Understand Your Rights. Solve Your Legal Problems

The latest annual Legal Benchmarking Report from MHA, the UK-wide group of accountancy and business advisory firms, reveals a third year of growth across the sector. However, while large firms continue to dominate the market, the fortune of small firms is more mixed as income and profit levels reduce and their cost base increases.

Overall, firms with five or more partners have experienced significant income growth rates of between 8% and 20%, fuelled by mergers, the volumes of corporate transactions and the improving economic conditions.

As a result, the gap in growth rates of the largest firms (more than 25 partners) compared to those of mid-tier firms (11-25 partners) continued to widen in 2016. Large firms are now nearly three times the size of their mid-tier competitors. The trend for mergers in mid-tier and large firms appeared to accelerate during 2016, and is expected to continue through 2017.

Most firms saw increases in net profits of between 2% to 5%, their highest levels in the last three years. While large firms saw a 4% increase fuelled, in the main, by a 20% increase in fee growth in the year and greater control on expenditure and overhead reductions, those with between 2 and 10 partners achieved an increase of 5%, reflecting decreases in non-salary overheads and fee income increases. In marked contrast, sole practitioners showed a 4% decrease in net profit.

However, firms with four or less partners saw a reduction in income in 2016 (-2%) reversing a trend of low levels of growth in the preceding two years of between 5% and 8%. This reduction reflects the significantly competitive market these firms operate in, and increased regulation and compliance requirements. Alongside the reduction in net profit, they faced significant increases in overheads, including professional indemnity insurance costs.

In 2016, the average income per equity partner in larger firms jumped to nearly £1.4million, from around £750,000 in the previous two years. The performance for those firms with 11-25 partners saw a reduction of 12% compared to 2015. Firms with 5-10 partners continued the trend from last year, with higher levels of average income compared to mid-tier firms, suggesting a drive for consolidation and increased efficiency in this group rather than adding new equity partners to drive growth.

The performance at a profit per equity partner (PEP) level showed a decrease in the smaller firms. Sole practitioners saw the first decrease in PEP performance for five years as it dropped 30% compared to 2015. The largest firms saw a recovery in their PEP performance from a drop of 16% in 2015 to an increase of 36% in 2016, as strong overall profit performance filtered down to the partner level.

Equity partner investment continues to be the favoured method of finance; in 2016 the amount of fixed capital invested in smaller firms was £87,000 and £215,000 in the largest practices. The percentage of total equity partner investment compared to fees increased in 2016, demonstrating a fall in return on capital. In addition, increases in equity funding point to moves to become less reliant on external sources. Total funding per equity partner for the smallest firms has grown from £135,000 in 2015 to £156,000 in 2016. For the largest firms, it has increased from £355,000 to £506,000 in 2016.

The growth in fee income has hit lock-up levels and practices are reporting a rise in lock-up as working capital is needed to pay new fee earners and fund work in progress. Despite a move toward greater control on lock-up resulting in a year on year reduction in the number of days, 2016 revealed a worrying increase with firms of 11-25 partners seeing lock-up increasing by 31 days from 129 in 2015.

The majority of firms have seen a stable level or reduction in salary costs in 2016, with only firms of between 2 and 4 partners experiencing a small increase. This position is in contrast to a broad pattern of increased costs in 2015 for all but the largest firms. In addition, smaller firms have experienced a sharp decline in the percentage of fee earning staff while larger firms continue to see an increase in the ratio which helps to add income onto the top line.

The risk of inadequate succession planning continues to be a challenge for the sector. As the financial performance rates of small and larger firms widen, it will become increasingly harder for small firms to attract new equity partners without adequate levels of profit available to be shared. For sole practitioners, an ageing equity partner base and the lack of appetite from younger solicitors to become sole practitioners in the future, is placing a greater emphasis on succession and investment in the fee earning staff.

Karen Hain, Head of the Professional Practices sector at MHA explains: “While our report reveals a sector in financial health, with performance in 2016 pointing to a positive outlook for the future, firms continue to face a challenging environment. With potential cost implications from areas such as the government’s new Apprenticeship Levy, pension Auto Enrolment, the National Living Wage and business rate assessments, firms will need to maintain control of expenditure if profitability is to be increased.

“There is a level of momentum in new work generation from corporate and property sectors in the economy at present. We expect this to continue, even after factoring in any negative impact from Brexit talks or with the up and coming general election. Competition in the sector is ‘hotting up’ with firms needing to be able to resource new work quickly and efficiently.”

