Understand Your Rights. Solve Your Legal Problems

In an important judgment given the ageing prison population, Louis Browne from Exchange Chambers has secured an important judicial review success for the Ministry of Justice at the Royal Courts of Justice.

In the case of Zifforah Tyrrell and HM Senior Coroner County Durham and Darlington and The Ministry of Justice, the issue concerned the question of what article 2 (the right to life) of the European Convention on Human Rights requires of a coroner when a serving prisoner dies of natural causes.

Michael Tyrrell, the claimant’s brother, died of pneumonia secondary to cancer. An investigation followed by the Office of the Prison and Probation Ombudsman which concluded that the death was a natural one. It looked at the quality of care which had been afforded to the deceased. The coroner, with the benefit of that report, obtained evidence from a number of treating doctors. The evidence pointed irresistibly to the conclusion that the death was from natural causes. In those circumstances the coroner determined that Article 2 ECHR did not impose upon him any obligation of further investigation.

In delivering its judicial review judgment, the court ruled that the coroner was right to conclude that the procedural obligation was not engaged. In those circumstances the claim for judicial review was dismissed.

Louis Browne said: “This is an important judgment particularly given the ageing prison population. Mr Tyrrells death was one which was clearly from natural causes. The cause of death was established and then confirmed on post-mortem examination. There was no indication of state involvement in his death of the sort that would trigger the procedural obligation under article 2 ECHR. Procedural obligation under article 2 where deaths occur in custody will, therefore, likely only arise where there is evidence of a violent or unnatural death or where there is some other question mark over the cause of death which points or may point to the possibility that the death was not from natural causes.”

(Source: Exchange Chambers)

Under new data protection regulation, consumers will have increased rights to object to processing of their personal information. Mark Fairbairn, Head of Retail at Equifax, explains what this could mean for retailers and both their online and offline marketing strategies.

“The EU’s new General Data Protection Regulation (GDPR), designed to protect consumer privacy and data usage, is due to come into force in 2018. While Brexit brings uncertainty over the UK’s implementation of this regulation, companies should press ahead with preparation for change. The UK government will have to decide whether it implements the new EU rules as planned, or develops alternative regulation. For UK businesses to continue to operate in the EU any alternative regulation must be palatable to European regulators. This means that whichever route the UK government takes the direction of travel will not change, although the end regulation may not look identical to the GDPR.

“So what does this mean for retailers? The UK’s retail sector leads the way in the development of digital commerce through personalised customer strategies. The key to this sophistication is found in mobilising customer data, and retailers are concerned about how changes to data protection could affect growth in this area.

“The new regulations refer to ‘unambiguous’ consent, a stricter definition than used today. Companies must ensure that they employ clear and transparent language in gaining consent from consumers to use their data in order to satisfy the new tighter definition.

“Exactly what this means in a digital context, for example when it comes to cookies, remains unclear. The Direct Marketing Association (DMA) has drawn attention to what is and is not considered ‘personal data’ in this instance. A cookie placed by a service provider who knows the individual, will generate ‘personal’ data about that individual’s behaviour, whereas an online advertiser cannot link such behaviour to a particular person – so that data would probably not be considered personal.

“When it comes to non-digital marketing, data protection rules still require that anyone processing personal data must have a ‘legitimate interest’ for doing so. While under the EU regulation data processing for direct marketing continues to be considered a legitimate interest, to ensure lawful processing, marketers need to carefully assess the relationship between their company and the consumer. Under the new law, consumers will have increased rights to object to any processing of their personal information, including profiling, at any time, free of charge. While unsubscribe/opt-out methods may continue to satisfy non-digital marketing performed under legitimate business interests, the right to unsubscribe/opt-out must also be highlighted during the first communication with the consumer, and should be clearly and separately stated.

“Much of the detail needs to be worked through over the coming months and years. The Information Commissioners Office (ICO) pledged in its 2016-2019 plan to work closely with the Department for Media, Culture and Sport to balance the interest of protecting the public and supporting economic growth. Co-operation across policy makers and industry players will become all the more important as Brexit negotiations commence and the UK shapes its future data protection laws.”

