Understand Your Rights. Solve Your Legal Problems

This week the Supreme Court upheld a challenge by Unison that employment tribunal charges were discriminatory.

The government is now due to scrap employment tribunal fees and pay back around £27 million in previous fees.

The court has ruled that the government was acting unlawfully and unconstitutionally after bringing in the fees, some of up to £1,200, in 2013 for things like unfair dismissal, equal pay and redundancy.

The fees have since seen claims in employment tribunals drop by about 70%, resulting in the argument that the fees themselves impeded access to justice.

Elaine Motion, Executive Chairman of Balfour+Manson, said the unanimous 7-0 decision sent out a clear message that the controversial decision by the UK Government to introduce tribunal fees in 2014 was wrong under both domestic and European law.

“The UK Supreme Court has decided unanimously that imposing significant fees has had a detrimental effect on access to justice,” said Mrs Motion, who represented one of the unions involved in bringing the legal challenge.

"This is the one of the most significant judgments in employment law in the modern era. All the evidence pointed to fees denying the principle of access to justice - and the Supreme Court's decision is therefore a resounding victory for justice itself."

Below, legal experts have provided their thoughts to Lawyer Monthly.

Richard Nicolle, Employment Law Partner, Stewarts Law:

This ruling will leave many employers who have been stung by vexatious employment law claims in the past living in fear of a rise in costs to their businesses. Our analysis of the data shows that the success rate of cases making it to tribunal since the introduction of fees did not rise as might have been expected – suggesting vexatious and valid claims were being equally deterred. Today’s ruling determines that the cost of delivering that objective was too great in restricting access to justice and the protection of employee rights.

The Court has suggested that it is wrong to think that it is only those who use employment tribunals that benefit from them. When a tribunal’s focus is to uphold the law in relation to circumstances such as protecting the rights of the worker, the tribunal is in fact protecting the rights of all workers and not just those whose rights have been neglected.

It remains to be seen whether the Government will now drop tribunal fees in their entirety or seek to introduce them in a revised version which addresses the concerns set out in the Supreme Court’s judgment. Given the other higher priority objectives on the Government’s agenda it may be that this particular issue is put to one side for at least the medium term. That the Order has been quashed leaves open the possibility that fees are removed in this period of uncertainty.

Suzanne Horne, Head of the international employment practice, Paul Hastings:

This is an incredibly significant decision for employers but just how momentous the fallout will be remains to be seen. Before all else, the government will be obliged to pay back all fees obtained since 2013. However, this may be just the tip of the iceberg as lower paid potential claimants, turned off previously by exorbitant Tribunal fees, enter the fray with union backing. Fundamentally, though, it is still unclear whether those who did not bring a claim in the last three years because of the fees will be able to submit a claim given that most will be out of time.

Tribunal fees have long since been described as preventing access to justice– a fact clearly evidenced by the seismic reduction in claims since their introduction. And today, the second tier fees have also been held to be indirectly discriminatory to women. Given it was a Labour manifesto pledge to abolish the fees, this setback for the Conservatives could be the first real test for the fragile coalition. Under normal circumstances, the Government would attempt to rush through new legislation to re-design the fees regime and limit claims pre-dating this decision – however Theresa May’s slim majority makes this difficult. Whatever their next steps are, today’s ruling may soon transform the trickle of tribunal cases into a deluge.

Tabytha Cunningham, Associate Solicitor, Coffin Mew:

Tribunal fees have always been controversial. In this case, ultimately the Government could not convince the Supreme Court that its objectives in introducing fees, such as to reduce vexatious claims, had been met. It found that the fee system was set at an unaffordable level and could create impossible situations for many employees, for example where a claim is worth less than the fees payable.

It also felt that the Government had overlooked the importance of an effective system for society, and that lack of access to justice could encourage employers to act without fear of repercussions.

The unprecedented drop of approximately 70% in claims when fees were introduced clearly supports the Supreme Court’s decision that these fees reduced access to justice.

In the longer term, it’s unlikely that fees will be abolished completely. The problem is the suitability of the current system, not paying a fee in principle. We expect that the Government will now consult on an alternative system, most likely with fees at a lower level, or with a reciprocal requirement for employers to also pay fees to level the playing field.

