Understand Your Rights. Solve Your Legal Problems

You just nailed the perfect position and it’s day one, but you’re not really sure what the etiquette is, so naturally you’re nervous and likely don’t know where to start. As part of our Law School & Careers series, Lawyer Monthly hears from experts across the world about key questions and considerations in the legal sphere. Today we hear from Andrea Hall, Founder and Principle of US based The Hall Law Office, LLC, on the crucial steps to take when you first walk in to your new job as a lawyer.

This can be a very exciting time as you just spent the last three years in school, studied hard to pass the bar and you are now a licensed attorney. You know the feeling all your hard work has finally paid off. Unfortunately, you are a student once again. You will have to start the learning process all over again. Take what you learned in school yet be open to things being totally different. Come to your new location with an open mind and ready to listen to what is being presented.

Coming into a new firm right out of law school is very exciting. Yet know that everything you learned in law school will more than likely go out the door. Law school doesn’t necessarily give you the tools for the everyday processes of a law firm. Things like meeting with a client for the first time, what information is gathered at the intake of the client, how to sell the client on you and your firm being the best fit and closing the deal. Be willing to start the coffee maker and make copies things you didn’t technically go to school for those things are not beneath you. Remember that you are no better than the janitor who cleans up after you. You both put your pants on the same way everyday one leg at a time.

The most important thing I can tell you is that your secretary and the court clerks will be your best friend and you need to treat them as your best friend. Create the best relationship you can with them. You might have a law license yet those people will either make or break your life as a lawyer. Your secretary will do things for you when you are in a pinch, they will talk your client off the cliff when you are too busy or just no longer able to deal with the client. The court clerk will bend over backwards for you if they like you. When you have an emergency motion that needs to be addressed your file will get moved to the top of the pile. When you need a continuance, they will go to bat for you and will help you when you are in a bind. This is the first thing I was told and I will never forget it.

Learn and watch everything you can. Follow all the lawyers around and watch what they do and say. Ask questions and be curious about why the lawyers do the things they do. Take notes, read the statues and on your down time re-read the rules of civil or criminal procedure and the rules of evidence. If you want to be a trial lawyer those rules will make you great one day and when you get busy you won’t have the time yet now before your career is starting to take off you will have the time.

Relax and know you will make mistakes it is ok. Don’t be too hard on yourself. Practice makes perfect. It takes 10,000 hours to be a master at something enjoy the journey and be prepared to be a student for a while.

A recent High Court ruling has limited the investigative powers of HMRC beyond the UK after someone permanently leaves the jurisdiction. The ruling was made in a judicial review: Michael Jimenez -v- HM Revenue & Customs and Other, handed down on 20th October. Jimenez was represented by Steve Thomas of Excello Law, Rory Mullan of Counsel and Gary Brothers of Independent Tax.

This landmark ruling clarifies how HMRC should conduct itself in matters relating to non-UK individuals and recognises the reduction in how far HMRC can enquire into their tax affairs once they leave the UK. A game changer for the powers vested in HMRC, it will also greatly interest non-domiciled residents who have made their permanent domicile outside the UK. In effect, HMRC’s powers now stop at the border.

The claimant, Mr Jimenez, is a past co-owner of Charlton Athletic Football Club. After leaving the UK in 2002, he lived in Cyprus and then in Dubai. Events relating to HMRC culminated in the 2012 launch of an investigation into his tax affairs.

Mr Jimenez continued to cooperate with HMRC about questions relating to his residence status. But despite this cooperation, HMRC still tried to force matters by issuing a production notice to him at his Dubai residence. As a non-UK taxpayer, who lives outside UK and has done for many years after cutting his ties with the UK, he challenged HMRC’s right to do this. Eventually, he decided to bring the case for judicial review in London.

The key dispute was the degree to which HMRC can exercise its powers outside the UK. Mr Jimenez’s case centred on these powers, especially that of issuing notices under Schedule 36 to the Finance Act 2008 (Schedule 36) which do not extend to subvert the sovereignty of foreign states. The wording of Schedule 36 is silent as to its territorial limits. The argument continued that it has no extra territorial effect, and that HMRC therefore had no power to issue a notice against him when he was resident in Dubai.

