Understand Your Rights. Solve Your Legal Problems

Robin Allen QC, Chair of the Bar Council’s Equality and Diversity and Social Mobility Committee, said the recent publication of the Lammy Review was a major contribution to the important and urgent task of securing a fair and equal criminal justice system.

He said: “The Lammy Report and all its recommendations require proper consideration. Criminal barristers in particular have a significant contribution to make in any national debate on the CJS.

“The Bar Council is committed to ensuring access to justice for all and we will continue to play our part in ensuring defendants and their families have the information they need to understand their rights and options.

“Transparency is critical to building trust and confidence in the CJS and we support any initiative to make sentencing remarks more accessible.

“We want our profession and the judiciary to reflect the diversity of the population it serves. As Lammy observes, we are making progress but it is slow. Improving diversity and supporting under-represented groups to enter the profession and progress into the judiciary is an important aspect of our work and something we devote considerable resources to.

“With proper consideration and communication, targets for the number of minority judges can play an important role in addressing under-representation. They focus the mind and have been used to try to improve the gender balance in UK boardrooms.

“However, targets are not the complete solution. Justice requires that good judges from a comprehensively diverse background are appointed. That is why the Bar Council’s immediate focus is on developing a foundation course in judgecraft – to be undertaken pre-application – that will demystify the skills needed for judicial appointment and increase the confidence, particularly of ethnic minorities, women, and those from a non-traditional background, when applying. This work, already well on foot, aligns closely with Lammy’s Recommendations 15 and 16.

“Finally, none of these important and imaginative recommendations will happen without adequate resourcing. The Bar Council therefore calls on the Treasury to find the funds for the Ministry of Justice to take forward these proposals.”

The Bar Council will also be looking closely at how it can support work on the following recommendations:

(Source: The Bar Council)

It has been revealed that Equifax, one of the three major consumer credit reporting agencies in the United States, has suffered a data breach where hackers had access to names, email addresses, social security numbers, driver’s license numbers and other sensitive information concerning 143 million of its customers. So where did it go wrong? Below are a few comments Lawyer Monthly has heard from industry sources.

Ross Brewer, vice president and managing director EMEA at LogRhythm, commented:

Equifax and its peers build their reputation on trust and the protection of consumers, so this breach becomes even more critical - and the immediate, dishonest actions of its executives will definitely come under scrutiny. It’s common practice to offer victims access to free credit monitoring in the aftermath of a data breach, but this incident now calls into question the integrity of all similar companies gathering, processing and storing such vast amounts of sensitive information. Whichever way you look at it Equifax lost a goldmine of information - and with that level of detail to hand, identity theft would be child’s play for even the most inexperienced cybercriminal.

It is important that organisations such as Equifax understand the true value of the information that they hold, and take suitable measures to protect that data - at any given time. With such a lucrative potential payoff, credit monitoring firms are likely targeted by some very sophisticated, determined hackers, and in response should invest in the right monitoring and alerting technologies for when (not if) one of those attackers breaks through their defences. Only then can the organisation reduce the time taken to detect and respond to threats down to minutes, and stop a significant data breach in its tracks.

If anything, this is a solid reminder that even though British and European consumers may not directly deal with overseas businesses, those organisations might still hold - and ultimately lose - our personal data. This is exactly why we need the incoming EU GDPR, to hand down appropriate penalties to those US companies collecting huge amounts of highly sensitive personal data on European citizens and then not protecting it. Let’s not forget, if the ICO were to impose the highest level fine - four percent of Equifax's turnover - it would be looking at a bill of over $100m.

Adrian Rowley, EMEA Technical Director, Gigamon made the following comments:

The fact that a company like Equifax was a target is not surprising, considering the wealth of information it holds. Given the sensitivity of this type of data any such organisation needs a robust system in place to prevent these attacks from being successful. You cannot secure what you cannot see and when it comes to something as important as social security numbers, which could make ID theft easy, organisations must take data protection very seriously. Credit monitoring companies manage a treasure trove of information that can be damaging if it lands in the wrong hands, especially when it’s been in those hands for several months.

