It’s often assumed by the public that serious injury claims in England and Wales end up being decided by a judge sitting in court. After all, they involve complex medical issues, with life-changing consequences for the injured person and their family. So, surely let the judge decide how much the claimant should get?

The total compensation awarded in complex injury cases can run into the millions of pounds, but only after an enormous amount of skilled legal work from the lawyers involved in the case. So, it might surprise laypersons that most serious injurycases settle (in excess of 96%) and resolve without the necessity of a full trial on liability or quantum.

This is not due to the simplicity of the issues or to the modest nature of the injuries – far from it. It is because the English civil justice system forces the parties to the claim to identify strengths and weaknesses, exchange evidence, and evaluate the risks involved long before trial.

Whilst serious injury claims are frequently listed for trial, this only serves to put further pressure on the parties to ensure they have all the evidence they need to enable serious and meaningful negotiations to take place before the court hearing.

In serious injury litigation cases, liability is addressed at an early stage. The Pre-Action Protocol for Personal Injury Claims applies to lower-value cases, where the expected damages require the claimant to set out the factual and legal basis of the claim at the outset, supported by whatever evidence is available. The defendant is then required to investigate and provide a reasoned response.

Whilst serious injury claims are conducted without the requirement to adhere to a strict protocol, it is expected that the spirit of the protocols should still mean that matters are dealt with expeditiously. Indeed, the Practice Direction on Pre-Action Conduct makes it clear that it expects parties to do all they can to avoid unnecessary litigation, with costs sanctions as the penalty for failing to do so.

It is therefore relatively common for defendants or their insurers to make an early admission, after which the case focuses entirely on the consequences of the injury and the level of compensation required.

Even where liability is contested, English courts expect parties to clearly identify the points of disagreement and get to the crux of what is in dispute and what’s not.

In serious injury claims, obtaining the right medical evidence is at the centre of the whole claim. Medico-legal evidence from multiple experts is usually required. The severity of the claimant’s injuries usually means that follow-up reports are required on an ongoing basis. As a result, it is often impossible for the parties to assess final damages until a firm prognosis can be made with confidence. This means that cases may take many months, if not years, to reach a conclusion.

However, during this time, the parties will exchange expert reports covering not only the medical position, but also care needs, whether the claimant’s accommodation needs adaptation (or even changing altogether), if there is a requirement for assistive technology (and if so, what types), and future loss of earnings. These reports are usually prepared by acknowledged experts in each field and remain subject to strict procedural rules.

Once both sides have digested all the expert evidence, the likely range of damages can start to be assessed. There may still be differences between the parties, but they are usually about the extent of the injury or loss, rather than whether compensation is due at all. By this stage, going to court for an assessment trial becomes less attractive, due to the extra costs involved. In other words, it becomes a question of whether the costs, delay, and uncertainty of a hearing are justified when both parties are in broad agreement about what the case entails.

English judges play an active role in managing serious injury claims through case management conferences and cost budgeting. At the case management conference, the parties must justify the steps they propose to take.

The costs budgeting hearing requires the parties to provide a detailed estimate of the legal costs each expects to incur throughout the proceedings. The court will then state the extent to which it approves each budget.

Serious injury claims are expensive to run. A sensible settlement reached earlier can often deliver a better outcome for all involved.

Another reason serious injury cases settle is the need to support the injured claimant while the claim progresses. Where liability is admitted, interim payments are often made to fund rehabilitation, care, equipment, and adaptations to accommodation.

Once the claimant’s immediate needs are being met, the case becomes less adversarial. The emphasis shifts towards long-term planning.

It would be wrong to think that serious injury trials never happen. Some cases do need to be decided by a judge at court. Liability is not always admitted in serious injury claims. Expert evidence cannot always be agreed upon. Still, such cases remain in the minority.

Settling a case is sometimes seen as a soft option. That may be the case with some lower-value claims.

However, lawyers who act for seriously injured or catastrophically injured claimants, and indeed their counterparts acting for the defendant, are usually highly experienced specialists with years of experience behind them. They are equally expert at balancing risk and reward for their clients and know that getting the best result doesn’t always involve their clients in “having their day in court”.

Navigating the aftermath of an accident can be a challenging endeavor, where the pursuit of fair compensation often becomes a primary focus. The outcome of a personal injury claim isn’t solely determined by the severity of the injury or the clarity of fault. Instead, it’s frequently influenced by the actions and decisions of the injured party in the critical days, weeks, and months following the incident.

Unfortunately, many individuals can inadvertently make mistakes that substantially diminish the value of their settlement or award. Recognizing and avoiding these common pitfalls is essential for protecting one’s legal rights and financial future.

Below are the common errors that reduce personal injury compensation:

One of the most detrimental errors is delaying or outright refusing medical evaluation after an accident. Even when pain seems minor or nonexistent initially, adrenaline can mask serious symptoms. From an insurance adjuster’s perspective, a gap between the accident date and the first medical treatment can create a powerful argument that the injuries weren’t caused by the collision or were less severe than claimed.

A consistent medical record, beginning immediately after the event, can establish a direct causal link. Furthermore, failing to follow through with all prescribed treatments, therapies, or follow-up appointments can be interpreted as a sign that the injured party isn’t genuinely committed to their recovery, thereby undermining the claim’s credibility.