Karen went on to say: “If firms are planning to grow income at similar levels for 2017, they must consider how to fund this growth. We have already seen lock-up increasing so plans need to be made now for additional bank finance or partner contributions before cash runs out.”

(Source: MHA)

According to a recent report by Homeland Security Research Corp. (HSRC), security and public safety organizations are spending large sums of money on big data infrastructure and software, in order to deal with growing global security threats. The rising use of smartphones, computers, and other personal devices is creating huge amounts of data, making it possible to track and analyze potential threats. The research, Big Data and Data Analytics in Homeland Security & Public Safety: Global Market 2017-2022, forecasts that by 2022, spending on big data will reach $11 billion.

The big data trend is leading to new opportunities for intelligence processing, exploitation, dissemination, and analysis. Big data collection improves the investigative capabilities of security and intelligence organizations when dealing with issues of war on crime & terror, cyber defense and public safety.

HSRC forecasts that the big data market will witness rapid growth in APAC and Europe, with an expected CAGR of over 20% for both regions, particularly in China and Western Europe.

The big data report breaks down industry spending by verticals, as follows:

The report also provides a breakdown by data sources, region, leading countries and technology.

(Source: Homeland Security Research Corp.)

Here Debbie Gardiner, CEO of Qube Learning, an Ofsted grade 2 Apprenticeship training provider, explains to Lawyer Monthly the positive impact of Apprentices on businesses across a range of sectors and age groups.

Apprenticeship Reforms commenced on 1st May, which saw a shift in focus, putting employers firmly in the driving seat! Large employers with an annual payroll over £3m started paying a 0.5% Apprenticeship Levy from April and registered on The Apprenticeship Service (TAS). Smaller employers now make a 10% contribution to the price of the Apprenticeship, whilst the government fund the remaining 90%. Additionally, there is a £1000 employer incentive for starting an Apprentice aged 16-18. Micro employers also benefit from 100% funding for their 16-18-year-old Apprentices. Our training and skills development services help our customers to recruit, train and develop their workforce through Apprenticeships; by demystifying Apprenticeship Reforms and bringing a bespoke and flexible offer to the table, whilst bringing about business improvements and a Return on Investment (RoI).

Apprenticeships are an all age programme that can be delivered to new entrants to work as well as developing and upskilling existing employees. They are available from level 2 to level 7; level 2 is entry level aimed at those new to work or in job roles without management or additional responsibilities, level 3 is for junior management and experienced employees, level 4 is management, level 5 senior management and levels 6 and 7 are Graduate Apprenticeships. From an employer perspective Apprentices are beneficial in many ways; improved productivity, customer satisfaction, staff and customer loyalty, sales, profitability and reputation. The employers Qube Learning works with that hire young Apprentices report a reduction in staff turnover, improved succession planning, and how being able to train and mentor a young person means they have a competent and motivated member of staff that adds significant value to their business.

Graduate Apprenticeships are relatively new; we anticipate much growth in these Elite Apprenticeships in the coming years. The most effective Graduate Apprenticeship programmes happen when there is a four-way partnership; a Training Provider (Qube), a University (the University of Surrey has partnered with Qube), an employer who wants to use the Graduate Apprenticeship scheme in place of their traditional graduate recruitment/training programmes (or wants to embark on the graduate route for the first time), and finally a Student who prefers the Graduate Apprenticeship route to the traditional University one. This is more so with Graduate Apprentices, who don’t finish with a debt and learn the valuable practical skills throughout.

We work with many credible brands in aiding the implementation of a scheme. Hitachi Capital Consumer Finance (Qube Newcomer of the Year 2016) selected Qube Learning to give the finance business’ employees the opportunity to embark on Apprenticeship programmes. The successful bid by Qube saw 56 employees from the Hitachi Capital Consumer Finance on their way to completing an Apprenticeship by the end of 2017, a number that the company expects to see increase as people begin to see the benefits and understand the Qube way of training. Jason Bell, L&D Partner at Hitachi Capital Consumer Finance, says “the Apprenticeship programme builds self confidence in the induvial as they benefit from learning in the workplace. We’ve seen how beneficial this can be in terms of employee engagement and reducing staff turnover as Apprentices are stretched and challenged. Additionally, customer service levels have improved because of the training undertake as part of the Apprenticeship programme; we see a massive value in Apprenticeships."