To combat threats targeting valuable data like this, technologies should be in place that take into account the growing size and complexity of today’s networks and eliminate any monitoring blind spots that may occur as traffic increases. A key prerequisite for a sound IT security strategy is knowing exactly what data is in your networks. Visibility is key, and our recent research found that sixty-one percent of respondents in the UK cited network blind spots as a major obstacle to effective data protection, while 41% of those without complete visibility of their network admit to lacking sufficient information to identify threats. Unfortunately, it seems that this has become a reality for Equifax.

It’s now less than a month until the UK’s Criminal Finances Act comes into force on 30th September. This is a really significant piece of legislation which gives HMRC a global mandate to pursue the possible facilitation of tax evasion anywhere in the world should it involve a UK tax liability. As such, it will pull in a huge variety of businesses and sectors, yet many firms are still very underprepared for its introduction.

Marie Barber, Managing Director of Tax Consulting and Accounting Services at Duff & Phelps, here comments for Lawyer monthly on the Act, its implications and what businesses need to do to ensure compliance:

“Transparency, fairness and accountability have been dominant themes in taxation for some time. The Criminal Finances Act is a continuation of this and we should expect tax authorities to quickly wield these new powers to target corporate facilitators wherever they are around the world. This new legislation is not dissimilar to other legislation designed to influence corporate behaviour, such as the Bribery Act and the GDPR, and as such requires a similar approach to assess risk and put measures in place to prevent the targeted activity from occurring.

“The legislation requires more than an inclusion of a policy or a statement and instead require businesses to identify areas of risk, considering proportionate steps to mitigate any facilitation of tax evasion. Businesses need to have completed this assessment before implementing prevention policies and procedures. It is not possible to do one before the other. HMRC appreciate the tight timeframe and do not expect 100% compliance by 30th September, but they do expect businesses to have performed the risk assessment and have the policy and procedure process well underway. The Criminal Finances Act is extremely far-reaching and will put the spotlight on a huge range of businesses, meaning many people have a lot of work to do in less than a month to ensure their firm is compliant.”

With litigation costs higher than ever before, it has never been more important for lawyers to ensure claims are supported in the best manner possible when considering bringing proceedings or seeking settlement. Here Gavin Cunningham, forensic accounting partner at Menzies LLP, delves into the importance of forensic accounting and the impact a proper assessment can have on a claim.

Even when the legal aspects of a claim are strong, without proper interrogation and thorough financial analysis of the evidence, there can be no certainty as to the benefit of embarking on potentially long and costly proceedings. Despite this, lawyers sometimes fail to call in forensic accountants early enough to provide their assessment of what the claim is worth.

In theory, the role of forensic accountants in the claims process is a simple one: to provide some certainty as to the value of the claim and to test the causal link between the facts of the case and the financial damage claimed as a result. In doing so, this assists the client and their advisers in deciding whether it is worth taking the matter to court and, when acting in a formal Expert capacity, to give independent opinion.

The process of evaluating a claim can vary widely depending on the stage litigation has reached. Sometimes, when forensic accountants are called in late, the outcome has been more or less decided and the brief is simply to check if the client’s schedule adds up.

It is not unusual in those circumstances to find that the schedule lacks intellectual rigour and the scope of work needed is far wider than initially thought. The situation is made worse if disclosure has already been settled and the many queries that inevitably arise cannot be answered without access to the opponent’s papers that are no longer available.

This scenario probably arises because when lawyer and client meet for the first time, the dialogue understandably seeks to establish the basic legal merits of the case. Little consideration tends to be given to establishing the loss element of the claim at this stage and the potential client is simply asked what they think it is. The answer given can be wildly out, even in cases where the client has a large internal accounting department. The client simply lacks the knowledge and experience of litigation that an experienced forensic accountant can bring.

It is precisely because the accounting profession has developed a specialisation around forensic accounting that you should not expect a finance director, book keeper or entrepreneurial CEO to identify all the financial loss aspects of a claim. In addition, formulation of evidence is not their normal role or focus and having to carry out their usual duties in the day job necessarily divides their attention. In the same way that a property lawyer would not be suitable to handle criminal defence litigation, lawyers should not just accept the client’s views, or those of a non-specialist accountant, when assessing loss.

