New Jersey’s health insurance program for nearly 150,000 local government workers is on the brink of financial collapse — and Gov. Phil Murphy says only a $260 million taxpayer-funded bailout can stop it. But his plan comes with a bombshell condition: workers will pay sharply higher premiums, higher deductibles, and lose nearly all of their plan options.

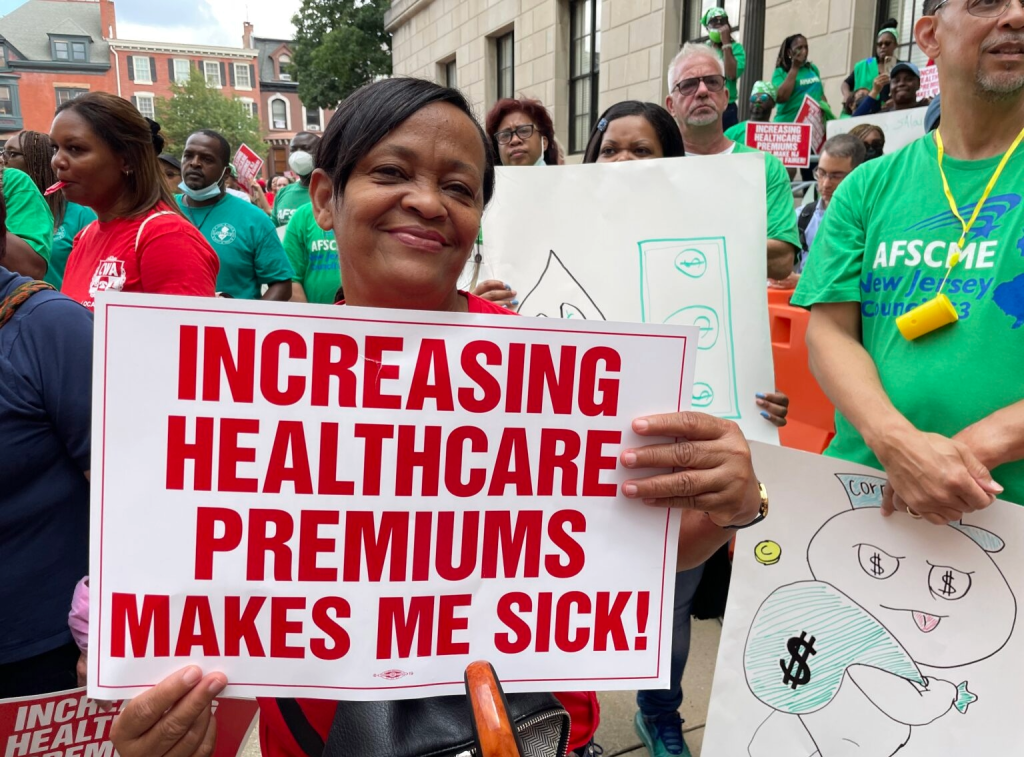

Union leaders are calling it an ambush. Economists are calling it a market failure. And lawmakers are now staring down the largest benefits showdown since the Christie-era pension wars.

Murphy’s message to public employees was blunt: the State Health Benefits Program (SHBP) is broke, bleeding members, and will implode next year without sweeping structural changes. Unions had a different message: “This proposal is a joke.”

Premiums in the SHBP for local workers have surged 59% in three years, causing major counties and towns to flee to private carriers. That exodus left behind a smaller, sicker pool — driving costs even higher.

Murphy wants to plug the hole with a $260 million rescue plan that includes:

A $180 million loan to wipe out old claims

An $80 million emergency reserve

A massive overhaul reducing plan choices from 50 to just 6

Much higher worker contributions and out-of-pocket costs

Workers currently enjoy platinum-level benefits with minimal copays. Under Murphy’s proposal, some copays would triple, and deductibles would explode to thousands of dollars a year.

Union leadership didn’t hold back.

