forum for raising incidents of human rights violations in China and elsewhere will continue as long as domestic systems fail to provide for transparency, accountability and justice.

‘If China is truly serious about deepening its engagement with the UN, it cannot pick and choose to engage only when it suits it. Its efforts to support development and peace and security, needs to be matched by more tolerance of critical voices and more commitment to open and frank discussions about its own human rights record,' said Ms Brooks.

Mr Yang has been on a hunger strike for over six weeks in protest of his treatment.

You can read the full statement delivered at the 32nd session of the Human Rights Council in Geneva here.

(Source: ISHR)

The General Data Protection Regulation (GDPR) intends to strengthen and unify data protection for individuals within the EU, but how will this affect the eDisclosure industry and what new challenges does it present? James Merritt, Director of Forensic Technology & eDisclosure at CityDocs, discusses.

Regulation (EU) 2016/679 of the European Parliament protects a person by imposing strict conditions on the gathering of personal data, the processing of personal data and the movement of personal data. Persons or organisations that collect and manage personal information must protect it from misuse and must respect certain rights of the data owners, which are guaranteed by EU law.

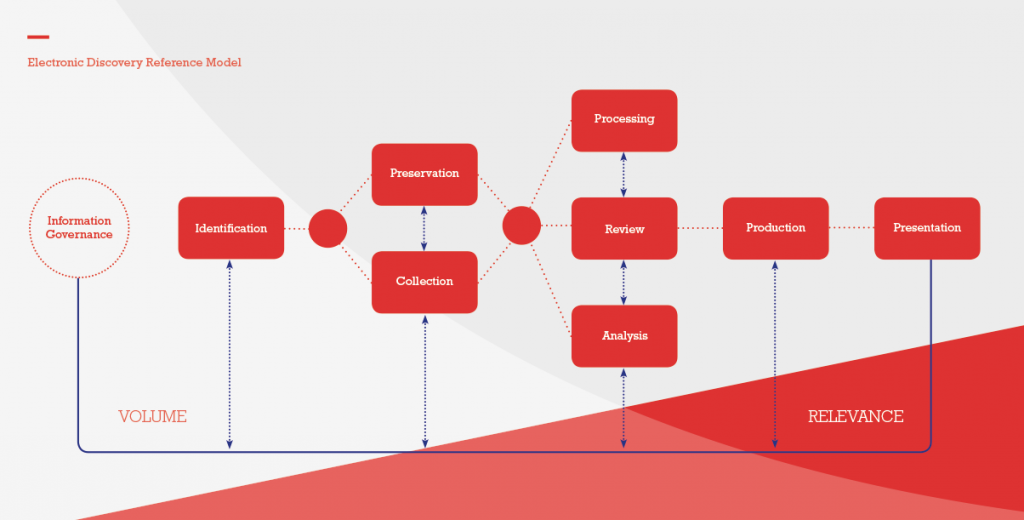

The electronic discovery reference model (EDRM) represents a conceptual view of the eDisclosure process and summarises the various areas of industry practice. The EDRM portrays an iterative mechanism, with one stage repeated numerous times in order to refine results and produce more precise data. It is normal to cycle back to earlier stages, refining the approach as a better understanding of the data emerges, or as the nature of the project changes over time.

Source: EDRM – CityDocs: http://www.citydocs.co.uk/forensic-technology-edisclosure/electronic-disclosure/

As eDisclosure is primarily concerned with the handling of data, the GDPR has a huge impact on the industry. Understanding the impact is one thing, but fulfilling the challenges it creates, is entirely another.

The GDPR was designed to reinforce and strengthen the protection of personal data but in the specific case of eDisclosure, which already has strict guidelines around the collection, management and transmission of data, it has created a new set of challenges.

Although the GDPR is clear enough in law to understand the guidelines and how to follow them, its application into eDisclosure creates situations of misunderstanding and change.

The collection of forensic data, for instance, now must adhere to the additional obligations of the GDPR, such as data minimisation. In addition, the data controller is wholly accountable for the processing of personal data and liable for any damage resulting from a violation of the GDPR rules. Where a controller processes personal data jointly with another controller, they could be jointly and severally liable towards the individual.

Already, the impact of the GDPR on the EDRM is profound. The data collector(s) will have to adhere to more rules and governance, with strict penalties applied to misuse, which will make projects harder to complete and more difficult to manage effectively.

I see the main challenge being an implementation issue. How will organisations adapt to the new regulation quickly and effectively? How will this impact each stage of the EDRM? How will eDisclosure adapt to meet the increasing demands set by regulation and policy?