The client will usually be able to give an indication, but the reliability of that assessment may be significantly above or below a reasonable range of value for the damages. That figure is then often used not only in pre-action exchanges but can also end up in the particulars of claim. In cases where the value is significantly under stated, it is very rare that the other party will say “hold on, you’re not claiming enough!”

In some cases, where the extent of the losses appear limited to what is obvious, additional expertise may not seem necessary. However, even in these cases forensic accountancy services may prove valuable where there are significant consequential losses that can only be assessed by careful calculation. This is particularly true where the impact of the direct loss causes unseen contingent losses, perhaps around loss of opportunity, which could only be quantified based on specialist professional insight and experience.

It is important to involve forensic accountants as soon as possible. It is likely that some form of alternative dispute resolution will be attempted at an early stage and having reliable financial evidence regarding the loss is as vital to enable the client to achieve the correct result at mediation, as in formal Court proceedings.

When brought in early, forensic accountants can also help shape the legal arguments of a claim according to its financial strengths. It can also help in shaping disclosure requests to ensure the relevant evidence is available when needed.

One other benefit is to assist in procuring litigation funding as, increasingly, potential funders will want to know a reliable value for a claim before committing to pay the costs. Forensic accountants can use their skills to assess the overall range of the loss and so assist in obtaining funding support.

Collaboration is at the heart of the matter and the risks are high for all parties if the financial elements of a claim are not given enough thought at an early stage. By seeking specialist input, lawyers can strengthen their clients’ claims and avoid unfavourable outcomes.

Drugs manufacturer Indivior has had £1bn ($1.3 billion) wiped off their value as a result of it losing a US patent dispute over its heroin treatment substitute.

Reports indicate that the patent dispute between Reckitt Benckiser and Dr Reddy’s that was first ruled upon in 2014 has taken a vicious turn, as an appeal against the 2014 decision that a patent for ‘Suboxone Film’ was not infringed upon has been rejected.

According to the Guardian, chief executive, Shaun Thaxter said: “Today’s news is disappointing … given the belief that the company has in its intellectual property for Suboxone Film … We remain confident in Indivior’s long-term outlook and vision.”

This loss of patent dispute means that investors are losing confidence, given that 80% of Indivior’s revenue comes from ‘Suboxone Film’, which occupies 6% of the market. This in turn has led to a loss of £1 billion in the firm’s overall value. The company has stated that a sudden rise in competition for ‘Suboxone Film’ “could potentially result in a rapid and material loss of market share for Suboxone Film in the US.”

Nick Bassil, patent attorney and Partner at Kilburn & Strode, had this to say for Lawyer Monthly: “The impact of the decision against pharma giant Indivior, which recently pushed its shares into a tailspin, derives from the complex question of patent infringement, not validity. It’s important to remember this is only a first instance judgment and the validity of the patents was upheld.

Indivior look likely to file an appeal so the situation could change. Markets often overreact to such decisions, but it is all part of the cut and thrust of how generics seek to launch new products.”

