Understand Your Rights. Solve Your Legal Problems

Jian Cao, Florida Atlantic University professor, comments on the interplay between securities law and the capital markets.

Much like individual taxpayers race against the clock to pay income tax on time to the Internal Revenue Service each year, companies are on deadline to file the required comprehensive summary of their financial performance with the US Securities and Exchange Commission called a Form 10-K.

Whether a company makes that deadline or files late tells us a lot. Timeliness of filings is an important characteristic of relevant information and is one of the determinants of security prices and warning signs leading to securities litigation.

Recently, Citizens, Inc. received an expected NYSE Notice on April 3rd that it was not in compliance with the exchange's continued listing requirements as a result of its failure to timely file its 2016 Form 10-K. On April 11th Scott+Scott, Attorneys At Law, LLP announced filing of a securities class action lawsuit against Citizens, Inc., claiming the company's statements about its business, operations, and prospects were materially false and misleading and/or lacked a reasonable basis at all relevant times.

A study I recently conducted with my coauthors, Julia Higgs at Florida Atlantic University and Feng Chen at the University of Toronto, found that failure to file a periodic report on time may be a sign of trouble, especially if accounting/auditing issues are cited as a cause of delay.

Our study revealed evidence that firms requesting a filing extension for Form 10-K had higher incidences of subsequent restatements and SEC enforcement actions. Although the disclosed reasons (accounting issues, inability to complete report, distress & restructuring, control issues, and regulatory affairs) reveal some issues about late filers, the risk of low reporting quality persists even when the explanations are more innocuous.

As of the stock market's close on Thursday, April 20th Citizens' shares have fallen $1.74 per share – over 21% – since its March 17th filing for an extension with the SEC. Understanding what happens to late filers is important, as investors are clearly being harmed.

(Source: Florida Atlantic University College of Business)

Bipartisan legislation (H.R. 2148) introduced last week by Rep. Robert Pittenger (R-NC) and Rep. David Scott (D-GA) would help clarify and reform the Basel III High Volatility Commercial Real Estate (HVCRE) Rule, which is negatively affecting certain commercial real estate loans and impairing economic growth. The bill is supported by The Real Estate Roundtable and a coalition of national real estate organizations.

Real Estate Roundtable President and Chief Executive Officer Jeffrey D. DeBoer said: "Congressmen Pittenger and Scott are to be commended for recognizing the negative economic impact that the HVCRE Rule is having on acquisition, development and construction lending and for taking steps to introduce legislation intended to correct these problems. The Roundtable and our coalition partners support regulatory agencies' efforts to promote economically responsible CRE lending, and the Pittenger-Scott bill will help guide the agencies in clarifying and reforming the HVCRE Rule, while encouraging sound lending practices, spurring economic growth and creating jobs in local communities."

By amending the Federal Deposit Insurance Act to clarify capital requirements for certain acquisition, development, or construction loans (ADC), the legislation would address concerns regarding the HVCRE Rule.

As currently written, the Rule is overly broad and is applied to many stabilized loans without construction risk, unduly burdening stabilized loans with capital charges after the construction risk has passed. Many banks, including small community financial institutions, have been deterred from making this type of loan – which can represent up to 50 percent of a small bank loan portfolio.

Since introduction of the HVCRE rules in January 2015, necessary clarification for key elements of the rule have not been provided by regulators despite ongoing requests. Without modifications, the consequences of the HVCRE rule could have an adverse economic impact on commercial real estate lending, local economies and job creation. Without a response from the regulatory community, the proposed legislation is intended to address the problem.

Among the clarifications in the legislation are the following:

As the House Financial Services Committee considers legislation in the 115th Congress to address the HVCRE rule, The Roundtable and its industry partners will continue to encourage policies that permits stable capital formation and balanced lending in a sensible financial regulatory framework.

(Source: Real Estate Roundtable)

Janice Kephart, former 9/11 Commission border counsel and partner with Identity Strategy Partners, LLP (IdSP), recently issued the following statement: "With or without President Trump's March 6th 2017 Executive Order: Protecting the Nation from Foreign Terrorist Entry, refugee vetting can be instilled with greater confidence, enabling the reactivation of legitimate refugee resettlement. (Right now, all refugee applications are suspended by until at least July 2017). Improvements in current refugee vetting will require a language change to current law, identity enrolment taking place earlier in the process, and the implementation of a long-ignored 9/11 Commission recommendation. But improvement is doable, and now.