Perhaps the most overarching error is attempting to navigate the complex personal injury claims process without expert guidance. The legal system is replete with procedural rules, statutes of limitations, and strategies known primarily to professionals. An individual negotiating directly with an insurance company is at a severe disadvantage, lacking knowledge of case law, proper valuation methods, and litigation tactics. Securing knowledgeable counsel, such as the Trusted Injury, Family, and Criminal Law Attorneys in Charlotte & Concord or similar locations, can level the playing field. These professionals can manage communications, conduct thorough investigations, consult with medical and economic experts, and advocate aggressively to secure maximum compensation, often obtaining settlements that far exceed what an individual could achieve alone.

It’s crucial to remember that the insurance adjuster for the at-fault party isn’t an ally. Their primary objective is to minimize the company’s financial payout. When contacted for a statement, politeness shouldn’t translate into compliance. A recorded statement can be a minefield. For instance, casual remarks about feeling "okay" or speculations about the accident’s cause can be taken out of context and used to deny or reduce a claim. There’s no legal obligation to provide such a statement, and it’s generally advisable to decline politely and direct all further communications to a legal representative.

In the modern digital age, social media activity can pose a significant threat to personal injury claims. Insurance investigators routinely scrutinize claimants’ profiles for any evidence that contradicts the alleged injuries. A photo from a social gathering can be misconstrued as evidence of a full recovery, while a comment about physical activity can be used to argue that injuries are not disabling. The safest course of action is to deactivate or severely restrict social media access for the duration of the claim, treating all platforms as public forums under surveillance by the opposition.

A successful personal injury claim is built on compelling evidence. Failure to document the scene, injuries, and impacts of the accident can weaken the case substantially. Critical documentation includes photographs of vehicle damage, roadway conditions, visible injuries, and the accident scene. A detailed pain journal documenting daily physical limitations, emotional distress, and the impact on family life can provide invaluable subjective evidence of non-economic damages. Meticulous records of all medical bills, prescription costs, travel expenses for appointments, and documentation of missed work and lost wages are non-negotiable for calculating economic damages accurately.

Many claimants focus exclusively on tangible economic losses like medical bills. However, non-economic damages, often called "pain and suffering," can constitute a substantial portion of a claim. This category includes physical pain, emotional distress, loss of enjoyment of life, loss of consortium, anxiety, and insomnia. Quantifying these losses is complex and requires skillful presentation. An experienced legal professional understands how to articulate and validate these intangible harms to ensure they’re not overlooked in settlement negotiations.

Insurance companies typically present a low initial settlement offer shortly after the accident, capitalizing on the claimant’s potential financial strain and lack of information. Accepting this offer is almost always a mistake, as it can permanently extinguish the right to seek additional compensation, even if future complications arise. Early offers rarely account for long-term medical needs, ongoing pain and suffering, or lost future earning capacity. A comprehensive assessment of all present and future damages is necessary before any settlement discussion can be considered fair.

Every jurisdiction has strict statutes of limitations that set an absolute deadline for filing a personal injury lawsuit. Missing this deadline, even by a single day, typically results in permanent loss of the right to seek compensation through the courts. Furthermore, there are numerous other procedural deadlines within the claims and litigation process. An attorney can ensure that all filings, responses, and documentation are submitted in a timely and proper manner, preserving the integrity of the claim.

The path to fair compensation after an injury is fraught with potential missteps. Proactive measures are vital. By avoiding these common errors, injured victims can navigate the legal complexities with confidence and ensure they receive full and fair compensation necessary to support their recovery and future well-being.

You might think a criminal charge disappears the moment a judge closes the case. The reality is more complicated. Even when charges don’t result in a conviction, they can still leave a mark that follows you into job interviews, housing applications, or professional licensing.

That’s why it’s crucial to understand how long dismissed charges remain visible and what you can do to protect your future.

A criminal record is more than a list of convictions. It reflects the entire history of criminal offenses and charges brought against you. The entries vary in severity and impact:

Understanding these distinctions clarifies why even dismissed charges matter. They may not carry the penalties of a conviction, but they can still shape how others perceive your reliability and trustworthiness, especially when decisions hinge on first impressions.

Dismissed charges don’t automatically vanish. In most states, they remain part of the public record until you take formal steps to have them removed. In Illinois, you can ask the court to clear dismissed charges right away. In New York, dismissals are usually sealed, sometimes automatically, while others require a request. Other states, like Texas, impose waiting periods. Federal records don’t clear automatically, meaning dismissed charges can remain unless addressed through legal action.

Background checks pull from multiple databases, so dismissed charges may continue to appear until every system is updated. The length of time they remain visible depends on state law and the type of database involved. In some places, dismissed charges can show up indefinitely unless you pursue formal removal.

Given this complexity, it's essential to find a criminal defense lawyer who can explain your options, guide you through eligibility requirements, and ensure your record is properly cleared. Without expert guidance, you risk carrying dismissed charges longer than necessary, even though the case was resolved in your favor.

Even though a dismissal means you weren’t convicted, the record can still affect your life. Employers may hesitate when they see dismissed charges, especially in industries like healthcare, finance, or education. Landlords may worry about renting to someone with a history of criminal charges, even if those charges didn’t stick.

The impact isn’t just professional. Carrying dismissed charges can feel like a shadow over your personal life. You may find yourself explaining the situation repeatedly, which can be stressful and discouraging. That’s why managing your record proactively matters.

The good news is that you often have options. Expungement and record sealing are legal processes that can limit or erase the visibility of dismissed charges. Expungement removes the record entirely, while sealing restricts access so the public can’t view it.