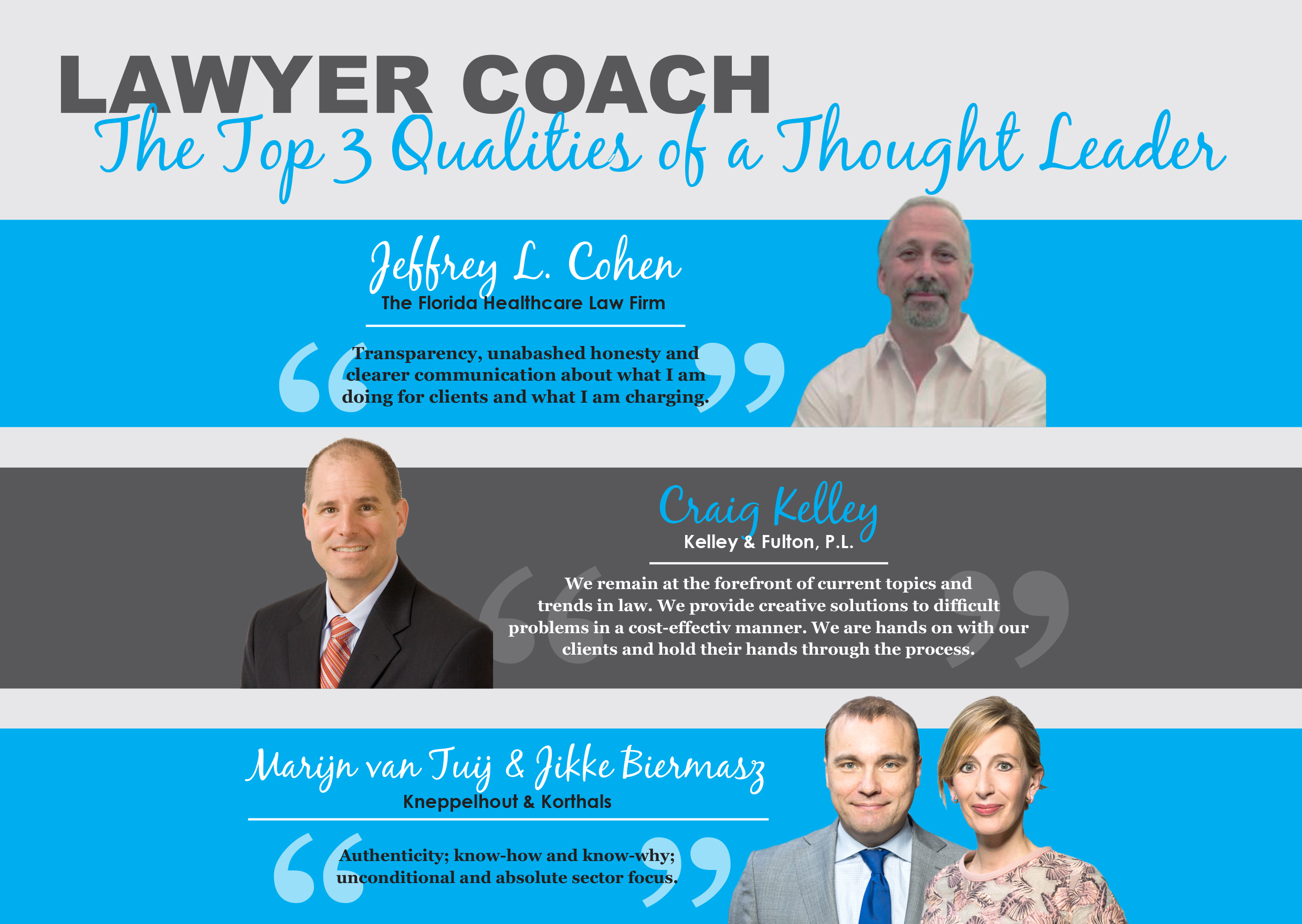

What do you think are the best qualities found in a leading legal professional? Honesty, commitment, tenacity? Below Lawyer Monthly has put together several short responses to this question from highly esteemed thought leaders and legal professionals, who each have a different view of what character traits their clients expect above all.

Alison Horner, VAT partner at MHA MacIntyre Hudson, below discusses the UK government’s recent moves on customs duty.

This announcement is a very bold step from the UK government, especially given the EU’s public stance on the single market and the clear message that Brexit means an exit from the associated free trade arrangements. But the step is very much needed to get us to a workable transitional agreement.

Without decisive action, we appear to have only one outcome, defaulting to the World Trade Organisation’s (WTO) customs duty tariffs. The Government’s understanding of the practical implications of this outcome is finally becoming evident, which should be reassuring for businesses.

A Free Trade Agreement (FTA) is what all UK businesses who deal with European trade really want. It’s also better for UK consumers, who, without an FTA, could for example be faced with an additional 10% Customs duty cost when they buy a European car. Businesses trading with the EU may also encounter administrative snarl ups, similar to those seen recently with holiday makers at passport control in some EU destinations.

These proposals are only a starting point and we think that the retail and motor industries in particular will lobby hard for a sensible agreement, as it affects both importers and exporters of goods throughout Europe. In the meantime, businesses should continue to assess the potential worst-case scenarios and review WTO tariff codes for their intra-EU supply chains, just in case.