So why does the refugee population present a threat to national security? The reason is twofold: (1) intelligence for years has revealed a terrorist travel tactic of infiltrating refugee populations for eventual resettlement into Europe or the United States, and (2) by legal definition refugees are displaced persons with unknown identity. Even for those with an ID, establishing its authenticity or trusting its origin is difficult since by policy, no information is shared with the home country, so there is no country of origin against which to run checks as in a regular visa referral. Since the refugee demographic tends to be anonymous, it is more difficult to ensure a person is who they say they are, and then affiliate that identity with intelligence and other potentially significant financial or other data. In short, limited identity and intelligence information diminish confidence in recommendations about which refugees to accept for US resettlement.

The program responsible for vetting refugees seeking US resettlement is the United States Refugee Admissions Program (USRAP). It is run jointly by the State Department, who receives referrals from the United Nations and conducts initial processing including a biographic name check, and the US Citizenship and Immigration Service (USCIS), who conducts more in-depth interviews and collects biometrics from applicants. The program has been fine-tuned over many years. Yet the program requires vital improvements, and the recommendations below should be considered minimum baseline requirements.

Congress must change law to enable US access to refugee biometric data collected by the United Nations. Since 2013, the United Nations has a sophisticated biometric identity management system that collects 10 fingerprints, two irises, and face of every refugee, sometimes two to four years before a US referral for initial biographic screening. Right now, due to an archaic law that prevents sharing of biometric information collected by a non-US citizen, the US has no access to this key identity information. The law needs to change to permit that biometric data be available for vetting against federal databases from designated international partners such as the United Nations.

Refugees must be biometrically enrolled the first time they enter the US system. State does not collect any biometrics from refugees, and thus only has the word of the refugee as to who they are, making the required biographic checks a potential goose chase. While USCIS does collect rolled prints and a face photo at the time of the interview, current vetting against some US biometric holdings do not return results for up to 24 hours, after the interview is already over. If State collected the biometrics as part of their pre-screening interviews conducted by their Resettlement Service staff, USCIS interviews would be better informed, and so would the final assessment.

Implement the 9/11 Commission recommendation for a person-centric immigration system. State and USCIS use different case filing assignments for refugees. Policy does not require that State initiate a file number that USCIS recognizes or uses in the processing of the ultimate immigration benefit the refugee seeks. Thus, each applicant has two different file numbers, creating disconnect and potential for confusion and duplication. Yet the problem could be eliminated entirely if case numbers were eradicated and the 9/11 Commission recommendation for a biometric-based identity number for the entire immigration system were put in its place. When biometrics become the baseline for any immigration encounter, identity is protected and the automatic creation of a timeline of immigration encounters reduces fraud and increases efficiencies for legal immigration. Implementation of this long ignored 9/11 Commission recommendation could drastically improve the US immigration system, and with it, refugee vetting as it stands today."

(Source: Identity Strategy Partners)

With Britain now set on heading for the EU exit door, focus moves to the next two years and what the exit negotiations will mean for the future of the UK and the remaining 27 EU states. One of the biggest areas of contention is what the UK financial market will look like and how firms here will be able to continue playing a leading role in the world.

Of particular interest are the regulations laid out by PSD2 and what role this EU wide regulatory framework will play in Brexit Britain. The regulations are aimed at increasing competition and improving access to data and services and Craig James, CEO of Neopay, tells Lawyer Monthly they will continue to benefit Britain long after Brexit.

Levelling the playing field

For UK tech start-ups looking to enter the financial market, PSD2 provides the perfect opportunity to play on the same level as established providers by requiring banks to share data about customers’ accounts (with their consent).

Allowing these payment service providers (PSPs) access to this information will make it much easier for them to create competitive products, both in the UK and the European Economic Area (EEA) and will lead to increased competition and a more innovative marketplace.

PSD2 in Brexit Britain

A major concern for UK financial firms is what will happen to their place in the market when the UK is no longer a member of the EU, and potentially is no longer seen as a gateway to the single market.

From a general business perspective, it is worth noting here that choosing where to be based and regulated is less about Brexit and more about commercial demographic. If for instance, a significant proportion of your business is from the UK it makes sense to be regulated by the FCA, and if the UK does leave the Single Market as well as the EU, then being regulated by the FCA would be a requirement if you want to continue doing business in the UK.

UK firms can be reassured by the fact PSD2 aims to increase the standards of financial transactions, making them more transparent and competitive while ensuring firms – whether banks or non-traditional market entrants – comply with stricter requirements on transparency, competition and security.