(Source: Equifax)

A Goldsmiths, University of London MFA student has put a computer algorithm on trial for manslaughter in a piece of performance art that questions the accountability of artificial intelligence.

A group of lawyers first performed artist Helen Knowles’ work, The Trial of Superdebthunterbot, at an April 2015 group exhibition. The project has since been restaged at Southwark Crown Court and made into a film, which was screened to guests at Knowles’ Goldsmiths MFA show earlier this July.

In a fictional plot, Superdebthunterbot sees an unscrupulous debt collection agency buying the debts of students across the UK, and then using unconventional means to ensure there are fewer defaulters.

Through the use of big data, individuals are targeted and constantly shown job adverts, so more money gets paid to the debt collection agency once the students sign up to a job. In a tragic twist, two young people die after taking part in a risky medical trial advertised to them through the algorithm.

Is the algorithm culpable? If Superdebthunterbot has the ability to self-educate, learn, and modify itself independently of humans, can it be found guilty of manslaughter if someone dies as a result of its actions? Can rigid legal rules apply to something that’s essentially abstract?

Recorded over half a day at Southwark Crown Court using three cameras, a camera drone, several GoPros, and an actor playing the judge, Knowles’ video was largely cast with legal experts, recruited through an email campaign to law schools.

The Superdebthunterbot algorithm was housed in a see-through computer built by artist Daniel Dressel, providing a tangible object to be tried in the courtroom. Both Knowles and fellow artist Liza Brett also produced traditional-styled courtroom drawings depicting the action.

Throughout the trial, Superdebthunterbot sat motionless in the dock, continuing to execute its code without feelings of guilt or moral conscience. It is, says Knowles, a “preposterous” situation to prosecute this non-human object, but it throws up a host of questions about ethics, computers and the law as technology continues to develop.

Born in 1975, Helen Knowles is an artist and curator living and working in London and Manchester. Before completing her MFA at Goldsmiths in July 2016, she studied at the Glasgow School of Art. Helen is the director and curator of the Birth Rites Collection, the first and only collection of contemporary artwork dedicated to the subject of childbirth.

Her mixed media artworks are held in public and private collections including The Joan Flasch Artist Book Collection, Winchester Special Collections, The National Art Library, RCA and GSA Special Collections, The Whitworth Art Gallery, Tate Library and Archive, Museum of Motherhood, New York and Birth Rites Collection.

(Source: Goldsmiths UoL)

First-time buyers looking to get their foot on the housing ladder are turning to increasingly complex ways to purchase their first home as rising house prices push the dream of owning a property out of reach for most of those trying to ‘go it alone’.

New research conducted for law firm Simpson Millar finds that first time house purchases today are increasingly complicated affairs, with multiple parties involved in funding the transaction. Gone are the days where young people – on their own or in couples – simply saved for a deposit, obtained a mortgage, and moved in. The research finds nearly half (47.5%) of first time buyers expect to need to deploy three or more additional means of financing their first purchase – including a mix of gifts and loans from parents, grandparents or other relatives, buying with friends or siblings, various government Help to Buy support schemes and shared ownership. The proportion of first time buyers expecting to need to pull in at least two of these additional means of financing rises to 70%.

Yet despite the rising number of people involved in buying a first property, a worryingly high 33% of joint buyers putting down uneven deposits would not put a legal agreement in place to protect their respective contributions in the event of a split. And amongst all joint buyers with uneven deposits, 18% explicitly say they won’t seek a legal agreement for fear of “damaging trust” and placing a strain on relationships. Without such a legal agreement people who, on their own or with family help, have contributed more to the purchase of the property will have no guarantee of getting their fair share if the relationship breaks down.