In the short term, however, employers should brace themselves for a surge in Employment Tribunal claims.

Christina Tolvas-Vincent, Partner, Bond Dickinson:

The Supreme Court has today handed down its decision in R (on the application of UNISON) v Lord Chancellor. The issue was whether fees imposed by the Lord Chancellor in respect of proceedings in employment tribunals (ETs) and the Employment Appeal Tribunal (EAT) are unlawful because of their effects on access to justice.

Fees were imposed in July 2013 under the Employment Tribunals and the Employment Appeal Tribunal Fees Order 2013 (Fees Order). Claimants have to pay up to £1200 to issue a claim and have it heard in the ET. Fees are also payable for bringing an appeal in the EAT. Fees can be fully or partially remitted depending on the income and capital of the claimant and their partner, and the number of children they have. A fee can also be remitted in exceptional circumstances.

UNISON applied for a judicial review of the Fees Order and argued that it was not a lawful exercise of the Lord Chancellor's statutory powers because the fees interfered unjustifiably with the right of access to justice under the common law and EU law, frustrated the operation of legislation granting employment rights, and discriminated unlawfully against women and other protected groups.

The High Court and Court of Appeal both rejected UNISON's application. The Supreme Court unanimously allowed UNISON's appeal, finding that the Fees Order was unlawful under domestic and EU law because it prevented access to justice. It must therefore be quashed. The Supreme Court pointed out that fees bear no relation to the value of the claim and therefore act as a deterrent to claims for small amounts of money or non-monetary remedies. The evidence showed that the effect of the Fees Order was a dramatic fall in the number of claims and it contravened the EU law guarantee of an effective remedy before an ET. It was also indirectly discriminatory because the higher fees for discrimination claims put women at a particular disadvantage. This is because a higher proportion of women bring these claims than claims that attract lower ET fees.

The Lord Chancellor previously gave an undertaking to repay all ET fees paid since 2013 if the Fees Order was found to be unlawful and the Government will need to set up a system for repayment. It is unclear what will happen where a claimant was successful in the ET and the respondent employer reimbursed the fees. We are likely to see an increase in ET claims, as fees will have to be abolished with immediate effect, and the Government will presumably now give some thought as to how it can implement a lawful scheme for ET fees, perhaps by introducing a scale of fees linked to the value of claims.

A UK Bar Council spokesperson:

This decision from the Supreme Court is welcome to all who believe in the fundamental importance of the rule of law. There are broad and encouraging implications for those of us that believe in the case for increasing access to justice in our society. The decision makes it clear that in order for the Courts to perform their role of ensuring the law is applied and enforced, people must have unimpeded access to the them. Charging fees which deter or prevent access is unlawful, and undermines the government of society by the rule of law.

In addition, and specifically, we welcome the fact that in relation to issues that arise in the work place, the Supreme Court has ruled in favour of giving people who face age, sex or race discrimination the right to challenge their employer without being deterred by high tribunal fees.

Ruth Kennedy, Barrister in the employment team. 2 Temple Gardens:

The Supreme Court’s recognition today of the profound impact that the Fees Order 2013 has had on access to justice is a huge step forward for UK employment law.

It also clearly demonstrates that the courts are prepared to intervene when the Lord Chancellor seeks to use his powers, using blunt tools to reduce the cost to the state of facilitating litigation.

Now the Lord Chancellor will have to honour his predecessor's promise to pay back the fees already paid, which is sure to be a costly endeavour.

However, this ruling still does nothing for the claimants that would have brought claims, but for the fees.

With rising cyber concerns among businesses worldwide, security is becoming more and more of a priority, but has the issue always been this prominent, with the need for burglar alarms? What’s worst, having your fleet of devices stolen, along with mouse and keyboard, or have the data stolen and usurped? Here Lawyer Monthly has heard from Darren Guccione, CEO of Keeper Inc., who answers the question: is cyber protection more important than having a burglar alarm at the office?