Avery Healthcare Group (Qube Large Employer of the Year 2016) has worked with Qube to develop a 16-18 years Apprenticeship programme which attracts young people to join them and, in many cases, build a career with them. This is an innovative approach to the recruitment of young people in the health and social care sector and shows Avery Healthcare is leading the way. Avery has clearly demonstrated its ongoing commitment to Apprenticeships and training by supporting over 700 employees with their Apprenticeships.

Milton Keynes University Hospital NHS Foundation Trust (Qube Public Sector Employer of the Year 2016) has been working with Qube since 2009 and recently have been a key part of Qube’s Apprenticeship Funding Reform consultation groups. The Trust has utilised the Apprenticeship programme to improve customer service and administration skills across the hospital. The management team at Milton Keynes Hospital actively promote Apprenticeships through celebrating learning events and encouraging colleagues to develop new skills. The hospital embrace Apprenticeships and see the benefit in staff earning whilst they learn and gaining nationally recognised qualifications; they’re proud of what their Apprentices have achieved and can site increased motivation and career development as tow of the benefits.

Qube Learning itself recruited two young Apprentices in 2015, both achieved their Business Administration Apprenticeship and now have full time permanent jobs with the company. In 2016 Qube recruited three young Apprentices; one in HR and two in the Data team, and they are still on an Apprenticeship programme, adding value and are important members of the team.

The Commission presented a package of measures to make the Single Market work better for citizens and businesses.

The Single Market is one of the EU's greatest achievements. It enables people, services, goods and capital to move freely. It has fuelled economic growth and made the everyday life of European businesses and consumers easier. A functioning Single Market stimulates competition and trade, improves efficiency, raises quality, and helps consumers benefit from more varied and better priced products and services.

Despite the overall success of the Single Market, its benefits do not always materialise because rules are not known or implemented, or they are undermined by other barriers.

Last week the European Commission continued to deliver on its Single Market Strategy - the Commission's roadmap to unlock the full potential of the Single Market.

The package of measures adopted will make it easier for people and companies to manage their paperwork online in their home country or when working, living or doing business in another EU country and it will help ensure that commonly agreed EU rules are respected.

The three concrete initiatives adopted by the Commission are:

A Single Digital Gateway

In the future, people and companies will have easier access, through a single digital entry point, to high quality information, online administrative procedures and assistance services. Key administrative procedures will have to be made available online, including requests for a birth certificate, to register a car, start a business or register for social security benefits. The Single Digital Gateway could help companies save more than EUR 11 billion per year, and EU citizens up to 855 000 hours of their time annually.

A Single Market Information Tool

Single Market rights, for people as well as companies, can only be fully exercised if the commonly agreed rules are fit for purpose and correctly applied throughout Europe. To ensure this, timely access to comprehensive, reliable, and accurate market information is crucial. The Single Market Information Tool will allow the Commission, in targeted cases, to source defined and readily available data (such as, for example, cost structure, pricing policy or product volumes sold) in cases of serious difficulties with the application of EU Single Market legislation.

A SOLVIT Action Plan

The Commission will build on the success of SOLVIT, a free of charge service which provides rapid and pragmatic solutions to people and companies all over Europe when they experience difficulties with public administrations while moving or doing business cross-border in the EU. The Action Plan aims to increase the use of SOLVIT by making sure that more citizens and businesses can easily access it and by improving data collection so that evidence from SOLVIT cases can be used to improve the functioning of the Single Market.

(Source: The European Commission)

Here below Lawyer monthly has collated a number of short responses from highly esteemed legal professionals, in answer to the question: What led you to embark on a career in the legal sector? Whether law runs in the family or a succinct moment in time gave them vision, these lawyers, from all around the world, all started somewhere.

Last week, it was revealed that the car finance industry is the latest to reportedly be lending irresponsibly. Here Wagonex explains to Lawyer Monthly why and how this sheds light on fresh emerging opportunities for business fleets and employee benefits.

Car finance has seen the fastest expansion of consumer credit, followed closely by personal loans and credit cards. By last November the annual growth of consumer credit had reached 10.9% - the fastest rate since 2005, when household debt was building up to the financial crash.

Advances on car loans have reached a staggering £32.7 billion, and 60% of cars are currently financed through car finance agreements. Dealers are accused of inflating interest to 9.4% when the best price found online was 3.2%.

As pay increases hang in the balance and households up and down the country feel the pinch at the rise in prices of food and clothing – it’s hardly likely that car finance deals with inflated interest are going to be an affordable commodity. The issue is, that for many working families and parents, a car is a lifeline for travelling to work and ensuring children get to their places of education safely, and on time.

