Understand Your Rights. Solve Your Legal Problems

Sam Houston specialises in litigation. He has handled cases for both the defense and plaintiff’s sides. After focusing his practice on professional malpractice, representing doctors, lawyers and other business interests, in the last few years, he has begun handling business disputes for both plaintiff and defense sides. He speaks with Lawyer Monthly on how honesty is key in his line of work.

How has mediation changed cases?

Mediation is a very effective tool in resolving cases. Basically, mediation forces the parties to focus on the real issues sooner, rather than later. However, I have found that premature mediation is usually a waste of time. The parties need to entertain necessary discovery to argue the points clearly, as well as seriously and honestly consider their respective positions.

What is a ‘top tip’ you think lawyers should consider before going to the Court of Appeals?

Recently, I obtained a significant verdict in a business litigation case – $12.7 million. The case is now on appeal and I have learned several lessons. Foremost, I think it is important for every lawyer to see the record in one of his or her cases. We now use audiovisuals so often that it is not always clear what we are talking about to the Court of Appeals. Lawyers should keep in mind that while audiovisuals are important for the jury, the record will not always reflect the images on the screens.

You have been listed as a Super Lawyer since 2005. What do you think accounts for such an achievement?

I am proud of my continued status as a Super Lawyer because it reflects the views of my peers. I think I have treated lawyers on both sides fairly and they view me as a person who tries to resolve matters if possible, but who will go to trial if the other side is not taking a reasonable position. I have tried over 50 cases to jury verdicts and I have tried cases to the bench as well. I win most of my cases because I honestly assess the facts and feel confident in our position.

Is there anything else to add?

I am proud to call myself a trial lawyer. I grew up in a small town where I learned about honest work. I try to focus on honesty in my relationships with my clients, and my views towards the bench and legal system. Lawyers take a hard rap because, like in any profession, there are a few bad apples. People need an honest way to resolve disputes and a good lawyer (of which I include myself) can help people put such disputes behind them and move on with their lives.

SAMUEL A. HOUSTON

SENIOR PARTNER

713-650-6600

www.schlawyers.com

Sam Houston obtained a BBA and then attended law school at Baylor University. In law school, Mr. Houston was a member of the Order of Barristers and the Phi Delta Phi fraternity. Graduating in 2 ½ years, he then began his legal career in the litigation section of Andrews & Kurth in Houston, Texas. He worked as an associate at Andrews & Kurth from 1987 until 1992. He then left with his current partners and began the practice at Cruse, Scott, Henderson & Allen, where he was named a partner in 1993. In 2010, Cruse, Scott, Henderson & Allen changed its name to Scott, Clawater & Houston. Mr. Houston remains at the firm and is co-managing partner. Mr. Houston has practiced as an attorney for over 25 years. He is a general litigator but has focused his practice on professional malpractice, commercial disputes, and administrative licensing proceedings. Mr. Houston is also a trained mediator. Mr. Houston became board certified by the Texas Board of Legal Specialization in Personal Injury Trial Law in 1995 and recertified in 2000, 2005 and 2010. Mr. Houston is licensed to practice in Texas and Pennsylvania (non-active). He is also licensed with the U.S. District Courts in the Southern, Northern, Eastern and Western Districts of Texas and in the United States Supreme Court.

SCH Law Firm is an A.V. rated firm that specializes in civil litigation. The firm represents individuals and businesses in commercial, product liability, and personal injury lawsuits. Lawyers from, Scott, Clawater & Houston, L.L.P. have defended clients against multi-million dollar claims and also obtained seven and eight figure verdicts and settlements on behalf of plaintiffs in contract, oil and gas, toxic tort, and personal injury cases.

Mobile phones are a great help in these days to secure this permanent accessibility not only during regular business hours. Sometimes a five-minute call on a Saturday or Sunday can make all the difference instead of having a client experiencing a dreadful weekend by receiving a phone call from its lawyer only on Monday.

“It is Rihm Attorneys’ business policy that clients can access us at all times. This usually requires that we are reachable in the evenings and if necessary over the weekend.”, shares Dr. Thomas Rihm. He speaks more about his practice below.

How has legal work in contract negotiation evolved throughout Switzerland since you entered the profession? What would you say have been the major game changers in this field over the last decade?

Over the last 30 years, the law firms have experienced in full the fast development of communication techniques, from receiving and writing paper letters, to the use of fax starting in the 1980s and later on e-mail including electronic attachments in the 1990s. Mobile phones make the constant communication with clients much easier.

Needless to say, that these techniques have accelerated lawyers’ work enormously and contributed much in terms of effectiveness and cost savings. Extended travelling to global business capitals in order to finalize during an entire week in personal meetings a complex set of contracts and other legal documents have – unfortunately - become quite seldom.

What remains of course is the due analysis of client needs when it comes to drafting and negotiating. Seasoned business lawyers with broad work experience are more than ever in great demand, as they can achieve much more affordable price than a handful of legal specialists which is usually difficult to handle and coordinate.

How have the recent events in Switzerland affected your work and your clients?

The US tax programme of 2013 lead to an immense work load for business law attorneys in Switzerland when advising Switzerland based banks in their negotiations with the DoJ in Washington. International and national anti-money laundering legislation became also a constant source for business law advise over the years. Similarly, employment laws and innumerable flexible compensation plans, the Swiss fat cat regulations of 2014 and international and national data protection laws have created an immense need for business law consulting, also on a more strategic level.

What common issues arise when providing counsel to SMEs? Are there any legislations from this which you think would be worth revising?