Cyber protection is more important than having a burglar alarm in the office. Many organizations spend a tremendous amount of money and time preparing for disasters such as theft, tornadoes, earthquakes, fires and floods without protecting their digital assets and the PII (personally identifiable information) of their employees and customers. The fact is, the chances are greater a computer security incident will occur than any one of these scenarios.

According to the Ponemon Institute, the impact of cyber threats is rising, with the average cost of a data breach now over $7 million. The exposure businesses can face in the event of a data breach include direct and cross-claims relating to costs incurred to investigate and mitigate damages that could be attributed to the breach, indemnification from individual or class action lawsuits filed against the business by employees or customers, and penalties for violations of government regulations. Other damages can include reputational damage and network damage.

On average it takes 46 days to resolve a cyber attack at an average cost of $21,155 per day. Furthermore, 76 percent of consumers say they would move away from companies with a high record of data breaches and business disruption accounts for 39% of total external costs. If a business is disrupted during its busy season the cost could affect more than half the business’s annual income.

It is clear from this data that a significant data breach can put an organization out of business. A frustrating fact is that there are simple measures a company can take to prevent breaches.

For instance, a startling report by the Ponemon Institute, sponsored by Keeper Security, titled ‘The 2016 State of SMB Cybersecurity’, found that 50% of SMBs (Small and Mid-sized businesses) have been breached in the past 12 months. Considering more than 80% of breaches are due to weak or poor password management it was a shock to find out that 59% of SMBs have no visibility into their employee password practice and hygiene. In fact, 65% that have a password policy do not strictly enforce it.

In a modern digital world adding a strong cyber defense, by adopting a password manager such as Keeper, is more valuable to a business’s overall security than a burglar alarm.

Whether it’s an interview at a local bar, or an interview at Google, there’s always the usual advice for nailing the job, but when it comes to being interviewed at your dream law firm, you need the right advice. Charles R. Toy, Associate Dean of Career and Professional Development at Western Michigan University-Cooley Law School has seen many come and go, and has all the best tips for standing out amongst the rest.

You meticulously follow application instructions. You submit a relevant and errorless resume. Your exacting work achieves your desired result – an interview!

Now what? Your job search process advanced a quantum leap from distant to face-to-face. You no longer have spell-check or numerous redrafts – now the perspective is personal, verbal, and dynamic. You can flourish at this next level by using these tips to nail your interview.

Be Prepared. You already started this key component by researching the employer to match your application materials to the position. Now is time to refine the scope and depth. Research the potential interviewers, specific cases handled by the employer, major clients, and law firm profiles. Do not beat the interviewer over the head with this information, but casually use this information in a conversational manner to answer questions or give examples. Begin to think and effortlessly speak in the employer’s vocabulary.

Speak to networking contacts that may have information about the employer or interviewers. Find these informed contacts using LinkedIn or your law school’s alumni database. These contacts may know about firm or corporate culture. By seamlessly speaking in the language used by the employer, the interviewer will feel more at ease and conclude that you are a great fit for the law firm.

Practice interviewing skills. Make an appointment with a career advisor at your law school to schedule a mock interview. Prepare concise statements of your key achievements or times you demonstrated sought-after qualities. Anticipate difficult questions and rehearse your answers. Use your research about the employer to form thoughtful questions to ask during the interview. Think about what you are asking and what you hope to learn with the answer. Incorporate questions from the interview – it clears up any uncertainty and it demonstrates that you were listening.

Learn different interviewing techniques and be prepared for any type of interview. Know how to answer behavioral based interview questions to highlight your best characteristics or what you learned from a challenging event. Frame your answer by stating the situation to give context, what needed to happen, what you did to address the situation, and the outcome. Prepare answers to dovetail with the qualities the employer is seeking in a new associate.

Be enthusiastic. Employers know immediately whether you are passionate about a job. You need to communicate that you are a great fit for the position and you have a strong desire to work for the employer without saying it. If you are not excited about an employer’s specialty practice area or the law firm, you are pursuing the wrong job. Your actions, your demeanor, the expressiveness of your voice, and your posture all show your enthusiasm. If you are engaged and enthusiastic, your interviewers are as well. Remember, exude confidence.

Be professional. Displaying professionalism starts with your timeliness, manners, and appearance. Many employers have quipped that if a job candidate cannot attend to the little things in life, how will they manage the big things in life.

