Understand Your Rights. Solve Your Legal Problems

According to extensive research, Finland was named the happiest country in the world. The report was compiled from the answers of a series of questions relating to the quality of people’s lives, from 0 to 10. The average was taken from over 2015-2017, with 156 countries taking part.

The World Happiness Report scored each country against a hypothetical nation named Dystopia. Explanations for the levels of happiness per country were broken down into the following areas:

Tilly Bailey & Irvine Law, medical negligence claims experts investigate further. Is there a correlation between less income tax and happiness, for example, as we lose less of our hard-earned wage?

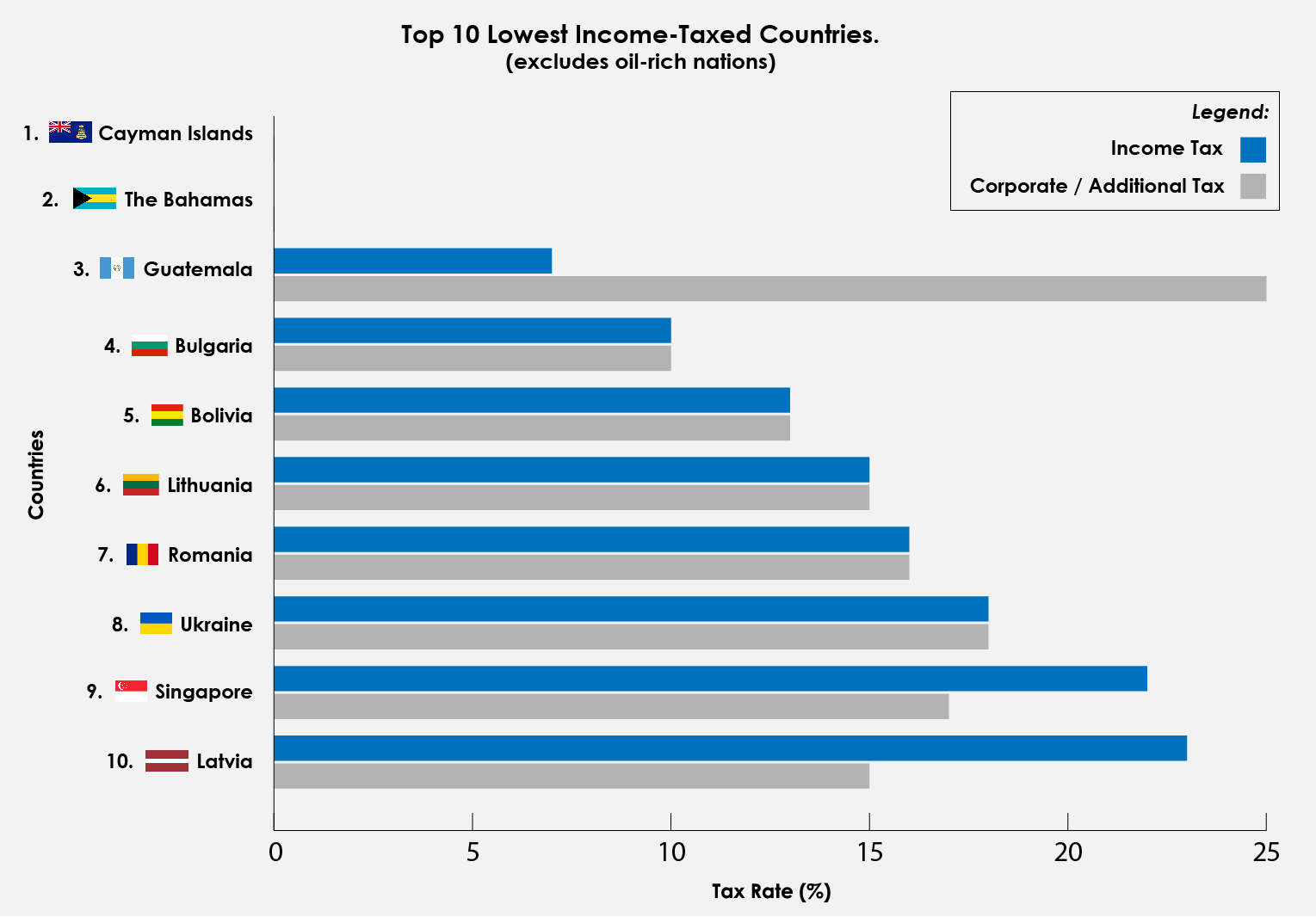

Which countries have the lowest income tax?