The mid-sized business law firm of Rihm Attorneys constantly provides general business law advise to SMEs both for their day-to-day business and in more extraordinary and complex business constellations. SME clients in particular appreciate a hands-on approach in solving their legal issues without being too much absorbed when collaborating with their lawyers. SMEs favour any legislation that reduces their legal and other paper work.

How do you battle through the challenges in court cases involving SMEs?

Rihm Attorneys has fought many court battles, also for its SME clients. These clients quite often underestimate the time efforts necessary to make a court case successful. The better the support from our SME clients is in a litigation case, the better we are in making the case.

Dr. Thomas Rihm

Founder

Rihm Attorneys at Law

Brandschenkestrasse 4

8001 Zurich

P +41 44 377 77 20

F +41 44 377 77 29

Rihm Attorneys at law is a Swiss practice with an international outlook and counseling focus around all aspects of entrepreneurship. The firm is headed by its founder Dr. Thomas Rihm. For more than 30 years, he has advised and represented companies and entrepreneurs in complex transactions and restructurings as well as in state court, arbitration and insolvency proceedings.

Based in the centre of Zurich nearby Paradeplatz, Rihm Attorneys at law can draw upon a well-established global network of correspondent law firms in all major business centers. Working languages are German, English, French, Italian, Turkish and Serbo-Croatian and communication can be secured by most advanced encryption systems (Wire, Proton and Threema).

According to Chambers, Best, Lawyers and Who`s Who Legal, Rihm Attorneys at law is leading in the fields of M&A, insolvency and employment & compensation benefits laws.

Rihm Attorneys at law is a member of the Swiss and Zurich Bar Associations as well as the XBHR (Global Forum for Cross-Border Human Resource Experts in London), DRI (the Voice of the Defense Bar in Chicago), EELA (European Employment Lawyers Association) and the BSCC (British Swiss Chamber of Commerce in Zurich and London).

Sampsistemi, one of the global leaders in the drawing and extrusion technology for the wire and cable market, announced the recent acquisition of Setic, Pourtier and their Service Division C2S. The combined resources with leading technologies in each market segment in which they operate, will greatly enhance the capability to offer a complete range of products able to match the evolving needs of our customers worldwide.

Setic and Pourtier, two well-known French Companies, part of the Gauder Group, with more than 100 years of combined experience in the design and manufacture of high technology rotating equipment, will contribute in further developing and strengthening Sampsistemi’s overall process focus and expertise.

The C2S Service division will boost the ability to support wire and cable makers on a global basis with dedicated solutions. Throughout its over 80 years of history Sampsistemi has always believed that new ideas and effective processes are the key drive to a company’s continuous growth and development.

“Setic and Pourtier are an exciting opportunity for our Group. We are confident that our joined forces will greatly strengthen and expand our product range in the rotating machinery industry” explains Lapo Vivarelli Colonna, CEO of Sampsistemi. “The acquisition of Setic and Pourtier supports Sampsistemi’s strategy aiming at leading the market and meeting the ongoing demand for a single source-provider capable of managing the clients process with cutting edge know-how.”

Customers worldwide will benefit from a more focused approach and a new technological boost concerning machines and services, while an improved organizational structure will bring the Company closer to its customers’ needs.

This acquisition is entirely complementary, in terms of portfolio, know-how and technology guaranteeing the most cost-effective solutions to clients. The actual Setic and Pourtier product portfolio will be ensured and further enhanced, as well as the fast and easy supply of original spare parts, updated technical drawings and machine software.

Sampsistemi is a Company of the Maccaferri Industrial Group, an international holding active in 7 main sectors, boasting a turnover of 1.2 billion Euro, 58 production plants and 4,600 employees worldwide

Interview with Marco Pezzetta, Partner at Studio Associato Molaro–Pezzetta–Romanelli-Del Fabbro

In your experience, what is the best part, regarding the legal process, of an acquisition where the party acquires all shares?

Probably the most interesting aspect is the design of the process itself: the milestones to transform a possible goal into a realised deal. There are many steps to be logically sequenced up to the closing: non-disclosure agreements, non-binding and binding agreements, (followed or preceded by the identification of the counter party). These milestones need to be matched with current and strategic decisions required to run the business during the negotiations, with due diligence activities and the financing of the operation. To design and find the more appropriate solutions, asks not only for technical skills and experience, but also for project-managing abilities, such as a creative approach and remaining aware and inquisitive towards personal and psychological aspects of the key individuals.

However, in terms of the Sampsistemi deal, can you share the difficulties during the legal process?

The principle difficulties arose from the fact that the deal involved several companies, based in different countries. In a situation like this, it becomes necessary to have a framework agreement dealing with the kind of issues, to ensure you are being compliant with all the applicable rules, not only for corporate-law aspects, but also in terms of finance, accounting principles, taxation and so on.

How did your level of expertise guide you through these challenges?

First of all, I think that the multidisciplinary skills of our team helped a lot. To have practiced and experience many deals and special situations in which financial, legal and tax issues are interweaved definitively increased our ability to face this kind of project. A second important aspect coming from experience, is related to the ability to focus the attention on the very core goals of the client and to have a strong commitment in achieving them, in order to provide a very “tailored” service.

What attracted you to work on this deal?

The project was very challenging, and, in my opinion, challenges are always stimulating. Furthermore, I was attracted to the fact that the goals of both parties were very consistent in relation to a strategic vision of the evolution of the markets and of the industrial sectors involved. I have to admit, anyway, that I was also attracted towards the idea of contributing towards such an important international business combination, which keeps in Italy in France headquarters and decision makers.

How did the’ complementary’ aspect [i.e., an equivalent level of technology know-how to both parties] of the acquisition help during this deal?