Being professional extends to all the characteristics that make an effective attorney. During your interview demonstrate transferable attorney skills, as listed in the last paragraph and published in endnote 1. Your preparation, listening, and oral skills are plainly on display during an interview. Some interview questions test whether you can logically organize an answer and effectively advocate on a very emotional issue. Remember, if you act and sound like an attorney, the employer will see you as an attorney.

An interview is never over or “off the record.” At social events, think about your professional appearance. Do not eat messy food, drink alcohol, or relax around staff or associates. Every employee’s observations of the candidate gets back to the decision makers.

Be likeable. Who wants to work around a cranky and whining person? Every employer has experienced the stress of being an attorney. They do not want to add to that stress by hiring a negative person. In the interview, you need to accentuate that you can collaborate and work cooperatively with everyone. Being likeable extends to exhibiting good manners – do not forget to send a thank you card after the interview.

By remembering these dynamics you will nail your interview. Simultaneously you will demonstrate effective attorney skills that include: preparation, analysis and reasoning, creativity, problem solving, practical judgment, research, questioning and interviewing, listening, influencing and advocating, organizing and managing your work, seeing the world through others' eyes, and using effective methods of oral and written communication.[1] After your successful interview, you will use another skill of an effective attorney -- negotiation.

Charles R. Toy is the Associate Dean of Career and Professional Development at Western Michigan University-Cooley Law School. During his 9 years in that position he has interviewed over 1,500 legal employers. He practiced law for 27 years as an appellate judicial law clerk, assistant prosecuting attorney, and as an attorney in boutique, midsize, and large law firms. Toy is a Past-President of the State Bar of Michigan.

At least 10 female BBC presenters are considering legal action following last week’s news about BBC salaries above £150,000.

The women, who did not appear on the £150,000 list, are looking to take the BBC corporation to court over the gap difference with their colleagues who do the same job. The gaps in salary are up to £180,000 in some cases, and overall males were paid up to four times the amount of females each year.

Since the announcement of salaries last Wednesday, BBC females have been discussing amongst themselves how to move forward with action. The intention is clearly to bring their salaries in line with those of their male counterparts, and it appears they will achieve this in a ‘strength in numbers’ approach.

The question the BBC has to answer is can this be objectively justified or does this reveal institutional sexism?

Here, Tabytha Cunningham, Associate Solicitor at law firm Coffin Mew, responds to the prospect of legal action against the BBC. She told Lawyer Monthly: “The news that female presenters are now considering legal action following the BBC’s publication of salary information is unsurprising given the gap revealed.

“Equal pay claims could prove costly for the BBC, potentially resulting in decisions that female presenters should receive the same pay as their male comparators and arrears of back pay.

“Whether claims succeed will depend on whether they can demonstrate they are doing “equal work” and if so, whether differences can be justified by the BBC on other material factors. For example, the BBC looks set to argue that it is market forces which dictate the level of pay set for some stars.

“Whilst the BBC has suggested they could solve the problem by slashing male salaries, this is not an easy solution. Whilst they may have scope to re-negotiate contracts for independent contractors, the BBC could only alter male employees’ salaries with their agreement - failing which they would need to look at dismissing employees and offering re-employment on new terms. This could then result in unfair dismissal claims from those employees. A classic case of in-between a rock and a hard place.

“The current outcry gives those larger employers who will be required to publish some gender pay gap information from April 2018 a taste of the issues they may face.”

Once a month, Scott Haley, Family Practice Manager at One Pump Court brings Lawyer Monthly Wednesday Wisdom, and this week he tells readers why barristers wear the very special wigs we're all used to seeing.

We’ve all had our own fashion faux pas, but spare a thought for the ‘in crowd’ of the 17th Century.

Along with bringing back Christmas and liking Spaniels, King Charles II can be thanked for making wigs the shell suit of his day.

The fad of wearing a smelly, itchy mass of curls came onto the fashion scene due to syphilis and a pair of self-conscious Kings.

Long hair was a trendy status symbol and a bald dome could lead to public embarrassment. In the 16th century an increasing number of people were contracting the STD. Without widespread treatment with antibiotics, hair loss was a big giveaway that you had contacted the disease. This made the wearing of wigs a necessity.