While many businesses have previously offered employees, salary sacrifice schemes to help meet the costs of modern necessities such as these, as well as saving tax; the wide adoption of these schemes has meant that the Government has found it increasingly difficult to track how much tax it is losing – because firms are not reporting how much both them, and their employees are saving.

In the 2016 budget, it was revealed that the UK Government plans on limiting the range of benefits that attract tax savings through salary sacrifice. The good news is that employers will not be blocked from offering salary sacrifice schemes for cars, and those that are currently in place are protected, but it does mean that the financial incentive for businesses to do so, has decreased. It has also been announced that salary sacrifice for ultra-low emission cars will not be affected.

With the financial reward landscape looking so bleak, many employers are looking for alternative ways to keep staff productive and motivated. Company cars or a car allowance have long been considered to be a much sought after staff benefit, and Capita have previously reported that 66% of staff say that they would be more likely to stay with an employer that offered good benefits. It’s a well-known fact that employee retention is far healthier for a business’s bottom line; in fact, a report by Oxford Economics revealed that replacing a member of staff costs a business a total of £30,614 per employee, through lost output and the logistical cost of recruiting and absorbing a new worker, making hiring a very costly exercise.

Of course, if employees opt for a car allowance rather than a company car, then they could choose to take a car on finance – which given these vastly inflated costs that are associated it could mean that they are worse-off financially. Especially when you consider the added extras that provide stability and peace of mind such as maintenance, servicing and roadside assistance – all of which make a personal car through a car allowance as worry-free as being provided with a company car.

But there are now alternative options beginning to appear on the horizon. Following in the footsteps of Cadillac, who have recently launched a similar plan in America, the UK will soon have a car subscription service that leverages new use-models that have become increasingly popular with more consumers over the last five years.

Car subscription services are a strategic initiative to align car ownership with modern demands, values and expectations, as well as offering true price transparency. The service enables drivers and employers to change their cars as and when their needs change. This could include using an impressive, top of the range motors for employees to use as a perk, or when board members/prospects visit from abroad, to more economical vehicles for days, weeks or months when travel becomes extensive, and even larger vehicles when there is a number of staff travelling to one location for trades shows and conferences.

Of course, when used through a car allowance, it enables employees the chance to change their minds as they please, adding to the work/life integration that is so highly sought after.

It is widely thought among those who are advocates of these new subscription services, that this new model is going to be particularly appealing to the millennial, or Gen Y generation, who value experience over ownership. As the workforce is now made up of around one- third of millennials, it’s vital that employees make a shift in their offering to first attract this generation of talent by offering benefits that meet their expectations.

Car manufacturers are also looking at this new flexible ownership model, with Hyundai having launched their pilot program in January of this year in California.

With the FCA investigation highlighting the fact that we have been taken advantage of yet again, it won’t be long before the masses, individuals and business included, leave the outdated car ownership models, and the hassles that come with them behind.

The United States spends $218 billion each year on food that is never eaten. The nation's staggering food waste problem reflects chronic inefficiencies in the American food system—40% of food produced in the US ends up in the landfill at the same time that one in seven Americans faces food insecurity. The US currently uses 20% of its agricultural water, cropland, and fertilizers just to produce wasted food. In Opportunities to Reduce Food Waste in the 2018 Farm Bill, the Harvard Law School Food Law and Policy Clinic (FLPC), with support from ReFED and Food Policy Action (FPA), identifies opportunities to reduce food waste that Congress can implement through the next farm bill, the nation's most influential food and agricultural bill, which is up for reauthorization next year.

The farm bill is an omnibus piece of legislation that shapes our entire food system, regulating a range of programs from crop insurance to the Supplemental Nutrition Assistance Program (SNAP, formerly food stamps). The last farm bill was passed in 2014, allocating nearly $500 billion over five years to food, nutrition and agriculture. Yet, none of these funds went toward efforts to ensure that the food produced was actually consumed.

Opportunities to Reduce Food Waste in the 2018 Farm Bill focuses on recommendations that provide ways to reduce food waste at its source, help surplus food get to hungry people, and divert food waste from the landfill. "The US simply does not have policies in place to manage food waste and its ramifications. It's time for Congress to demonstrate its leadership by addressing this pervasive national challenge," says Emily Broad Leib, Director of the Harvard Law School Food Law and Policy Clinic. "By adopting just some of the measures we suggest, Congress can benefit the American people, the planet, and our economy all at once."