Another point of concern is how these regulations will impact transactions made between UK and EU firms post Brexit, but PSD2 puts in place new legislation that requires EU firms to meet transparency rules, even when dealing with providers outside the union.

Under current legislation, transparency requirements for payments service providers (PSPs) only apply when both the payer’s and recipient’s PSP are located in the EU, and if payments are made in euros or a member state currency.

PSD2 extends the geographical scope of transparency and conduct of business requirements to include “one leg” transactions, as long as one of the PSPs is located in the EU and also to transactions in non-EU currencies which have at least one leg in the EU.

This means that clearing foreign currency transactions abroad is no longer relevant and the EU part of the transaction will be in the scope of PSD2 regulations if the above conditions are met.

For the next two years at least, banks and fintech start-ups will be able to establish themselves as reliable providers of services with the surety that the UK will continue to implement and comply with PSD2.

Indeed, even after Britain exits the EU and possibly the Single Market, PSD2 will remain in place for those firms still based in the bloc, ensuring they continue to meet the strict regulations. For UK firms, this will prove particularly beneficial if they are hoping to continue pan-European trading, as EU competitors will remain regulated by the stricter financial legislation, in terms of remaining transparent, and will not be able to undercut UK firms.

The real advantage the UK will hold in these scenarios is that once it is no longer in the EU and EEA, it is no longer required to comply with EU regulations implemented post Brexit and the market will be able to adapt accordingly, and much more quickly than the EU market.

Being able to adapt regulations without the agreement of 27 other nations will serve the UK well as it steps away from the EU.

While remaining nations will be forced to continue complying with EU wide legislation, the UK can be much more agile and react to market needs as required.

It should be noted that it is likely that many positive elements of PSD2 will survive in UK law after the Brexit negotiations as the government will want to create an environment that promotes innovation and growth in one of the country’s most historic and important economic sectors.

Business as usual in the short term

With PSD2 set to come into force next year – in the middle of Brexit negotiations – the financial sector can expect an element of business as usual in the short term.

Of course, the UK government has a commitment to remaining engaged with and complying with EU legislation while the UK remains a member so, for the immediate future at least, financial firms across the continent will be operating on a level playing field, under the same regulations.

Whilst we expect many regulatory aspects to remain in place after 2019, forward thinking companies will at least be considering the possibility that no longer needing to comply with EU legislation could offer UK lawmakers a lot more freedom in how the market develops and the advantages that may bring.

The following is a statement of Matthew L. Myers, President, Campaign for Tobacco-Free Kids:

New disclosure documents filed this week show the big tobacco companies are spending huge sums and hiring an army of lobbyists to influence Congress and the Trump Administration, including giving $1.5 million to President Trump's inauguration.

It's no secret what the tobacco companies want: They're waging a multi-pronged assault on a new rule the Food and Drug Administration issued last year for electronic cigarettes and cigars – products that are sold in a huge assortment of sweet flavors and threaten to hook a new generation of kids. If draining the swamp of special interests is to mean anything, it should start with protecting America's kids and not the tobacco industry.

The new disclosure documents reveal the tobacco industry is going all out to get its way:

In Congress, tobacco companies are pushing two bills that would greatly weaken FDA oversight of e-cigarettes and cigars and protect tobacco companies' ability to market candy-flavored products that are so enticing to kids. Tobacco lobbyists and their congressional allies are working to insert these harmful provisions in the spending bill Congress must pass by April 28 to keep the government open:

The big tobacco companies are behind these efforts. The New York Times has reported that Altria drafted the first of these bills and that it was endorsed by R.J. Reynolds. The Times reported that the bill as initially introduced "pulled verbatim from the industry's draft." Reynolds and Altria make two of the best-selling e-cigarette brands in the US (Vuse and MarkTen).

Fifty-one leading public health and medical groups recently wrote Congress to urge rejection of these harmful measures.

In addition to this legislative attack, e-cigarette and cigar interests have filed several lawsuits against the FDA's rule. While the Department of Justice under the Obama Administration vigorously defended the rule, the Justice Department under the Trump Administration recently filed a motion requesting an extension "to more fully consider the issues raised." The government's counsel on the motion included Chad Readler, the Acting Assistant Attorney General of the Civil Division, who previously represented R.J. Reynolds when he was a partner at the Jones Day law firm.

The Campaign for Tobacco-Free Kids and other public health groups recently urged the Justice Department to recuse any lawyers who represented tobacco companies from any tobacco-related litigation while serving in the government, specifically mentioning Mr. Readler and Noel Francisco, the nominee for Solicitor General, who long represented R.J. Reynolds in tobacco litigation while at Jones Day.

