With advisory support from Gecic Law and others, Remus acquired a controlling stake in GLM from Star Capital Sgr. Remus specialises in manufacturing exhaust systems for the automotive and motorcycle industries, while GLM is an Italian manufacturer of automotive components. Gecic Law highlighted that this acquisition involved an indirect takeover of GLM RS Zrenjanin, which is part of GLM's global manufacturing capabilities.

The Gecic Law team included Partner Ognjen Colic, Senior Associates Milos Petakovic and Nemanja Sladakovic, and Associates Bojan Tutric, Marko Jovic, Nikola Ivkovic, Vasilije Boskovic, and Zarko Popovic.

Several vital considerations were crucial to ensure compliance with local and international regulations. First and foremost, thorough due diligence was conducted to assess GLM RS Zrenjanin's legal and tax standing. This included meticulously reviewing corporate records, contracts, employment agreements, and existing liabilities.

A critical aspect of the takeover was ensuring compliance with Serbian corporate regulations. Additionally, since GLM operates in multiple countries, the acquisition had to comply with the regulatory frameworks of these jurisdictions, which required close coordination with the team of law firms handling the matter from their jurisdictions' perspectives.

Another vital consideration was protecting ownership rights. The legal team ensured all rights were correctly transferred and no outstanding disputes could affect the transaction. The team also had to address any potential issues with the workforce in Zrenjanin, including the transfer of employment contracts and ensuring compliance with local labor regulations.

Integrating GLM RS Zrenjanin into Remus’s existing operations required a strategic approach to maintain operational continuity and ensure that the Serbian entity could operate efficiently post-acquisition.

The multijurisdictional legal team initially guided the structuring of the acquisition to align with Remus’s strategic objectives. This included drafting and negotiating the sale and purchase agreement to reflect the terms agreed upon by the parties and to safeguard Remus's interests.

The essential advice was to carefully implement the findings from the due diligence process into the transaction documents. This ensures that all insights and identified risks are adequately reflected in the final agreement, safeguarding the integrity of the transaction, aligning all parties with the discovered realities, and, first and foremost, protecting Remus's interests.

The due diligence process was a critical element in the acquisition. It involved a thorough and systematic examination of GLM RS Zrenjanin’s legal and operational status alongside a separate tax review. The process was marked by the close coordination and integration of findings from the legal teams in this complex multijurisdictional project. Our team conducted a comprehensive legal due diligence review of the Serbian entity, covering several key aspects.

A significant part of the process involved an in-depth review of the target entity's corporate documentation, including the articles of incorporation, internal bylaws, and management meeting minutes. Through this review, we ensured that all necessary measures were taken to maintain the integrity and continuity of the company’s operations.

"Overall, the due diligence process played a critical role in identifying key areas for ensuring the seamless operation of GLM RS post-acquisition, with particular emphasis on securing the company's rights over the production facility. This comprehensive approach ultimately contributed to a smooth and successful transaction for Remus."

Another crucial segment focused on regulatory compliance. We meticulously verified the entity’s adherence to local regulations governing the industry, including licenses, permits, and other government filings. Our work to ensure that GLM RS Zrenjanin would continue to hold its rights over the production facility post-acquisition was particularly important. Our findings transposed into the transaction documents, were essential in securing these rights and ensuring the uninterrupted operation of the facility.

We also examined in detail the entity’s contracts, including those with suppliers, customers, employees, landlords, and lenders. We provided recommendations that were reflected in the transaction documents to safeguard our client’s interests moving forward. Additionally, we assessed ongoing and past litigation, disputes, and potential legal claims to ensure that any risks were effectively managed within the acquisition terms.

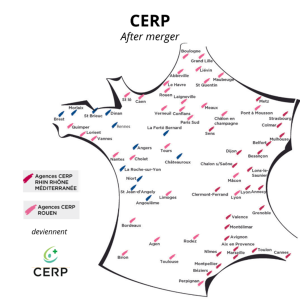

CERP Rhin Rhône Méditerranée (CERP RRM) is the 4th largest French pharmaceutical distributor and with CERP Rouen as the 2nd this merger connects two big players in the industry. The group now has a market share of 32.5% representing almost 8 billion euros in turnover.