Whether you qualify depends on state law. Some states allow expungement for first-time charges or non-violent cases. Others exclude serious crimes like assault with a deadly weapon or certain drug offenses from expungement. The process usually involves filing a petition, meeting waiting periods, and sometimes attending a court hearing where a judge decides whether your request should be granted.

Expungement and sealing do more than protect your reputation. They also provide peace of mind by ensuring dismissed charges won’t resurface during background checks.

So what should you do if you have dismissed charges on your record? Start by checking your own background report. Many people don’t realize what’s visible until they see it for themselves.

Next, research your state’s expungement and sealing laws. If you’re eligible, file a petition as soon as possible. Keep documentation of your dismissal handy, since you may need it during the process.

Finally, remember that dismissed charges don’t define you. They’re part of your history, but they don’t have to shape your future. Taking proactive steps ensures you control the narrative.

Dismissed charges don’t always disappear on their own. They can remain visible in records, influence background checks, and create unnecessary obstacles. By understanding how records work, exploring expungement or sealing, and taking proactive steps, you can protect your reputation and move forward with confidence.

Dismissal is a relief, but it’s not the end of the story. Managing your record ensures that your past doesn’t hold back your future.

You’re staring at an offer from the insurance company, and it doesn’t even cover half the repairs. The ceiling in your Meyerland living room still has that ugly water stain from last week’s storm. The adjuster’s voicemail says, “This is our final number.” Final? After you’ve been living with fans running 24/7 and a blue tarp flapping in the wind? Yeah, no.

Here’s the thing: a good insurance claims attorney in Houston doesn’t accept low-ball offers. They push back—with facts, with law, and with steady pressure—until the number makes sense for real life.

Houston is no stranger to big messes. Hurricanes, hail, the 2021 freeze, flooding along Brays Bayou and Greenspoint every time the sky opens up. When claims spike, offers tend to drop. It’s not personal. It’s math for them. But you’re not just a number on their spreadsheet.

There are a few classic excuses: - “Pre-existing damage.” They point at old roof wear on a Katy ranch home and try to avoid paying for storm dents and broken shingles. - “Not covered.” They throw policy language at you about flood vs. wind, or mold limits, and hope you give up. - “Depreciation.” They take a big bite out of the payout because your stuff isn’t brand new.

This can be confusing, but a Houston insurance claims lawyer knows when those excuses don’t fly under Texas law. They translate the mumbo-jumbo into a simple plan.

A strong case starts right away. A lawyer steps in, calms the room, and tells the insurance company, “Talk to me.”

Evidence fades fast in this city. Roofers start patching. Water dries. Security cameras overwrite footage. Your attorney lines up trusted pros—independent adjusters, engineers, and contractors—to document the damage the right way. Moisture maps, attic photos, hail impact reports, all of it. Not just “my carpet is ruined,” but “here’s the exact path the water took after wind ripped shingles near the ridge.”

For car crashes on 610 or the Gulf Freeway, they grab police reports, dashcam clips, and witness names from the Valero on Westheimer. For storm claims in Cypress or Spring, they use weather data to show hail size and wind speed on your exact block. It’s Houston-specific and hard to argue with.

Adjusters can be polite, but they have a job: pay less. A lawyer shields you from recorded statements designed to twist your words. They handle the emails, the “just checking in” calls, and the requests for the same forms three times. You get to go back to work, deal with kids, and try to sleep without worrying about saying the wrong thing.

It’s not just repairing a roof or a bumper. It’s the whole picture of what this cost you.

A lawyer adds up the hidden parts: hotel nights on I-10 while crews dry your walls, meals because the kitchen is torn up, missed shifts at the Port of Houston, a dehumidifier rental that runs nonstop. In home policies, that’s usually called “additional living expense,” and it can add up fast. For car claims, it’s rental cars, missed wages, and sometimes the lost value of your repaired car (yes, that’s a thing in Texas).

They also check for code upgrades—if city rules require stronger materials or a different setup when you rebuild, your policy may cover that. Many folks don’t even know to ask.

Policies love big words. An attorney cuts to the chase: replacement cost vs. actual cash value, deductible rules, mold caps, and water leaks that are sudden vs. slow. They figure out what applies, then turn that into a clean number with receipts, estimates, and expert reports. It’s not a guess. It’s proof.

Now, here’s where it gets tricky—but also where a lawyer’s leverage shines.

Texas has rules that say insurers must play fair and move fast. An attorney uses those timelines as a clock the insurance company can’t ignore. In many cases, insurers have to: - Acknowledge your claim quickly. - Make a decision in a set time after they get what they need. - Pay within a short window after accepting.

When they drag their feet, there can be penalties, interest, or fees. You don’t need to recite the statute; your lawyer will. The message to the insurer is simple: do this right, or it gets more expensive for you.

For car crashes, there’s another pressure point. If you were hurt and the other driver’s insurance won’t pay a fair amount within policy limits, a time-limited settlement demand can put the heat on. If they blow it and a jury later awards more than the policy, the insurer may be on the hook for the extra. That’s inside baseball, but it moves offers in Houston every day.

This isn’t about yelling. It’s about structure.

A Demand Package the Adjuster’s Boss Can’t Ignore

Your lawyer sends a tidy, complete package: photos, reports, estimates, receipts, and a calm summary of your story. Not a rant. A roadmap. The tone says, “We’re ready to settle, but we’re also ready to try this in court.” That balance matters.