Steve Tully of AFSCME called Murphy’s plan an “insurance executive’s dream” and said any legislator supporting it “should have their head examined.”

Labor argues the Governor is targeting workers rather than tackling the real drivers of cost: hospital pricing, drug manufacturers, and insurer markups.

Just days before Murphy unveiled his bailout, Horizon Blue Cross Blue Shield agreed to pay $100 million after a state Attorney General investigation found the insurer had overbilled the SHBP.

Workers say the timing is infuriating:

How can the state demand workers pay more when the program was being drained by overbilling?

Tonya Hodges of CWA District 1 blasted the proposal:

“We should be moving toward more oversight and more affordable benefits — this plan does the opposite.”

Union leaders say Murphy is sending workers the bill for years of mismanagement while refusing to police insurers that profited from a broken system.

At the League of Municipalities conference in Atlantic City, Murphy told lawmakers, mayors, and union leaders that ignoring the crisis will guarantee “astronomical” rate hikes next June — and jeopardize healthcare access for tens of thousands of public workers.

But his clock is running out.

Murphy leaves office Jan. 20, handing the crisis to Gov.-elect Mikie Sherrill.

Both houses of the Legislature would need to pass a bill implementing the overhaul immediately — a tall order given the uproar.

Senate President Nick Scutari says Murphy’s plan is a possible “compromise,” but labor leaders are already campaigning to kill it.

Assembly Speaker Craig Coughlin signaled openness but offered no support beyond “discussion.”

Public employment in New Jersey has long relied on better-than-private-sector health coverage to compensate for modest wages. Murphy’s overhaul would erode that bargain.

Even after the bailout, workers face:

Sharply higher premiums

Steeper deductibles

Fewer plan options

Higher costs for popular medications like GLP-1 weight-loss drugs

Tighter restrictions on leaving or joining the SHBP

Treasury officials argue these changes are overdue given skyrocketing national medical costs. But labor leaders say the Governor is using fiscal panic to force concessions workers have rejected for years.

The SHBP is a $2.27 billion program. The bailout is $260 million. That leaves a long list of questions no one in Trenton has answered:

How long will the bailout actually stabilize the program?

Will workers be asked to pay even more in 2027?

Why did the state ignore cost-saving reforms unions pushed for years?

And why were workers not protected from the Horizon overbilling scandal?

New Jersey is heading into a political, fiscal, and labor confrontation that will define Murphy’s final weeks — and Sherrill’s first crisis as governor.

New Jersey’s State Health Benefits Program (SHBP) is governed by N.J.S.A. 52:14-17.25 et seq., which gives the state broad authority to set premium rates, plan structures, and cost-sharing requirements for public workers. Under the statute, the State Treasury and the State Health Benefits Commission must ensure the program is actuarially sound — but the law does not guarantee workers any fixed premium level or specific plan design.

This means the state is legally permitted to:

Raise premiums and deductibles

Reduce the number of available plans

Restructure benefits to stabilize the fund

Use state appropriations to shore up deficits

Murphy’s $260 million bailout proposal falls squarely within these powers, but its cost-shifting elements — higher worker contributions, fewer plan options, and increased deductibles — are what triggered immediate unrest among labor unions.

Complicating the legal landscape is the Horizon overbilling settlement, in which the insurer agreed to repay $100 million after an Attorney General investigation. While unions argue this strengthens the case for stricter oversight, the SHBP statute does not require the state to offset future premium increases with recovered funds.

The legal bottom line:

The state has wide discretion to overhaul the SHBP, but unions have equally broad rights to challenge those changes through collective bargaining, arbitration, and litigation. With the program approaching insolvency, both sides are preparing for a high-stakes battle over what “shared sacrifice” should legally look like in 2025 and beyond.

👉 MTA Latest: Thanksgiving Travel Alert: Major MTA Changes, Extra Trains, Closed Stations — Here’s What NYC Commuters Need to Know 👈