This changed in 1655 when the King of France started to lose his hair at 17. Worried that baldness would hurt his reputation, Louis XIV started wearing wigs. Five years later, to cover up his greying locks, King Charles II followed his cousin. Courtiers and other aristocrats followed suit and the style tricked down to the upper middle class.

Being left behind by the cool kids, English courtrooms were slower to act. In the early 1680s judicial portraits still showed a natural no wig look, however by 1685 it had become part of the proper court dress.

At first wigs were made of human hair. People in debt would sell their hair to the wigmaker, and there was a macabre trade in the hair of the dead. They were expensive to make and hair hard to find. With much of it coming from horses’ tails or cut off the patients at lunatic asylum or stolen from corpses.

In 1822, Humphrey Ravenscroft (not to be mistaken with the famous Witch Rowena Ravenclaw) invented a legal wig made of whitish-grey horsehair known as a forensic wig that did not need frizzing, curling, perfuming or powdering.

No one really still knows why Wigs are kept, apart from keeping with tradition, those who support it suggests it enforces an authority of the law.

However, over the past decade various attempts to get rid of the wig have been gaining ground. Now barristers need not wear the traditional wig and gown when they stand before the Supreme Court or in civil or family cases with Wigs only being required in criminal cases.

Today a Wig will cost from £425 to £560, although there is a black market also known as eBay where you may be able to grab yourself a bargain.

Last week we heard news that the government is increasing the UK state pension age from 67 to 68 seven years ahead of the original schedule, to now be implemented in 2037.

This means that six million more men and women currently between the ages of 39 and 47 will have to wait a year longer than they expected to get their state pensions.

After the Secretary of State for Work, David Gauke’s announcement in the Commons last week, Lawyer Monthly heard from various legal, employment and pension experts on the matter.

David Assor, Head of Pensions, hbfs:

As a stand-alone change, accelerating the increase in the SPA looks like a sensible move in the context of a population that is living longer. It gives those affected plenty of time to do something about it (assuming it is eventually enshrined in law which we won’t know until after the next election at the earliest).

It also reinforces the principle when planning for retirement: we must not assume that current pensions legislation will remain unchanged. We must be mindful that tax-advantageous retirement savings opportunities will likely only be limited further. We have seen this in the recent past, with the Lifetime Allowance reduced from £1.8m to £1m, and the Annual Allowance reduced from £250,000 per annum to £40,000 per annum (and even lower for higher earners).

Pension freedom will help but only if we take full advantage of the tax efficiencies it offers us before we retire, at retirement and, just as importantly, in terms of any legacy we leave to our children.

So, what should we be doing? In the short-to-medium term it has to be the case of “buy now while stocks last” – no point in waiting until you can better afford to put aside money for retirement (as the 2006 tax changes suggested you could) because the option may not be available when you get there. In the longer term, it will be all about looking to provide for ourselves and our dependants from the point at which we stop working full-time in the job which provides our main source of income which could be well before we reach state pension age.

We shouldn’t rule out further tax restrictions from the government on all sorts of pensions, whether they be paid by the state, public or private sectors and therefore people need to be both prudent and savvy when preparing for life after retirement.

Andrew Campbell, Partner, Doyle Clayton:

Millions of people will now have to work an extra year before retiring at age 68, after an increase in the state pension age was brought forward from 2044 to 2037. This follows on from existing proposals to equalise the state pension age between men and women to 65 by the end of 2018 before increasing it to age 66 in 2020 and age 67 in 2028.

The primary driver and justification for this latest change, is, unsurprisingly, cost, with the DWP estimating that the 12 month increase will save around £74 billion over the next 30 years as well as promoting intergenerational fairness, in view of increased life expectancy amongst the population.