HMRC asserted that Mr Jimenez is a taxpayer for the purposes of Schedule 36 and it does therefore have the power to give a notice to such taxpayers outside the UK to help establish that taxpayer’s tax position. As a general rule, countries will not assist other countries to collect tax unless they have a reciprocal arrangement.

Mr Justice Charles agreed that HMRC’s approach was both unlawful and unreasonable. He held that ‘Schedule 36 does not provide a power to give the taxpayer notice that was given to the Claimant in Dubai and so the Revenue should not have given it.’ He added that ‘the taxpayer notice given to him was not lawfully given and should be quashed.’

This important judgment has provided a clear safeguard to former UK-resident taxpayers who have moved permanently from the UK once they leave, then HMRC’s capacity to enquire into their tax affairs is much reduced. In the case of Mr Jimenez, this was more than ten years before HMRC asked to review matters.

Mr Jimenez said afterwards: "For a long time HMRC have held the view that distance was no object to their powers meaning any ex-pats outside of the UK were in their sights long after they had left the UK. Young or old, rich or poor, retired or not or simply wanting to move to warmer climates and having made the decision to no longer be a resident of the UK, made no difference the attitude that HMRC adopted towards these ex-pats. This ruling shows that this is fundamentally not the case and that HMRC's powers actually stop at the UK border.”

There was no lack of cooperation by Mr Jimenez, nor was there any an attempt by him to engage in tax evasion or avoidance, rather he openly and voluntarily cooperated with HMRC. Nevertheless, HMRC still elected to try to force a man to answer their questions despite his voluntary attempts at helping them many years after he had left the UK.

The House of Lords EU Committee has today published its report Brexit: deal or no deal, outlining the potential impact of the UK leaving the EU without a deal, and examining the feasibility of a transition period immediately post-Brexit.

The Committee describes the Government’s assertion that ‘no deal is better than a bad deal’ as ‘not helpful’, and says it is ‘difficult, if not impossible, to envisage a worse outcome for the UK’. The report makes clear that ‘no deal’ would not only be economically damaging, but would bring an abrupt end to cooperation between the UK and EU on issues such as counter terrorism, police and security and nuclear safeguards. It would also necessitate the imposition of controls at the Irish land border.

The Committee identifies shortage of time, the ‘ticking clock’ of the Article 50 deadline, as the greatest risk factor that could lead to a ‘no deal’ outcome. The Committee agrees with the Government that concluding all aspects of the negotiations before March 2019 would be the best outcome, but notes that the overwhelming weight of evidence suggests that this will be impossible. The Committee concludes that enshrining the Article 50 deadline of 29 March 2019 in domestic law would ‘not be in the national interest’.

The Committee also questions the feasibility of a ‘bare bones’ deal, as described by the Secretary of State for Exiting the EU, in the event that a full agreement is not achieved, and agrees with the Confederation of British Industry that it would in any case be a ‘very bad deal’.

The Committee questions whether a legally binding transition deal can be reached in time to prevent damage to the UK economy. The Committee suggests that negotiations could last several years, and that a ‘standstill’ transition period may therefore be needed to buy time for negotiations to continue beyond March 2019.

The Committee notes that the only secure legal basis for transition may be to use one of the two options available under Article 50, either to extend UK membership of the EU for a time limited period, or to set a date later than March 2019 for withdrawal to take effect, and calls on the Government to review these options.

Commenting on the report, Lord Jay of Ewelme, acting Chairman of the House of Lords EU Committee, said: “The overwhelming weight of evidence suggests that ‘no deal’ would be the worst possible outcome for the UK, in terms of the economy, security, the environment and citizens’ rights.

“The biggest risk factor that might lead to a no deal outcome is time – the clock is ticking. While we support David Davis’ ambition to secure a comprehensive agreement by 29 March 2019, almost nobody outside the Government thinks this will be possible. The negotiations may need to continue beyond that point, and enshrining the deadline in domestic law would not be in the national interest.

“Both sides agree that we will need a transition period, to give confidence to businesses and potentially to buy time to complete the negotiations. But the Government hasn’t yet explained how transition will work, or what its basis will be in EU law. The evidence is clear that in legal terms the most secure way to buy time is to use one of the options that exist within Article 50 for a time-limited extension of the UK’s EU membership.

“We will live with the consequences of Brexit for decades to come, so we need to get it right. If buying a bit more time means that we get a better outcome, which benefits businesses and citizens on both sides, a short extension of EU membership may be a price worth paying. This is not about unpicking Brexit, but about delivering the best Brexit possible.”