These aspects were certainly helpful. The absence of significant technological gaps in industrial processes, in the IT systems, and also in the habit of managing structured and complex corporate processes, facilitated the success of the implementation phase of every business combination. They become, in some cases, an element able to orientate the identification of the partner.

Peruvian cement producer Unacem has purchased, via its Unión de Concreteras (Unicon) subsidiary, a 100% stake in Hormigones Independencia, part of the Chilean Hurtado Vicuña group from Hormigones Bicentenario S.A. and Tyndall SpA.

The US $22.2 Million transaction covers seven concrete plants located throughout Chile. The transaction was funded by the Purchaser’s own funds and a bank loan.

UNACEM manufactures and distributes cement in Peru, Ecuador, Chile, Colombia, and the United States. With its headquarters in Peru, their subsidiary companies, enable the company to implement plans for investment and growth in Peru and the region.

Serving the construction and energy sectors, the company offers cement bags and bulk cement under the Selvalegre, Campeón, Armaduro, Gladiador, Magno HE, and Cemento HS brands.

Albagli Zaliasnik advised Unicon Rodrigo Albagli, Cristián Riquelme, Daniel López and Arie Misraji.

Larraín y Asociados advised Tyndall and Hormigones Bicentenario S.A. with Jorge Granic, Cristián Araya, José Pedro Ruíz.

Interview with the team at Albagli Zaliasnik

Please tell me about your involvement in the deal?

In November of 2016 Inversiones Caburga Limitada (Caburga), a Chilean cement company and Holchile S.A. (Holchile), a Chilean door manufacturer, presented before the National Economic Prosecutors Office (FNE) a notification of a potential M&A transaction between the two companies. Caburga, through a public offer, was in motion to buy all shares of Cemento Polpaico S.A., which is owned by Holchile.

During the investigation process into the legality of the pending M&A transaction, the FNE discovered that there were risks in the ready-mix concrete market that could affect certain geographical regions of Chile. Due to these findings, the FNE, Caburga, and Holchile came to an agreement on the terms and conditions of the M&A outside of the court of law.

In June of 2017, the M&A transaction was approved by the Court of Defence of Free Competition. As a part of the terms and conditions of agreement, both parties agreed to the creation of an independent subsidiary with the name of Hormigones Bicentenario S.A. For this independent subsidiary, there are 7 different concrete mixing plants that are located throughout the south zone of Chile, which will be managed independently by a fiduciary agent or asset manager, Tyndall SpA. Our client, UNACEM / UNICON, a Peruvian concrete construction company, has purchased Hormigones Indepndencia S.A. for USD 22,200,000.

Why is this a good deal for all involved?

This is the second acquisition for UNACEM / UNICON within the last year. As they are continuing to expand their presence within Chile and the rest of South America, they are on pace to be one of the biggest cement producers and manufacturers in South America.

By using the expertise he has gained over 50 years’ experience, firstly involved with on-site works, followed by managerial roles in construction, both in this country and overseas, Roger Gibson is a recognised and qualified Expert in the engineering and construction fields.

Roger states: “I think it is important for a ‘party’ involved in a delay and/or disruption construction claim to use an ‘expert’ who is experienced in this type of claim, and additionally ‘he’ is recognised as an ‘Expert’ by the Arbitrator, or Judiciary of the governing body.”

He speaks more below about construction disputes.

How important is a carefully constructed extension of time (‘EOT’) submission on a construction/engineering project?

The standard forms of contract set out a number of possible contingencies, the risk of which is to be borne not by the contractor but by the employer. For example, the Joint Contracts Tribunal (JCT) form, details relevant events which are beyond the control of the contractor. If the occurrence of any of those contingencies occur so as to cause the work to take longer to complete then, because those contingencies are not at the contractor’s risk, more time must be added to the contract period. Without provisions for more time to be granted, for example, for the effect on the contract period for late issue of information, time would become at large. This means that the contractor would have to complete, not within the contract period, but within a reasonable time - whatever that happened to be. Furthermore, the employer would not be able to recover liquidated damages for any overrun of the contract period. This is why there are provisions for time to be extended in the event that the contract period is adversely affected by those risks that are borne by the employer.

The amount of time to be added to the contract period for employer responsible delaying events which have caused delay to the completion date, should be calculated logically and methodically by the contract administrator, or architect, and he must form his judgement impartially and objectively. This means that if it comes to a dispute as to whether a fair and reasonable extension of time has been granted and the contract administrator has determined the period of that extension of time instinctively, intuitively, or under the instructions of one of the parties, his decision is likely to be overturned.

Unfortunately, none of the standard forms provide any indication of the sort of information or technique upon which such a logical and methodical appreciation of the factual matrix upon which an extension of time should be calculated.

Arising out of its role as an aid to the planning of a project and as a monitor of current performance, it was a short step to the programme being used to provide a quick and simple means for appraising delays and showing entitlement for extensions of time. By the early 1970’s, the use of computers and project planning software meant that the Critical Path Method (CPM) was developed as a tool for assessing responsibility in delay and disruption construction disputes.

Since then there has been a proliferation of techniques which have evolved with increasing sophistication and ingenuity, but most of these suffer from weaknesses to adequately address a number of issues relating to the use of CPM for extension of time submissions and delay claims, such as programme float and concurrency.

The recognised EOT assessment techniques can be categorised into the following groups:

However, the critical importance of reliable documentation and records in establishing EOT entitlements cannot be over-emphasised, whatever the technique that is ultimately adopted.

What challenges have helped push the boundaries of your expertise in this field?