The new entity is called CERP and governed under the joint control of Astera and CERP RRM.

CERP Rouen accepted legal support from Valoris-Avocats throughout this merger.

Valoris-Avocats were legal advisors to CERP Rouen, Luc Julien Saint-Amand worked on this project.

Valoris-avocats has been advising Astera / CERP Rouen for 20 years. The pharmaceutical distribution sector in Europe is subject to numerous mergers, with the Phoenix Mac Kesson merger in 2022 creating the largest player in France. Faced with this concentration, the directors of CERP Rouen and CERP RRM decided to join forces.

With my team at Valoris Avocats, we looked at the legal structure of such a merger, because although Astera and CERP RRM are majority-owned by pharmacists, Astera is a cooperative company, while CERP RRM is a commercial company - two models governed by different legal rules that had to be made compatible.

We started with the design of the project by submitting various possible scenarios to the management. The essential thing was to combine the strengths of the two companies while retaining their spirit and culture, i.e. a global offering of pharmaceutical distribution and services by pharmacists for pharmacists.

A merger was not possible because of the different legal regimes, which is why the option of a contribution of the branch of distribution activity was chosen. This approach was put to the CEOs, to the boards of directors, to staff representatives and trade unions. All were convinced of the merits of this project and its procedures and approved it. The merger was subsequently approved by the competition authorities.

With this merger, CERP not only becomes number 2 in France, but also covers almost the entire country. At a time when national pharmacy groups are expanding, CERP can now offer a nationwide service. What's more, the close-knit culture of the two entities, which have been part of the French landscape for a century, means that their teams are able to work very effectively together.

Valoris Avocats as well as Chaintrier avocats advising CERP RRM and represented by Arnaud Moquin, worked very closely with the teams at both CERP Rouen and CERP RRM throughout the merger process. Pharmacists who are customers of CERP RRM have been invited to become members of the Astera cooperative; conversely, pharmacists who are members of Astera have been invited to become shareholders of CERP RRM. The pharmaceutical distribution sector is essential to public health, and regulations are constantly changing. All these aspects augur well for continued cooperation in the future, in line with the cooperative and confraternal principles valued by CERP. CERP will have to continue to adapt, to be agile, and perhaps to move forward with other mergers. Valoris Avocats will be delighted to be at its side.

"In my entire career, this merger has been the most relevant and constructive I have ever experienced: very little duplication, a complementary geographical area and a very similar culture, managers with equally complementary profiles working as a team. CERP is set for great success."

Cobbora Solar Farm is a 700MWac solar farm with a battery energy storage system in NSW which has now been acquired by Pacific Partnerships. Once developed, Cobbora Solar Farm will be one of the largest solar farms in Australia with an approximate footprint of up to 1600MGh of BESS to supply energy on demand.

This adds to Pacific Partnerships extensive portfolio of renewable energy projects across Australia. They will manage the construction, investment, delivery and operations of the solar farm working with CIMIC Group’s subsidiary, UGL in matters of development and maintenance of the solar farm and BESS.

Pacific Partnerships were assisted by Minter Ellison throughout this acquisition.

Commenting on the deal Partner, Paul Paxton, said

" The solar farm forms part of CIMIC Group's strategic commitment to Australia's energy transition, and will contribute to the Australian Government's target of net zero emissions by 2050. We were pleased to assist Pacific Partnerships on this deal and once again, to display MinterEllison’s commitment to being a leading adviser in renewable energy."

Euston Ventures is an investment company focusing on acquiring specialty manufacturing, engineering and technical service businesses in the UK. They were supported in this acquisition by Shawbrook Bank with whom they have a pre-existing partnership with making them the best option for a financial partner.