Many of the report's recommendations are based on groundbreaking food waste reduction research conducted by ReFED and published in their 2016 report, A Roadmap to Reduce US Food Waste by 20 Percent. Chris Cochran, Executive Director of ReFED, explains, "The US food waste problem is so systemic that it seems overwhelming. Our Roadmap identified implementable steps for reducing food waste across the food system. Opportunities to Reduce Food Waste in the 2018 Farm Bill takes that a step further, locating policy opportunities to incorporate the Roadmap's solutions into the next farm bill."

The report presents a range of different solutions, from small modifications that incorporate food waste reduction efforts into established programs, to new initiatives that could catalyze larger-scale food waste action and awareness. "It's not every day that Congress has the chance to support proposals that have such overwhelming public support and will do so much to reform existing food policy," said Willy Ritch, acting Executive Director at Food Policy Action. "Congress can either create an entirely new Food Waste Reduction section of the farm bill to adopt these recommendations or incorporate them into the existing titles in the bill—either way this is a great opportunity to significantly reduce the amount of food that goes to waste in this country."

Food waste reduction has all the ingredients necessary to become a successful bipartisan effort. Executive agencies and the private sector have both taken action against food waste. In 2015, the USDA and the EPA jointly announced the nation's first-ever food waste reduction goal, and last year 15 major companies, including Campbell Soup Co., Kellogg, PepsiCo, and Walmart, pledged to cut their food waste in half by 2030. Food waste is also frequently appearing on the agenda for state governments, with food waste legislation pending in more than a dozen states. Even so, goals to reduce food waste will not be met without concerted action from the federal government. Opportunities to Reduce Food Waste in the 2018 Farm Bill offers Congress a menu of specific policies, all implementable in the upcoming farm bill, to reduce the astonishing amount of US food waste for the good of the American people, the planet, and the economy.

(Source: The Harvard Law School Food Law and Policy Clinic)

Despite the promise of new information technologies, governments, non-state actors, and corporations worldwide are censoring vast amounts of information using complex and sophisticated tactics.

The 2017 edition of Attacks on the Press, published last week by The Committee to Protect Journalists, chronicles singular methods of controlling the flow of information, including financial pressure on journalists and news outlets, exploitation of legal loopholes to avoid disclosure, and wielding copyright laws and social media bots to curb criticism.

The book, subtitled “The New Face of Censorship,” features articles by Christiane Amanpour, Rukmini Callimachi, Jason Leopold , Alan Rusbridger, and other leading journalists. It features an essay by David Kaye, UN special rapporteur on the promotion and protection of the right to freedom of opinion and expression, looking at the laws and institutions that are fighting to protect free expression. Chapters spotlight the media environment in countries including China, Egypt, Mexico, North Korea, Russia, Syria, Turkey, and the United States.

“Following the election of Donald Trump, the rise of fake news and the hostile environment for journalists created by Trump's rhetoric has raised concerns in the United States. But around the world the trends are deeper, more enduring, and more troubling,” said Joel Simon, CPJ's Executive Director. “While we are awash in information, there are tremendous gaps in our knowledge of the world—gaps that are growing because of violent attacks on the media, new government systems of information control, and the power of technology to censor and surveil.”

(Source: Committee to Protect Journalists)

This week is Mental Health Awareness Week across the globe, and is an opportunity to highlight serious misunderstandings about mental health, especially in the workplace.

A recent survey asked 1,104 British adults in full-time employment about their attitudes to mental health. Around 49% said they would likely not tell their boss about problems such as anxiety, depression or bipolar disorder.

Below Lawyer Monthly hears from a number of specialists on the stigma attached to mental health issues and just why it still persists as a workplace taboo.

David Brudö, CEO and Co-Founder, Remente:

Unfortunately there is still a stigma attached to having a mental health problem, and often employees would rather not acknowledge them or don’t have the right tools and understanding of how to handle these issues. Efforts in mental health are focused on healthcare as opposed to wellbeing, and the suffering that this caused people because they didn’t have the correct tools to manage their mental wellbeing.

I have personally experienced mental health issues at work. I started my own business in e-commerce a few years ago, but as much joy as you get from running your own business, it can be stressful and demanding. My work was all-consuming and I wasn’t prepared for the mental strain of running my own business. It reached a point that I had a lot of work-related stress, I was really burnt out and eventually hit a brick wall. I didn’t know where to turn to at this point, eventually seeking psychological help. This is also a reason why I developed the app, with the aim to help individuals and businesses achieve their full potential with the help of a digital tool.

