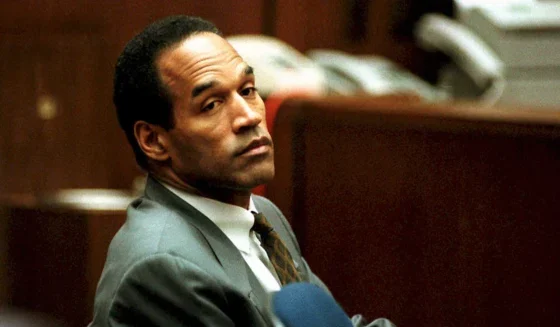

OJ Simpson Estate Agrees to $58M Claim From Fred Goldman in Probate Case

The estate of O.J. Simpson has accepted a $58 million claim from the family of Ron Goldman, advancing enforcement of a decades-old civil judgment and raising procedural questions about probate administration and creditor priority.

Introduction

The estate of O.J. Simpson has formally accepted a $58 million claim filed by the family of Ron Goldman, confirming the acknowledgement in recent submissions to the Clark County District Court in Nevada.

The development involves the estate’s executor, the Goldman family, and federal and state tax authorities. It surfaced this month when probate filings documented the estate’s position and outlined steps for processing the claim.

The central issue concerns how a long-standing civil judgment from the 1997 wrongful-death case will be administered under probate rules.

Agencies implicated include the Nevada probate court and tax authorities responsible for reviewing outstanding federal and state obligations.

The matter has wider relevance to public accountability, victim-rights enforcement and the reliability of civil-judgment mechanisms when a debtor dies before satisfying a court-ordered award.

What We Know So Far

Court records confirm the estate’s acceptance of the Goldman family’s claim, reflecting the unpaid civil judgment with accrued interest.

The acknowledgment follows earlier disputes over interest calculations between the executor and the family.

Under probate law, the estate must resolve federal and state tax liabilities before distributing funds to judgment creditors.

The executor has indicated that certain assets potentially relevant to the judgment may be missing and subject to recovery efforts.

The Legal Questions Raised

The case raises issues about how civil judgments are enforced against estates, including the priority of tax liens over private creditors.

Courts typically evaluate the validity of interest calculations and determine how older judgments are treated under current probate statutes.

Questions also arise about the executor’s duties to locate and safeguard estate assets that may be used to satisfy lawful claims.

The matter reflects broader considerations about creditor hierarchy and compliance with existing court orders.

Human Rights, Safety and Public-Interest Context

Victim-rights principles referenced in frameworks maintained by the UN Office of the High Commissioner for Human Rights emphasize access to effective civil remedies.

Decades-long delays in judgment enforcement highlight systemic pressures on families seeking compensation awarded by courts.

The case aligns with rule-of-law standards, including OSCE principles on legal remedies and enforcement, underscoring the importance of predictable civil-justice outcomes.

Role of Law Enforcement & Regulators

Law-enforcement agencies may become involved if recovery of missing estate property is required to fulfil court-ordered claims.

Probate courts oversee asset inventories, valuations and executor reporting to ensure duties are met under state law.

Tax regulators assess federal and state liabilities before any distribution to non-government creditors.

Prosecutors would typically intervene only if potential evidence of asset concealment or interference arises.

Risks, Implications & Public Impact

Extended delays in civil-judgment enforcement may affect public trust in the legal system’s ability to uphold binding court orders.

Creditor-priority rules can prolong the resolution of longstanding wrongful-death awards, shaping public understanding of probate constraints.

High-profile estates can influence expectations about consistency and transparency in asset administration.

The handling of estate property may inform broader discussions about due diligence in probate management.

Key Questions People Are Asking

How is a civil judgment enforced once the defendant has died?

Probate courts apply established creditor-priority rules, review asset inventories and determine whether existing property can satisfy the remaining judgment.

Why do tax authorities take priority over judgment creditors?

Federal and state law typically place tax claims ahead of private civil judgments, requiring estates to satisfy these obligations before others.

Can missing estate assets affect the payout?

If assets are missing, the executor must report the issue and pursue recovery where possible under court supervision.

How is post-judgment interest calculated?

Courts rely on state statutes governing interest rates and apply them to the outstanding balance until the judgment is fulfilled.

Does acceptance of the claim mean payment is imminent?

No. Acceptance permits the claim to proceed within probate rules, but payment depends on asset availability and resolution of higher-priority debts.

What Happens Next & Final Legal Takeaway

The probate court will review inventories, tax liabilities and contested interest calculations as part of routine administration.

The executor must continue recovery efforts for any missing estate property and report progress to the court. Federal and state tax authorities will determine final obligations before assessing remaining assets.

Additional filings are expected as the estate moves through valuation, accounting and judicial review stages.

The acceptance of the Goldman family’s $58 million claim allows Nevada’s probate court to advance enforcement of a decades-old wrongful-death judgment.

The case illustrates the high priority of tax obligations, the limits of estate assets and the complexities of administering civil awards long after they are issued.

It underscores ongoing public-interest concerns about consistent judgment enforcement and the rights of families seeking long-delayed compensation.

The probate court will review inventories, tax liabilities and contested interest calculations as part of routine administration. The executor must continue recovery efforts for any missing estate property and report progress to the court.

Federal and state tax authorities will determine final obligations before assessing remaining assets. Additional filings are expected as the estate moves through valuation, accounting and judicial review stages.

The acceptance of the Goldman family’s $58 million claim allows Nevada’s probate court to advance enforcement of a decades-old wrongful-death judgment.

The case illustrates the high priority of tax obligations, the limits of estate assets and the complexities of administering civil awards long after they are issued.

It underscores ongoing public-interest concerns about consistent judgment enforcement and the rights of families seeking long-delayed compensation.