Lisa Gibbs, Conveyancing Partner at Simpson Millar Solicitors, said: “Buying a first home today can involve a bewildering array of joint-buyers, gifts and loans from parents, other relatives and support from government incentive schemes. This can lead to large imbalances between the contribution of one buyer and their family, and the contribution of another buyer. It isn’t romantic or fun to be the one insisting on legal protection of your financial contribution. But without one, a fair division of assets and the protection of ‘the family silver’ cannot be guaranteed if the property does need to be sold and proceeds divided at a later date – as is so often the case”.

When it comes to the best way to buy a property, it seems the ‘Bank of Mum and Dad’ remains as popular as ever, with 32% of first time buyers expecting to receive a gift from their parents towards their house purchase, and 26% expecting a loan. One in four (24%) will be using money from an inheritance to buy.

There is a surge of popularity for the Government’s array of “help to buy” support schemes, with many first time buyers intending to make use of the Help to Buy Isa (38%), Lifetime Isa (12%), Help to Buy Equity Loans (10%) or the Help to Buy Mortgage Guarantee Scheme (13%).

Lisa Gibbs from Simpson Millar Solicitors added: “Owning bricks and mortar these days is increasingly a luxury that can only be enjoyed by people with a network of supportive relatives and the support of government policies designed to boost home ownership. While this is a heart-warming story in many respects, the potential for equity held in the property to be divided in a way that is unfair on one joint owner and their benevolent families is a real one – and a risk families and their loved ones need to take seriously at the point of purchase, when legal protection by way of declarations of trust can be put in place easily. You wouldn’t sign a £20,000 plus contract for anything else in life without reading the small print. But when it comes to property, emotions can get in the way of common sense.”

(Source: Simpson Millar Solicitors LLP)

The Bank Mellat Iranian sanctions litigation, which has been through both the UK Supreme Court and the European Union Court of Justice, is now going back to the High Court to deal with the damages claim. The claim is for $4 billion; the largest claim made against HM Treasury, and is slated to begin in October.

Bank Mellat Case History:

Bank Mellat is the largest private bank in Iran. In 2009, it was sanctioned by Her Majesty’s Treasury, under the Financial Restrictions (Iran) Order, pursuant to the powers granted to it by the 2008 Counter-Terrorism Act. The 2009 Order prohibited UK financial institutions from having any business relationship with Bank Mellat.

Bank Mellat challenged the 2009 Order on the ground that it violated its rights under the European Convention on Human Rights, including its rights to property and right to a fair trial. In the High Court, Justice Mitting dismissed both the procedural and substantive challenges to the order, and Bank Mellat lost its subsequent appeal before the Court of Appeal before the case was taken finally to the Supreme Court. For the Supreme Court proceedings, Bank Mellat changed its legal team. Stephenson Harwood were substituted by Zaiwalla & Co.

The dispute was heard by the General Court before going to the ECJ, where it was held that Bank Mellat was not a state-owned bank – the Council had not been able to accurately verify the extent to which the state had any shareholding in the bank, nor was it the case that the bank was supporting nuclear proliferation. The EU Council was ordered to cover both its own and Bank Mellat’s costs for the proceedings.

Returning to the UK, for the first time the Supreme Court held a closed material procedure, much to the vexation of Lord Neuberger, who said that the decision to hold the secret session was taken “with great reluctance.” Mr Zaiwalla also spoke out strongly against the use of secret courts, remarking in one interview from the time that “justice conducted behind closed doors with evidence hidden from view is no kind of justice at all.”

The court supported Bank Mellat’s procedural as well as substantive challenge against HM Treasury. The majority held that the mere existence of a statutory provision for effective judicial review did not excuse the Treasury’s common law duty of fairness. The judges also held that, as the Order was directed against individuals, the Treasury was obligated to provide prior notice for representations to be made. It was also decided that Bank Mellat had been irrationally singled out, and that the elimination of its business in London was a disproportionate response to the Treasury’s stated goals. The Supreme Court ordered HM Treasury to pay Bank Mellat’s costs and it remitted the case to the High Court for the assessment of damages caused to Bank Mellat as result of the 2009 Order.