According to this report, which excludes oil-rich nations, the lowest income tax rates are enjoyed by:

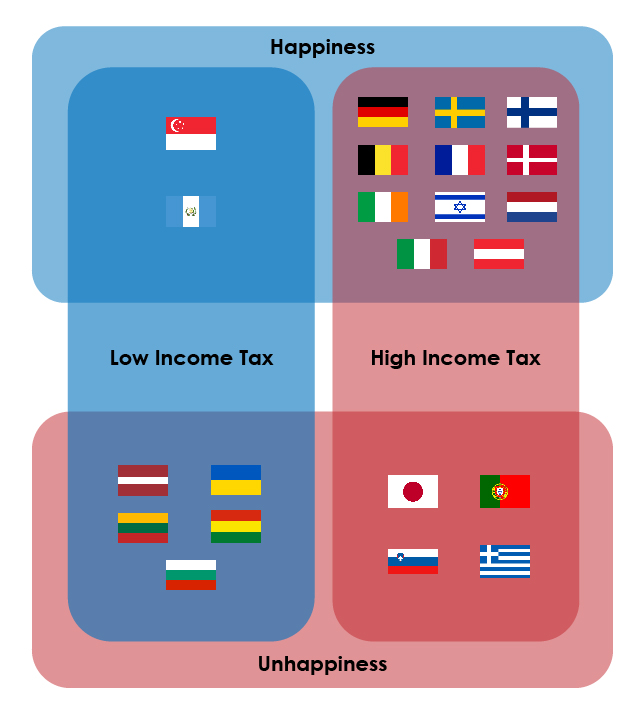

However, are these countries positioned in the same way on the happiness report? In the report of 156 countries, we placed the benchmark at 50th place — anything above 50th place would be deemed “happy” and anything below 50th place would be deemed “unhappy” in comparison.

Guatemala came 30th, Bulgaria 100th, Bolivia 66th, Lithuania 50th, Romania 52nd, Ukraine 138th, Singapore 34th, and Latvia 53rd. The Cayman Islands and Bahamas did not have data in the report, sadly. Unfortunately, the Cayman Islands and Bahamas did not have data to report on.