An eDisclosure vendor will become the joint data controller during the processing of data as there will be consent and a contractual basis for the firm having the data, however all the data in their possession should have been collected for a specified, explicit and legitimate purpose, in this case it would be for a eDisclosure investigation.

The collections will become more targeted and the previous mind-set of sweeping everything up to make sure that nothing has been missed will become a thing of the past. It will mean that, together with the Law Firm, the eDisclosure vendor must make the right decisions during the identification stage to make sure that appropriate date ranges and keyword culling is applied to gather only pertinent information relevant to the case, to limit the processing and therefore data minimisation.

Operational compliance may become a real issue. It will be undoubtedly harder to manage, while specific future cases and situations might create grey areas for misunderstanding.

Every eDisclosure/eDiscovery firm will need to hire or have a role of a Data Protection Officer (DPO). The role of this person is similar to that of a Compliance Officer, but differ in that they are also expected to be proficient at managing IT processes, data security (including dealing with cyber-attacks) and other critical business continuity issues around the holding and processing of personal and sensitive data.

The appointment of a DPO will be a challenge, as well as for the individual concerned, due to the myriad of governance that will need to be addressed and given the nature of the role. The skill set required from the DPO also spans far beyond just understanding legal compliance with data protection laws and regulations. In addition, the post holder will need to implement their own support team and will be responsible for their own professional development, as they need to be independent of the company that employs them - effectively as an independent regulator.

There is only a 2 year period to become compliant, before the GDPR comes into effect. This will fly by, so eDisclosure companies who are not ready in time will be in breach of the new regulation and therefore, could face stiff financial penalties.

(Source: Written by James Merritt, Director of Forensic Technology & eDisclosure at CityDocs)

Senior in-house lawyers have seen their pay rise by £8,130 this year, according to the latest research from specialist legal and compliance recruiter Laurence Simons. According to the research, lawyers’ average total earnings (basic salary and bonus) now stand at £165,190 – which is £8,130 (5%) higher than 2015’s typical package (£157,060).

This has been driven by a significant increase in basic salaries for senior in-house lawyers over the last 12 months – rather than bonuses. Between 2015 and 2016, basic salaries increased by 12% from £112,920 to £126,100, which in cash terms amounts to £13,180.

Bonuses, meanwhile, have shrunk. In 2015, the typical senior in-house lawyer commanded a bonus that stood at 39% of basic salary – or £44,130. This year the average senior in-house solicitor reported receiving a bonus of 31% basic salary, or £39,090. Despite this, the size of the average bonus remains significantly higher than the £31,500 reported in 2014. With 72% of senior in-house lawyers set to receive a bonus in 2016, this means they are going to share a massive £570 million bonus pot[1]. This is 9% down from the £623 million bonus pot they took home last year, when 70% of senior in-house lawyers received a bonus.

Salaries for senior-in house lawyers are significantly larger than those taken home by accountants. The £165,190 taken home by senior in-house lawyers is more than double the average UK accountants’ total earnings of £78,010[2]. This is also nearly six times the size of the average £27,600 salary[3].

Clare Butler, Global Managing Director at Laurence Simons, comments: “High spending on the salaries of top in-house lawyers is not merely corporates splashing the cash, but represents a structural shift in their approach to the provision of legal services. While legal is mission critical, most corporates don’t have huge budgets to spend on elite firms. The result of this is a greater focus on building stronger and broader in-house teams, which means recruiting lawyers from private practice at a premium.

“As a result of this competition, salaries for senior in-house lawyers are increasing. While a big salary for an experienced lawyer is a significant outlay, it is an important investment that can save a company huge amounts of money in fees and costs.

“The paradigm shift in the provision of legal services has had a knock on effect for in-house lawyers, and we are seeing pronounced demand for a more predictable and stable income that isn’t tied to the performance of their employer. With demand in their favour, they’re in a strong position to not only dictate how much they are paid, but also the structure of their remuneration.”

While senior-in house lawyers are well-paid, the research reveals that money is not necessarily their primary motivation in the workplace. According to Laurence Simon’s research, the top reason reported by lawyers for leaving their previous job was for better career development prospects, with 29% departing for this reason. 22% report leaving their previous job for one with a better salary, and 11% moved on for better bonus prospects. A further 15% moved on for both a better work-life balance and a better cultural fit.

Lawyers still look to improve their earnings when changing jobs, however. According to the research, senior in-house lawyers would reportedly look for a premium of £22,700 when moving jobs – which equals 18% of their basic salary. This premium has remained broadly flat since the end of the recession.