Prospects for Proceedings in November 2017:

Following the Supreme Court Judgement, Bank Mellat is seeking damages worth $4 billion. A damages hearing has been scheduled for November 2017 at which the court will assess the Bank’s damages. Bank Mellat appreciates that the UK courts are prepared to courageously uphold the rule of law against actions taken by Western executive bodies. As the first series of cases to conclude in favour of an Iranian business in relation to Western sanctions, one suspects that further Iranian corporations will look to submit damages claims as the nation begins to reintegrate itself into the global economy.

(Source: Zaiwalla & Co.)

Paid 557% markup for IT products -

Suppliers are exploiting a lack of transparency in the IT market to inflate product prices, according to the annual KnowledgeBus IT Margins Benchmarking Study.

Now in its fourth year, the study shows that the practice of charging excessive margins by suppliers is still commonplace across the legal sector.

Identifying the best price for IT products is notoriously difficult, given the short lifecycle of products and the constant fluctuation of trade costs. Although industry best practice, as specified by the Society of IT Managers, states that organisations should not pay more than a 3% margin to suppliers.

Despite this guidance, the research revealed that one supplier successfully charged a legal company a margin of 557% for an order of cables.

The study suggests that awareness of the high mark-ups charged by some suppliers needs to be improved. The average margin paid across the legal sector was actually found to have risen to 17% in 2015 from 15% in 2014.

Yet this does compare favourably with the average margin paid across the board by buyers, which currently sits at 17.6%.

Al Nagar, head of benchmarking at KnowledgeBus, said: “Organisations are getting better at scrutinising purchases and negotiating better deals with suppliers. But the analysis shows that many purchases are far in excess of industry best practice.

“The most extreme example of excessive margins are regularly found on those lower volume, spontaneous, ‘as and when’ purchases. These are typically unplanned purchases consisting of items such as memory sticks, power adapters and cables.

“All procurement officers need to be aware of this trend. Although this type of purchase may be perceived to be of a lesser value, compared to major pieces of IT infrastructure, they can make up a good 25% of the IT budget. By the end of the year, this can easily add up to a six figure difference to the overall IT budget.

‘‘Today’s procurement managers don’t have endless amounts of time to talk to multiple suppliers to find the best price. What they need is for there to be greater transparency between suppliers and customers. With the right tools organisations can gain that transparency and bring those margins down to 3%.’’

For organisations looking to achieve best practice levels on IT product purchasing, Al Nagar offers three key tips:

Organisations can empower their negotiators, and speed up the IT procurement process, by deploying benchmarking tools. This provides IT buyers with access to up-to-date and validated trade level information that will identify the exact margins suppliers are charging.

Companies can agree ‘cost plus’ contracts with their suppliers to ensure no IT product purchased exceeds an agreed maximum margin level. Procurement teams can use their benchmarking tools to police these contracts.

By analysing historic or seasonal trade price trends, IT buyers can identify the best times to buy. When trade prices fall to their lowest, suppliers often try to maximise margins achieved, but by monitoring the market, companies can counter this practice.

(Source: KnowledgeBus)

The Bar Council, the Chartered Institute of Legal Executives (CILEx) and the Law Society of England and Wales have joined forces to set up a Joint Working Group to examine the viability of a Contingent Legal Aid Fund (CLAF) and make recommendations by the end of the year.

A CLAF is a recyclable, pooled fund which is financed by money derived from the damages recovered in successful civil cases where the client was supported by the fund. In this way, once up and running, a CLAF would fund litigation for those who don't have the resources to achieve it and wouldn’t qualify for legal aid. The intention of a CLAF is to facilitate access to justice.

The Working Group, which is chaired by Justin Fenwick QC, will make recommendations as to what changes would be needed to make a CLAF viable including changes to other forms of funding and any legislative changes and any changes to the Civil Procedure Rules. The group will investigate how a CLAF could be established (including its initial funding), how it would operate and the outcomes it would deliver for consumers, lawyers and the wider justice system.