This was a seven-figure acquisition of Silex. Silex offer a unique market position and heritage as a silicone manufacturer with a strong reputation.

Entrepreneurs Hub supported Silex throughout this acquisition.

My role as Lead Advisor was to work closely with the shareholders of Silex in order to understand their business and establish what were their objectives and goals in pursuing a sale. I then work with the rest of the team at Entrepreneurs Hub to address any areas that need attention before taking them to market and helping them achieve those goals. As Lead Advisor, I essentially stand in the gap, providing expertise and advice to the shareholders, and sometimes a buffer between seller and buyer when required.

Selling businesses is very much a team effort here at Entrepreneurs Hub. We are fortunate to have visionary founders in Malcolm Murray and Andrew Shepperd who have built an incredibly skilled and experienced team. I had the full support of my colleagues through the process including a Project Manager, a CFO-level colleague acting as Finance Lead, an Approach Consultant, a Document Writer and of course our superb team of Researchers.

For all of us at EH the goal is the same – we want to achieve the best outcome for our client which involves providing them with a choice of acquirers and thereby a mix of deal structures. To achieve the success we desire, we need to build a rapport with the client and a level of trust such that they always know we are on their side. Ensuring that we have regular contact with the shareholders is vital even when that means we might be sharing news they don’t want to hear. In the case of Silex this was rare given the strength of the business and the level of interest that we were able to identify across acquirers in the UK, Europe, Canada and New Zealand.

The acquisition of Silex by Euston Ventures will enable Silex to build on the strong levels of client relationship and loyalty they have enjoyed over many years but also provide a new injection of ideas and sales focus. The acquisition will also provide opportunities for key members of the Silex team to advance within the business. Having worked closely with the team at Euston Ventures I know that they have already identified a number of key areas within the business that will benefit from fresh investment which include strengthening their finance team within their German subsidiary NVQ and introducing new process improvement within the UK factory.

This week, Elon Musk is back in the headlines for a bold legal move against multiple major corporations. Since acquiring the social media platform now called X in 2022, the platform’s advertising revenue plummeted by over 50% within the first year. Elon Musk is accusing these corporations for boycotting X for advertising purposes leading to this drop in revenue.

Elon Musk has filed a lawsuit in federal court in Texas against, Unilever, Mars, CVS Health, Ørsted and the World Federation of Advertisers.

The lawsuit is founded on the accusation that the companies have violated US antitrust laws by boycotting X. Claims that they conspired against X and have deprived the platform of “billions of dollars” in advertising revenue.

Musk argues that they have also harmed themselves by steering clear of X and missing out on the benefits of advertising on a major social media platform.

Musk's legal team is likely to argue that the actions of Unilever, Mars, CVS Health, Ørsted, and the World Federation of Advertisers constitute a concerted effort to stifle competition and harm X's business operations.

Since Musk's acquisition, X has faced increasing scrutiny over the rise in harmful content on the platform. X reports that 31% more people have reported harmful content since Elon Musk’s takeover.

The X guidelines state that there is no screening process to remove potentially offensive comments and their policy is to not mediate content or intervene in disputes between users.

Companies have avoided X as the harmful content on the platform could easily affect their brand safety. A Unilever executive who testified at last month’s congressional hearing and defending the company’s practice mentioned that they choose to place ads on platforms that won’t harm their brand. This comes as brands avoid X due to having their ads show up next to pro-Nazi content and hate speech.

X has stated that it had applied brand-safety standards which compare to competitors and that “meet or exceed” measures specified by the Global Alliance for Responsible Media. They are seeking unspecified damaged and a court order against continues efforts to conspire against X by withholding advertising.

The American Bar Association (ABA) has published its first ever formal opinion of the use of generative artificial intelligence (GAI) in legal practice as its influence increases.

Formal Opinion 512, which has been created by the ABA’s Standing Committee on Ethics and Professional Responsibility, states that to ensure that all clients are protected then lawyers and law firms that are using GAI must “fully consider their applicable ethical obligations”.

