Benjamin Chow Lawsuit: $107M Crypto Fraud Allegedly Used Melania Trump, Javier Milei for Pump-and-Dump

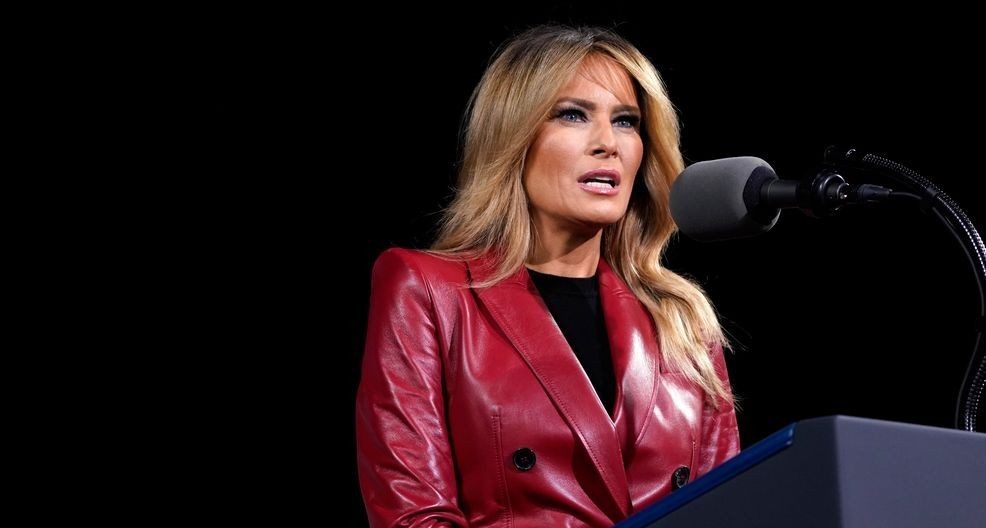

A federal class action lawsuit was filed in a U.S. District Court against crypto founders Benjamin Chow and Hayden Davis of Meteora and Kelsier Labs, alleging a massive pump-and-dump scheme involving the MELANIA and LIBRA meme coins.

The complaint states that investors suffered devastating losses after the tokens crashed by as much as 98% following promotions linked to public figures like Melania Trump and Javier Milei.

The case, currently unfolding in the Southern District of New York, is considered a critical test of how U.S. securities laws apply to fraudulent activities in the decentralized finance market.

The Crash: A $10 Million Haul From a 98% Collapse

The details laid out in the lawsuit are stunning, painting a picture of calculated greed.

The MELANIA Coin ($MELANIA), launched after a promotion on Melania Trump’s official X account in January 2025, quickly soared on the hype. But its value then plummeted a catastrophic 98%, sinking from $13.73 down to just $0.18.

Plaintiffs allege that insider wallets connected to Chow and Davis systematically dumped their holdings, walking away with an estimated $10 million from the MELANIA collapse alone.

Similarly, the LIBRA token, which was promoted by President Milei, saw an alleged insider offload of over $107 million before its price tanked by over 90%.

The suit contends that the founders leveraged their firms, Meteora (the technical platform) and Kelsier Labs (the liquidity provider), to repeat this "playbook" across at least 15 different tokens, defrauding investors out of tens of millions of dollars.

A Pattern of Fraud: Chow's Prior Insider Trading Conviction

The seriousness of the current allegations is underscored by defendant Benjamin Chow's history. Chow, a former partner at a private equity fund, was previously convicted of insider trading in the Southern District of New York.

That conviction involved him illegally tipping a friend with material nonpublic information regarding a potential acquisition, which resulted in significant profits.

This legal history is relevant to the current case, as the core allegation, leveraging privileged information (the timing of celebrity promotions) for personal gain mirrors the classic definition of financial deception.

The Legal Hammer: Why U.S. Authorities Are Watching

This case isn't just about a broken crypto promise; it's a test case for whether federal anti-fraud laws can catch up to the world of decentralized finance (DeFi).