Chairman of the Bar, Chantal-Aimee Doerries QC said:

“I am very pleased that the three professional bodies have agreed to investigate the viability of a CLAF. The Bar Council has examined this as a possible alternative source of funding civil justice over many years. Our first report was published as long ago as 1998. Since our last report on the subject in 2011, the civil justice landscape has changed considerably. The Legal Aid, Sentencing and Punishment of Offenders Act 2012 resulted in significant cuts in civil legal aid and in some cases the removal of public funding from entire areas of civil work. It is therefore timely to re-examine the feasibility of an independent, not-for-profit CLAF established by the legal profession, in the public interest, to promote access to justice. The Bar has much to contribute to the investigation of this important cross-profession initiative.”

President of CILEx, Martin Callan said:

“CILEx is keen to support all routes that enable access to justice and is ready to play its part in the joint project to test the feasibility of a CLAF. The concept has been discussed regularly over many years and models do operate successfully in other jurisdictions. As funding for civil litigation has changed, particularly following The Legal Aid, Sentencing and Punishment of Offenders Act, the renewed interest of the government and Judiciary is welcome. There is real opportunity to investigate if a CLAF could work in practice in England and Wales, and to identify the scope of its potential application, in the public interest.”

President of the Law Society, Robert Bourns, said:

“A Contingency Legal Aid Fund could provide a valuable method to fund litigation and facilitate access to justice for those who lack the means to pay for legal services. The Law Society looks forward to working with our colleagues at the Bar Council, CILEx and the judiciary with a view to exploring how a CLAF could work in practice. We are keen to discuss ways to overcome the obstacles that prevented this idea from proceeding in the past. It is also important to consider any unintended consequences on existing funding options, which are presently working well for people.”

At their first meeting, members of the group agreed to produce an initial report by the end of September 2016 and a final report before the end of December 2016.

(Source: UK Bar Council)

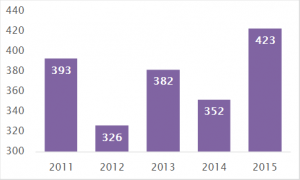

An increasing number of commercial and business-related disputes are being heard by the European Court of Justice (ECJ) up 20% in the last year to 423, compared to 352 in 2014, according to research from the Legal Business of Thomson Reuters, the world’s leading source of intelligent information for businesses and professionals.

However, the Brexit vote has brought into question the access of UK businesses and individuals to the ECJ to resolve legal disputes, pursue damages or challenge government decisions that might impact their profitability.

Thomson Reuters says that the significant increase in usage by businesses of the ECJ is being driven by businesses being more willing to make use of the European Courts as a tool to achieve commercial aims, particularly if they fail to get matters satisfactorily resolved at national level.

Thomson Reuters adds that the strengthening economic recovery has brought more financial firepower to many businesses to pursue claims all the way to the ECJ, which can be extremely expensive and time-consuming to do.

Areas which have seen significant increases in the number of cases heard by the ECJ include:

Examples of businesses involved in recent cases in the European Court include:

“The European Commission has been going through a more active period in terms of competition investigations, creating more cases for the ECJ.” says Professor Laurence Gormley, Professor of European Law at the University of Groningen and a member of the editorial board for the European Law Review, published by Thomson Reuters.

“One area of particular attention is the internet sector where there is a strong tendency for markets to develop into monopolies. Google and Amazon are just two players on which the EC has set its sights.”

As technological innovation gathers pace, the scope for IP-related disputes increases as firms seek to exploit intellectual property assets, and ground-breaking developments encourage more me-too competitors looking to seize market share.

Public procurement claims emerge as a growing area for litigation

Public procurement cases have also emerged as a growing area for litigation - with 26 cases in 2015 compared to zero in 2010. The cases are brought by businesses who believe they have unfairly missed out in a tender process run by a local government or public sector body.