Settle too early and you might miss hidden damage (wet insulation behind that Memorial townhouse drywall, a cracked slab in Sugar Land, a herniated disc that didn’t show up for two weeks). Wait too long and repairs get delayed. A good lawyer times it with your recovery and the reconstruction timeline, then makes the move that gets the best number.

Many property policies in Texas have an “appraisal” option to settle fights over the amount of loss. Think of it like hiring independent experts to set a fair value, with a neutral umpire if they don’t agree. It’s not for every case, but in hail and wind claims across Katy, Kingwood, and The Woodlands, it can be a fast path to a better payout. Your attorney knows when to pull that lever—and when to skip it.

Sometimes the low offer sticks. That’s when the tone changes.

Filing Suit Without Blowing Up Your Life

Filing a lawsuit doesn’t mean you’re in a TV courtroom tomorrow. It means the insurer has to show up and explain themselves. Your lawyer handles the hearings, the discovery, and the depositions. You keep living your life. For many cases, just filing is enough to move the number, especially when the paperwork is tight and the facts are clean.

If it goes further, your attorney brings in the local voices that matter: a roofing expert who knows Houston’s codes, a contractor who’s rebuilt half of Meyerland since Harvey, a doctor who can explain why your back still hurts after the I-45 crash. These aren’t random people. They’re trusted, credible, and used to speaking to regular folks.

After a hailstorm rolled through Cypress, an insurer offered a couple grand for “minor roof damage.” The homeowner’s lawyer hired an independent adjuster who found bruised shingles across three slopes and collateral damage on the gutters. They demanded appraisal, backed it with photos and a weather report for that afternoon. The result? A full roof replacement at today’s prices, not a patch job.

A family in Kingwood had a pipe burst during the freeze. The insurer tried to deny parts of the claim, blaming “long-term leakage.” The attorney gathered plumber reports, timeline photos, and temperature data, and pressed the company on delays. The final check covered demolition, rebuild, code upgrades, and months of living expenses while the house dried out.

A delivery driver was rear-ended on 610 near the Galleria. The insurance company offered a tiny amount, calling it a “low-speed impact.” The lawyer found a traffic cam clip, grabbed repair estimates that showed frame damage, and got a note from the client’s supervisor about missed shifts. The second offer jumped. Not enough. A time-limited demand went out. The case settled within policy limits before trial.

None of this took magic. It took process.

Start a simple folder—digital or paper—with photos, receipts, repair estimates, and notes. Keep it tidy. When your lawyer builds the demand, this saves time and stress.

Write a short timeline. When did the damage happen? Who came out? What did they say? Dates help.

Get a second opinion on repairs. Two estimates beat one, especially if the second is from someone who actually works in your part of town.

Stop giving new statements to the insurer. Be polite, but let them know you’re getting help. Then let your attorney handle the back-and-forth.

If you’re still living in the mess—fans, tarps, hotel nights on Beltway 8—keep receipts and track daily costs. Those little amounts add up fast.

Policy “matching” matters. If one side of your house’s siding is damaged, you may be able to get matching materials so it doesn’t look patchy. Don’t settle for a polka-dot fix.

Diminished value is real for cars in Texas. Even after repairs, your car may be worth less because it’s been in a wreck. That loss can be part of your claim.

Condo claims can be tricky. The HOA’s master policy covers some parts; your unit policy covers others. If you’re in Midtown or the Heights, your lawyer can sort out who pays for what so you’re not stuck in the middle.

Business interruption coverage can apply after storms or pipe bursts. If you run a shop on Washington Avenue and had to close, your policy might help cover lost income. Many owners don’t realize it’s in there.

Slipping or falling can change your day in an instant. One moment you are walking through a grocery store or climbing the steps to your apartment, and the next you are on the ground in pain. If this has happened to you in Bridgeport, the shock and discomfort can feel overwhelming. Beyond bruises or scrapes, you may face medical bills, missed work, and stress about what happens next. Knowing what steps to take and what mistakes to avoid can make a big difference for both your recovery and any claim you mightpursue.

It is easy to think that a sore wrist or stiff back is not a big deal. Many people get up, brush themselves off, and go about their day. Sometimes the injuries do not show up right away. A small sprain can become a more serious problem if left untreated. Head injuries or broken bones may not hurt immediately, but they can cause long-term issues if ignored. Even minor bruises can hide deeper injuries. Seeing a doctor quickly is important. Medical documentation not only protects your health but also creates a record that links your injuries to the accident. This record becomes critical if you need to claim compensation for medical expenses, pain, or lost income.

A Bridgeport slip and fall lawyer can guide you through the process and protect your rights. Many people try to handle claims on their own, only to find insurance companies undervalue the injury or deny part of the claim. Speaking with a lawyer early ensures deadlines are met, evidence is preserved, and any settlement discussions reflect your true losses. Lawyers can also communicate with insurers on your behalf, removing a lot of stress and uncertainty.

If you fell on someone else's property, report it to the manager or property owner. Ask them to make a written report of the incident and keep a copy for yourself. Note the date, time, and circumstances of the fall. If anyone saw what happened, get their contact information. Without this record, it may become your word against theirs later on. For example, if you slipped on a wet floor in a supermarket and the manager does not document the spill, it is much harder to prove the hazard existed.