I want to democratise mental wellbeing. While many businesses have done a lot to ensure that the physical health of their employees is at the forefront, not enough has been done to put mental wellbeing on a level with the physical.

Companies should also adapt their working practices to help those suffering from mental health conditions, and give more room for an open discussion of mental health problems.

Mental health is a sensitive subject, many don’t want to talk about their problems, especially at work, where it is harder to approach the subject. According to a study by a mental health charity, 95% of employees that call in sick due to stress gave another reason.

Rhiannon Cambrook-Woods, Managing Director, Zest Recruitment & Consultancy LLP:

The legal sector is synonymous with being a high-pressure and demanding environment. But the perception that career progression is the reserve of those who can consistently demonstrate the ability to thrive in these conditions, without recourse, means that some lawyers may be afraid to come forward and admit to experiencing any form of mental health issue; they would rather suffer in silence than ‘risk’ jeopardising their future prospects. It is a fear of failure, a fear of stand still.

Perhaps the biggest reason why mental health remains taboo is because of the way in which the legal sector itself has evolved in recent years. There has been a spate of mergers and acquisitions over the last few years, with smaller firms looking to go regional or national, national firms looking to diversify or eye up global expansion, or the merger simply happened because of financial pressures.

On the face of it, these are sound strategic moves but what they highlight is the degree to which the legal sector has become increasingly competitive. As firms face the constant pressure to be better, offer more and become more financially sound it is the lawyers on the ground that bear the brunt of this growing demand.

While awareness of mental health is certainly increasing, more should be done to overcome many of the misconceptions that people have. Employers and employees alike need to be better educated on what it means to suffer from a mental health issue. They need to understand why unhelpful comments such as ‘cheer up’ or ‘pull yourself together’ are unacceptable – sufferers can’t simply ‘snap out of it’.

There also needs to be a marked shift in the way that mental health is positioned in the workplace. It needs to be made clear that mental and emotional health is taken just as seriously as physical health. Employees also need to know who they can speak or turn to for support and help. The greater the awareness and better the understanding, the easier it will be for sufferers to come forward and get the help they need and that benefits not just the individual, but the rest of team and firm too.

Susan Scott, business psychologist and author of 'How To Have An Outstanding Career', www.youngprofs.net:

You’ve got it all wrong! Mental health is not a serious, possibly dangerus personality disorder such as manic depression, schizophrenia or psychosis that may tell an employer you’re not up for the job. Mental health is actually positive. When your mind is working well, you can think clearly and focus. You feel ‘on the ball’ and can cope well with pretty well whatever’s thrown at you. The taboo is there because it hasn’t been properly defined!

Worse still – the taboo exists because it’s related to the mental conditions mentioned above, yet these only accounts for about 10% of cases. But that isn’t the whole story.

Mental ill-health is more commonly down to stress, anxiety and depression.

Lawyers are stressed – it’s official! They work long hours doing intensive work and this puts their health and career at risk. Recent research of Young Professionals conducted across all sectors in April 2017 to coincide with the launch of my new book – How To Have An Outstanding Career –showed 29% feel unable to cope with the pressures and demands of the job. It’s likely to be even higher for young lawyers based on my experience of working with Young Professionals in this industry.

Young lawyers are typically hard working, driven, intelligent, competitive and highly aspirational. Above all they are tenacious, and keep on doing what they need to do to get to where they want to get to…and it’s this that causes the stress. Yet the reality is if they burnout their career is cut short almost before it has started and their employer also suffers because they lose valuable talent.

My experience working with young lawyers has found the following:

Clearly, I would argue that this leads to a toxic situation and culture within many firms. The answers are complex, but a good start can be made if partners and managers really take the time to listen to their staff...and avoid judging them, when they express doubts and worries.

Dr David Lewis, Co-Founder, The Mind Changers:

In the 17th century, the wealthy would flock to asylums, such as St Mary’s Bethlem (the original Bedlam) to be entertained by the antics of their inmates. However, today we are more likely to stigmatise than to mock.

Mental health is still a taboo as those who are, or have been, mentally ill are perceived as different, disturbing and potentially dangerous.

With a few exceptions (the scars of self-harming for example) the mentally ill differ from the well only in their behaviour and utterances. This combination of sameness and otherness is, for some, profoundly disconcerting.

Sufferers are often blamed for their condition. They have behaved badly, for example by taking drugs or drinking to excess, or have become possessed by the devil.