The ‘challenges’ to the Expert have always been,

Although the Markets in Financial Instruments Directive II (MiFID II) was implemented at the start of the year, work for the financial services industry to comply with this new regulation is far from over. Still remaining are a number of uncertainties, with multiple milestones and deadlines for specific requirements set throughout 2018 and beyond.

Hailed as one of the biggest overhauls of the financial services industry in decades, MiFID II introduced 1.4m paragraphs of rules and a number of new obligations for firms operating in the sector. These included new and extended transparency requirements, new rules on payments for research, increased competition in trading and clearing markets and guidelines to promote financial stability. With many of these rules being delayed or their introduction staggered over the course of the year, there is still a challenging path for the industry to navigate.

Below, Matt Smith, CEO of compliance tech and data analytics firm SteelEye, explains the key steps financial organisations should take over the course of the year to ensure they are meeting MiFID II’s demands.

Q2 2018: Best execution under RTS27 and 28

MiFID II has two major “best execution” requirements which must be met by financial services firms – regulatory standards RTS27 and 28. As part of their obligations, RTS28 mandates that firms report their top five venues for all trading. With the deadline being 30 April, the purpose of RTS28 was to enable the investing public to evaluate the quality of a firm’s execution practices. Firms were required to make an annual disclosure detailing their order routing practices for clients across all asset classes.

Obligations include extracting relevant trade data, categorising customers and trading activity, formatting the data correctly in human and machine readable formats, adding analytical statements and placing all of this information in a publicly available domain.

Limiting disclosure to five trading venues makes complying with these obligations relatively simple for small firms with straightforward trading processes. As a firm’s activity increases in complexity, however, so does its reporting obligation and managing RTS28’s data component could become a significant burden, as compliance departments spend time classifying trades, normalising data, formatting reports and completing administrative tasks.

RTS28 is followed soon after by RTS27, which will hit the industry on 30 June. RTS27 requires trading venues to provide quarterly best execution reports, free of charge and downloadable in machine readable format, and is intended to help investment firms decide which venues are most competitive to trade on. All companies that make markets in all reportable asset classes that periodically publish data relating to the quality of execution will be required to comply with RTS27.

The necessary publication of these reports requires the gathering and analysis of a significant quantity of data, which must detail price, costs, speed and likelihood of execution for individual financial instruments. Investing in the right technology ahead of the June deadline will ensure firms have the solutions needed to help digest such data and analyse it to inform their trading decisions. As we move through 2018 and 2019 however, analysis of this data, rather than being an additional burden, should help firms refine their best execution processes and generate a competitive business edge.

Q3 2018: Increasing transparency under Systematic Internalisers

One of MiFID II’s main aims was increasing transparency in the financial services industry in an attempt to avoid repetition of the 2007-2008 financial crash. In order to do this, a number of new rules attempting to regulate ‘dark pool’ trading were implemented, allowing regulators to police them more effectively and bring trading onto regulated platforms.

This system of increased transparency is designed to be effected through MiFID II’s new expanded Systematic Internaliser (SI) regime, the purpose of which is capturing over-the-counter trading activity to increase the integrity and fairness of industry trading and reduce off-the-book trades. For a firm to become an SI, they must trade on their own account on a ‘frequent and systematic basis’ when executing client orders. However, it is currently unclear what precisely ‘frequent and systematic’ means and as a result, many in the industry have been left without the necessary guidance to be able to implement these new rules correctly.

In August 2018, ESMA is set to publish information on the total number and volumes of transactions executed in the EU from January to June 2018. Any firm that has opted in under the regime or that meets the pre-set limits for ‘frequent and systematic’ basis will thereafter be classified as an SI under MiFID II.

The deadline for SI declaration follows shortly afterwards in September, which is when investment firms must undertake their first assessment and, where appropriate, comply with the SI obligations, which will become a quarterly obligation from then on.

Firms’ reporting obligations will increase considerably should they be classed as an SI. They will be required to notify their national competent authority; make public quotes to clients on request for their financial instrument; publish instrument reference data, post-trade data, and information on execution quality; and disclose quotes on request in illiquid markets. Adopting an effective pre- and post- trade transparency solution can help any firm set to be classified as an SI in September meet their obligations well ahead of the deadline in four months’ time.

Q4 2018: The impact of the pricing of research

Another major change under MiFID II is the regulation’s new rules on payment for research, which had previously been distributed to fund managers, effectively free of charge, but paid for indirectly through trading commissions. The provision of equity research is now considered to be an inducement to trade and the sell-side is only able to distribute their research to fund managers that pay for it. Moreover, an extra burden of red tape and reporting is being introduced as, by the end of 2018, investment firms must have provided clients with detailed information related to the costs and associated charges of providing investment services.

Research has effectively moved from an unpriced to a priced model and fund managers are now having to find a budget for research, with most firms electing to absorb that cost, which will inevitably impact their bottom line. The sell-side meanwhile will have to grapple with how to price their research, an unenviable task, given JPMorgan’s strategy to grab market share from smaller rivals by charging $10,000 for entry-level equity research.

Even before the aggressive pricing strategy adopted by the investment banking behemoth, the sell-side was facing consolidation and significant analyst job losses as the shrinkage of overall payments for research services to investment banks continues and asset managers become increasingly selective about the products and services they procure from investment banks. What is already certain is that the pricing and quality of investment research will be subject to closer scrutiny than ever before, driving up competition among research providers and triggering fragmentation and innovation in the marketplace.