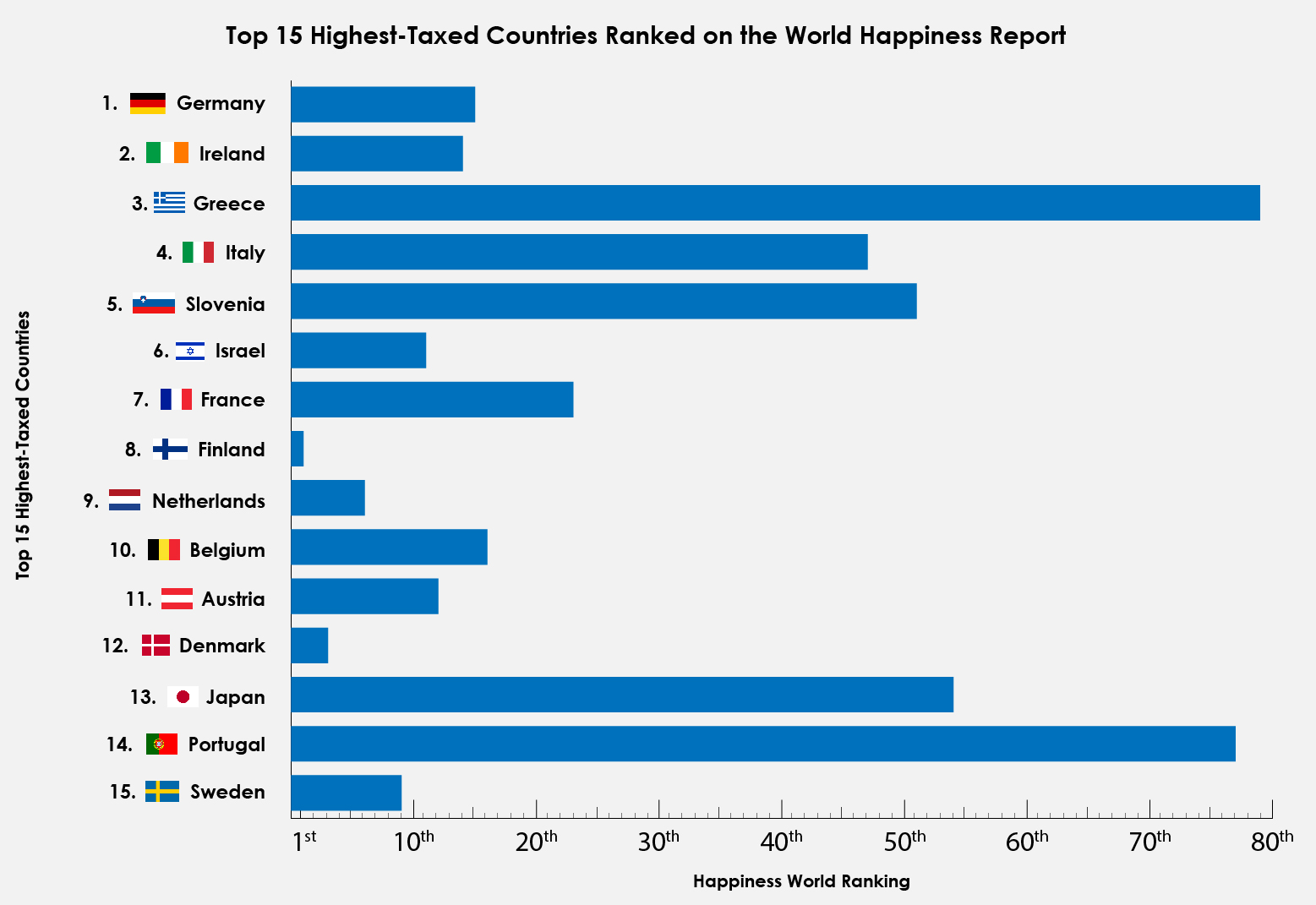

The highest income-taxed countries

Although we have looked at the lowest income-taxed countries, it’s important to also review the highest. Nomad Capitalist named 15 high-tax countries: Germany, Ireland, Greece, Italy, Slovenia, Israel, France, Finland, the Netherlands, Belgium, Austria, Denmark, Japan, Portugal, and Sweden. Sweden has an income tax rate as high as 57.1%.

“I would advise you to think twice when it comes to being a resident of one of these countries […] pick a place that treats you best” commented the author, Andrew Henderson.

Because of this, it would make sense that a higher tax rate would equal a lower level of happiness. Again, with 50th place as our benchmark, let’s see where these high-tax countries landed on the World Happiness Report:

Although these countries have high tax rates, only four landed under the 50th benchmark. In fact, four appear in the top ten happiest countries. None of the lower-tax rate countries broke into the top ten, in contrast.

Although Sweden may have a higher tax rate, there were more supreme benefits in the country that include affordable childcare, 480 days of joint parental leave, pensions and more.

Teen vaping is reaching epidemic levels and FDA is considering regulation to curb it. One proposal would be banning flavoring of e-cigarette liquids.

Women Count 2018 found that in the last three years there has been no progress on gender diversity in senior roles in the FTSE 350 – and by some measures, it is going backwards. Women Count is the third annual report by The Pipeline, that tracks and analyses the number of women on Executive Committees of FTSE 350 companies. The report found that:

Despite these shocking statistics, British businesses expect firms providing professional services to be more gender diverse. With the service sector delivering 79% of UK GDP, this points to a growing issue for the legal sector.

It is becoming the norm that businesses purchasing services from other businesses expect, as a bare minimum, to see women on the presentation team that is attempting to win the work. In response to this, it has become an unwritten rule that organisations pitching for services present gender diverse teams. This is particularly true amongst the larger firms providing professional services such as legal advice, accountancy support and consultancy.

The Pipeline is now also seeing that firms pitching for services are being closely questioned on whether the same women presented in the team will also actually be delivering the work. The high standards business expect law firms to demonstrate, was also seen earlier this year by business’ response to gender pay gap data law firms released. The FT reported on 23 March 2018 that some of the top law firms had come under pressure from their clients to include partners in their gender pay data.

It goes without saying that those firms with greater numbers of senior women will have a competitive advantage over their peers. However, this won’t be an easy task. A 2017 PwC report, highlighted that leading firms have significant imbalance at equity level where 80% of partners at the top 50 law firms are men.

Laura King, Partner, Global Head of People and Talent, Clifford Chance: “Gender balanced teams are better for our clients, better for our business and better for our people - so ensuring our pitch teams are representative of society is our goal. We (and our clients) know that diversity leads to better service and problem solving, and clients and prospective clients have expressly requested that we field diverse teams when pitching to them. It's not just the right thing to do, it's a wise business decision.”