A generation of vulnerable people could be faced with problems managing their finances and assets if improvements to the process of setting up a Lasting Power of Attorney (LPA) is not improved, according to leading law firm Roythornes Solicitors. Elizabeth Young, head of private client at Roythornes, discusses for Lawyer Monthly below.

Denzil Lush, the hugely respected former Master of the Court of Protection, has vocalised his long-known views on the robustness of our system for regulating and supervising decisions made on behalf of those no longer or never able to make decisions for themselves.

After years of seeing first-hand how an LPA can be used to abuse the most vulnerable in our society, I do consider the views of Mr Lush a stark reminder of the importance in making the right decision of who should be appointed as an attorney and involving professionals to support people make these decisions wisely.

Highlighting the importance of choosing an attorney comes at a time when the Ministry of Justice is keen to simplify and digitalise the system for completing LPAs.

Mr Lush has described the promotion of using LPAs as a ‘crusade’ which ‘demonised’ the legal alternative - the appointment of deputies by the Court of Protection itself. There is indeed potentially more security as the deputys themselves must have insurance, whereas attorneys do not, and so if they do relieve their ward of funds, a deputy’s bond can be called in.

Deputys must produce accounts and submit these annually for scrutiny so problems and concerns that arise are far more likely to be spotted. Although, if proper safeguards are put in place, and the right people are appointed, then LPAs do work well for most people who prepare them.

When LPAs were introduced in 2007, applications required the involvement of a suitably qualified professional and that nominated people were notified upon completion of registration. However, both conditions have since been dropped, which has lost a certain level of safeguarding and protection.

Perhaps the Ministry of Justice (MOJ) might listen to Denzil and reintroduce previous safeguarding measures, or consider ways of how to improve the LPA process. Denzil’s comments could also instigate the introduction of insurance and accounting requirements for attorneys, and a more stringent creation process.

Even if this is only at a professional level, it would be useful to improve best practice, and reverse the relaxation of the MOJ’s stance. We could also request for banks to notify when LPAs have first been actively used, with the Office of the Public Guardian looking at random samples of LPA attorneys for details of account activity.

We are all often reminded of our aging population and the full extent of the impact of dementia. For many years Roythornes, as a matter of course, has advised client families on the importance of making plans in case of potential health problems that could inhibit them making decisions for themselves, whether a short-term injury, such as a bump to the head, or a longer-term debilitating illness.

We hope Lush’s comments will not deter people from thinking carefully about what would happen if they sustained a health problem that would affect their decision-making capability, and they understand the importance of future-proofing themselves and their families against difficulties that could have an impact on their personal lives and businesses.

We take great care in helping our clients choose the right team of people to represent their interests, if the worst happens. The risk of abuse is hopefully averted through implementing a whole string of safeguards that we work with clients to put in place.

Should the inheritance tax, a tax which is paid from the assets you leave behind when you die, be scrapped or is it actually something we want to keep?

Opinions on this subject differ widely, so as part of this week’s Your Thoughts Lawyer monthly reached out to a number of experts in the field, but in the UK and beyond, to hear what they had to say.

Saul Zneimer, Financial Adviser, hbfs:

The most invidiousness thing about IHT is that your money is taxed twice. Any legitimately earned income or capital appreciation will have been taxed as its being made during a person’s lifetime. As a result an individual’s Estate is made up of assets that have already suffered tax. The idea that the State then takes 40% of it away after your death, instead of allowing you to do what you wish with your money, is not one that sits comfortably with me or with many other people.

There are strong utilitarian arguments too for abolishing IHT. Beneficiaries are likely to spend much of the money they receive, investing in businesses and so on, generating economic activity and making the money inherited work for them. An extra 40% is a lot of money to inject into the economy. There of course will then be a tax take for HMRC – based on the profits generated from these assets. Now that’s a good way for the State to share in the fruits of the Estate.

Paul Falvey, Tax Partner, BDO:

The argument about Inheritance Tax (IHT) has been going on almost since the tax was introduced. The ‘for’ camp argues that the tax prevents the over concentration of wealth in a small number of families which inhibits enterprise. Those ‘against’ object that IHT taxes wealth a second or even third time, they suggest that if it were abolished, wealth would cascade down generations and stimulate economic growth.

