The case of providing the victims of the Post Office and Horizon scandal compensation has been ongoing and remains in this state. Alan Bates appeared today, the 27th February to provide evidence to MPs on the need for justice for the victims and their families.

Bates highlighted the importance to speed up the scheme and proposed that people are given a supplementary amount whilst they wait for the process to be completed.

“It’s financial redress. This is money these people are actually owed”

They were also joined by James Hartley of Freeths and Dr Neil Hudgell, the executive chariman of Hudgell Solicitors, as both are dealing with a large number of the branch operators and acting on behalf of the victims.

Hartley explained that the process of the Post Office disclosing their evidence is delaying action greatly.

As well as waiting for the Post Office to provide justice there has also been discussion of whether Fujitsu, the creators of the Horizon system will provide redress.

They have set up a GLO scheme, where claimants can choose this avenue to compensation. As well as this, an Overturned Convictions Scheme is also available where members will receive payments while final settlements are processed.

It has also been stated that, legislation to clear wrongly convicted sub-postmasters is also expected to be brought forward next month.

Both lawyers agreed an estimate of 1-2 years before all victims are properly compensated.

Various individuals were called on including Nick Read, the current Post Office CEO as he updated MPs on the progress to redress victims. Mr Read argues for the change he has brought to the Post Office and for the postmasters to rebuild the trust however, the slow action to bring justice for the former postmasters was in question.

It could be quite some time for the victims to receive correct justice as organisations and MPs discuss the process and the fate of those who are waiting for what is owed to them.

On the 24th of February 2022 Russia launched their invasion on Ukraine by sending armed forces into the capital, Kyiv as well as the second largest city in Ukraine, Kharkiv with the aim of overthrowing President Volodymyr Zelensky’s government.

Now, two years on this war is on-going with thousands of people killed, forced from their homes, and torn from their families.

The BBC offers current updates on the war.

Ukraine currently has very limited claimed land as the Russian forces make their way and take control over major areas with their main goal being the subjugation of Ukraine.

The Geneva Conventions are the set of humanitarian laws which should be followed during a war, originally created in 1864 to help preserve humanity during wartime. The International Criminal Court (ICC) accused Russia of breaching these conventions as well as the US making the same claim, both very early on in the invasion of Ukraine. Both Ukraine and Russia are not a member of the ICC however, Ukraine has accepted their jurisdiction and so cooperation with the court say the ICC.

There are multiple investigations in place with evidence building up as lawyers aground the world work to build cases against Russian troops and in some cases even charges against Putin is the aim.

Ukraine have relied on the support from the west, providing ammunition and troops, however with their aid becoming less dependable they face a struggling defeat. The long-term commitment of Ukraine’s allies are beginning to be questioned.

Ukraine is in desperate need of further military aid and whilst the US and UK have been steadfast in their pledges there has been a recent slowdown of actions. This delay in action has already caused the Ukrainian soldiers to be left short when they needed aid the most.

The Japanese Prime Minister, Kishida Fumio pledges his “unwavering support” during a speech as the Japan-Ukraine Conference in February 2024.

The Diplomat paper reminds us that legal restrictions prevent Japan from sending lethal aid so instead it largely focuses on humanitarian, economic, and non-lethal military aid.

Japan is offering…

The world would never have imagined the war would go on for this long and yet there is no end in sight now two years later.

With both Ukraine and Russia continuing their battle and urging for more weaponry, the negotiations have reached a worrying stalemate. Without any movement and only more violence there is concern for how much more disruption the war is causing for thousands of people.

Every year thousands of people flee their home countries to migrate to the UK. Often people will have to enter through unsafe routes such as small boats and this will likely cause them to have a traumatic journey before they arrive.

Those who leave their home countries often do so to escape from war, violence and the threat of persecution. The urge to find a better and safer life fuels people to take these risky journeys even without the correct legal authorisation to do so.

“In the year ending June 2023, there were 52,530 irregular migrants detected entering the UK, up 17% from the year ending June 2022. 85% of these arrived via small boats.”

Once people arrive in the UK they can apply as an asylum seeker, however, this is not possible until they are physically in the UK, leaving no legal, safe way to migrate. The government estimates that in the year ending, June 2023, 90% of arrivals from small boats had an asylum claim recorded as a main applicant or dependent. The process could take years until people receive the authorisation to be a resident in the UK.

74% of all small boat asylum applications since 2018 are awaiting a decision and only 1% of the arrivals in the year ending June 2023 have received an initial decision. People will remain detained until a decision has been made.

If permission is denied to stay in the UK this would make someone an irregular migrant in the UK which makes it more difficult to acquire regular status again. A person could be removed from the county and banned from re-entering for 1-10 years.

In July 2023 the UK government passed the Illegal Immigration Act which restricts those who enter the UK without the correct documentation.