The investors’ claims are filed under key U.S. laws, specifically the Securities Exchange Act of 1934 and its anti-fraud provision, Rule 10b-5.

This law makes it illegal to employ any "device, scheme, or artifice to defraud" in connection with the purchase or sale of any security.

Legal Expert Perspective: David Silver, a partner at Silver Miller who has handled multiple federal crypto-fraud cases, emphasizes the core issue:

“When promoters and insiders manipulate token prices for personal gain, it’s not innovation — it’s fraud. The SEC and the courts have made clear that the substance of conduct, not the label on the token, determines liability.”

While many meme coins avoid the technical label of a "security," the alleged behavior - secret insider trading, misleading promotions, and market manipulation falls directly under the classic definition of financial deception prohibited by federal law.

Real-Time Legal Moves: The seriousness of the allegations led a U.S. district judge to initially freeze $57 million in funds linked to Chow and Davis.

Though some funds were later unfrozen, the broader litigation continues, demanding accountability and significant damages for the thousands of alleged victims.

The Warning Shot for Public Figures

This scandal exposes the massive risk taken by public figures, including politicians and their families, who promote unverified crypto assets.

Neither Melania Trump nor Javier Milei is a named defendant, but their involvement is a central pillar of the fraud allegation.

The lawsuit argues they were used as "window dressing" to give the schemes credibility, driving the retail investor frenzy.

This places a spotlight on the legal risk of celebrity promotion.

The SEC and FTC demand that public figures must disclose compensation for any asset promotion, a standard that is often violated in the murky world of viral tokens.

Former SEC Official on Enduring Fraud: John Reed Stark, the former head of the SEC’s Office of Internet Enforcement, is not surprised by the allegations:

“Pump-and-dump tactics are timeless. The technology changes from boiler rooms to blockchains, but the deception remains the same. Regulators can either act now or keep cleaning up after the next crash.”

The Future of Crypto Regulation

The Meteora class action is more than just a lawsuit; it’s a bellwether for the future of decentralized markets.

- Precedent Setting: If the plaintiffs prevail, this case would establish a clear precedent for treating meme-coin pump-and-dump operations as fraud under existing U.S. securities statutes.

- Congressional Push: The scandal provides fresh ammunition for lawmakers currently pushing legislation like the GENIUS Act and the Clarity Act. These proposed laws seek to impose stricter rules, including mandatory reserve audits and expanded disclosures, which could effectively ban the most speculative and abusive meme coins from U.S. exchanges.

As this drama unfolds in federal court, the outcome will directly determine if the Wild West era of crypto is truly coming to an end, finally closing the gap between cutting-edge finance and traditional legal accountability.

People Also Ask (PAA)

What is the Benjamin Chow lawsuit about?

The Benjamin Chow lawsuit is a federal class action filed against crypto founders Benjamin Chow and Hayden Davis (of Meteora and Kelsier Labs) alleging a massive pump-and-dump scheme involving meme coins like $MELANIA and $LIBRA. The suit claims the founders used insider trading and high-profile promotions to inflate token prices before dumping their holdings, causing investors to lose up to 98% of their investment.

Are Melania Trump or Javier Milei named as defendants in the lawsuit?

No, neither Melania Trump nor Javier Milei is a named defendant in the federal class action. However, the lawsuit argues that their public promotions were a "central pillar of the fraud allegation," used as "window dressing" to lend credibility to the schemes and drive the retail investor frenzy.

How much money did the crypto founders allegedly make from the token crashes?

The lawsuit alleges the founders and connected insider wallets made millions from the crashes. Specifically, they allegedly walked away with an estimated $10 million from the $MELANIA coin collapse alone, and offloaded over $107 million during the $LIBRA token's crash.

Why is this crypto fraud case considered a "test case" for U.S. law?

This case is considered a test case because it seeks to determine how U.S. securities laws, specifically the anti-fraud provision Rule 10b-5 of the Securities Exchange Act of 1934, apply to fraudulent activities in the decentralized finance (DeFi) market. A plaintiff victory would set a precedent for treating meme-coin pump-and-dump operations as fraud under existing federal statutes.