(Source: The House of Lords)

Toby Tiala, Programme Director of Equiniti KYC Solutions, discusses with Lawyer Monthly how banks can get a handle on the spiralling costs of KYC and due diligence, while also safeguarding their regulatory compliance.

In a bid to combat money laundering, market manipulation and even terror funding, the rising tide of conduct-based regulations continues to challenge banks globally. The cost of compliance - and non-compliance - is steep. The average bank spends over £40m a year on Know Your Customer (KYC) processes yet, in 2016 alone, bank fines worldwide rose by 68%, to a staggering $42bn.[1]

A double squeeze

Resource stretched mid-sized banks, in particular, are having a tough time. As regulators up the ante they are creating an operating environment increasingly conducive to fines. To cope, banks are expanding their compliance resources to mitigate their risk of transgression. Those with resource limitations are, therefore, the most vulnerable.

They are right to be worried. Since 2008, banks globally have paid a staggering $321bn in fines. Earlier in the decade, high profile money laundering and market manipulation cases caused the level of overall fines to skyrocket. After a brief period of respite (when governments and the Financial Conduct Authority backed off fearing industry suffocation), the fines have been steadily creeping back up. This time, however, big ticket fines have been replaced by a far higher number of smaller penalties. Put another way, the regulators are now tightening a much finer net than before.

A bank’s ability to profile and identify risky customers and conduct enhanced due diligence (EDD) is critical to ensuring compliance with anti-money laundering (AML) law. This is no trivial task. Major banks are ploughing expertise into their KYC and creating proprietary systems dedicated to meeting the new requirements. Mid-sized banks, however, don’t have this luxury and are challenged by the need to beef up their resources. Applying regulations like AML4, PSD2 and MiFID II to complex legal entities like corporates and trusts is a convoluted business.

New focus

A large proportion of regulatory fines result from high risk customers slipping through the cracks, usually stemming from ineffective beneficial ownership analysis, customer risk rating or EDD. This is especially common in complex entities with numerous ‘beneficial owners’ - something that has brought these individuals into sharp focus. A beneficial owner in respect of a company is the person or persons who ultimately own or control the corporate entity, directly or indirectly. Conducting KYC to effectively identify high-risk beneficial owners of complex entities is skilled and complicated work, to say the least.

Nowhere can the new focus on beneficial ownership be seen more clearly than in the EU AML4 Directive, which recently came into force, in June 2017. This directive is designed to expose companies with connections to money laundering or terrorism, and decrees that EU member states create and maintain a national register of beneficial owners.

Big impact

The growing focus on beneficial ownership is having a clear impact on banks’ relationships with their trade customers. According to research from the International Chamber of Commerce,[2] 40% of banks globally are actively terminating customer relationships due to the increasing cost or complexity of compliance. What’s more, over 60% report that their trade customers are voluntarily terminating their bank relationships for the same reason. That this could be evidence of the regulations working will be of little comfort to banks that are haemorrhaging revenue as a result.

The UK has already formed its beneficial owners register but caution is advised. The data quality still has room for improvement and the regulations make it clear that sole reliance on any single register may not translate into effective AML controls. Mistakes - genuine or otherwise – may still occur but automatically checking these new beneficial ownership registers is a clear step forward.

The key for mid-size banks is to zero in on what will both enhance their KYC procedures and deliver clear and rapid visibility of high risk entities. Once established, this will enable them to manage their own risk profile, together with their customer relationships, and minimize the negative impact on their revenues.

Highly complex KYC and EDD activity can severely inhibit the onboarding process for new customers, often causing them to look elsewhere. The deepening of these procedures is making matters worse – it can now take up to two-months to onboard a new client according to Thompson Reuters[3], with complex entities usually taking the most time. Large banks have proprietary systems to accelerate this process but, for mid-sized banks, this is a serious headache; not only does it extend their time-to-revenue from corporate clients, it can also turn them away entirely, and lead them straight into the hands of their larger competitors.