The redistribution argument is more persuasive if you distinguish between passive and active wealth. IHT does this with Business Property Relief, a significant relief from the tax for trading businesses which enables businesses to be passed on rather than being broken up or sold to pay IHT.

IHT is also redistributive by giving relief for charitable gifts, and allowing a reduction in the IHT rate for non-charitable gifts from 40% to 36% where at least 10% of the estate goes to charity, so that the deceased’s heirs also benefit.

Generally people are happier to see passive wealth taxed, except when it comes to their own home. This is an emotive subject, especially as for most people their house is by far their most important, or often their only significant asset. They perceive IHT as unfair even if they bought their home years ago and have benefitted from rising house prices. The ‘residence nil rate band’ introduced in Finance Act 2016 is an attempt to take family homes out of IHT, but it is complex and limits relief to those who have children. Increasing the ‘standard’ nil band would be far simpler and fairer.

A specific exemption for the home has been suggested, but this could further increase house prices and reduce people’s willingness to move. There are already concerns over the shortage of family homes and the concentration of property ownership in older generations. Property market flexibility could be improved if there were incentives to downsize and gift or spend the wealth released, making larger houses available to families. Transaction costs often put people off, so lower rates of SDLT for downsizers would be needed to achieve this. Levying IHT on homes can also help; often a home is sold to pay IHT or to make it easy to divide an inheritance amongst children. In short - there are no simple answers in the scrap it or keep it debate.

Catriona Torrance, Private Client Solicitor, Balfour+Manson:

Dealing with the practicalities of inheritance tax when winding up estates, we see the impact this tax has at ground level. People worry about IHT but have little understanding of it, which leads to misconceptions. On one hand, there’s a widely-held perception that the government will swoop in, take your hard-earned assets and leave precious little for your family; on the other hand, there’s an assumption you’re not ‘rich’ enough to pay it but that the truly ‘rich’ should be heavily taxed before their families benefit from inherited wealth. Where to draw the line causes consternation.

In the current economic and political climate, I don’t believe there is an appetite in the UK to scrap IHT, with pressure to set higher rates of tax on the wealthiest using various tax measures. The least well-off are already, for IHT purposes, exempt – if the value of the estate is less than the nil rate band, or everything is going to a spouse.

What we are seeing, though, is pressure from the middle brackets. With estates where the house value is the largest proportion of wealth, people often don’t feel ‘rich’ because their main asset is not liquid and not divisible. We are, in the UK, peculiarly attached to the notion of a ‘family home’ – despite demographics and reality not substantiating this. People are concerned to preserve the ‘family home’ for the next generation. The next generation, however, are likely to be in their 50s or 60s, and usually sell the house, only occasionally keeping it as a second home.

Recent changes to the nil rate band reflect this attempt to preserve the family home, but also reflect a distinct set of moral standards. You only get the maximum extra tax-free allowance if you marry and have children to whom you leave your house. Because these rules only apply in specific circumstances, to a specific asset, they are complex. This adds to the confusion and misconceptions surrounding IHT.

IHT is a tax that can be mitigated with proper planning and the reality is that less than 4% of all UK estates are liable to pay IHT. However, the more complex the rules become, the more likely it is that only the very wealthy will feel they can afford the professional advice required. If it is to be kept, there is a strong case for simplifying it.

Charles Hutton, Partner, Charles Russell Speechlys:

Inheritance tax (IHT) is probably the most emotive tax. Its pros and cons have been debated for decades. At present it is payable at 40% above £325,000 (£650,000 on the death of most widows, widowers or surviving civil partners). The main exemptions are for gifts to spouses or charity and for gifts made more than seven years before death. Certain agricultural and business assets qualify for relief.

In 2015/16 it raised £4.7 billion. It is paid by around 4% of estates.

The arguments in favour of keeping IHT are essentially that it one of the least painful ways of raising tax. It is a tax on a windfall and that in most cases the recipient will still be significantly better off even if they only receive 60% of the estate. Moreveover, allowing wealth to pass down the generations completely intact will, it is said, disincentivise certain people from work or being inventive.