Whilst on the face of it, a costs argument does not appear completely irrational, increasing state pension age on its own does feel redolent of taking a blunt instrument to the wider problem of an aging population. For example, it is all very well expecting people to work for a further 12 months, but this is predicated on the assumption that the job market will be there to absorb an ever-aging population. In my view, it seems most unfair for the private sector employer to bear the cost of providing an additional 12 months’ work simply because a state benefit has been unilaterally deferred by a government some 20 years previously. Also, although this is something of a generalisation, those who are in better paid jobs will often be in a position to retire earlier and not be reliant on the state pension, which is a markedly different position to those in lower income brackets who do rely on the state pension but who may find themselves physically incapable of continuing their current role until age 68. If increasing state pension age is just about cost saving, then the government should acknowledge this – as things stand, this ignores the wider conversation that needs to be had around different ways to manage the implications of people living longer, and guaranteeing that the jobs market and social infrastructure is in place to ensure that people in old age get adequate support.

Ben Simpson, Head of Wealth Management, Menzies LLP:

As with all areas of financial planning, the impact of this decision will depend very much on individual circumstances. While increasing the state pension age by one year will be understandably painful for those who are ‘just about managing,’ it is likely to be viewed as more of an annoyance for wealthier people, rather than a catastrophe. Of course, any delay in receiving a state pension will also be felt most keenly by those with a reasonable expectation of reduced life expectancy.

Another measure certain to impact retirees is the recommendation to remove the ‘triple lock’ in the next parliament, the justification being that it has led to disproportionate increases in pensioners’ incomes relative to the working population since it was introduced in 2010.

Given the UK’s ageing population, the decision to bring forward the increase in state pension age should come as little surprise to many, indeed earlier this year the WEF (World Economic Forum) recommended a retirement age of 70 by 2050. It is also fair to note that whilst future generations will have to work longer than their parents, increasing life expectancy makes it likely that they will ultimately be in receipt of a state pension for longer than previous generations.

In many ways, it could be argued that the Government’s plans shouldn’t affect retirement planning at all. Rather than having their retirement age defined by the state, effective retirement planning should afford people control, allowing them to manoeuvre themselves into a better position to choose when to stop working.

We would also love to hear more of Your Thoughts on this, so feel free to comment below and tell us what you think!

A wholesome £10,000 reward is being offered to anyone who finds the murder weapon that killed a businessman in his £1million home.

Guy Hedger was shot during burglary gone wrong in his home in Castlewood, Dorset, UK, at the end of April. The shotgun that killed him is still to be found.

Three men have been charged with the murder of the insurance executive and are due to appear in Winchester Crown court this week. Some previously investigated alleged perpetrators have been released.

Crimestoppers is now offering £10,00 to find the shotgun, or information leading to its recovery, and the recovery of jewellery that was also stolen in the burglary.

Roger Critchell, from the Crimestoppers charity, said: “This incident has seen an innocent man lose his life in the one place he should feel safe and secure, his home.

“The weapon reportedly used is still out there and I am asking local people to give anonymous information to our charity that leads to its recovery, along with the sentimental items Guy's family have reportedly had taken.

“Your identity will never be revealed, because we never ask who you are.”

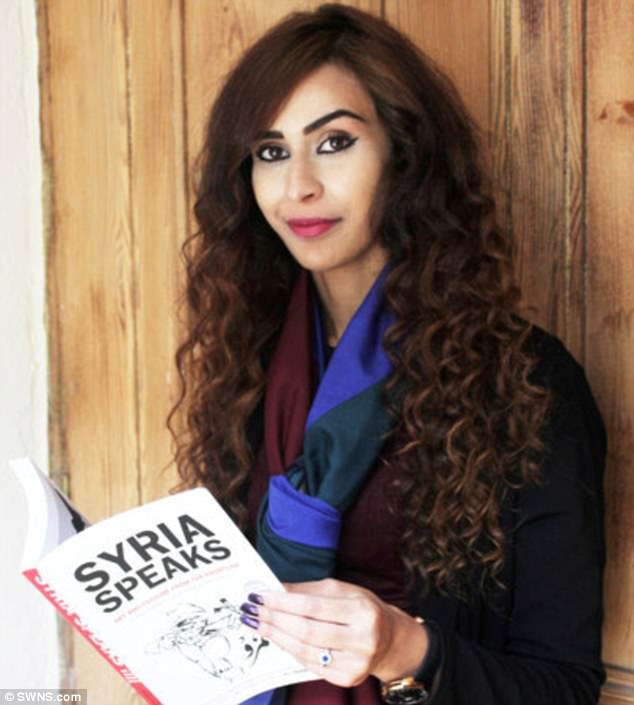

A muslim woman, Faizah Shaheen, 28, was simply reading a book on her outbound flight to Turkey, only to be mistaken as a terrorist and arrested under the suspicion of anti-terrorist police.