This act means that irregular migrants will be detained and then removed to their home country or a safe third country such as Greece or Rwanda. This process could take years whilst the families and individuals will have to remain detained and unable to work, generate an income, receive access to education, and proper healthcare and be witness to potentially scarring scenes.

The Government have laid out the aims for this act…

If irregular migrants are forced to relocate from the UK they will either be sent to their home country or a safe third option.

In 2022 Boris Johnson agreed to a Migration and Economic development partnership whereby those who enter the UK illegally and who are not granted authorisation to stay will be relocated to Rwanda.

Only a small number of people will be accepted into Rwanda each year due to what their system can handle.

The Supreme Court ruled against this policy stating that Rwanda was not a safe option due to inadequacies in their asylum system. In response, the UK Government agreed to a new treaty to update and replace policies in order for Rwanda to be declared a safe country for asylum seekers.

Rwanda is now stated as safe and there would be no argument for irregular migrants to stand on unless they in particular would be unsafe there. The treaty aims to deter people from making the unsafe journeys to the UK as they could be sent to Rwanda once they arrive.

Illegal immigration is an act of seeking protection and refuge from another country without legal documents when one's own is unsafe. It can be difficult to acquire the correct authorisation to legally stay in the UK and the process could last years before a decision is made. This often leads to people being unable to work and receive the resources needed for healthy wellbeing. The immigration laws in the UK are often changing and for those who seek asylum, it could become more challenging to receive a positive outcome.

DAC Beachcroft’s Commercial Technology team successfully advised CoBa Technology on a deal with Lloyds Banking Group to offer next-level digital solutions to commercial banking clients.

Tim Ryan, Partner, and head of the national technology team at DACB, said

"We were delighted to work with the fantastic team at CoBa on a deal that is helping the company continue to realise its vision of re-imagining the way businesses and banks collaborate."

Carl Hasty, CEO and Co-Founder at CoBa, commented,

"We're very grateful to the DAC Beachcroft team for their invaluable advice during this important business win for CoBa."

I have known one of the entrepreneurs behind CoBa for many years, having initially met him via mutual contacts in FinTech. I always say that the best relationships are long-term; they build understanding and trust. Having been introduced to the rest of the senior CoBa team and discussed what was required, I was pleased that we were chosen to advise them on this deal. The DACB team was led by me and Senior Associate Alistair Cooper, with the support of others in our specialist group.

The key is always to understand the commercial and operational drivers of the parties and, certainly, to be embedded in the detail of the technology underpinning the deal. This is something we focus on heavily in our team, as well as delivering legal and strategic advice on time and on budget, of course.

CoBa's cloud-hosted connected banking platform is, in conjunction with Lloyds Bank, transforming the collaboration between the bank and its business customers by connecting core financial information and services to create an all-in-one digital banking solution. Through the platform, customers can have all their banking needs supported in one place so they can enjoy seamless banking, quickly make informed decisions and scale with confidence.

The deal is testament to the work of our DACB team, in supporting companies that are disrupting financial services markets through innovation. The team works closely with clients to help them navigate every step of their business lifecycle in the technical and regulated sector in which they operate. We understand the underlying technology behind the commercial solutions pursued by our clients. We speak the language of those in FinTech, from the positive tech disruptors to the financial institutions, understand their commercial needs and market nuances, and apply our legal, regulatory, and commercial expertise to enable our clients achieve their business goals. We work for developers, suppliers and procurers of IT and digital solutions, so we understand the complex and often unique challenges and opportunities across a wide spectrum of client types and markets. In addition, we are entrenched in the complex and evolving regulatory and legal framework, including a network of senior decision makers in the UK Government, key industry bodies (e.g. the Investment Association), the regulators of the financial services industry and leading global financial institutions. Our team combines a relevant cross-skill set including technology, commercial, corporate, regulatory (financial markets), data, IP – in short, it is our sweet spot.

The national Commercial Technology team at our firm which I head-up is one of the largest in the UK, with over 40 lawyers advising clients domestically and internationally across all sectors and all types of projects and business-as-usual work. The team regularly advises on issues ranging from day-to-day contractual matters to complex digital transformation projects.

We are at the forefront of positive disruption and digital evolution, within financial services and other key vertical sectors, including healthcare, insurance, and real estate. This is driven by our expertise and reputation, built as a result of helping our clients deliver value on landmark projects and industry firsts. Naturally, it enhances our profile and credibility in the market, and builds a strong brand equity, in the emerging and deep tech space, including AI, financial platforms, data, blockchain and web3, for example. Our clients see us as key specialists in these areas; as enablers and experts in technology and business, rather than just specialists in the law itself. Ultimately it's about people – I'm proud to say my team is full of them. This is one of the reasons our clients work with us on a repeat basis, I believe.