Q1-2 2019: The UK’s departure from the European Union

While the FCA has stated that Brexit – at least currently – will not have an impact on their enforcement of MiFID II rules, the UK’s departure from the EU still leaves considerable uncertainty for those in the market. One recent survey found that 14% of surveyed compliance professionals had no idea how Brexit would affect their compliance requirements.[1] There is speculation that the UK could opt for ‘MiFID II-lite’ in all or some areas in order to better align it with the UK’s financial markets. This could mean that, while the industry must comply with MiFID II for this next year, after April 2019 a whole host of new rules and amendments could come into force.

As one of the core architects of the MiFID II rules, including many of its record-keeping and reporting principles, the FCA is unlikely to favour watered-down standards that could see London regarded as a less safe or transparent marketplace. However, with so much still up in the air, preparations should be made in order to ensure a swift transition once Brexit comes into force.

The strength of the UK’s regtech and fintech offering means the City should be well-placed to adapt to whatever shape MiFID II takes post-Brexit. To help prepare, strategy teams should work on plans for various post-Brexit scenarios in order to help weather the challenges that the UK’s EU departure will bring. UK players will undoubtedly emphasise their strengths in financial talent, product development, AI, fintech and regtech, helping the UK retain its leading position in the European financial market.

Matt Smith

CEO

Matt Smith is CEO of SteelEye, a fast-growing data analytics firm. After two decades as a manager, technologist and business partner, Matt is now focused on helping firms use technology and their data to gain a competitive edge and solve complex regulatory needs.

Matt has spent his career in technology management and, prior to his role at SteelEye, he was CIO for a global, $100bn trading company, where he was responsible for regulatory technology and the deployment of big data, trading and analytics platforms. He then spent time at a world-leading financial technology firm where he held a senior role in delivering financial regulation and compliance solutions.

SteelEye is a cloud-based platform which helps you consolidate and conform your trade and communications data to meet your regulatory obligations. This includes storing data securely in tamperproof form.

In addition, SteelEye allows you to analyse your consolidated data and gain powerful new insights into your business activities, helping you to trade with greater efficiency and profitability. Our mission is to empower you to leverage the opportunities presented by your data.

[1] https://www.thetradenews.com/uk-compliance-managers-predict-mifid-ii-exemption-post-brexit/

Rosa Twyman is an energy regulatory lawyer and has exclusively practiced law in the energy industry since 2001, first as commercial oil and gas litigation counsel, and then specialising as an energy regulatory lawyer in oil, gas and electricity matters. She speaks to Lawyer Monthly about her role in the energy sector. Rosa touches on the importance of aiming to be your best self, in everything you do, including navigating the energy legal sector.

What were your first steps in becoming a lawyer and what inspired you?

I never wanted to become a lawyer. I wrote an aptitude test when I was in high school, and the outcome of that was that a combined commerce and law degree was a good match for me and my educational future. I never expected to remain in private practice. In fact, as a young lawyer, I was disenchanted with how lawyers went about providing legal services. I have come to love the intellectual rigour and being able to work as a team with our clients and others, and use my skill set to add to the team achieving their goals. I feel grateful to have found a profession that keeps me engaged in this manner. Enabling clients’ business success is always rewarding.

What in particular led you to specialise in law surrounding energy matters?

I love anything energy - oil, gas, electricity. The way it is harnessed (produced), shipped, upgraded, traded, all the way to where we can use a Ziploc bag (petrochemical product) and flick a light switch. We all rely on energy to keep things going. Can we be more efficient? Can we add more value? Can we be more responsible - globally?

For example, we know green-house gasses remain within to jurisdictional boundaries. Are we optimising global energy production to emit as little as possible? Also, some energy comes with greater human right violations. How can we address achieving goals truly in the global public interest to optimise the use of the earth’s energy sources while we rely on energy use to advance humanity collectively? Intriguing questions like these keep me engaged in energy matters.

How would you describe the source of what drives you to succeed in your role?

What constitutes success is different for different individuals. I define success as being healthy - both emotionally, physically and financially, maintaining deeply meaningful relationships and having a sense of purpose. My sense of purpose is not elaborate. I simply endeavour to show up as my best version, grow and learn and continually do my best. I always tell my daughter (who is 11 years old), that her job is to continuously strive to become the best version of herself. Asking her to live that way, means it is only fair that I show up doing that myself.

In what way would you say your legal work has shaped an impact on your clients’ work/lives and thereafter in the energy sector throughout your 18 years in the industry?

I love it most when we need to do the least amount for a client. I find being pro-active a lot more rewarding. Clients are in the business sector to do ‘business’. It’s analogous to the doctor’s patient who does not get sick, because he/she shared knowledge enabling them to be pro-active about their health needs, rather than the doctor who does miracles for his/her ill patients. I am happy with behind the scenes thinking, planning and executing to be pro-active for clients about actions that they can take to reduce regulatory risk and enable business execution.

How would you say you stand out in this sector as a lawyer that is raising the status quo?

I have no desire to stand out in the legal sector. I am not particularly enamoured with the status quo, so raising it does not make sense to me. I also believe we are here to create, rather than compete. Can we create solutions for problems that enables a better energy future globally? To achieve this, at minimum, we need to start with solid values, solid people and have fair legal processes and execute on sound legal substance. I cannot guarantee that everyone in the legal community uses their skill-set and talents to achieve this. But in a small way, I can expect that of myself and my team and live well by doing that, however challenging it may be at times.

Rosa Twyman

Founder

T 403.930.7991 | C 403.710.0905

601-888 Fourth Avenue SW | Calgary, Alberta T2P 0V2

rosa.twyman@rlchambers.ca

Rosa exclusively practices energy regulatory law in oil, gas and electricity matters at Regulatory Law Chambers (RLC), a boutique law firm she co-founded in 2008.