Congress must reject the tobacco industry's efforts to weaken FDA oversight of e-cigarettes and cigars, and the Trump Administration must continue to vigorously defend the FDA's authority. They should side with America's kids, not the tobacco industry.

Background on E-Cigarettes and Cigars

While the US has reduced youth cigarette smoking rates to record lows, efforts to reduce overall youth tobacco use have been undermined by the popularity of e-cigarettes and cigars, which are marketed in a wide array of sweet flavors that attract kids. Studies have found more than 7,700 e-cigarette flavors and 250 cigar flavors – including flavors like gummy bear, cotton candy and cherry crush for e-cigarettes and sticky sweets, tropical twist and banana smash for cigars (for details, see our recent report, The Flavor Trap).

Current e-cigarette use among high school students increased from 1.5% in 2011 to 16% in 2015, surpassing use of regular cigarettes, according to the government's National Youth Tobacco Survey. Another national survey, the 2016 Monitoring the Future survey, showed the first evidence of a decline in youth use of e-cigarettes, but e-cigarettes continue to be the most-used tobacco product among kids. In addition, more high school boys now smoke cigars than cigarettes (14% vs. 11.8% in the 2015 Youth Risk Behavior Survey).

Both cigars and e-cigarettes pose significant health risks. According to the National Cancer Institute, cigar smoking causes cancer of the lung, oral cavity, larynx and esophagus.

A 2016 Surgeon General's report on e-cigarettes concluded that e-cigarette use among youth and young adults "is now a major public health concern." The report warned that youth use of nicotine in any form is unsafe, can cause addiction and can harm the developing brain. The report also found that e-cigarette use is "strongly associated" with the use of other tobacco products among youth and young adults, including conventional cigarettes.

(Source: Campaign for Tobacco-Free Kids)

You’re probably here because you think you don’t know what metadata is or how it is used, but in fact you’ve probably used it every single day. Here Dean Sappey, the President and Co-Founder of DocsCorp, delves into the ins and outs of metadata, including the best uses and risks behind it too.

Now don’t be alarmed. Metadata has a scary reputation because of certain cases of high-profile cyber-spying by the NSA, but no matter what your views are on metadata collection, the everyday uses are not as controversial.

Metadata is loosely defined as ‘data about data’. Whenever you look at a file on your computer, the contents of the file itself is the data. The additional information about that file, such as the date it was created, when it was last edited and by whom, is all metadata. This is how the file system on your computer sorts documents by date – pretty useful!

But that’s not all. Metadata goes much deeper than this. There are at least 13 types of metadata used by Microsoft Office, for example:

So, other than sorting documents in Windows Explorer, how can metadata make our lives easier? What can we make it do?

Uses of metadata

Searching for documents

Let’s use an example you’ll be familiar with: you.

Your name, address, phone number, NI number, date of birth, is all data about you.

Structuring this information in a database allows anyone with access to that database to search and find people who fit certain criteria, demographics, or even a specific person, based on partial information, a tactic used frequently by telesales companies.

In the same way, your document management system uses metadata to store data about your documents, which users might search for: the name, date, author, who opened the document last and when, and so on and so forth.

By putting some time into organising your metadata structure, and then sticking to it, you can turn a jumbled mess of folders and files into a much more efficient system, which doesn’t rely on long-winded folder navigation to return your documents.

Comparing documents

One of the most intriguing types of metadata is to do with revisions, version control, and changes.

We’ve all been there, opened a shared template document, saved a new version, made changes and sent it to a colleague who makes their own version. The two documents then have to be merged.

Version control can be tricky to get right. It only takes one slip to descend into version chaos and merging the documents could take hours, if not days, of hard manual work – headache!

But version control becomes much easier when making use of metadata. Software is not only capable of searching the contents and properties of documents, but also comparing documents for differences. This is how you can catch all those changes that your colleague didn’t track in MS Word.

Customising your metadata

Despite all the metadata that Microsoft Office and Windows Explorer collect, the software is fairly limited in some respects. We all know how long it takes just to search a hard drive for a file name using standard Windows kit.

Specialist Enterprise Content Management (ECM) software is designed to extend the functionality of Office to create a completely customisable, tailored document management system. This means you can create your own metadata fields to organise files and search by, whether that’s by department, internal teams, projects, document types, or markers for specific stages in your processes.