Arriving at Doncaster airport, South Yorkshire, UK, Shaheen was arrested and questioned for 15 minutes under Schedule 7 of the Terrorism Act. She was told that suspicion was raised about her book after a cabin crew member had reported that she was reading a 'Syrian phrase book'.

The book, titled ‘Syria Speaks: Art and Culture from the Frontline’, is an award-winning collection of essays, poems and songs from Syrian artists and writers. But reading this was mistaken as a terrorist’s behaviour and wrongly so.

Shaheen now intends to sue the travel company Thompson, taking legal action to obtain a court declaration that she was discriminated against under the Equality Act.

According to the Daily mail she said: “It's just completely stupid really because it was clearly an art book, written in English, and 'Syrian' isn't even a language.

“It just shows a complete lack of education and ignorance about the region.

“Even if the book had been in another language, no one should be discriminated for just reading a book.

“Being detained by the counter-terrorism police after my honeymoon because I was reading a book about art and culture was humiliating.

“All I want is an apology for being treated in this way.”

A spokeswoman for Thomson said: “We appreciate that in this instance Mrs Shaheen may have felt that over-caution had been exercised, however like all airlines, our crew are trained to report any concerns they may have as a precaution.

“We're really sorry if Ms Shaheen remains unhappy with how she feels she was treated.

“We wrote to her to explain that our crew undergo general safety and security awareness training on a regular basis.

“As part of this they are encouraged to be vigilant and share any information or questions with the relevant authorities, who would then act as appropriate.

“We appreciate that in this instance Ms Shaheen may have felt that over caution had been exercised, however like all airlines, our crew are trained to report any concerns they may have as a precaution.”

Faziah Shaheen

Pensioner Leslie Gilmer allegedly boarded the train with a standard ticket, but helped himself to the first-class wine and snacks trolley. His cheekiness did not go unnoticed, as Barrister Dr Peter Ellis spoke out after this took place five times.

Of course first-class food and drink is reserved for those who pay a first class ticket, so arguing ensued. After walking off, Gilmer returned to the carriage and stuck a £10 note in the barrister’s mouth.

He later told police at Exeter St David’s station that he chucked the note at Dr Ellis, a former hospital doctor and personal injury lawyer, but any physical contact was accidental.

Dr Ellis told the police Gilmer was in a row with train staff over poor toilets, which according to the Daily Mail were described as a ‘****ing disgrace’. After this he reportedly argued about receiving complimentary food and wine. Dr Ellis explained that Gilmer then kept returning to the first-class carriage for more help-himselfs.

On the fifth occasion, Dr Ellis spoke up and told Gilmer to use the buffet in his own carriage, as Gilmer was at this point quite inebriated.

He said Gilmer replied: “I am hungry, if you have a ****ing problem with that I will see you in court,” and walked off.

After this, the £10 ram ordeal took place.

Gilmer has now been found guilty of assault by beating by Exeter magistrates court.

He has been fined £650 and told to pay £840 court costs and £250 to Dr Ellis.

President Trump says the federal investigation into Russian interference in the 2016 election and possible collusion between Russian actors and the Trump campaign is the “greatest witch hunt in political history.” And sitting at the head of it is just one man: Robert Mueller.

Mueller was appointed lead special counsel for the Russia investigation by deputy Attorney General Rod Rosenstein back in May, after the eyebrow-raising dismissal of former FBI director James Comey, who’d originally been helming the probe.

A former federal prosecutor and FBI director himself, Mueller has spent the last 10 years in private practice at WilmerHale, a global law firm with more than 1,000 attorneys. Since his appointment, he’s quietly assembled a hand-picked team of legal all-stars, mostly drawn from his former employer. Here are some of the heavy hitters.

(Source: Vice News)