Slippery floors get cleaned, debris is removed, and hazards disappear. Take photos of the exact area where you fell. Show the condition of the floor or stairs, any wet spots, torn carpeting, missing handrails, or loose tiles. A short video can also help. Collecting evidence quickly can make a difference when proving what caused the accident. If possible, include a photo of your surroundings to show visibility or lighting, which can further support your claim.

You may get a call from the property owner's insurance company. Adjusters are trained to limit payouts. Avoid admitting fault or saying your injuries are minor. Stick to the facts: what happened, where, and when. If an adjuster requests a recorded statement, it is okay to wait until you speak with a lawyer. Even casual remarks about feeling “okay” or being “fine” can be used to reduce your claim.

Keep detailed records of all medical care, including doctor visits, physical therapy, medications, and supplies. Save receipts and invoices. Note any travel expenses for appointments. Record the time you miss from work and lost wages. These details show exactly how the accident affected your life and your finances. For example, if you need multiple visits to a specialist or require ongoing physical therapy, documenting each step will make it clear that the accident’s impact is long-term.

It may seem harmless to post about your accident or recovery online. Pictures of you walking, exercising, or enjoying activities after the fall can be used to argue that your injuries are not serious. Until your claim is resolved, it is safest to keep these details off social media.

Insurance companies often offer quick payouts. These initial offers rarely cover long-term medical treatment, lost wages, or ongoing pain. Accepting too soon can leave you paying future costs on your own. A lawyer can review offers and make sure your compensation reflects your actual needs. For instance, even if a settlement covers current hospital bills, it may not account for future physical therapy, ongoing medication, or lost income if you cannot return to work immediately.

Your health and recovery should come first. Follow your doctor’s instructions, attend appointments, and rest when needed. Pain and injury affect sleep, mood, work, and family life. Taking care of yourself and documenting your progress strengthens both your recovery and your case. If you need help with daily tasks or mobility, consider asking friends or family for support. Showing that your life has been disrupted by the fall can also support your claim for damages.

Understand the Full Impact of a Slip and Fall Accident

Slip and fall accidents can affect more than your physical health. Emotional stress, anxiety about returning to the scene, and fear of re-injury are common. Keep a journal of your experiences and symptoms. Write down how the accident affects daily activities, work, or social life. This type of record adds context to your medical documentation and helps lawyers and insurers understand the full impact of your injury.

Getting married isn’t just about romance. You’re also stepping into a shared financial life, complete with assets, obligations, and long-term plans. That reality is exactly why more couples are openly talking about signing a prenuptial agreement before walking down the aisle. It’s a practical, transparent, and respectful move.

Money disagreements are one of the most common stress points in relationships, particularly when expectations around marital property aren’t discussed upfront. Addressing these issues early creates clarity and reduces future conflict.

A prenup, also called a premarital agreement, functions as a customized marriage contract that defines how finances work during the relationship. It can understandably be a tricky subject for some people.

When emotions mix with finances, conversations can quickly become overwhelming. This is where seeking legal help for prenuptial agreement makes a real difference. Instead of guessing what’s fair, you’re guided through a structured process that protects both partners equally.

Having an agreement provides predictability and fairness, whether assets are split under community property laws or equitable-distribution states. Understanding how these legal frameworks differ and which rules apply helps couples make informed choices.

Many couples choose a prenup because they want clarity, not control. When expectations are clear early on, misunderstandings are far less likely to grow into conflict.

Couples with existing real estate, retirement accounts, or investment portfolios often see a prenup as a way to protect what they’ve already built while still planning a shared future. In reality, though, a clear discussion covering property rights, management of joint bank accounts, and protection of individual financial interests is crucial to married and unmarried couples. That’s why some explore a cohabitation agreement as a potential solution.

Life is financially complex. Careers change, businesses grow, and investments fluctuate. A prenup helps account for those realities by outlining how assets are handled if circumstances shift.

This preparation can significantly reduce stress and uncertainty during a difficult divorce process. Prenups help simplify dividing marital assets and protecting long-term savings, particularly for high-net-worth individuals.

Without clear terms, divorce proceedings often become longer and more expensive. A prenup helps streamline decisions, reducing reliance on court interpretation.

While a prenup can’t decide matters like child custody (who has legal responsibility for and makes decisions about children) or child support, it can still clarify financial responsibilities tied to family planning. Working with family law attorneys, couples can ask about issues related to spousal maintenance (ongoing payments to a spouse after divorce), financial obligations, or life insurance policies to ensure stability.

Prenups also work alongside estate plans, especially when inheritance rights or children from previous relationships are involved. Planning allows families to avoid uncertainty and protects everyone’s long-term interests.

Rather than amplifying conflict, a prenup often makes difficult moments easier to navigate. Without clear terms, separation can trigger frozen accounts, disputed assets, and unexpected expenses. When agreements already exist, you avoid scrambling to protect savings or long-term investments during a stressful period. Instead of reacting, you’re following a plan you both agreed to.

Clear financial disclosures simplify future discussions around dividing assets, reducing stress if circumstances change. Features like a sunset clause allow agreements to evolve, ensuring flexibility as relationships grow and change.

Why is this important, when recent data shows that the divorce rate in the US is declining? This is what many people don’t know: Marriage trends are shifting alongside financial realities. Separations involving couples over 50 years old, also known as grey divorce, are rising. This can be another reason that urges couples to plan proactively, especially those entering second marriages.