These include duties to supply competent legal representation, to ensure the protection of client information, establish client communication and to charge reasonable fees that are consistent with using time with GAI.

The 15-page opinion booklet outlined a host of model rules, for example surrounding competence a rule said that lawyers are obligated to provide competent representation to clients and requires they exercise the “legal knowledge, skill, thoroughness and preparation reasonably necessary for the representation.”

While lawyers also need to understand the risks and benefits with technologies that are used to deliver legal services to clients.

A further model rule over confidentiality, revealed that lawyers need to be aware of their duties to keep all information as part of their client representation under wraps.

Other model rules have asked lawyers to extend similar protections to former and potential clients’ information looking to the future.

Clients should also receive timely communication from their lawyers if it is important to their situation.

As for fees to be paid for legal services another model rule stated that expenses must be at a reasonable rate, where there needs to be a set of criteria in place to ensure that prices must not spiral out of control.

The formal opinion notes that if for example a lawyer uses GAI to draft a pleading then he or she can charge the client for the time spent on this, and for any time necessary to review the resulting draft for accuracy and completeness.

Yet a lawyer cannot charge a client for any time taken by learning how to use a GAI tool in the processing of the case.

“With the ever-evolving use of technology by lawyers and courts, lawyers must be vigilant in complying with the Rules of Professional Conduct to ensure that lawyers are adhering to their ethical responsibilities and that clients are protected.”

Formal Opinion 512 concluded.

There have been a number of steps forward that GAI has made in legal practice in recent times.

They include user-friendly interfaces that has made them more favoured by legal professionals, it’s a development that is allowing more influence from GAI in their working patterns.

Also there has been several new releases on base AI models, where they have shown huge improvements in their performances, making them more appealing for lawyers as they become better equipped to deal with legal tasks.

Communication and transparency are areas that the ABA highlighted as part of its opinion views of GAI, and there has been a notable increase of interaction and clarity from AI vendors in how information is used.

KPMG have made of series of forecasts over what the future holds for GAI and how influential it is set to become in law.

The application of GAI to legal work will significantly increase efficiency and productivity.

These are gains which are also set to grow, as legal professionals become even more comfortable with GAI solutions and develop more ways to use them.

Although legal teams are advised to stay vigilant as the dependence on GAI escalates, as there are risks involved such as data breaches that could effect client privilege.

KPMG also believe that as GAI continues to advance and collect huge volumes of data, it will become increasingly difficult to trace and verify the sources used to train these technologies.

As a result there have been disputes over the GAI’s use of copyrighted information, proof of who “owns” a source of original data could frustrate any efforts to gain intellectual property protection for AI generated results.

In response privacy teams will need to expand their focus to streamline processes, and adapt to AI related risks and regulations by rapidly forming internal policies.

Cyber security threats are likely to increase, as KPMG predict that as cyber criminals become more able to use GAI for disruption purposes and spreading misinformation.

Legal teams will be called upon to combat security attacks, by advising companies on consistent policies to be able to defend against any attacks.

Cyber security will need to be in place at an appropriate level to protect the data of an organisation, and legal firm employees will need the skills to recognise and understand the sources of cyber risks.

In four years it will be Los Angeles’ turn for the third time to host the Olympic Games, and the city has secured a significant funding package of $900 million that has been signed into law.

The Biden administration in March this year allowed the spending through the Bipartisan Infrastructure Law and the Inflation Reduction Act.

The Los Angeles metro system will receive a huge $709.9 million from the law alongside the city’s transportation spending law for the current financial year, which will be directed towards the East San Fernando Valley Light Rail Transit Project.

Additionally the Los Angeles region is set to be delivered $160 million in new federal grant funding for street and transit infrastructure, traffic safety and to improve connections between neighbourhoods.

The California Senator Alex Padilla has also announced $139 million arriving from federal funding as part of the Los Angeles County Metropolitan Transportation Authority “Removing Barriers and Creating Legacy” project.

