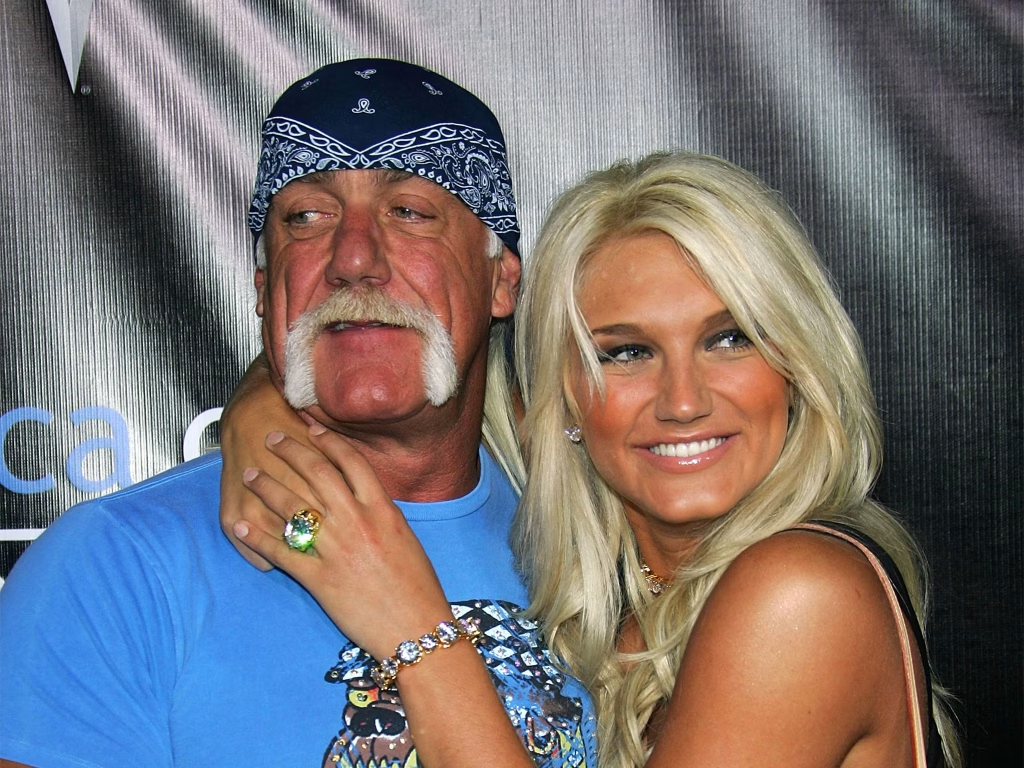

In the days following the death of wrestling legend Hulk Hogan, a surprising revelation emerged from inside the Hogan family: his daughter, Brooke Hogan, will not inherit anything from his estate. But unlike many cases involving celebrity inheritances and legal disputes, this was not a case of being cut out. Instead, Brooke proactively asked to be removed from her father's will—nearly two years before his passing.

According to sources close to Brooke, the decision to withdraw from Hulk Hogan’s estate was made in 2023. At the time, Brooke had grown deeply concerned about the people surrounding her father and their influence over his financial affairs and Hulk Hogan's net worth. Rather than become entangled in future estate litigation or family conflict, she formally requested her removal from the will by contacting Hulk’s financial manager.

Insiders say her motivation was grounded in love, not greed. Brooke’s goal had always been to protect her father, even when they disagreed about the people he trusted. Their relationship reportedly became strained over those disagreements, but Brooke never wavered in her conviction that avoiding a future legal battle was the best course for both their peace of mind.

“She’s never been about the money,” a source familiar with the situation told TMZ. “She just didn’t want to be part of the chaos.”

With Brooke no longer listed in the will, she will not receive any portion of Hulk Hogan’s estate, which is expected to include trademarks, intellectual property rights, real estate, and possibly earnings from licensing and media royalties. However, she will receive a modest sum from a separate life insurance trust established by her father, where she remains a named beneficiary.

According to reports, Brooke plans to use those proceeds toward her children’s future college expenses. It’s the only financial connection she’ll have to her father’s legacy, and she’s reportedly at peace with that.

As of now, the full details of the estate plan and its remaining beneficiaries have not been made public. It remains unclear who will take ownership of Hulk Hogan’s personal brand, wrestling-related intellectual property, and various assets accumulated during his long career.

Brooke Hogan’s case offers a rare, real-life example of voluntarily stepping away from an inheritance. In California, it is legally permissible for an individual to remove themselves from a will or decline to accept an inheritance, either during the testator’s lifetime or after their death.

Pre-Death Removal via Will Amendment (Codicil):

If a beneficiary wishes to be removed during the lifetime of the person making the will (the testator), the proper method is to execute a codicil, a formal legal amendment to the will. Under California Probate Code § 6110, this codicil must be in writing, signed by the testator, and witnessed by two individuals. In Brooke’s case, this appears to be the route she took in 2023, asking Hulk’s financial manager to remove her before his death.

Post-Death Disclaimer of Interest:

If a named beneficiary decides to decline their inheritance after the testator’s death, California allows for a legal disclaimer of interest under Probate Code §§ 275–288. The disclaimer must be:

In writing and signed by the disclaimant

Delivered to the estate’s personal representative or trustee

Filed within a reasonable time—typically within nine months of the decedent’s death

A valid disclaimer is treated as if the person predeceased the testator, meaning the disclaimed assets will pass as if the individual had never been named.

Importantly, California law does not impose inheritance rights on adult children. Because the state does not follow forced heirship rules, individuals may exclude adult children from their estate entirely, or—as in this case—allow them to voluntarily decline involvement.

Brooke Hogan asked to be removed from Hulk Hogan’s will in 2023 due to concerns about people influencing her father’s financial decisions.

She will receive no inheritance from the estate, only a small sum from a life insurance trust.

California law permits both pre-death and post-death removal from a will through codicils or disclaimers of interest.

No forced heirship exists in California, so parents are not legally obligated to leave assets to adult children.

The rest of Hulk Hogan’s estate—trademarks, brand assets, property—has not yet been publicly assigned.

1. Can someone legally remove themselves from a will in California?

Yes. A person can ask to be removed from a will while the testator is still alive, typically through a codicil. Alternatively, a named beneficiary may file a disclaimer of interest after the testator’s death, under Probate Code §§ 275–288. The disclaimer must be written, signed, and submitted in a timely manner—usually within nine months of death.

2. Do adult children automatically inherit from a parent in California?

No. California law allows parents to disinherit adult children. Wills and trusts must clearly express this intent, and as long as the document complies with the Probate Code, it will be legally enforceable.

3. What is a codicil, and how is it used?

A codicil is a formal amendment to a will, executed in accordance with California Probate Code § 6110. It must be in writing, signed by the testator, and witnessed by two people. It allows changes such as adding or removing beneficiaries without rewriting the entire will.

4. Does money from a life insurance trust go through probate?

No. Life insurance trusts operate outside the probate system. The proceeds go directly to the named beneficiaries. California trust law under the Probate Code §§ 15000–19403 governs these arrangements, which offer privacy and speed in asset distribution.

If you are considering modifying an estate plan or removing yourself from a will in California, it’s advisable to consult a qualified estate planning attorney. Proper documentation and timing are essential to ensure your wishes are honored—and to prevent future legal disputes.