Rosa appears in energy regulatory hearings before the National Energy Board and the Alberta regulators on regulated tolls and tariffs, market rule development and energy facilities approval matters. Rosa has acted as counsel in contested court applications, trials, appeals, and Supreme Court of Canada matters, including being counsel on leading upstream oil and gas issues.

Rosa recently graduated from Queen's University with an executive master’s in business administration (EMBA). As part of the EMBA Rosa analyzed the small specialised business law firm model. Rosa analysed both what clients want when requiring legal support and what private practise lawyers want when providing legal services, namely:

RLC specialises in understanding and achieving energy regulatory clients’ business objectives and works closely with clients and industry experts to provide practical solutions and when needed, effective advocacy.

RLC’s roster of clients includes:

RLC is also in the process of implementing its Energy Regulatory Law Education Sharing program (RLC ESP Program), to share knowledge about energy regulatory law principles and processes through an online platform. The RLC ESP Program will operate both as an educational and knowledge sharing program for lawyers at RLC, the legal industry and other energy industry participants.

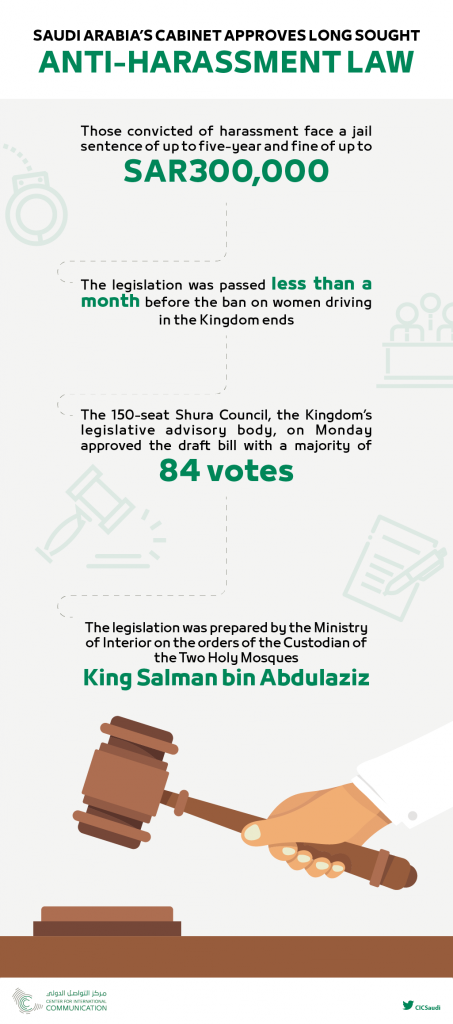

Saudi Arabia’s Council of Ministers has passed a long sought anti-harassment law, which carries a maximum penalty of up to five years in prison and a fine of up to SAR300,000.

The Council of Ministers, which met in the port City of Jeddah, swiftly passed the law only a day after the 150-seat Shura Council, the Kingdom’s legislative advisory body, approved the draft bill with a majority of 84 votes. The legislation was prepared by the Ministry of Interior on the orders of the Custodian of the Two Holy Mosques King Salman bin Abdulaziz, who heads the Council of Ministers.

“After reviewing the comments of His Royal Highness the Minister of Interior, and after considering the Shura Council Resolution No. (163/40) dated 13/9/1439 H (May 28, 2018), the Council of Ministers decided to approve the system to combat the crime of harassment,” the official Cabinet statement. “A royal decree has been prepared.”

The draft legislation was passed by the Shura Council less than a month before the Kingdom lifts the ban on women driving. King Salman made the historic decision in September 2017 to allow women to drive from June 24. The decision is in line with the Vision 2030 blueprint for the future, spearheaded by Crown Prince Mohammed bin Salman.

The legislation consists of eight articles and “aims at combating the crime of harassment, preventing it, applying punishment against perpetrators and protecting the victims in order to safeguard the individual’s privacy, dignity and personal freedom which are guaranteed by Islamic law and regulations,” according to a Shura Council statement.

King Salman ordered the Ministry of Interior to prepare the anti-harassment bill in light of the negative impact of harassment on the individual, family and society. Harassment also violates Islamic values. In order to combat the social phenomenon of harassment, it was deemed necessary to enact a law that criminalises such behaviour and spells out its legal consequences.

The anti-harassment legislations “is a very important addition to the history of regulations in the Kingdom,” Shura Council member, Dr. Latifa Al Shaalan, said. “It fills a large legislative vacuum, and it is a deterrent system when compared with a number of similar laws in other countries.”

A clear definition of what constitutes harassment will help the Public Prosecutor investigate complaints and present suitable punishment for those convicted.

In addition to mandating a prison term of up to five years and a fine of up to SAR300,000, the bill also doubles the potential penalties for several other factors, including multiple occurrences of the harassment; occurrence of the crime in the workplace, place of study or care home or shelter; or if he perpetrator occupying a position of authority vis-a-vis the victim. Other factors are if the victim was unconscious; the offence was being committed at a time of crisis, accident or disaster; or if the crime was against a child or person with special needs.

Calling the new law a ‘qualitative leap’ in the fight against sexual harassment, leading lawyer Dimah Alsharif told Arab News that the end of the driving ban focused attention on the issue of potential harassment. The new law will help by “imposing clear and specific clauses directly related to driving and to ensuring people’s freedom to practice this right.”

(Source: Center for International Communication)

Unbeknowst to most, employment issues are an important aspect to consider when undergoing an M&A transaction. Often overlooked, this area of law is vital when deciding employee’s rights when a company is bought out. We speak about this more with Roman Kolos, a specialist in employment law.