On the other hand, it is a strong human urge to provide for one's children and IHT is a significant impediment to doing that. Many feel that they have paid plenty of tax during their lifetimes, not least on income and most gains. For the same estate to suffer a 40% charge a third time on death adds insult to injury. It is comparatively easy to mitigate, notably by giving assets away and then surviving seven years. This means that in practice it is, or at least is perceived to be, a tax unduly borne by middle England, by those who cannot afford to pass on a large proportion of their estates during their lifetime. As such, it is a tax on aspiration, much like the Labour party's ill-fated mansion tax. Even many people who are unlikely to have to pay it think it is unfair.

We are constantly hearing that the young will spend most of their adult life trying to pay off their student debts and will find it extremely difficult to get on the property ladder. Taxing inheritances heavily can only exacerbate this problem.

In my view, IHT should be retained, but in a modified form. The threshold has been frozen since 2009, and even prior to that failed to keep pace with house price inflation. It should be raised significantly, to, say, £750,000.

There is also scope for simplification. For example, an additional threshold for residences has recently been introduced, but the details are inordinately-complex and it does not apply to all estates. This should be abolished. Finally, the IHT treatment of life interest trusts should revert to the pre-2006 system whereby the life tenant was treated as owning the underlying capital for IHT purposes, rather than there being IHT charges every ten years.

Christine Thornley, Head of Wills, Trusts & Probate, Gorvins:

Inheritance tax is without doubt an unfair tax. You pay tax all your life and then you are taxed on what you leave after your death. There are a number of exemptions in place which are designed to ensure spouses and charities are not penalised and that businesses can continue to be run after a shareholder passes away but otherwise a 40% tax charge on any amount over the nil rate band is a high charge.

Inheritance tax was initially designed to tax the very rich but with rising house prices more and more estates end up paying inheritance tax. The very wealthy are able to minimise their liability through setting up trusts and investing in inheritance tax friendly products however those who are comfortable but not incredibly wealthy are often caught by this tax. The impact on their beneficiaries can be extensive and the thought of thousands of pounds of a parents/relatives hard earned money going to HMRC to cover this tax often leaves a bitter taste in that beneficiaries mouth.

Unfortunately however, I do think that it is a tax that will have to stay for the considerable future. To abolish inheritance tax will lead to a loss in revenue that will need to be replaced. To increase income tax, stamp duty, council tax or any of the other taxes that directly impact people during their own lifetimes seems even more unfair than making estates pay a tax on large estates post death. If there was a choice between paying more income tax and keeping inheritance tax, I would be fairly confident that most people would vote for keeping inheritance tax. Times are tough enough as they are without day to day taxes having to be increased to replace the revenue lost through abolishing inheritance tax.

Elizabeth Young, Partner and Head of the Private Client Team, Roythornes Solicitors:

Increasing the inheritance tax allowance to £1 million means it has been abolished for most estates, with the exception of the wealthiest who fail to seek out specialist planning advice in good time.

There are arguments for and against the abolition of inheritance tax, which seem to divide opinion.

Some describe it as a ‘Robin Hood’ tax which penalises those who have worked hard to provide a better future for their family and that it is unfair people who carefully save for their families’ security should be penalised by paying a slice of their inheritance to the government, having paid income tax all their lives.

It is also considered an overly complex regime that favours those who are able to take advice and plan their estate in advance. With people being taxed throughout their life on their income and capital gains, being charged on the amount they leave behind for loved ones when they die is one step too far for many.

An alternative, perhaps fairer tax system, but not an easy one to administer might be to tax individuals at progressive rates on the total amount of gifts and inheritances they receive over their lifetime - or extending the reach of the tax to gifts made more than seven years before death, for example to 15 years.

Elizabeth Young, Partner and Head of the Private Client Team, Roythornes Solicitors:

Increasing the inheritance tax allowance to £1 million means it has been abolished for most estates, with the exception of the wealthiest who fail to seek out specialist planning advice in good time.

There are arguments for and against the abolition of inheritance tax, which seem to divide opinion.