Misuses of metadata

When you send that document to your colleague for editing, you send all that metadata with it, creating a digital paper trail connecting you to the people you communicate with.

The Solicitors Journal found in a 2010 survey that 97% of law firms have no metadata management system in place to control what metadata is stored in legal documents, which are accessed by mobile devices.

This is striking considering how many documents could be sent around each day that contain metadata, some of it undoubtedly confidential, relating to clients and sources. Communications metadata has always been considered public information, so although the contents of communications is protected by law, this makes metadata a powerful tool for hunting down whistle-blowers.

Many organisations prefer to use a metadata scrubber before documents are sent via email, and this is usually integrated with email systems and mobile devices, to make sure nothing gets through the email system without being scrubbed of metadata first.

Despite its bad name, metadata is nothing to be scared of and can be much more beneficial than harmful if handled correctly.

Motor insurance premiums have risen by £110, up 16% since this time last year, and yet the cost of pay outs to injured motorists and workers have all gone down, according to campaigning law firm Thompsons Solicitors.

Data from the claims portal and analysed by insurance law firm Weightmans, shows the number of claims for road accidents, workplace accidents and diseases have all gone down in the last year.

The analysis found that workplace accident and diseases have decreased by 21% in the last year, while road traffic accidents and public liability claims dropped by 7% and 12% respectively.

Thompsons’ consumer campaign, #FeedingFatCats, has been tracking the insurance industry’s actions since the government announced its intentions to increase the small claims limit in November 2016.

The Ministry of Justice claimed that the measures which will remove injured people’s access to free or affordable, independent legal representation would tackle a ‘rampant compensation culture’, however these figures clearly show that claims are already on the decline.

Thompsons argues that far from putting consumers’ financial interests at heart, the government’s planned reforms are set to gift £200m a year in additional profit to insurance firms while at the same time robbing the Treasury and the NHS an additional £150m per year.

Tom Jones, head of policy at Thompsons Solicitors said: “These are the numbers the insurers don’t want us to see: the number of claims has gone down across the board and most dramatically in workplace accidents.

“The government has no evidential justification on which to progress with these reforms and its increasingly clear that consumers will lose out financially, there will be no real or sustained reduction in car insurance premiums and if they get injured they will, with no lawyer to represent them be offered paltry compensation by insurers.

“It’s clear that the number of claims – whether they’re up or down - has no bearing on the cost of car insurance, and that the industry is set on increasing premiums no matter what. Meanwhile the government is prepared to keep on feeding the fat cats in the industry and swallowing their claims of ‘crisis’ without any challenge.

“The figures prove that the insurers have been stirring up an ‘epidemic’ which doesn’t exist. The end goal is exposed for what it really is - consumers to pay more so that shareholders and CEOs continue to enjoy booming profits and dividends.”

(Source: Thompsons Solicitors)

A new report from the Center for Immigration Studies analyzes the fraudulent abuse of the "credible fear" process by aliens seeking to enter or remain in the United States, fraud made possible by weaknesses in the US asylum system, resource constraints, and evidentiary limitations. Already more susceptible to exploitation by terrorists than the refugee process because applicants are not screened before entering the United States, the credible fear process is particularly vulnerable to fraud, hindering the effectiveness of expedited removal and undermining the immigration enforcement system.

Expedited removal is intended to facilitate the removal of aliens who entered illegally or through fraud, and who are apprehended at entry or who have been in the United States for a limited period of time.

But according to the report's author, Andrew Arthur, a former Immigration Judge and the Center's Resident Fellow in Law and Policy: "Many have been instructed to claim 'credible fear' of returning to their home countries. With their oral testimony often offered as the only evidence to support their claims, and with few Asylum Officers, only 35 Fraud Detection and National Security officers assigned to asylum offices throughout the country, and a mere 316 Immigration Judges already overwhelmed by a backlog of 542,411 cases, it should be no surprise that the credible fear process is uniquely susceptible to fraud."

Among the findings:

(Source: Center for Immigration Studies)

A new tool published by the independent Interstate Renewable Energy Council, Charging Ahead: ‘An Energy Storage Guide for State Policymakers’, provides regulators and other decision makers with specific guidance on key issues for policy consideration, including foundational policies for advanced energy storage—a new generation of technologies characterized by flexible operating capabilities and diverse applications.

The characteristics that make energy storage so valuable and attractive also make it challenging to address in policy and regulatory contexts.

Despite its game-changing potential to transform the electricity system, energy storage is vastly underutilized in the US electricity sector. Its deployment remains hampered by the current features of regional, state and federal regulatory frameworks, traditional utility planning and decision-making paradigms, electricity markets, and aspects of the technology itself.