Thomson Reuters says that this suggests that private companies are becoming more aggressive over litigating over public sector contracts.

It adds that despite some EU member states beginning to ease austerity measures, resulting in more public procurement projects coming on stream, competition for project tenders remains tough. This could increase the potential for disputes over the way contracts are awarded and handled.

It points out that despite the public purse strings loosening slightly as critical infrastructure projects get the go-ahead after years on hold, budgets remain very tight and governments and local authorities want to see real value for money.

Number of commercial cases heard by the ECJ continues to rise

*Data from European Court of Justice – year 1 January to 31 December

(Source: Thomson Reuters)

This week, Eurojust and the European Union Intellectual Property Office (EUIPO) signed a Memorandum of Understanding (MoU) to further expand the existing fruitful collaboration to support European prosecutors working with cases concerning violations of intellectual property rights (IPRs).

The MOU, signed at Eurojust headquarters in The Hague (Netherlands), will enable the further development of specific cooperation projects, such as joint seminars, training and intelligence, to support European prosecutors. In addition, the MoU reinforces the capacities of the European Intellectual Property Prosecutors Network (EIPPN) and formalises its role.

The signature of this MoU coincides with the release of an EUIPO report on online business models infringing IPRs. The study shows that new business models have been developed to further exploit IPR infringement. Indeed, IPRs are systematically being misused as a way to disseminate malware, carry out illegal phishing and simple fraud to the detriment of society, businesses and the ordinary user of the Internet.

Eurojust’s activities and casework in IPR, which is an EU crime priority, focused on identifying existing legal and judicial barriers within the Member States in the field of IPR. Building upon the excellent foundation for cooperation established by Mr László Venczl, National Member for Hungary and Eurojust contact point for intellectual property, Eurojust will further expand its cooperation with and support to EU prosecutors in dealing with cases involving IPR.

The President of Eurojust, Ms Michèle Coninsx, said: ‘Eurojust is committed, together with EUIPO, to supporting a multi-disciplinary approach to fighting IPR, which is a growing threat to the EU and world economies.’

The Executive Director of the EUIPO, António Campinos, said: ‘The EUIPO is committed to continue investing its efforts to expand knowledge and good practices among prosecutors dealing with IPR infringement, and welcomes the development of the EIPPN created in 2015’.

(Source: Europa.EU)

The US Government has been intentional about requesting authority access to the firm’s servers abroad, but a court has now ruled this cannot be forced.

In what now sets a precedent for privacy protection in the sector of cloud computing and data services, the US Department of Justice (DOJ) will not be allowed to access Microsoft’s foreign servers.

The intention was to obtain data regarding a drugs investigation, from a server in Ireland, according to the BBC.

This court ruling now overturns an original court order granted in 2014 in Manhattan, US. If the DOJ decides to appeal, the case would be taken to the Supreme Court.

According to the BBC, Microsoft said it welcomed the ruling. "It makes clear that the US government can no longer seek to use its search warrants on a unilateral basis to reach into other countries and obtain the emails that belong to people of other nationalities," says Brad Smith, President and Chief Legal Officer at Microsoft.

In this case, Microsoft was backed by other tech companies such as Amazon, Cisco and Apple. In addition, a UK group campaigning for digital rights also backed Microsoft. The Open Rights Group said: "The US Court's decision has upheld the right to individual privacy in the face of the US State's intrusion into personal liberty.

“As a consequence, US law enforcement agencies must respect European citizens' digital privacy rights and the protection of their personal data.

“States should not arbitrarily reach across borders just because they feel they can bully companies into doing so."

The ruling against the DOJ came from Judge Susan Carney, on grounds that the Stored Communications Act of 1986 limited warrant reach applicable beyond US jurisdiction; a factor that is crucial in maintaining positive relations with other countries.

The BBC states that another judge, Gerard Lynch, says the Stored Communications Act is in need of an update. "I concur in the result…But without any illusion that the result should even be regarded as a rational policy outcome, let alone celebrated as a milestone in protecting privacy."