The number of lawyers who would consider moving jobs is also increasing, with 76% of lawyers either potentially or definitely open to a move – up from 72% last year. Of these, 28% reported they would actively be looking for a job, while another 48% would be willing to move if the right opportunity presented itself.

Clare Butler continued: “While an improved package is instrumental to lawyers when it comes to moving jobs, career development remains their priority. HR teams looking to retain their best talent this year should be aware that impressive salaries alone will not allow keep hold of their high performers in an increasingly competitive market; even the most senior of lawyers want to feel like they are growing in a role.

“There is clearly an appetite among senior in-house lawyers for a move this year too, with fewer willing to rule out a move compared to a year ago.”

[1] Total bonus pot based on figures from the Law Society on number of solicitors working for commercial organisations , published April 2016

[2] Marks Sattin Salary Survey 2016.

[3] ONS annual survey of hours and earnings, 2015

(Source: Laurence Simons)

Cost of premises is increasing yet firms are still not investing in IT and remote working, highlights MHA Legal Benchmarking Report.

The latest annual legal benchmarking review from MHA, the UK-wide group of accountancy and business advisory firms, points to encouraging signs of growth for a second year, most notably through an upturn in the Property and Construction Sector.

The review, undertaken by MHA’s Professional Practices Group, indicates a much more positive outlook across most firms, helping to ease the considerable financial pressures experienced in recent years.

The MHA Report highlights:

It is concerning to see that the much improved fee income has not translated into increases in net profit. Most firms have had to recruit new staff to cope with their workloads and many have seen their salary costs increase, as well as being faced with the costs of auto enrolment pension schemes and increasing premises costs.

Karen Hain, Head of the Professional Practices sector at MHA explains: “A significant downward pressure on net profits is the high costs of keeping premises. It is clear from our review that firms have not downsized their premises, with the larger practices actually expanding. To make any significant inroads into premises cost savings, firms will need to make substantial changes to their way of working, such as hot desking, home working or paper free working. The lack of change in working procedures is echoed by the lack of real investment in IT spend.”

Indeed, productivity and time management are also key to a profitable business and a number of efficiencies can be gained through the use of technology and improved processes.

Karen went on to say: “As we look ahead, we expect 2016 to continue to see succession planning as a key risk for law firms. Difficult questions need to be considered about future strategy, so that changes can begin to be made. Firms also need to review their funding structures to understand their cash requirements, which usually fall under pressure during periods of growth. They must have plans if additional funding becomes necessary, as traditional banking routes may be restricted.”

(Source: MHA)

The CMA has written an open letter to businesses alerting them that, if suppliers restrict their retailers’ prices, that can break the law.

The Competition and Markets Authority’s (CMA) open letter is accompanied by an at-a-glance guide to the law and follows two recent cases in which businesses were fined a combined total of more than £3 million for engaging in resale price maintenance (RPM).

RPM occurs when a supplier and a retailer agree that the retailer will not resell or advertise the supplier’s products below a specified price. RPM can also be achieved indirectly, for example as a result of restrictions on discounting or where there are threats or financial incentives to sell at a particular price. Merely setting a ‘recommended’ retail price is not, however, against the law, provided that there are no attempts to enforce compliance with the recommended retail price. RPM agreements are usually illegal as they can prevent retailers from being able to offer lower prices to attract customers, or to sell off surplus stock. The CMA has produced a short video to explain what RPM looks like in practice.

This is a particularly important issue as online sales channels develop, with restrictions on discounting for internet sales capable of being illegal RPM.

In the two cases earlier this year, Ultra Finishing Ltd, a supplier of bathroom fittings, and ITW Ltd, a supplier of commercial fridges, were fined for engaging in RPM by restricting retailers’ ability to sell their products online at independently determined prices.

The CMA’s research shows that businesses’ understanding of RPM is low; about one-third of the businesses surveyed incorrectly thought it was legal to set the price at which other businesses can resell their product, with another 37% uncertain on the rules. Only 29% correctly responded that “it is unlawful to set the price at which others can resell your products”.

The open letter gives details of different kinds of RPM that can break the law, including the use of ‘minimum internet advertised price’ policies. It also warns that both suppliers and retailers can be fined for engaging in RPM. The CMA’s letter makes it clear that the internet is an increasingly important channel for competition because it opens up markets, provides customers with more choice and enhances price competition.

Ann Pope, CMA Senior Director, said: “Price competition from online sales is usually intense, given the ease of searching on the internet. RPM, by preventing retailers from offering discounted prices, denies buyers the benefit of the lower prices and increased quality that comes from genuine competition.