Combine and conquer

For these banks, outsourcing their KYC to a dedicated specialist partner is a compelling solution. These partners have agile, tried and tested KYC systems already in place, are perpetually responsive to the changing regulatory requirements and have highly skilled personnel dedicated to navigating the KYC and EDD challenge in the shortest time possible. Plugging into a KYC-as-a-Service partner enables mid-size banks to seriously punch above their weight, by accelerating their onboarding of new clients to match (and often beat) the capabilities of large banks, dramatically reducing their overall compliance costs and helping them get ahead – and stay ahead - of the constantly shifting regulatory landscape. This, in turn, releases internal resources that can be redirected in support of the bank’s core revenue drivers and day-to-day business management.

It is clear that the regulatory squeeze is set to continue for the foreseeable future. Banks that have the vision and wherewithal to accept this notion and take positive steps to reorganise internally will not only be able to defend their ground against larger competitors, they may even turn KYC into a competitive differentiator.

Specialist outsourcing is fast becoming the norm for a wide variety of core banking processes. Few, however, are able to demonstrate as rapid and tangible benefit as the outsourcing of KYC.

[1] https://www.thomsonreuters.com/en/press-releases/2016/may/thomson-reuters-2016-know-your-customer-surveys.html

[2] http://store.iccwbo.org/content/uploaded/pdf/ICC_Global_Trade_and_Finance_Survey_2016.pdf

[3] https://www.thomsonreuters.com/en/press-releases/2016/may/thomson-reuters-2016-know-your-customer-surveys.html

One of the biggest differences between law students qualifying now, and those seeking a career 20 years ago, is the prevalence of the internet in the former groups’ lives. New research shows that this generation of aspiring lawyers see websites as their preferred careers influencer. Becky Kells, Editor at AllAboutLaw, explores what this means.

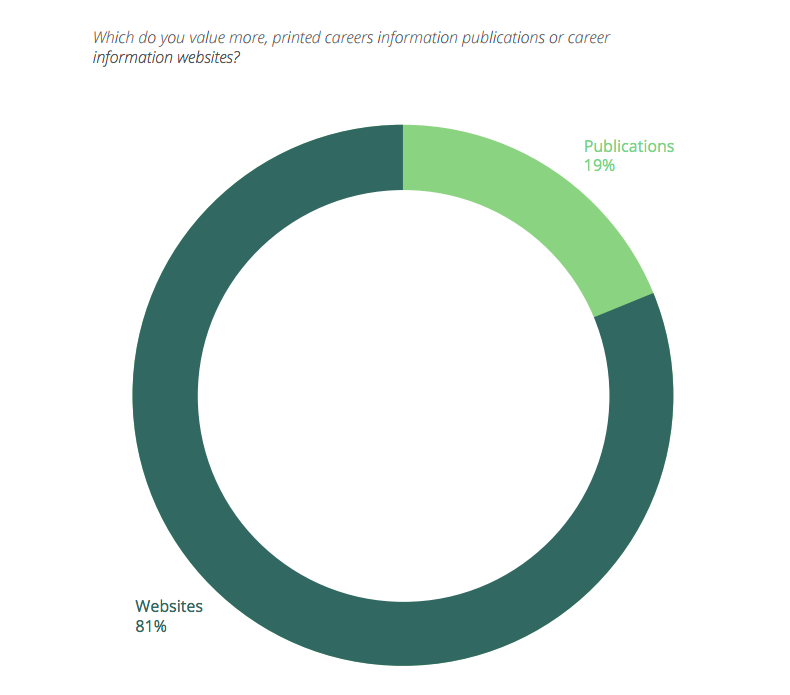

It’s no secret that the students of today are very much geared towards the internet – they shop, socialise and forge relationships online – but the internet has now extended to become career-defining. This does not exclude law students, as shown by AllAboutLaw.co.uk’s latest research. When asked whether they preferred to get their careers advice from websites or from print sources, an overwhelming 81% of students sided with the internet. This significant majority suggests that using the internet as a careers adviser is not just a trend – it’s a habit.