It’s an assignment that is designed to reconnect communities in the city across highway and arterial barriers.

The main aims of the investment is to improve bus speed and reliability, alongside first and last project strategies and mobility hubs that will upgrade connectivity in the LA County to one million disadvantaged Angelenos.

It’s a grant from the Reconnecting Communities Pilot and Neighbourhood Access and Equity programmes, that were created and established by the Bipartisan Infrastructure Law, which other projects will also benefit from.

Overall $30 million has been allocated to the Alameda County Transportation Commission for the Lake Merritt to Bayfair Project, that is to develop 10 miles of street improvements in the cities of Oakland and San Leandro.

Connectivity between communities is again the main driving force of the project, where the funding will be directed to shared-use paths, protected bikeways, neighbourhood routes, protected intersection treatments and pedestrian crossing safety.

Other projects include $9.96 million that is to be diverted to a three-way partnership between LA Metro, Caltrans, and LA County Public Works, that will construct a pedestrian and bicycle overcrossing adjacent to the existing Humphreys Avenue bridge.

Also the Port of Los Angeles is to be modernized with a $5 million grant to support a pedestrian bridge that can also support emergency vehicles.

It is felt that there is no time to waste to develop the city and considerably strengthen its infrastructure in time for the next Olympics, a sentiment that grew during a visit by a delegation from Los Angeles to the Paris Games.

The vision of the investments are to ensure that the Games in four years time runs as smoothly as possible, but also to leave a legacy of a lasting public services where mobility and transports connections have been improved.

It’s also hoped that a bus service with increased efficiency will open up more job opportunities.

The Bipartisan Infrastructure Law was signed into law in August 2022, and is seen as a historic opportunity to repair public infrastructure and transport links.

Also the vision is to make the largest investments in the nation’s history to combat climate change, and to promote long term sustainability.

A party of 28 from the Los Angeles County Sheriffs Department joined officers from all over the world to support law enforcement in Paris.

While they are there to protect American citizens and the athletes who are competing at the Games, their visit is also to help prepare the city and its level of security in hosting the next Olympics.

A statement from the sheriff’s office said that a diverse group has been sent to gain invaluable experience, to ensure that the Los Angeles Games is delivered safely and without major incidents.

Specialised units were sent including patrol and canine teams, and discussions on public safety strategies have taken place with law enforcement officers from different parts of the world.

In January the Secretary of Homeland Security declared that the area surrounding the Games a National Special Security Event, where the formal planning processes for the designation began in June and the first meeting of the Executive Steering Committee took place.

The committee comprises of senior representatives from federal, state and local law enforcement and public safety partners.

Such a designation is typically based on the size and significance of the event, and the amount of people who will attend.

The federal government will allow significant resources to police a major event like the Olympics, in a partnership with state and local law enforcement bodies as well as public safety organisations.

In addition the United States Secret service will be authorised to take its role as the lead agency in the implementation of a security plan.

The integration of generative AI within the legal industry offers substantial advantages for both lawyers and clients. By enhancing efficiency, AI significantly reduces the time required for tasks such as legal research, document drafting, and case analysis. This technological advancement allows lawyers to allocate more of their focus and expertise to other critical aspects of their cases, ultimately improving the overall quality and effectiveness of legal services. The streamlined processes facilitated by AI not only expedite case management but also elevate the precision and depth of legal work, benefiting all parties involved.

Adhering to ethical guidelines is crucial for law firms to mitigate the potential risks associated with AI usage and to uphold the integrity of their practices. Law firms must establish and enforce comprehensive policies that govern the ethical implementation of AI. These guidelines ensure that AI is utilised responsibly, safeguarding against biases, protecting client confidentiality, and maintaining compliance with legal standards. By following these ethical protocols, law firms can confidently integrate AI into their operations while preserving the trust and credibility they have built with their clients.

The ABA have recently provided their official opinion on the uses of AI providing those in the legal industry a clear guidelines going forward.