It’s in your best interest to seek independent attorney support for transparency and mutual respect. An initial consultation is essential to understand the basics and scope of a prenup.

With professional guidance, you can clearly define what remains separate property and what becomes shared. Prepare to discuss assets, debts, and expectations to establish trust and ensure that the agreement holds up as a valid legal document.

For example, couples marrying or relocating to New York must ensure their agreement complies with state-specific requirements. Failing to meet local legal requirements can render a prenup unenforceable, which is why professional guidance is essential.

While attorney fees vary, they’re often minimal compared to the cost of prolonged litigation. Consulting a prenup lawyer early, or even a divorce lawyer later, can save time, money, and emotional energy. Many couples now prefer a collaborative process that prioritizes agreement over confrontation.

Choosing a prenup isn’t about expecting the worst; it’s about being prepared. By clarifying financial obligations, protecting assets, and aligning expectations, you create a stronger foundation for marriage. With open communication and the right guidance, a prenup supports trust, stability, and confidence as you build your life together.

Ultimately, planning allows you to face the future—together or apart—with dignity. It turns potential chaos into an organized process and helps both partners move forward without unnecessary financial loss or emotional exhaustion.

Red Lion Chambers is pleased to announce the appointment of Maurice MacSweeney in the new role of Client and Business Development Director.

Maurice's arrival comes at a time of continued growth for Chambers. While historically recognised for excellence in general crime, Chambers practice areas now encompass serious fraud, financial crime, corporate investigations, professional discipline, inquests and inquiries and advisory work for corporates, regulators and government bodies.

Maurice brings a specialist combination of legal, commercial and strategic experience to the role. After a Law degree at the University of Cambridge, he spent four years at a solicitors’ firm which specialised in white‑collar crime, before moving into senior BD and strategy roles at 2 Hare Court and Doughty Street Chambers. Most recently, he spent five years at Harbour, a global litigation funder managing over $1.5bn invested in commercial litigation, where he sourced investment opportunities and developed financing solutions for law firms. He brings to Chambers a deep understanding of the pressures and opportunities facing clients across the criminal, regulatory and commercial litigation landscape.

“I’m delighted to be joining Red Lion Chambers at a crucial moment in its development. I’m looking forward to meeting clients, understanding their priorities and learning how I can support both them and members of Chambers as we navigate the opportunities and challenges of the market on both sides of the profession.”

Joint Heads of Chambers Gillian Jones KC and Tom Forster KC said:

"Maurice stood out in a highly competitive field, impressing us with his exceptional experience and leadership and we are delighted to give him a warm welcome to Chambers. A key focus for him will be strengthening Chambers’ client engagement strategy ensuring that RLC continues to listen closely to the needs of our clients raising the bar on service delivery across all practice areas."

For more information please see: https://redlionchambers.co.uk/person/maurice-macsweeney/

Dog bites can happen fast and leave lasting damage. The injuries are not only physical. Medical bills, lost time at work, and emotional stress often follow. That is why understanding liability in dog bite cases matters. Knowing who is legally responsible can make a big difference in how you recover and move forward.

Dog bite laws are not always simple. Responsibility can depend on the dog's history, the owner's actions, and where the incident happened. Learning the basics helps you protect your rights and avoid costly mistakes. Read on!

Dog bite cases often raise questions about who is responsible for the injury. In many cases, the dog owner is held liable for the harm caused. Laws can vary by location, so liability depends on local rules. Understanding these basics helps victims know their rights.

Owners are usually responsible if their dog bites someone without reason. Some areas follow strict liability laws, meaning the owner is at fault even if the dog never bit before. Other places look at whether the owner was careless. Factors like leashes, warning signs, and behavior can affect the outcome.

State laws play a big role in how dog bite cases are handled. Each state has its own rules for deciding who is responsible. Some states make owners liable no matter what. Others require proof of negligence.

These laws can affect how a claim is filed and won. Time limits and damage rules may also vary. Knowing the local law helps victims take the right steps. It also helps owners understand their duties.

From the victim's view, a dog bite can cause pain and fear. Medical bills and missed work often follow the injury. Many victims feel stressed during the recovery process. Knowing their legal options can bring peace of mind.

Victims may have the right to seek payment for their losses. This can include medical care, lost income, and emotional harm. Reporting the bite is often an important first step. Getting help early can protect their rights.

Preventing dog bites starts with responsible ownership. Dogs should be trained and watched at all times. Using leashes and fences can lower the risk of harm. These steps also help owners avoid legal trouble.

People can also reduce risk by knowing how to act around dogs. Avoid teasing or surprising unfamiliar animals. Children should be taught safe behavior early. Prevention protects both the public and dog owners.

After a dog bite, legal help can make the process easier. A lawyer can explain rights and guide the next steps. This support helps victims feel more confident.

Working with dog bite injury lawyers can improve the chance of fair payment. They handle talks with insurers and gather proof. Legal help can reduce stress during recovery.

It's vital to be informed about your responsibilities as a dog owner and your rights if you are bitten. By understanding the elements of liability in dog bite cases, both parties can take necessary precautions to avoid mishaps in the future.

Did you enjoy reading this article? If so, then be sure to check out the rest of our blog for more!

The personal injury laws in Florida went through some significant changes in 2025. If you are a resident of West Palm Beach or anywhere in Florida, you need to be aware of these changes. It will help you with getting the best outcome when you encounter an injury. Read on and let’s explore it in detail.