“The CMA is strongly focused on enforcing competition law to ensure that digital and online markets are working as they should be, across all sectors, for the benefit of consumers.

“The CMA is issuing this advice so that all businesses know what to look out for when dealing with the supply and retail of products, whether this is online or via traditional ‘bricks and mortar’ stores.”

Michael Weedon, of the British Independent Retailers Association, said: “Imbalances in strength between suppliers and retailers can foster conditions where resale price maintenance can occur. All participants in the supply chain need to understand the law, so we welcome these materials, which will help retailers gain clarity on their rights and obligations around pricing restrictions.”

The consequences for businesses that break competition law can be very serious, including fines of up to 10% of worldwide turnover.

In addition to the new publications, the CMA has produced a series of animated videos explaining the main principles of competition law and how they affect small businesses.

(Source: Gov.UK)

Legal expert and UK200Group Executive Board Member Peter Duff has forecast that, in the case of Britain leaving the European Union, lawyers will be busy as our government and businesses adapt to being outside of the trade bloc.

“As a lawyer, it appears to me that the legal profession will have a boom time in the event of Britain leaving the EU – whether that’s a good thing or a bad thing, I’ll leave you to judge. It’s clear that the new trade deals that are going to be put in place will need to be negotiated. Apparently the UK government has 30 staff in the relevant department and New Zealand has 300 staff in that department, so they’re going to be outsourcing that and lawyers are the natural people to outsource that to.

“We also have the existing contracts that our businesses have with the EU countries, which have been negotiated against a backdrop of European law. If we remove ourselves from the European system of law there’s going to be some sort of conflict and again, lawyers will slot in to resolve that conflict.

“There’s also the questions of if we leave we can no longer appeal to the European Court, then the Supreme Court will be indeed supreme. There will be a rush of cases going to the Supreme Court to overcome what we don’t like about the European Court so there’s going to be quite a lot of business for lawyers.”

Peter Duff, who is a Partner at Glasgow-based Morisons LLP, was speaking as the UK200Group, the UK’s leading membership association of quality-assured independent chartered accountancy and law firms, published a report detailing the top 30 EU Referendum questions asked by SMEs and the respective answers of the official Remain and Leave campaigns.

The UK200Group compiled the questions in order to address a lack of clarity about how remaining or leaving the EU would affect the small business community.

Dr Bellini was joined by a panel of business leaders, including Seven Investment Management’s Justin Urquhart Stewart, Co-Founder and Head of Corporate Development, a renowned market commentator who launched Seven Investment Management with a group of colleagues in 2001.

Justin said, “There is one word that runs any economy - and that is confidence.

“We need confidence so that - consumers buy "stuff", confidence so that companies invest in capacity and innovation and we need confidence so that overseas investors keep buying our debt to finance our deficit.

“Any wobble in confidence will easily unnerve that confidence, and that could frighten consumers, companies and investors into holding back. Such nerves could increase the cost and potentially lose much of the potential financial benefit that many have hoped for.

“Whatever your views, the effect of this vote is fundamental to the successful functioning of the UK economy.

“Our politicians are playing with fire - and whatever the outcome some of them will suffer the consequences. They may be fired with enthusiasm, but we will end up firing many of them - and with even more enthusiasm.

“We at 7IM have a great weight of responsibility to our investing clients, and regard this as possibly the most important issue we have had to address for them.”

(Source: UK200Group)

Ahead of National Kissing Day (24th June), solicitors Doyle Clayton, a leading specialist in workplace law, is warning that kissing in the workplace, even a ‘mwah’ on the cheek of colleagues and favoured suppliers, is a legal and etiquette nightmare – potentially even leading to costly discrimination and harassment rulings.

Darren Clayton, Senior Partner of Doyle Clayton, says: “With today’s politically correct employment law and changing conventions, sadly an innocent kiss on the cheek is a legal minefield for employers when it happens in the workplace between colleagues or clients.

“There are issues around whether someone is consenting to such contact, no matter how innocuous, and especially issues around whether subordinates are consenting or simply going along with it because they feel they have to. This gives the potential for accusations that it is unwanted attention leading to claims of harassment.

“Conversely there is also the potential for people who don’t get such friendly greetings to feel excluded and discriminated against!

“Sadly, the conclusion is that cheek kissing is a minefield, particularly for owners and bosses. I would strongly advise them to scrupulously avoid kissing any employee on the cheek, no matter how pleased you are with them and how established your relationship. A tribunal awarded a doctor’s receptionist £600 for injury to feelings in 2013 when one of the doctor’s kissed her after she told him she had run a half marathon the previous day.