The mentally ill are also seen, as WWI psychiatrists’ put it, of ‘lacking moral fibre’. Anxiety, for example, is considered a sign of weakness in men and hysteria in women.

Such ignorance adds to the unease felt by many. Lurid headlines about ‘madmen wielding axes’ can quickly transform that unease into fear.

“As you are now so once was I,” runs the epitaph on an old gravestone. To which we might add: “As I am now so may you be…”

Remembering this truth may help the mentally healthy to stigmatise less in the workplace and empathise more.

Wyn Morgan, Founder, Wynning:

It’s mental health awareness week – so a very timely week to look at this important issue. What makes it important? According to the The Adult Psychiatric Morbidity Survey published in 2016 (the most quoted survey on Mental Health matters, and used by the mental Health Foundation); 1 in 6 respondents said they had a mental health problem in the week prior to taking the survey. That’s not 1 in 6 anytime – that’s 1 in 6 in a given week! Over 43% of respondents of adults think that they have had a diagnosable mental health condition at some point in their life. Any yet we are more likely to talk about our sex life, salary and bank balance than our mental health.

While thankfully it is changing, and becoming less of a taboo, given how it is likely to be affecting many people you know directly right now, and will affect many more during their lives (approximately 77,400 readers of this very publication in fact) - it’s time we all quit feeling we can’t talk about this.

In talking with corporations and individuals about the link between mental wellbeing and performance at work for the past 16 years, it’s struck me how often people feel ashamed to admit their stresses, their anxiety, worries, depression etc.

I recently held an optional session on stress at the end of a training workshop on ‘What drives performance at work’. I had no idea how many would attend this bonus session. All but one of the 18 participants stayed until 9pm to learn the truth about stress (and the one who didn’t stay had a prior commitment). It shows to me, that given the opportunity, people are willing to talk and share their mental health experiences. We need to make it ok to do it and to offer people the environment to be open.

One reason we don’t talk is that we think we are to blame and that we are weak to suffer from any mental health issue.

I’m delighted to tell everyone I speak with that they are wrong. No one is to blame for whatever they are facing. In no way does it make us weak. Let’s take each one in turn.

Blame? Seriously, did anyone ‘will’ a mental health issue on themselves? No. It’s a complete myth. We are all off the hook when it comes to this – none of us ‘had it coming to us’ due to karma, superstition, genetics or anything else.

Weak? No one who suffers from a medical health issue is facing it due to being weak. The lack of mental wellbeing can strike anyone and everyone at any time. It is as undiscerning as any randomly occurring disease.

Can you recover? Yes. Absolutely. Can anyone resume work normally? Yes. Absolutely.

Anyone who has a mental health issue is guilty of one thing and one thing only – being human. It’s time we stopped thinking otherwise.

Talking openly about mental wellness and mental health issues will stop it being a taboo and help people get the support they need to get back to their innate mental wellbeing.

Louise Aston, Wellbeing Director, Business in the Community:

Last year, Business in the Community’s (BITC) Mental Health at Work survey found 77% of employees have experienced symptoms of poor mental health in their lives and 62% attributed these symptoms to work or said it was a contributing factor, but just 11% of employees discussed a recent mental health problem with their line manager and 35% did not approach anyone for support. People are suffering in silence, unable to access timely support because they feel unable to disclose.

One of the biggest barriers to addressing this is the persistent stigma around discussing mental health at work; Mind has found that 95% of employees who call in sick due to stress have told their manager it’s something else. Yet one in four people and one in six workers experience mental health issues such as stress, anxiety and depression.

There are many myths surrounding mental health in the workplace. For example, there is a perception that disclosing a mental health problem at work shows weakness and signals the death of your career. Yet mental ill health affects employees at all levels of seniority, and people can recover their performance at work after a period of poor mental health or time off for a stress-related condition.

We all have mental health and physical health, and treating both on parity is part of being a responsible employer. Just because mental health is on a continuum, rather than being black and white in the same way as a broken limb, doesn’t mean it should remain invisible or be used as an excuse to write people off.

BITC is asking our member organisations to sign up to the Time To Talk employers’ pledge, demonstrating their commitment to changing how we think and act about mental health at work and support employees facing mental health issues, and encourages legal sector employers to do the same. We also have a new suite of toolkits, published in partnership with Public Health England, which support employers to take a ‘whole person, whole systems’ approach to mental health.