Some describe it as a ‘Robin Hood’ tax which penalises those who have worked hard to provide a better future for their family and that it is unfair people who carefully save for their families’ security should be penalised by paying a slice of their inheritance to the government, having paid income tax all their lives.

It is also considered an overly complex regime that favours those who are able to take advice and plan their estate in advance. With people being taxed throughout their life on their income and capital gains, being charged on the amount they leave behind for loved ones when they die is one step too far for many.

An alternative, perhaps fairer tax system, but not an easy one to administer might be to tax individuals at progressive rates on the total amount of gifts and inheritances they receive over their lifetime - or extending the reach of the tax to gifts made more than seven years before death, for example to 15 years.

Beverley Jenkinson, Assistant Solicitor, QualitySolicitors Howlett Clarke:

The question of whether or not Inheritance tax (IHT) should be scrapped is an emotive subject. Those in Government will no doubt look at the Office for Budget Responsibility who forecast IHT to rise to £5 billion in 2017-18. This is equivalent to 0.2 per cent of national income. On a percentage basis, it does not seem very much (in Government terms anyway) but why would the Government scrap an easy and assured way of collecting revenue in austere times?

For individuals though, one of the most popular arguments for scrapping IHT is that they have paid tax throughout their lives (via income tax, capital gains tax and VAT etc.) so why should their estates be taxed again on death?

IHT is charged on net estates worth more than £325,000 (after deducting any liabilities, exemptions and reliefs). This £325,000 is known as the nil-rate band (NRB). For couples this rises to £650,000 as the NRB is transferable between spouses and civil partners but not cohabitees. In addition to this, since 6th April 2017 estates will be entitled to the residence nil rate band (RNRB) if on death they own a home/share of one which is left to “direct descendants”. Thereafter IHT is charged at 40%. This will mean that by 2020-21 married couples/civil partners would need to have collective estates worth over £1m before IHT becomes chargeable as each spouse/civil partner will have their own NRB plus a RNRB of around £175,000.

Some may argue that many estates will not be affected by IHT as their value is below the aggregate value of the NRB and RNRB. However, with property prices continuing to rise, it seems likely that an increasing number of estates will have to pay IHT.

In the spirit of fairness, surely consideration should be given to reducing the rate of Inheritance Tax and tapering the percentage according to the value of the estate. This would keep IHT in line with other taxes such as income tax and capital gains tax. In addition, there should be similar IHT reliefs available for cohabitees as there are for spouses/civil partners.

So we say – let’s keep it but tweak the provisions to make it fairer for all. Besides, in our soon to be post-Brexit Society the Government will no doubt need as much financial support as possible!

We would also love to hear more of Your Thoughts on this, so feel free to comment below and tell us what you think!

According to law firm RPC, UK trademark registration for beer brands has risen a huge 19% last year, supposedly due to the increase in craft beers produced by supermarkets and large companies.

In more detail, the firm’s research shows that beer brand registrations rose from 1,666 in 2015, to 1,983 in 2016, which is a significant jump for a year’s worth of registrations.

RPC specified that for example supermarket Aldi added 16 new bottles to its craft beer range, and the UK has also had a steady addition of independent craft breweries.

Jonathan Sherman, Solicitor at law firm Coffin Mew, told Lawyer Monthly: “The results of this study suggest that, having historically neglected the need to protect their intellectual property, the brewing industry is beginning to finally appreciate the importance of legally protecting their brands.

“We have seen a surge in high profile trade mark infringement cases involving UK brewers, notably the estate of Elvis Presley’s successful claim against BrewDog over the Scottish brewer’s ‘Elvis Juice’ beer and in turn BrewDog’s successful claim against the owner of the ‘Draft Punk’ pub in Leeds for breaching the trade mark of BrewDog’s flagship beer ‘Punk IPA’. These high-profile cases are likely to have a further impact on the number of trade mark registrations.

“In what is quickly becoming a crowded market, in which beer drinkers are faced with an abundance of choice on both the supermarket shelves and at the taps, the name and design of the beer labelling is arguably becoming the determining factor to stand out amongst the competition, perhaps more so than the taste of the beer itself. It would be no surprise therefore, to see trade mark infringement claims increase over the next few years as breweries become more robust at protecting their brands and their place within the market.”