This is the first formal ethics opinion on generative AI from ABA, giving law firms a guidelines of how to use the technology effectively and ethically. This takes into consideration the protection of both law firm and client when using AI, preventing any misconduct and potential risk that come with using technology.

ABA noted that when using AI the user must ‘fully consider’ their ethical obligations to protect clients, including duties related to lawyer competence, confidentiality of client data, communication and fees.

They have stated that lawyers do not need to be experts in the technology but should have a good understating and implications of what they are using. Lawyers must also keep up with any changes and law firms should provide a basic level of training.

Forbes emphasises the necessity of vigilance when using AI due to the significant risks involved. This point is illustrated by the genuine incident of when two attorneys submitted court documents containing fictitious legal citations and precedents generated by AI in a civil case. It is crucial to prioritise thoroughly checking AI-generated work to avoid such errors and ensure the integrity of legal documents.

Following last year’s noteworthy success, where summer associates achieved record-high employment rates and salaries, the landscape has shifted drastically this year. This year’s law student are experiencing significant challenged when it comes to job offers with law firms being much more conservative in recruitment.

Data from NALP (National Association for Law Placement) indicates that recruitment has hit an 11-year low, as firms extend fewer offers to their summer associates, partly due to reduced demand. In particular, there has been a 19% decline in offers for law graduates this year whilst the increased size of classes, averaging 12% has intensified the competition pool.

In a stark contract, the previous year saw 92.6% of graduates employed within 10 months of graduation, the highest rate on record since 1974 with NALP.

A US 2024 Summer Associate Survey reveals that 37% are most concerned about not receiving a position at their summer law firm, their apprehensions seem to be warranted this year.

The NALP report indicates that the reduction in hiring by Law firms’ is most likely the result of a slowing demand from clients as well as the excess capacity created from the record-high recruitment of summer associates in 2022. Notably, over 89% of the summer associates who were offered position in 2022 accepted and joined the firms in 2023.

Utilise your time at the law firm to gain a thorough understanding of its operations as well as to build relationships with your colleagues. Demonstrating your ability and willingness to integrate into the firms culture can go along way for you chances of gaining a position there. Working with your team and those in the firm is crucial for your internship as well as working there everyday if you get the position and is a significant part of the interview process.

Networking with your colleagues is beneficial for fostering strong professional relationships withing the firm as well as your future career. Knowing influential and successful people within the industry can be useful in the future. Learning from those around you will contribute to your development as a lawyer.

If you have not maintained a record throughout your summer which details your projects, accomplishments and methodologies then it is important to reflect back and create an organised log. This can serve as a great foundation for creating a professional portfolio which you can present in your interview.

The record should highlight any contributions and achievements you have made during your time there and this could influence the interviewers’ decision in your favour.

Your willingness to learn is crucial, however, if you do not clearly demonstrate this then your interviewer may not recognise it. During your placement, you will be assigned tasks and projects, it is advised to proactively seek any additional responsibilities. This could include, taking a lead role or requesting extra tasks.

Taking the initiative showcases your eagerness to expand your knowledge and understanding of the workplace but also highlights your commitment to actively contributing to the firm.

Vaxart is a biotechnology company developing a range of oral recombinant vaccines based on its proprietary delivery platform. Their vaccines are designed to be administered using pills that can be stored and shipped without the need of refrigeration and eliminate the risk of needle-stick injury.

Vaxart’s underwritten offering of 50,000,000 shares of its common stock at an offering price of $0.80 per share, a premium to the last closing price. The completed offering came to a value of $40 million.

Oppenheimer & Co. acted as sole bookrunner for the offering.

Thompson Hine LLP served as outside corporate and securities counsel for Vaxart. The deal was led by New York based partner Faith Charles, who leads the firm’s Life Sciences practice and co-chairs its Public Company practice.

Charles commented:

“I’m so pleased to have played a role in this deal and in helping Vaxart with its mission to develop and bring innovative vaccines and technologies to market.”