To date, state policymakers and electric system stakeholders have largely navigated energy storage issues without the benefit of a roadmap to inform pathways for widespread deployment.

Charging Ahead provides an in-depth discussion of the most urgent actions to take to support viable energy storage markets that effectively enable states to take advantage of the full suite of advanced energy storage capabilities. Four foundational policy actions are presented for consideration:

"Deploying energy storage at scale and optimizing its benefits will require innovative and forward-thinking policies to integrate it into existing electric system operations and state regulatory frameworks," explains IREC Regulatory Director Sara Baldwin Auck.

"As IREC works in numerous diverse states, we consistently observe that while the market players are ready to act, the regulatory structure is not keeping up with them," adds co-author Sky Stanfield, an attorney who represents IREC in storage proceedings. This guide is intended to alter that paradigm and encourage states to proactively adopt policy and regulatory solutions that address energy storage barriers more holistically and help set a glide path for the widespread integration of energy storage technologies on the grid."

The guide was released at the Energy Storage Association's 27th Annual Conference and Expo in Denver, CO. "The ESA conference brings together the global energy industry for forward-looking content," says ESA Executive Director Matt Roberts. "It provides a perfect opportunity to work with IREC on the dissemination of this important tool for policymakers."

(Source: Energy Storage Association)

It has been reported investors now own £483 billion pounds of commercial property in the UK, representing 55% of the combined total. Not only is this the highest value to date, but it exceeds the previous peak reached prior to the global financial crisis in 2008.

Previously, UK institutions such as insurance companies and pension funds were the biggest direct investors; now, they account for just a fifth of the total, down from a quarter in 2005.

In contrast, foreign investment in commercial property has increased rapidly over the last decade and overseas investors currently own 28% of UK commercial property – typically held as investments.

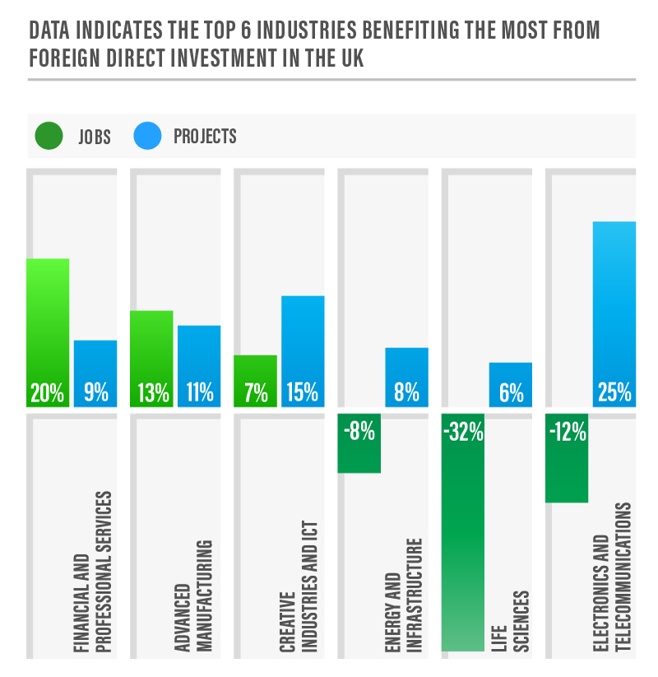

Savoystewart.co.uk decided to consider exactly which industries are benefiting the most from this surplus of foreign investment, in terms of job creation specifically. In fact, data collated from the ‘Department for International Trade’ report (first published 30th August 2016) by Gov.uk dictates 2,213 FDI inward investment projects were secured in 2015 to 2016 – altogether generating 116,000 jobs – the second highest number on record.

The same year, almost 1,600 new jobs were created per week by FDI and, since 2010, nearly 390,000 new jobs have subsequently been created here in the UK. The USA remains the UK’s largest source of inward investment; providing 570 projects. This was followed by China (including Hong Kong) with 156 and India with 140.

Savoy Stewart Director, Darren Best comments: “There’s no doubt that we are in a dubious time: a lot is set to change in 2017, and the free fall we are all experiencing post-Brexit is certainly chaotic, particularly in terms of business. However, from analysing recent data, I am confident the UK will remain a key market – just as it ever was. Our ties with investors all over the world remain interwoven and strong; we should embrace change, reaffirm our partnerships and focus on all that we have to offer.”

(Source: Savoy Stewart)