The most dramatic change affects how long you have to file a personal injury claim. Starting with accidents that occurred after March 24, 2023, you now have only two years to file your lawsuit - down from the previous four-year deadline.

This change applies to all negligence-based personal injury cases, including:

The shortened timeline means you cannot afford to wait. Evidence disappears, witnesses move away, and insurance companies become less cooperative as time passes. What seemed like plenty of time under the old law can now slip away quickly while you're focused on recovery.

Florida also changed how fault is determined in personal injury cases. Under the new "modified comparative negligence" rule, if you're found to be more than 50% responsible for your accident, you cannot recover any compensation at all.

Here's how this works in practice:

This represents a major shift from the previous system, where you could recover some compensation even if you were mostly at fault. The change makes it more important than ever to have skilled legal representation that can properly investigateyour case and present evidence showing the other party bears primary responsibility.

Beginning January 1, 2025, Florida courts implemented new procedural rules designed to make cases move faster and more efficiently. These changes include:

Mandatory Initial Disclosures: Both sides must share key documents and information earlier in the process, including insurance policies and witness lists.

Proportionality Standard: Courts now use federal-style rules to ensure discovery requests are proportional to the case value, potentially limiting extensive investigations in smaller cases.

Enhanced Case Management: Judges have more tools to keep cases moving, with stricter deadlines and requirements for attorney communications.

These procedural changes mean cases may resolve faster, but they also require more preparation upfront. Your legal team needs to be ready to act quickly and efficiently from day one.

If you've been injured in an accident, these legal changes create both challenges and opportunities:

Challenges:

Opportunities:

Protecting Your Rights Under the New Laws

To protect yourself under Florida's changed legal landscape:

Act Immediately: Don't wait to seek legal advice. The two-year deadline approaches faster than you might expect, especially when dealing with injuries and recovery.

Document Everything: Take photos, keep medical records, save all accident-related documents, and avoid discussing your case on social media.

Choose Experienced Representation: The new laws require attorneys who understand both the changed rules and how to work within tighter timeframes.

Don't Accept Quick Settlements: Insurance companies know about the new laws and may try to pressure you into accepting inadequate compensation before you understand your rights.

The legal changes of Florida reflect a broader trend toward faster, more efficient case resolution. While this can benefit injury victims by providing quicker access to compensation, it also requires more immediate action and professional guidance.

The key is understanding that time is now your most valuable resource. The old approach of waiting to see how injuries develop or hoping insurance companies will offer fair settlements may no longer work under the compressed timeline.

If you've been injured in an accident that wasn't your fault, don't let these legal changes work against you. Seek the help of a personal injury lawyer West Palm Beach today. Your future recovery may depend on the actions you take today.

