Wrong Tax Code? How to Check Yours in 3 Minutes and What UK Law Says If It’s Wrong

Recent reporting has highlighted a striking figure: millions of UK taxpayers paid more tax than they needed to last year because their tax codes were wrong.

Data obtained via a Freedom of Information request by UHY Hacker Young suggests the total overpaid during the 2023–24 tax year ran into the billions. With January tax deadlines freshly in mind for many households, the story has raised an obvious question: could this apply to you?

For most people, tax happens quietly in the background through PAYE. That is precisely why problems with tax codes so often go unnoticed. Small monthly overpayments rarely trigger alarm bells, but over the course of a year they can quietly add up to hundreds of pounds.

What has been less clearly explained is how ordinary workers can check whether this affects them — and what actually happens if their tax code turns out to be wrong.

Why This Matters to You

Your tax code tells your employer how much income tax to deduct before you are paid. If the code is wrong, you are not just paying the wrong amount this month — you may have been doing so all year.

Many people assume their employer or HMRC will automatically spot and fix any errors. In reality, tax codes are often based on estimates. When your circumstances change and those estimates are not updated, the system can drift off course.

You are more likely to be affected if you changed jobs, took on a second role, stopped or started receiving benefits, or gave up a company perk such as a car or private medical insurance. In those situations, it is common for people to carry on paying tax without realising their code no longer reflects their situation.

How This Affects You in Practice

In practice, an incorrect tax code usually leads to one of two outcomes: you pay too much tax each month, or you pay too little and face an adjustment later.

If your code assumes income or benefits you no longer receive, your tax-free allowance may be reduced unnecessarily. That means less take-home pay than you are entitled to. Spread across a year, the difference can be substantial even if each payslip only looks slightly off.

The opposite can also happen. If your code does not account for additional income, HMRC may later identify an underpayment. Rather than arriving as a dramatic demand, this is often recovered quietly through a revised tax code the following year — something many people only notice when their net pay suddenly drops.

What You Can Do Now

Checking your tax code is straightforward and usually takes only a few minutes.

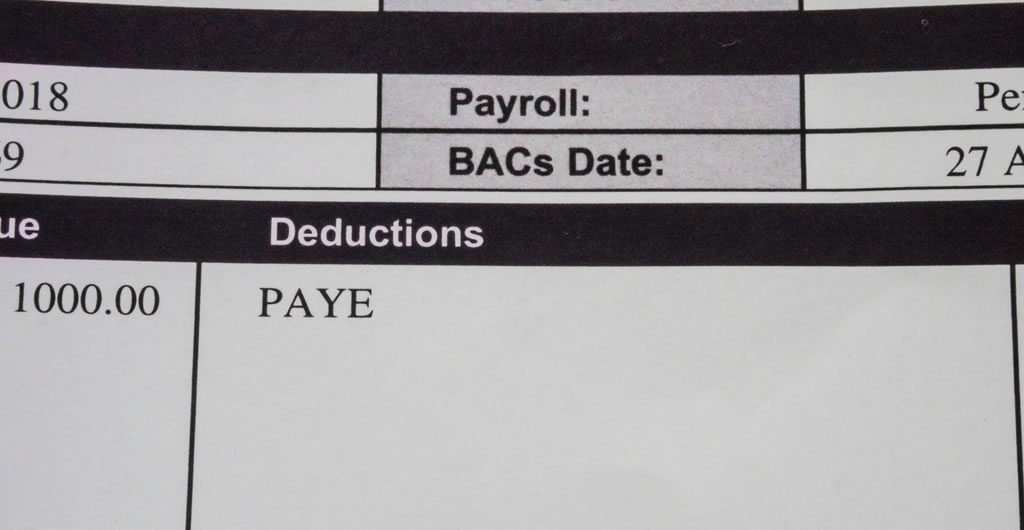

Start with your payslip.

Your tax code appears alongside your PAYE details. For most people with one job and no complications, it will look like 1257L. Codes with additional letters or unusually low numbers are often worth checking.

Log into your online HMRC account.

If you already complete Self Assessment, you will have an account. If not, one can usually be set up in a few minutes using your National Insurance number. Once logged in, you can see not just your tax code but the income and benefits HMRC has used to calculate it.

Compare it with your real situation.

If your code still reflects income, benefits or employment you no longer have, that mismatch is often the cause of overpayment.

Update HMRC if needed.

Changes can be reported online or by contacting HMRC directly. Where an overpayment is identified, refunds are often issued automatically, either as a direct payment or through adjustments to future take-home pay.

What the Law Says

The PAYE system is designed to collect the right amount of tax automatically, but UK law places ultimate responsibility on the individual taxpayer to ensure their affairs are correct. Employers operate payroll deductions based on the tax code they are given; they are not expected to question whether it accurately reflects your circumstances.

HMRC’s role is administrative rather than advisory. Tax codes are issued using the information held at the time, which is why errors can persist if circumstances change and are not updated promptly.

Where an overpayment is identified, taxpayers are generally entitled to a refund, often going back several years depending on the situation. If there has been an underpayment, HMRC will usually seek to recover it gradually through future tax codes rather than demanding immediate payment, provided the amount is not excessive.

There is no penalty for checking or querying a tax code. Doing so is treated as routine housekeeping, not a challenge or complaint.

The Bottom Line

Most tax code errors are not caused by mistakes or misconduct. They are a side effect of a system that relies on estimates and assumptions unless it is told otherwise. The risk is that those assumptions quietly stop matching real life.

Spending a few minutes checking your tax code is not about disputing your tax position or raising red flags. It is simply a way of making sure the system reflects your current circumstances — not an outdated version of them. For many UK workers, that small check can mean the difference between accepting lower take-home pay and reclaiming money that should never have left their account in the first place.

FAQs

Can I claim back tax if my tax code was wrong?

Yes. If your tax code was incorrect and you paid more tax than you should have, you are generally entitled to a refund. In many cases, HMRC will calculate this automatically once the error is corrected. Refunds may be paid directly to your bank account or reflected through an adjustment to your future tax deductions.

How long does HMRC take to refund overpaid tax?

Refund times vary depending on how the overpayment is identified. Where HMRC corrects the issue automatically, refunds are often processed within a few weeks. If the overpayment is identified after a tax year ends, repayment may follow the issue of a tax calculation (P800) or be made through your PAYE code. Delays can occur if HMRC needs additional information.

Will checking my tax code trigger a penalty or investigation?

No. Checking or querying your tax code does not trigger a penalty, fine, or investigation. HMRC treats this as routine account maintenance. Reviewing your tax code is a normal and sensible step, particularly if your employment or income circumstances have changed.

How far back can HMRC refund overpaid tax?

HMRC can usually refund overpaid tax going back up to four tax years, depending on the circumstances. The exact period can vary, particularly for PAYE versus Self Assessment cases, but taxpayers are not limited to reclaiming overpayments from the current year alone.