Cases of fraud have been growing rapidly in volume as well as, cost and complexity. Fraudsters are finding more complex and stealthy ways to commit the crime.

AI is being used by the fraudsters as well as the victim using it as a defence. SEON reported that 87% of fraud experts predict an increase in fraud for 2024 as in 2023 fraud in the UK had more than doubled.

Reported cases rose by 18% and high value cases which are those over £50m rose by 60% in 2023.

The use of technology gives people access to far more people from all over the world making it easier to reach more people at once too. Online scams are prevalent and in 2023 Barclays reported that 70% of scams were on social media. The use of AI makes these scams far more believable and the fraudsters can be smarter by impersonating a trusted organisation.

Phising has become a popular technique, using emails to pose as a reputable company to gather personal details such as passwords, credit card information or addresses.

The cost-of-living crisis has made individuals and businesses more desperate and provides an incentive to commit fraud.

“Fraud accounts for around 40% of all crime in England and Wales, with an estimated 3.2 million offences each year.”

The Crime Survey of England and Wales has found the estimated cost of fraud to society is £6.8 billion.

High value cases of fraud rose by 60% in 2023, usually meaning a business or wealthy individual has committed fraudulent acts.

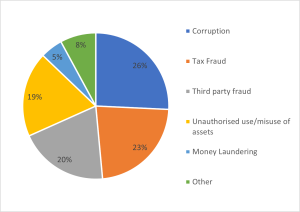

BDO conducted a study to discover which types of fraud are currently the most common by value.

The Government have now launched their campaign to prevent fraud, “Stop! Think Fraud.”

This campaign will spread awareness so people can be better protected from fraud. The Government is working with banks and organisations such as Barclays, Google, TikTok, The National Crime Agency and more so they can spread the message and be there to prevent and support.

Next month we can expect another strategy commitment to be delivered as the Home Secretary will welcome interior ministers from international partners to London where they will host the first ever Global Fraud Summitt.

The UK making legislative changes could drive up the statistics as they work to bring down the cost of the courts.

-The Economic Crime and Corporations Transparency Act’s new “failure to prevent” fraud offence is going to hold companies liable for any offences committed by an associate to benefit the organisation. If they can prove that they had reasonable fraud prevention procedures in place the charges could be dropped. This could add to the value of fraud cases despite the regulation being there to hold those accountable.

- Banks regulations are changing so that the banks will have to reimburse victims of APP frauds. This will add to the reported cases statistics.

It is likely that fraud will continue to increase in volume and value as strategies can become smarter and more efficient with the use of technology.

The Alberto Sordi Gallery was built in 1900 and has since held architectural value for the city. It is being reopened to hold 15 shops. The Gallery is located in the centre of Rome with famous landmarks such as the Pantheon or Fontana di Trevi close by. The reopening will bring a new shopping and leisure experience to the city.

Prelios sgr is the management company of the Megas Fund, whose the only shareholder is the Enasarco Foundation, in the complex administrative procedure that led to this grand reopening after two years of work so far.

The law firm Gattamelata e Associati, assisted Prelios sgr, for administrative law aspects.

“Three years of procedural activity returns an iconic property to Rome and enjoyable by its citizens.”

www.gattamelataeassociati.it/en/

Oncodesign Services is a French based, leading company in preclinical research and contributes to the development of innovative therapies in oncology, inflammation and infectious diseases. ZoBio is a Dutch based company that offers its customers solutions for fragment-based drug discovery, they use biophysical techniques for their innovative work in the field of drug discovery.

This acquisition of ZoBio allows Oncodesign to become a European leader in drug discovery and they will be able to expand their reach in Europe and further their expertise as well as what they are able to offer their customers.

Axon Lawyers (based in Amsterdam) advised ZoBio during this transaction.

“It was a pleasure to work with the driven and knowledgeable Zobio team on this deal.“ -- - Carine van den Brink, partner Axon Lawyers

The Norwegian company, Yara which specialises in the production and marketing of high-end fertilisers has sold its entire stake in Yara Cameroun. The sale means Yara Cameroun will operate under the name Hydrochem Cameroun. Noutchogouin Jean Samuel (NJS) bought the shares which marks a turning point for the group extending their influence in the agricultural sector. NJS has ambitions for expansion projects which will strengthen food security and promote innovation in the agricultural sector.

Yara were supported by Zangue & Partners providing legal advice during this deal and were honoured to have successfully led this transaction.

The role of Zangue & Partners consisted of;

Reviewing the transaction in accordance with Cameroonian law; Monitoring for the obtention of the authorisations required to complete the transaction; Assisting with the labour issues arising from the transaction; Monitoring and assisting with the fulfilment of the conditions precedent to the completion of the transaction; Monitoring the completion of post-closing formalities.

They remain at the entire service of their valued clientele.