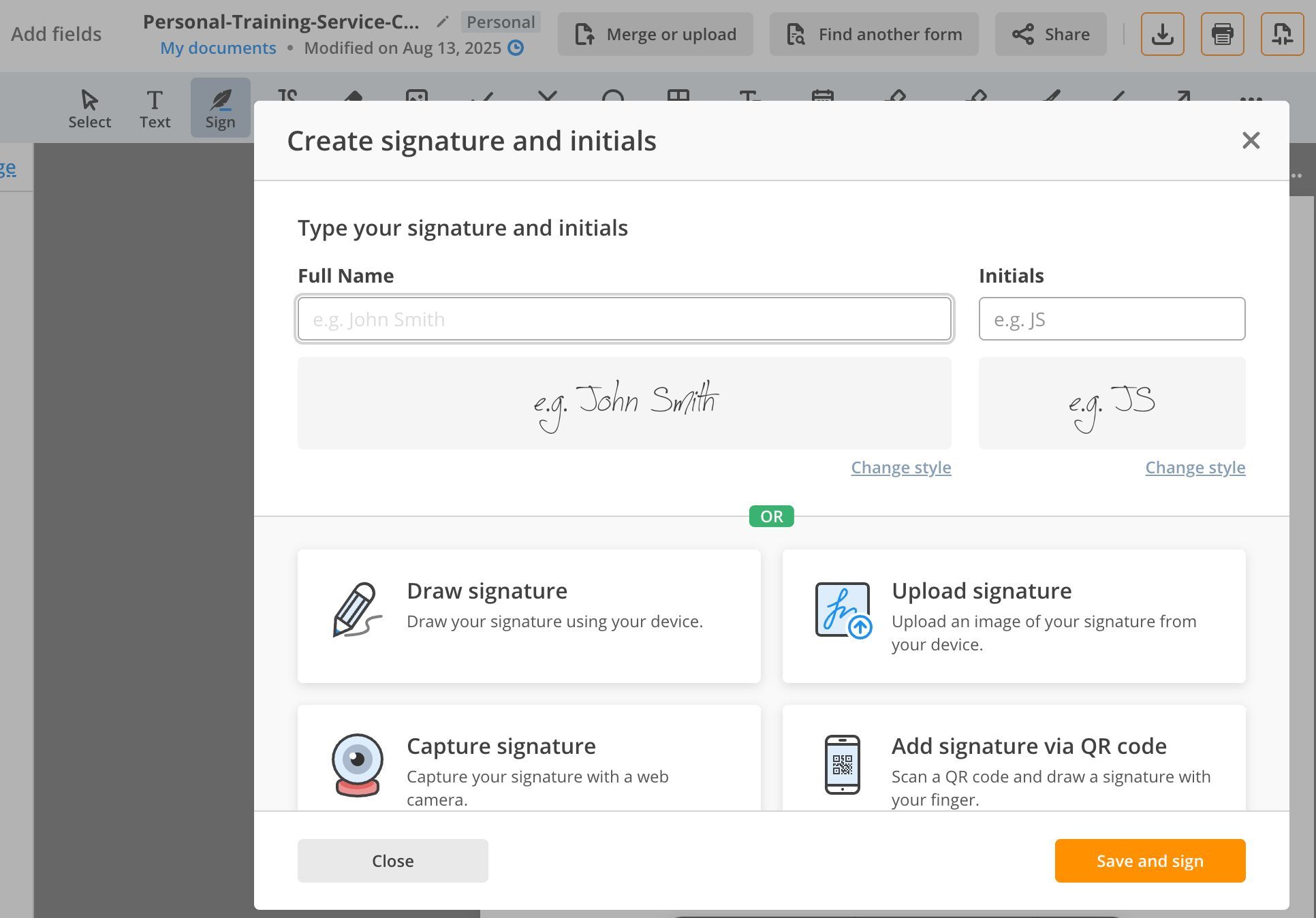

The legal profession continues its shift toward digital workflows, with electronic signatures becoming standard practice for law firms of all sizes. Remote work arrangements, client expectations for faster service, and the need to reduce administrative overhead have accelerated the adoption of eSignature technology across legal practices.

Selecting the right eSignature platform requires careful evaluation of security features, compliance capabilities, and integration options. Legal professionals must balance ease of use with regulatory requirements while ensuring document integrity throughout the signing process. In this article, we’ll examine why electronic signatures are essential and review the top platforms designed to help legal teams stay efficient and compliant in 2026.

An electronic signature is a legally recognized way to obtain consent or approval on electronic documents or forms. While definitions vary by jurisdiction, they are governed by laws such as the ESIGN Act and UETA in the U.S., and eIDAS in the EU. These regulations define an eSignature as more than just a digital image of a handwritten signature. It is described as an "electronic sound, symbol, or process attached to or logically associated with a contract or other record and executed or adopted by a person with the intent to sign the record."

For the legal industry, electronic signatures are more than a convenience; they are essential for keeping workflows moving efficiently. eSignatures streamline document execution for retainer agreements, settlement documents, court filings, and client contracts. The technology eliminates printing, scanning, and mailing delays that previously extended turnaround times by days or weeks. Law firms report significant time savings and improved client satisfaction after implementing eSignature workflows.

Legal validity is a top priority for attorneys moving to digital signatures. In the U.S., the ESIGN and UETA Acts provide the legal framework for their use. Most modern platforms meet these standards while adding additional security layers beyond basic legal requirements.

When evaluating eSignature platforms, legal professionals should prioritize several capabilities:

Choosing the right eSignature tool can impact a firm's efficiency, security, and bottom line. Here are five of the top solutions that legal professionals are relying on this year.

1. pdfFiller

pdfFiller serves legal professionals with a comprehensive document management platform with enterprise-level security and compliance. It combines a robust PDF signature tool with intuitive features for creating custom fillable forms, editing, storing, and collaborating on documents, tailored for legal workflows. The platform also includes templates for common legal documents, saving time on routine agreements. For added convenience, it offers an online notarization service for legally binding documents.

2. DocuSign

DocuSign maintains a strong presence in legal markets with enterprise-grade security and extensive authentication options. The platform provides notary services and advanced recipient verification methods that satisfy court requirements for high-stakes transactions. Integration with popular legal practice management systems streamlines document workflows for firms using platforms like Clio or MyCase.

3. Adobe Sign

Adobe Sign appeals to legal professionals already using Adobe Acrobat for document preparation. The solution offers robust compliance features and government-grade security certifications. Legal teams benefit from seamless transitions between document creation in Acrobat and signature collection via Adobe Sign, maintaining consistent formatting throughout the process.

4. SignNow

SignNow offers an affordable online document signing solution tailored for small and mid-sized law firms. The platform delivers essential eSignature functionality with straightforward pricing and quick implementation. Template libraries, bulk sending features, and seamless API integrations empower legal firms to handle high-volume document processing with ease, streamlining workflows and boosting efficiency.

5. Dropbox Sign

Dropbox Sign (earlier HelloSign) provides intuitive signing experiences that reduce client friction during document execution. The platform emphasizes simplicity without sacrificing security, making it appropriate for solo practitioners and small firms. API access allows custom integration with existing legal technology stacks.

Implementing eSignature solutions in legal workflows requires more than just selecting a platform; it demands a strategic approach to ensure both efficiency and compliance. Below are key best practices to help legal teams optimize their use.

By incorporating these use cases and best practices, legal professionals can maximize the efficiency, reliability, and security of their eSignature processes.

Choosing the best eSignature platform in 2026 is a critical decision for legal professionals aiming to enhance efficiency, maintain compliance, and deliver exceptional client service. The choice depends on firm size, practice areas, and existing technology infrastructure. Solo practitioners may prioritize affordability and ease of use, while large firms require enterprise features and extensive integration options.

Trial periods allow legal teams to evaluate platforms using actual firm documents and workflows. pdfFiller, along with other popular tools, lets you try out their service for free so you can decide if it's the right fit for your firm. Sign up for a trial period to see the platform in action, reducing administrative burden and focusing on what truly matters—a top-tier legal counsel.