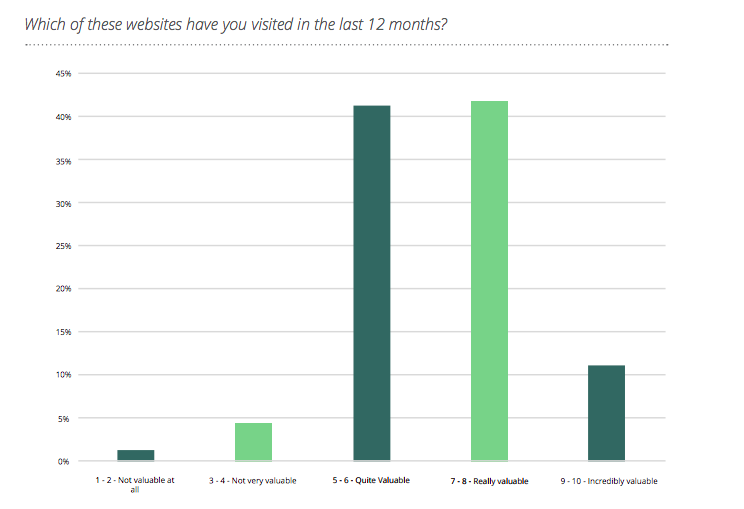

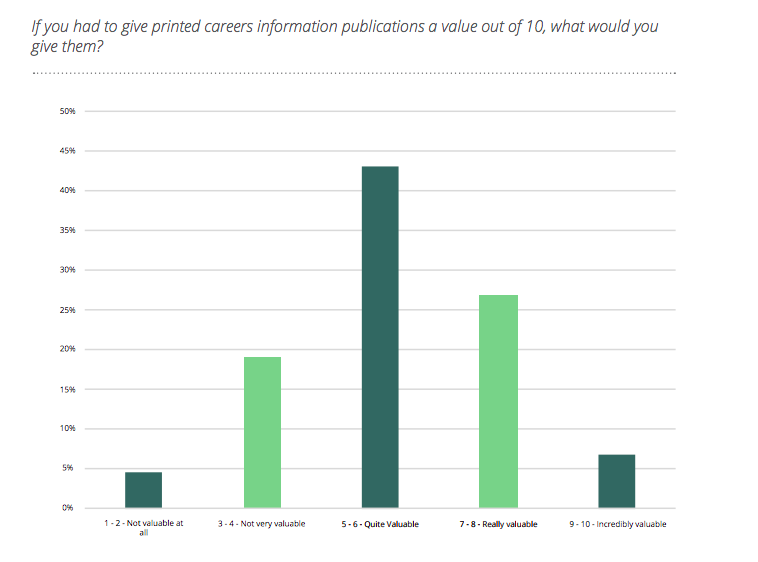

Students not only preferred websites, but also considered them to be more valuable than print. 94.21% gave websites a rating of 5 or higher, compared to the 75.39% who gave print publications a rating of 5 or higher. “There’s a huge benefit to the internet when it comes to keeping information relevant”, said Jack Denton, Co-founder of AllAboutLaw.co.uk. “This is especially true in an industry such as law, where things change frequently.” From this perspective, the internet is a resource that can evolve with law firms and students alike, serving as a flexible bridge between the two.

The internet has not always played such a fundamental role in law careers. Qualified lawyers can harken back to the day when they sent off their training contract applications and speculative work experience requests by hand, and pored over print-based careers guides. But the rise of an online counterpart to the legal sector, in the form of the network of careers websites available, means that information is more readily available – and so law careers are more accessible to everyone.

There are, of course, benefits and drawbacks to this hypothetical online careers adviser. Information is easier than ever to accumulate, and a query that, in the past, could only be solved by a parent or mentor who worked in law, can now be answered rapidly and accurately. This also gives students themselves more choice.

However, this has its issues. Not all information available is regulated, and not all those writing about law are well-versed in the sector. The existence of forums, while useful, can spread panic among students who may get exaggerated or incorrect answers to their questions from ill-informed sources. While the internet is useful and expansive, it can be difficult to weed out the rumour mills and extrapolate the relevant information. For this reason – and also because it is clear that students are prioritising the internet, and trusting the websites they consume – it is more important than ever for websites and forums to regulate their content.

Another important factor to note is that many law firms accept applications for training contracts and vacation schemes purely online now, so the entire process of making a first impression is digital. For the applicants who face these online forms and internet-based exams, websites are a natural place to start. Law firms want to see a range of commercial awareness, professionalism and experience in their candidates, alongside academic ability. An aspiring lawyer can tailor their online research to the ethos of firm they’re applying to.

The rise in websites providing careers advice is undoubtedly a good thing for law. It means that information on how to pursue this very competitive career path is readily available to a wide variety of people, rather than an exclusive pathway of just a small cross-section of society. But it also means that students and websites alike need to be more responsible – students in sifting the quality online advice from the myths, and websites in making sure that their content is relevant, accurate and up to date.