We are at a tipping point on mental health, thanks to awareness-raising initiatives such as Heads Together and the Prime Minister’s recent mental health legislation pledge. I am confident we are about to turn a corner, but we can only do so if business does not ignore this pressing issue. Only then will we end the injustice of people suffering in silence.

James Storke, Employment Partner at Lewis Silkin LLP:

As employees are working harder than ever, it is not surprising that that mental health issues are becoming increasingly common in the workplace. In fact, it is estimated that one on four people in the UK will experience a mental health problem in any given year. However, whilst mental health issues affect so many people, both employees and employers are often reluctant to fully acknowledge and engage with the subject.

For employees, there is a serious concern about the stigma attached to mental health conditions. Many employees fear they that if they told others about their mental health issues, they may be perceived as weak, unreliable or unpredictable. A reported prepared by Business In the Community (BITC) found that whilst stress is estimated to account for 43% of all working days lost to ill health, 95% of employees cited a reason other than stress for their absence due to the stigma associated with the condition. Sadly, it appears that the concern about stigma is well-founded as a survey by Unum found that 56% of respondents said that they would not hire someone with depression even if that person was the best candidate for the job.

Whilst the stigma issue makes employees reluctant to discuss their mental health, it is only part of the reason that there is a culture of silence regarding mental health in many workplaces. First, it appears there is still a disconnect on how employers and employees perceive their organisation’s attitude to mental health. In a BITC report, it found that 60% of board members and senior managers believe their organisations support people with mental health issues, but despite this, it found that only 11% of employees discussed a recent mental health problem with a line manager and half said that they would not do so.

Second, managers are often reluctant to discuss mental health issues with their employees. In many cases, this will because it is human nature to seek to avoid potentially difficult or sensitive topics. In other cases it will be due to fear of saying the wrong thing, making the situation worse or even getting the blame for causing the issue in the first place. Therefore, employers need to train their managers to both spot the early signs of mental health issues and to give them the confidence and skills to be able to have meaningful conversations with their staff about mental health.

Creating a culture of openness about mental health takes time and effort, but those employers who are willing to make that investment will reap the benefits have having a healthier, more engaged and more productive workforce with reduced sickness absence and staff turnover costs.

We would also love to hear more of Your Thoughts on this, so feel free to comment below and tell us what you think!

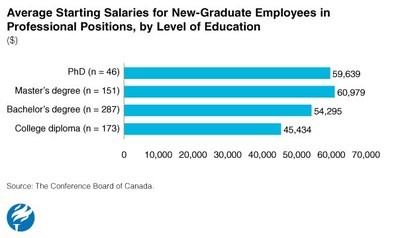

As a fresh crop of students complete their studies this spring, a new report by The Conference Board of Canada indicates that recent graduates with a bachelor's degree can expect to earn an average annual starting salary in the range of $45,000 to $69,000. These numbers are slightly lower for those graduates with a college degree, and are higher for those with graduate degrees.

"Many young Canadians are experiencing difficulties integrating into the workforce or are underemployed in the current job market," said Allison Cowan, Director, Compensation Research Centre, The Conference Board of Canada. "Despite these difficulties, many organizations are actively seeking highly educated millennials and are increasingly willing to pay a premium for new graduates to mine their specialized skill sets in areas such as technology and engineering."

Highlights

The unemployment rate remains highest among young Canadians and about one in five of them are underemployed or working part-time involuntarily. However, with rates of retirement expected to reach almost one-tenth of the workforce over the next five years, employers will be looking to the younger generations to fill entry-level positions.

The report, New to the Workforce: Compensating and Developing Recent-Graduate and Student Employees, outlines the salaries and hourly wages earned by both new-graduate and student-level employees based on a national survey of Canadian employers. Starting salaries tend to be highest overall in specialized positions such as geology ($69,736) and engineering ($65,183). The highest starting salaries for new graduate employees in corporate positions can be found in the legal function and the lowest average starting salaries are in administrative support roles.

Both employers and students have expressed concern with the school-to-work transition and many organizations are working alongside educational institutions for solutions to better integrate entry-level employees into the workforce. It is common for organizations to offer co-op, internship, and summer work opportunities, while others are offering rotational programs for new entrants into the workforce. Almost a quarter of responding organizations indicated they have some form of rotational program for entry-level hires, where they provide the opportunity to cycle through different departments and roles. These programs often lead to permanent employment for new graduates, as more than 40 per cent of organizations reported hiring employees from these programs on a permanent basis upon completion of the program.

This research was conducted by The Conference of Canada's Compensation Research Centre (CRC).

(Source: Conference Board of Canada)