“Of course, the law often flies in the face of common sense and convention – the idea that you can’t give a big friendly ‘mwah’ to colleagues will be anathema in many sectors such as fashion, Public Relations and much of the media. Indeed, in one case the employment tribunal commented that it struggled to understand an employee’s reaction, or over reaction, to a public display of affection colleagues in light of the evidence that it was “a cool environment in which to work”.

By contrast, straight laced professionals like many accountants and lawyers may well welcome an end to the uncertainty over when to deploy a greeting kiss.

“A work kiss raises all sorts of conundrums. What is the right etiquette for after works drinks? What about birthday parties of colleagues? What about kissing clients? What if your colleagues are kissers and you don’t like it? And what on earth do you tell your visiting French and Italian colleagues?

“Employers are liable for their employees’ acts carried out both at work and at work-related social events and what might seem like an innocuous act to one person may not be viewed that way by another. As a rule of thumb, if you would happily greet a colleague or client with a kiss, but refrain from doing so in the presence of their, or your own, boss then you should think again about whether your behaviour is appropriate.

(Source: Doyle Clayton)

Section 1 of the Children Act 1989 states that when a court determines any question with respect to the upbringing of a child the child’s welfare shall be the court’s paramount consideration.

There are seven statutory factors that the Court is directed to have regard in any Children Act proceedings, one of which is the wishes and feelings of the child. However, as Sir James Munby noted in a lecture on Human Rights of Children and Young People in June 2015, “the child is, by and large, completely invisible in court.” This is despite children often being at the centre of proceedings with their views and how they feel often not heard and vital decisions concerning their future left to the Court and third parties to decide upon.

In August 2014 the Rt. Hon Simon Hughes MP, established the Voice of the Child Dispute Resolution Advisory Group to ensure that necessary steps are taken to promote child inclusive practice in and out of court dispute resolution processes and that the voices of children and young people are heard in all private family law proceedings.

Careful consideration has been given by a Working Group set up by Sir James Munby and chaired by two of the Family Division judges, Hayden J and Russell J as to what changes to the Family Procedure Rules would need to be put in place to make the court system more child inclusive and appropriately child centred to ensure that the child’s wishes are heard.

In his lecture, Sir James Munby highlighted the need to ensure the practices of the English Family Courts abide by the obligations under Article 12 of the United Nations Convention of the Rights of the Child. In accordance with Article 12 of the Convention, State Parties should ensure that a ‘child who is capable of forming his or her own views (is given) the right to express those views freely in all matters affecting the child’, and that the child shall be ‘provided with the opportunity to be heard’ in any proceedings affecting them.

Sir James Munby suggests that this can be achieved by introducing special measures to enable children to attend court (physical participation) and to allow children to communicate their feelings and wishes to the court (intellectual participation).

To facilitate physical participation would involve allowing the child to visit the court room and/or to sit in and watch all or part of the proceedings and possibly to meet the judge, should they wish to do so. In order to facilitate intellectual participation consideration must be given to what the child wishes to communicate to the court and the best way to do this. In addition, to ensure that the child is informed as to the outcome of a case. Sir James Munby expects that the number of cases where a child will give evidence is likely to increase.

A great deal of change will be needed to practically implement any reforms. The layout of court rooms will need to be altered to ensure the child can sit in a suitable place so they can properly participate in proceedings instead of feeling like a mere spectator. Sir James Munby states that all family judges must be equipped with appropriate training. In addition, all those involved in the family justice system will similarly need training and support not least to enable them to directly communicate with children about sensitive matters. There will need to be more effective management of court time to accommodate those cases where children are present in court.

There have been pilot projects carried out in Leeds and York[1] seeking to make meetings between children and judges or magistrates more routine. Results from the project found that:

The purpose of the proposed reforms is to allow for a more child inclusive system in family law proceedings. However, it is of crucial importance that consideration is given to what a child may want from the court process and ensure the reforms reflect this accordingly. We shall eagerly await publication of the proposed Practice Directions and Guidance.

Sir James Munby and the Government’s continued support for the principle of child inclusive practice will bring a key development in the way cases involving children are dealt with. It will give children a chance to explain their feelings personally to judges particularly when life changing decisions about that child’s future are to be made. However, we must all remain ever mindful and respectful of the challenges these reforms will involve.

Tania Derrett-Smith, Associate, Weightmans LLP, www.weightmans.com, 0121 632 6100.

[1] ‘Listening to Children: are we nearly there yet?’ Lady Hale, Address to the Association of Lawyers for Children Annual Conference 2015, Manchester.

(Source: Weightmans LLP)