The value of fines being handed out to firms including art, antique and private jet dealers has more than doubled in a year, anti-money laundering and Big Data specialists Fortytwo Data recently revealed1.

The average penalty issued by HMRC rocketed 166% from £484 to £1,290 in 2016/17 as the number of fines overall dropped 23% from 1,153 to 886.

The total value of fines rose 105% from £558,000 in 2015/16 to £1,143,000 in 2016/17, research shows.

Dealers selling high-end jewellery, art, antiques, boats, cars and even private jets are among those overseen by HMRC as a AML supervisor.

Sectors the department supervises include money service business, high value dealers, trust or company service providers, unsupervised accountancy service providers and estate agents3.

HMRC is responsible for policing the way businesses in these sectors meet their anti-money laundering obligations and issuing fines when they don’t.

These business, as well as banks and other financial service firms, can file Suspicious Activity Reports (SARs), to raise red flags over possible criminal activity but reporting is still very low.

There were only 45 SARs filed by high value dealers in 2016/17 while auction houses submitted just NINE2. Estate agents registered 536 and trust/company service providers filed 72.

| Year | 2015/16 | 2016/17 |

| No. of HMRC Fines | 1153 | 886 |

| Total HMRC Fines | £558,000 | £1,143,000 |

| Av. Value of Fine | £484 | £1,290 |

Julian Dixon, CEO of Fortytwo Data, said: “I hope the dramatic rise in the value of fines is a sign that HMRC is getting tough on the weak links in our money laundering defences.

“High-value dealers and those handling large transactions, particularly in unregulated industries, are a money launderer’s dream.

“Awareness of money laundering risks will be low, profits are high which encourages those who are suspicious to turn a blind eye and criminals are able to launder huge amounts of money in a single, seemingly innocuous, transaction.

“Businesses who ignore their money laundering responsibilities should not expect a light touch.

“If HMRC has been an effective AML supervisor during this period, then the fall in the number of penalties issued is also encouraging and may demonstrate their tactics are working.”

1HMRC (FOI)

2NCA

(Source: Fortytwo Data)

The Supreme Court is allowing President Trump’s administration to fully enforce a ban on travel to the US by residents of six mostly Muslim countries. The order allows enforcement while legal challenges against it proceed. Legal analyst Seth Berenzweig joins CBSN to discuss the development.

With the ongoing review of the standard of proof in Solicitors Disciplinary Hearings, Steve Roberts, who heads up Richard Nelson LLP’s SRA services, takes a look at proceedings in the Solicitors Disciplinary Tribunal and asks whether any change is needed.

What is the SDT?

The Solicitors Disciplinary Tribunal is constituted under s.46 of The Solicitors Act 1974. Its primary purpose is to adjudicate on alleged breaches of the rules and regulations by which solicitors are governed. They can adjudicate upon allegations against solicitors and employees of solicitors firm (even after they have they left their role). The Tribunal is entirely independent of the Law Society and the Solicitors Regulatory Authority.

A Tribunal panel is made up of 3 members, 2 solicitor members (one of which is the chair) and 1 lay member. They are assisted by a legal clerk.

Are all allegations of misconduct dealt with by the SDT?

Most allegations of misconduct are investigated by the SRA. Even where the SRA believes there has been misconduct, the breach is not automatically referred to the SDT. There are several options available to the SRA when dealing with an allegation of misconduct:

If there is any finding of misconduct, they are also likely to ask for their costs to be paid.

How do cases before the SDT work?

Cases brought before the SDT are generally heard in public. There is an opportunity for the SRA and the person responding to the allegations to call witnesses and give evidence on their own behalf. Any witnesses can expect to be questioned by all parties, including the Tribunal themselves. As a professional Tribunal, they will often robustly challenge any witness who gives evidence to them.

What is the burden and standard of proof in the SDT?

As it stands, the burden of proving any allegation of misconduct falls on the SRA and they must prove their case to the criminal standard, i.e. beyond a reasonable doubt. The SRA is keen to reduce the standard of proof to that applied in civil cases which is, of course, the lower standard of the balance of probabilities.

What can the SDT do if misconduct is found?