To what extent do you engage in employment law in your daily routine and what are the most complex issues that arise with your clients?

Employment related matters are a substantial part of our firm’s business. Most M&A transactions require employment expertise, ranging from a basic identification of potential risks within the due diligence exercise, up to major pre or post completion restructurings, often involving transfer of employees, reductions-in-force, etc.

We are also often approached by our clients’ HR teams in case of any sub-standard situations or when a multidiscipline approach is required. For example, we often assist with implementation of global employment and compensation policies in local subsidiaries of multinational companies, formalisation of cross-border secondments, dealing with trade unions, resolving any sort of employment related disputes (including litigation), etc.

Commencement and termination of employees in top management is another area where clients often involve us, since such matters are usually very sensitive for the client and require a multidisciplinary approach, especially with expat management. In such cases, very often, what seems as a very straightforward arrangement may face a numerous Ukrainian regulatory obstacles, such as foreign currency control, tax related issues, work permits, and so on.

How would you say Ukrainian employment law is set apart from other European nations/EU law?

Ukrainian employment law is based on the same key principles and approaches as in in most other European countries. The key difference and actually an issue for many businesses, is that Ukrainian employment law is in many ways outdated. You should keep in mind that Ukrainian employment code dates back to 1972 and back then private business simply did not exist in Soviet Union (at least officially). Consequently, the act, regardless of its numerous amendments, still does not recognise any sophisticated corporate structures, modern corporate governance, possible cross-border employment matters, etc. Such gaps are partially addressed by corporate or tax laws, nevertheless, to deal with them from the employment law perspective often requires a lot of creativity and sub-standard approaches.

Is there specific employment legislation you would see changed in Ukraine to satisfy your clients’ needs?

Indeed, a number of changes are expected within the next couple of years. First of all, it’s a new employment code (initial draft was circulated more than year ago and is under discussion now). Hopefully the new code will close some existing gaps and will bring employment law closer to the today’s economic realities (as aforementioned). Other developments are expected in line with Ukraine’s obligations to harmonize its laws with EC Directives, within the framework of the association agreement between EU and Ukraine (fully entered into force on 01 September 2017). Certain adjustments were already introduced in such areas as antidiscrimination and equality, although, amendments in such areas as collective redundancies (EC Directive 98/95/EC), transfer of undertakings (EC Directive 2001/23/EC), and many others are still waiting for their turn.

What is the most complex employment issue you’ve worked on during M&A transactions, and what were the challenges therein?

Quite often employment related matters are not given adequate attention within M&A transactions with Ukrainian target companies, resulting in rather serious risks for the buy side, especially in such sectors as IT, banking, and other services, where employees are forming a key asset of the business. Please note that most contractual warranties or covenants of the sell-side in relation to employment matters will be hardly enforceable in Ukraine. Furthermore, Ukrainian employment law does not recognise a change of control as a due reason for any employment related adjustments in the company. Consequently, a careful analysis of any existing employment related issues and due pre-completion measures are a “must do” is these kinds of transactions.

Special attention is also required in case of post privatisation assets (covers most production facilities). Such assets are likely to bear certain employment related obligations, such as a prohibition to dismiss certain categories of employees, keep certain level of compensations, etc. Similar issues may also arise from the bargaining agreements if there are active trade unions in the company.

You’ve acted on behalf of many great firms; which of these are you most proud of and which of these would you say pushed your expertise out the most?

Usually the most challenging are employment related disputes. Such cases are usually very sensitive to the client and are highly confidential. Litigation also means that all peaceful ways of dealing with the issue are exhausted. But the biggest challenge is in manoeuvring around mistakes and deficiencies in fulfilling all formalities that either directly or indirectly caused the issue.

Another challenge, but in a more creative and positive meaning of this word, is in implementation of employment and HR standards of large multinational companies in their Ukrainian entities. Philip Morris is a good example of such a client. Such work usually requires addressing an issue from all possible angles (employment, regulatory, data-protection, foreign currency control, work of foreigners, tax, trade unions, etc.) in order to make sure that the company’s global approaches will duly work in Ukrainian realities and will not trigger any issues for the client.

With an A-class career already behind you, how did you come to build your own law firm? Where would you like to see Arslegem in another 10 years?

As of today Ukrainian legal services market is a relatively small one, but it has very good growth potential. We’ve already witnessed an investment boom of 2005-2007, caused by election of a pro-western president and declarations that the country is moving towards the civilised world. Revival of economy back then triggered an intensive growth of legal services market with many international law firms opening offices here. Unfortunately, everything ended disappointingly whereby stagnation followed. Today’s situation is different, the country is undergoing some real reforms, and although things move a bit slower than we would wish them to, it seems that the key factor that keeps the country from fast recovery is the military aggression in eastern part of Ukraine.

Such a situation creates unique opportunities for many local law firms to work with major international blue chips. And this was exactly the idea behind founding ArsLegem. Equipped with our experience, enforced by extremely good litigation practice headed by my partner – Oleksandr Petrov, and acting in full compliance with national and international professional standards in 2012 we launched our law firm.

As for the second half of your question, we anticipate that in a mid-term perspective Ukrainian economy will recover, causing a wave of revival on the legal services market. Until then our goal is to get fit and equipped to the best extent possible in order to be able to catch that wave and show our best in riding it. I believe that we will manage to develop our firm into a regional leader in our core areas and employment law (often neglected by others) is definitely one of them.