Lorna Fitzsimons, Co-founder of The Pipeline said: “This is an issue of competitive advantage and profitability which is echoed through FTSE 350. Companies who have at least 25% of women on their Executive Committees have the potential to benefit from 5% greater profit than companies that have no women. This adds up to a £13bn gender dividend for all of Corporate UK performing at the same level on gender diversity.

We’ve already seen that hundreds of US corporates signed the call to action on diversity set out by the General Counsel of Sara Lee. This confirmed their commitment to only procure services from diverse law firms. With UK companies starting to pay closer attention to the diversity of law firms, it’s just a matter of time before considering diversity before buying services becomes the norm on this side of the pond.

Since our poll confirmed that 59% of young people believe all male or male dominated workplaces should be a thing of the past, law firms that increase the number of women in senior roles, will stay ahead of the pack.”

(Source: The Pipeline)

The role of a chief data officer (CDO) has changed significantly over the past decade. Ten years ago, the job title was, more typically, data processing manager or head of data processing, and the job itself tended not to be recognised as a driver of added value. Here, Ken Mortensen, Data Protection Officer, Global Trust & Privacy at InterSystems, talks Lawyer Monthly through the complexities of data demands and tackling compliance concerns.

Today, few senior decision-makers within technology businesses go more than a day without running up against privacy and security. The world has become so digitally interconnected that the role of the CDO has shifted from being about meeting operational requirements to performing the difficult balancing act between ensuring compliance and helping deliver the organisation’s strategic goals.

In line with this, it is crucial that CDOs avoid simply vetoing projects or putting a brake on them arising from compliance concerns. Instead, when dealing with any data request, they need first to understand what are the goals or objectives of the person making the request and then try to facilitate the request in a way that drive the operational goal, but at the same time protects privacy and safeguards security

It could be that a direct approach does not work, simply because the law prevents it, but there may still be another way to achieve the same result. For example, most global laws stipulate that certain types of information cannot be used without the express consent of the individual. Yet, there may be related types of information that can be used under the right circumstances.

In the healthcare space, it is not unusual to receive requests for records showing a patient’s date of birth for use in specific kinds of project. Typically, in such a case the CDO will ask the obvious question: “Why do you need this piece of information?” to which the answer will generally be: “Well we need to know how old somebody is.”

In reality, the date someone was born does not tell you that. It tells you how to calculate how old they are. The data you are really looking for is not the date of birth of the individual concerned, but it is their age. And in this context, age is less critical and less sensitive than date of birth.

This is a perfect example of how a CDO can help to answer the key question – is there another way to get to the objective on which we are focused– in this case how old someone is - without exposing sensitive data and potentially breaching compliance requirements?

Another common example is where someone from the business asks for the names and addresses of everyone in a given area of a town with a view to understanding how many people are buying a product from this area. Again, by looking at the objective rather than just the request, the CDO can discover that the person does not actually need (or truly want) any personally identifiable information. They don’t need to know who these individuals are, but simply how many of them bought the product.

In line with this, the role of the CDO should never be simply to block progress but rather to help people within the business understand what they are looking to achieve and if there is another way of doing it that better meets compliance needs. Defining the objectives in terms of the goals rather than the inputs.

The negotiating and consultancy element of this is important because many people within the organisation immediately focus on the data that they think they can access rather than looking first at their end goal and what they require to achieve it. That’s where the CDO can help de-conflict ostensibly opposing needs for compliance and business benefit - and ultimately still get to the same result.

Of course, there will inevitably be certain objectives that simply cannot be fulfilled for compliance reasons. But for the most part, if organisations are acting ethically and within the law, there will be a way that they can achieve their business goals with respect to data. It is key that CDOs look to facilitate this. They don’t want to be regarded as an impediment. After all, no CDO that is perceived to be preventing the organisation from achieving its goals, will ultimately ever be successful.

At the end of the day, the CDO needs to understand what the organisation is trying to do and give them the ability to do it in a way that is not only compliant but also builds trust. Not only for the organisation and its customers and consumers, but also for their own role within the organisation. That way, they can get buy-in and be seen as part of the solution rather than an inhibitor to it.

For legal professionals, a healthy work life balance always seems far on the horizon, and when it comes to the holidays, it’s often difficult to switch off from case work. Below Lawyer Monthly hears from Richard Holmes, Director of Wellbeing at Westfield Health, who discusses the benefits of time away from work life, but more importantly, how to do it.