“Zangue & Partners – personalised advice, effective solutions, availability and expertise to support your needs.”

Effisus develops and sells integrated solutions for civil construction to promote the energy efficiency of buildings and guarantee the tightness and fire protection of facades and roofs.

This acquisition falls within the scope of Viriato Capitals strategy and aims to enhance the company’s growth, strengthening its position in the current markets and encouraging the opening of additional markets.

Viriato Capital plans to support Effisus in the development of solutions that will contribute to greater sustainable energy efficiency in buildings and consequent preservation of the environment. Viriato Capital received legal advice from CCSL Asvogados and also included a team from Farrer & Co.

The founders of Effisus were advised by law firm Teixeira & Guimaraes – Sociedade de Advogadosas, as well as the consultancy firm, Hub Advisory, who acted as M&A advisors.

Hub Advisory Partners has been advising Effisus on finding and executing the best strategy to address the future for both shareholders and the company. The company has enormous potential both in terms of its portfolio of solutions and products, its approach to the market, its geographic locations and market expectations. Our role has focused on managing the entire process, addressing potential investors, qualifying the project, negotiating the conditions and closing the deal.

Identifying the challenges of both shareholders and companies and translating them into realistic and executable strategies is the first step to address the different challenges to be faced within this kind of process. How to approach growth in a sustainable way, how to finance it, both organically and non-organically and how to integrate different cultures from shareholders to the organisation. These are very common challenges, which we address on a bespoke basis for every project. This deal has been very intensive from a cultural fit standpoint, aligning long term interest for both parties required a lot of fine tuning so all pieces fit together.

The potential of Effisus' solutions for commercial buildings is huge, and its geographical footprint with premises in the UK, EU and Middle East are an outstanding platform to leverage growth. Its business model will require a considerable reinforcement of commercial and technical support teams.

Viriato is aware of both the opportunity and the challenges to be faced and has already outlined an ambitious plan to be executed in the upcoming years.

Our business relationships are based on an exquisite knowledge of our clients' needs and expectations, allowing us to execute transactions and strategies in a very realistic way; Trust Building. Trust is very important due to the very intimate nature of the projects we execute. As an independent firm, our professional advice is sometimes not fully aligned with the shareholders or management conventional wisdom, and we need credibility and trust to share our thoughts regardless our clients view on the matter.

Our expectation is to continue to maintain high value-added relationships with our clients. HUB advisory follows a “boutique” approach, and we take great care and attention to our relationships and the execution of our engagements. We invest a lot of time with our younger associates, so this culture permeates and is perceived by our clients from our whole team.

Albaron Partnes LP has announced the completed sale of Albaron Podiatry Holdings LLC, Beyond Podiatry. This is the Midwest’s leading podiatric medicine practice management company, sold to CUC Inc.

Alboron Partners is an operationally middle market healthcare private equity firm.

Beyond Podiatry treats over 250,000 patients every year since being founded in 2018.

This transaction marks the first acquisition for CUC Inc, as well as the first private equity exit in U.S. podiatry.

Cozen O’Connor was the legal advisor to Albaron Partners.

“We partner with clients throughout all phases of a sale transaction with a focus on increasing value and minimizing risk.”

Cozen O’Connor represented Albaron Partners the controlling shareholder in the sale of its interests to CUC. The team included M&A attorneys, tax attorneys, employee benefits attorneys and health law attorneys.

The buyer was new to the U.S. market. Healthcare is a highly regulated industry. They did an incredible job coming up to speed quickly. The only way to ensure a smooth process is constant communication with the client, the attorneys for the other side and amongst our internal team. It’s very important to set and keep expectations.

Albaron’s general counsel is extremely knowledgeable about the business and the M&A process. Having a skilled attorney in house makes the process much smoother.

I spend significant time with clients to understand their priorities and communication style. I am involved in every step of all transactions. We don’t dump clients or transactions on junior attorneys. I understand a transaction is not about me winning arguments or points, it’s about the client reaching a successful conclusion, as they define it.

Cozen O’Connor’s Corporate Practice and attorneys have been consistently ranked by Chambers USA, IFLR and The Legal 500. In addition, the firm was named a Cannabis Practice of the Year for 2024 by Law360.

The firm recently launched its Global M&A Practice, comprised of attorneys who are well versed in the legal and regulatory requirements of diverse jurisdictions, as well as in the cultures, customs, and mores that underlie all successful international deal making. As a North American-based firm with more than 30 offices, Cozen O’Connor partners with foreign law firms to assist their international clients in executing M&A deals, as well as guides domestic and foreign clients in trajectory-changing transactions.

Founded in the United States, Cozen O’Connor expanded its corporate presence into Canada in 2023 with the addition leading corporate and securities attorneys in both Toronto and Vancouver. The firm continues to further expand its offerings with the strategic addition of attorneys throughout North America.