Roman Kolos

Partner

ArsLegem

5th floor, Studentska Street 5-7 B, UA - 04050, Kyiv, Ukraine

tel. +380 44 363 07 77 fax +380 44 586 98 29

r.kolos@arslegem.com

Roman Kolos is practicing Advocate and Partner of Ukrainian law firm ArsLegem. Prior to founding ArsLegem Roman was a Partner at Kyiv office of Wolf Theiss - one of the leading CEE law firms. He started his career in private practice in 2005 by joining the major Ukrainian law firm at those times – Magisters, where over two years he reached a pre-partner position, including a spell as Head of Corporate and M&A practice in the firm’s office in Moscow, in 2007. Before that, since 1999, Roman worked as an in-house lawyer and head of legal department for a number of local and multinational companies.

ArsLegem is an independent Ukrainian law firm providing litigation and counselling services in all major areas of business law. ArsLegem’s labour and employment team, headed by Roman Kolos, provides comprehensive advice and creative solutions in all matters pertaining to Ukrainian employment law and is experienced in all facets of the complex landscape of employment relations.

Data released from legal recruitment expert, Douglas Scott’s, annual Salary Survey recently revealed that flexi-time is the most valued benefit by legal professionals – yet only 20% of firms offer it as part of their package. Managing Director of Douglas Scott, Kathryn Riley, explains what lawyers are really looking for in their benefit packages and asks if firms are doing enough to attract and retain top talent…

I’m sure you’ll agree that it comes as no surprise that lawyers are looking for more flexibility in their roles; the world of work is changing and has been for some time now. Millennials in particular are seeking that elusive work-life balance, and the gig-economy is bringing about the ‘Uberisation’ of the workplace across industries.

Glassdoor’s 2018 50 Best Places to Work revealed the UK’s top employers as Google, Anglian Water and Bromford - businesses that all focus on employee wellbeing. Google is renowned for its culture and vast range of benefits including flexible working, free food and working from home. It’s a great formula to drive a happy workforce and something the Google credits for great performance.

Within the legal sector, however, that flexibility and balance is harder to come by; donning yesterday’s shirt after pulling an all-nighter is still seen by many as a badge of honour. It’s backed up by our research, which showed that in London across all levels legal professionals on average work a 44-hour week. Legal professionals are measured against ultra-high expectations which, while enforced by partners and management, is ultimately directed from bill-paying clients. For this and many other reasons, it’s important to note that from a practical point of view most businesses simply cannot mirror Google’s formula.

Remuneration has historically made up for these high expectations (and for many, remuneration alone is sufficient), but now we’re seeing a shift in attitude, with lawyers looking for a more holistic package. While changing expectations are largely being driven at employee level, if we can learn anything from Glassdoor’s findings, it is that prioritising employee happiness can pay dividends. This year, our Salary Survey showed an increase of three per cent on firm’s offering flexi-time from 2017’s results – a sign that smart firms are adapting.

In order to attract and retain top talent, firms need to get under the skin of what lawyers want and identify what they can offer. While flexi-time was voted number one in our survey, the results also showed a desire for increased holidays and private health care -all fairly standard benefits that will tick the box for many -, but to keep top talent, firms should start thinking outside the box.

There is no need for packages to follow the rigid formula they once did and, while some may view Google’s list of benefits as gimmicky, feedback from those benefitting is largely positive.

So, how do you know what benefits to include? Trial and error can be costly, not to mention disruptive to business. Research is key - conduct surveys with your existing team and be open when interviewing about what would excite them and demonstrate that they are valued by the firm. All too often we see the right candidate rejected because the employer is unwilling to show flexibility.

Something we all could do with reminding ourselves from time-to-time: work isn’t everything. For many, family, friends and travel all come before work. Rather than persecute those who are upfront about it, firms should be championing balance. Time and time again studies show a correlation between happiness and performance. If firms want dedicated and engaged teams, then the firm should show willing to help people find a balance across their lives.

A good example comes from a story I heard on the grapevine recently – a well-regarded solicitor was looking to make her next move on the career ladder. On the top of her priority list sat a desire to work a four-day week. She intended to spend the fifth day taking care of her child. Despite knowing her wishes, a firm went through the interview process, continuing to be taken by her credentials but thought that their reputation and high remuneration package would convince her otherwise. After rejecting their first offer and reiterating the importance of the four-day week, the firm instead offered to help with child support. She kindly declined and has since found a business who could offer what she was looking for. Fundamentally, and to the first firm’s detriment, they failed to understand the solicitor’s drivers, mired in an old-fashioned mindset that the way to attract talent is to keep adding to a salary.

Firms aren't keeping pace with the make-up and expectations of today's professionals - they must think beyond financial reward to understand what individuals really need.

There is huge opportunity for firms to trail-blaze and start setting new best practice. But the window is closing, with early adaptors already reaping the benefits of taking a new, braver approach.

As always, the best talent will go where the honey takes them – many firms will need to reconsider their definition of honey.

Kathryn Riley

Managing Director

A legal recruitment specialist for over 15 years, Kathryn Riley launched Douglas Scott back in 2004 with the intention of doing things differently. Widely regarded as one of the UK’s leading legal recruitment specialists, the business goals are to continually provide an exceptional service to both candidates and clients, to recognise talent and reward it accordingly, and quite simply, work in a way that is respectful of principles and basic good manners. Kathryn’s role as MD has allowed her to further her passion for innovation and technology within the recruitment sector and demonstrate her commitment to creating and supporting the growth of skills across the legal sector. A highly respected thought leader within the legal recruitment industry and a regular speaker on the HR & Recruitment circuit, Kath is passionate about adding tangible value to stakeholder relationships and shaping the future of legal recruitment.