If the SDT finds any allegation of misconduct proved, it has a number of sanctions which it can apply after hearing any submissions on mitigation:

Should the standard of proof be lessened?

The SRA takes the view that cases of misconduct should only be proved to the lower standard in order to protect the public. They point to other professional regulators who are only required to prove their cases to the civil standard, such as medical regulators.

Whilst it is accepted that there is a need for the regulator to ensure that the public is protected, it is unclear whether the reduction in the standard of proof required would serve as greater protection for the public or, alternatively, cause significant detriment to the profession as a whole.

It should be noted that, as opposed to other professionals, a solicitor who is struck off is not only stopped from holding themselves out as a solicitor but is also unable to be employed or remunerated by any SRA authorised body. For example, if a nurse is struck off, they may be able to continue to work within the healthcare profession, for example as a healthcare assistant. By contrast, a solicitor who has been struck off is unable to work for a SRA authorised body even as a receptionist or marketing assistant without the prior written consent of the SRA and such consent, if obtained, only relates to that particular employment and employer.

Another notable difference between a struck off solicitor and one who is struck off by another regulator is that a struck off solicitor will find it almost impossible to be allowed to return to the profession, whereas other professionals may be able to return to the profession where they can show a period of successful rehabilitation.

These consequences distinguish the regulation of the legal profession from that of other professions, and support contentions that the SDT should retain the requirement for allegations to be proved to the higher standard.

Further, it remains the case that, even where allegations of misconduct are not proved, the SRA continues to ask for the payment of their costs in investigating and bringing the cases before the Tribunal. The Tribunal rarely award costs to the respondent parties, even where the allegations are not proved.

It is our view that the issue of cases not being proved to the criminal standards is rare. Those cases where it is an issue are those where the SRA has failed to investigate allegations fully and properly. Given the obvious inequality of arms between the SRA and respondents, it seems that the answer to any SRA concerns would be to ensure cases of alleged disciplinary breaches are investigated properly and only presented to the SDT by way of clearly formulated allegations where clear evidence exists rather than rely upon a reduction in the burden of proof.

There is a real concern that any reduction in the standard of proof may lead to a reduction in the thoroughness of any investigation conducted by the SRA and/or an increase in the number of improperly prepared cases presented to the SDT.

News reports today indicate the UK government is intent on mounting a crackdown on bitcoin by introducing tighter regulation on the cryptomarkets.

The Treasury said it will regulate the digital money and bring it in line with current anti-money laundering laws and counter-terrorism financial legislation.

Reports suggest that under the EU-wide plan, online platforms that deal in bitcoin or other crypto currencies will be required to carry out due diligence with each customer and report suspicious transactions to the authorities. The main aim is to remove the anonymity criminals thrive on in the crypto economy.

A spokesperson for the Treasury said: "We have clear tax rules for people who use cryptocurrencies, and like all tax rules, these are kept under review.”

"We also intend to update regulation to bring virtual currency exchange platforms into anti-money laundering and counter-terrorist financing regulation."

According to Nicholas Gregory, CEO of London-based CommerceBlock, this comes as good news for the bitcoin sector, as government attention is like a stamp of approval: "What some will bill as censure, the cryptocurrency community will deem a stamp of approval that finally recognises the pivotal role that digital currencies will ultimately hold for the global economy.

"It's important to remember that bitcoin exchanges are already regulated as money service businesses in the US and that has failed to pour any cold water on bitcoin's incredible growth story.

"That's why any suggestion that bitcoin is used by money launderers any more than traditional currencies is a fallacy.

"The UK and Europe are playing catch up to some degree here but they are on the right page. Industry players want the same thing as politicians - cryptocurrencies that offer cheap, frictionless, international transactions used for legal purposes.

"If anything, regulation will only increase bitcoin's rate of growth as regulation lends credibility and engenders trust."

Lawyer Monthly recommends you take a look at the above video, along with the remaining 6 parts of this crash course on intellectual property law, as part of CrashCourse's 7part video playlist.

This week, Stan Muller launches the Crash Course Intellectual Property mini-series. So, what is intellectual property, and why are we teaching it? Well, intellectual property is about ideas and their ownership, and it's basically about the rights of creators to make money from their work. Intellectual property is so pervasive in today's world, we thought you ought to know a little bit about it. We're going to discuss the three major elements of IP: Copyright, Patents, and Trademarks.