With many employees in the legal industry working long hours in a client facing role, it can be really difficult to switch off. Learning how to switch off is important when you’re on holiday so that you can relax, recuperate and are ready to work with your clients to the best of your ability when you return.

A holiday is the perfect opportunity to take a break and step back from your workload. Here are some top tips to help you make the most of your time off:

By implementing these tactics just before, and during, your holiday you’ll notice a real difference in your ability to de-stress, relax and most importantly, enjoy yourself!

Forbes is warning to ‘quit Facebook before it inevitably accesses your banking data’ following reports from the Wall Street Journal alleging that Facebook has spent the last year in touch with banks such as JPMorgan & Wells Fargo in pursuit of its users’ banking data.

As a result, investors bled the social media giant of $120 billion. Banks haven’t budged and it’s unknown whether banks in Europe are also being asked to partner with Facebook. Other reports also indicate both Amazon and Google have also in the past pursued relationships with their users’ banks, for the end purpose of gathering banking data.

This week Lawyer Monthly hears from two top experts in the field who provide their thoughts on the dubious circumstances of these reports and the future fragility of consumer data and security.

Dan Goldstein, President, Page 1 Solutions, LLC:

The timing of the news that Facebook has been asking banks to share their customers’ financial data with on its Messenger platform is troubling coming so close on the heels of the Cambridge Analytica scandal as well as the subsequent privacy issues for Facebook.

While Facebook has started to make some changes to prevent malicious actors from using its platform to influence voters and access confidential information, the idea that it would ask banks to give it access to customers’ private financial records makes you wonder if Facebook really understands the significance of the issue.

Not only is Facebook’s apparent tone deafness to privacy issues a PR nightmare, it may result in legal liability as well.

At a minimum, Facebook should take a step back and make sure that it has fully addressed the problem of data privacy and data security before asking financial institutions, let alone consumers, to trust it with private customer account records.

Looking beyond Facebook in this matter, any bank that agrees to this data sharing arrangement is begging for a major PR problem, something Wells Fargo and other major banks already have to address.

Beyond the PR issues, Facebook’s lack of interest in protecting its users’ privacy (to say nothing of bank customers’ privacy) may well land it in legal hot water. The European Union’s GDPR regulations and the California Consumer Privacy Act (which will be enforceable in 2020), both pose the risk of state regulatory action. Beyond that, the likelihood of a spate of civil lawsuits from consumers who have had their private data accessed by malicious actors is almost certain unless Facebook actively and publicly takes clear steps to protect user privacy.

Adam Levin, Founder, CyberScout:

Facebook tried to partner with Netflix to share user video streaming choices as well as recently watched shows with friends in direct violation of a little-known privacy regulation called the Video Privacy Protection Act of 1988 (VPPA). Partnering with other industries without doing their homework regarding the regulatory consequences is reckless, and also, sadly, typical of Facebook.

Banks are not sufficiently mobile smart phone app based. By 2022, millenninials will make up 44% of the labour market [1], they are app users. Nearly a quarter of millenninials cite a lack of a mobile app as the main barrier to bank engagement [2] and that they are three times more likely to open a new account with their phone than in person [3] and suddenly the opportunity for Facebook with its integrated communication properties like Messenger and WhatsApp should be apparent.

This may represent Facebook’s approach to capturing a share of the mobile pay market in a "device agnostic” way with no need of Apple or Google pay systems. They have the advantage of being already built in to what users are doing on their phone rather than a separate app. While Messenger has enabled digital payments since 2015, it is still limited to: (a) a few geographies like the US, UK & France (b) debit cards only (c) peer to peer payments (no payment to businesses).

Why wouldn't Facebook want to move into different verticals like financial services? But consumer privacy and security should not be collateral damage.

[1] http://www.fico.com/en/node/8140?file=8406

[2] http://www.fico.com/en/node/8140?file=8406

[3] http://www.nielsen.com/us/en/insights/reports/2015/millennials-in-2015-financial-deep-dive.html

If you would like to voice Your Thoughts on this matter, feel free to do so in the comment box below and let us know what you think!

Paul Sachs is a leading expert in the field of legal technology, as well as the founder and CTO of digital evidence management platform CaseLines. Below he offers insight into the future of blockchain within the legal system and court proceedings.

There’s no shortage of commentators pushing their ideas on how artificial intelligence and blockchain can change the world currently. Indeed, while they are undoubtedly right, much substance is often lost when it comes to examining the practical details of it working.

When cryptocurrencies first emerged, supported by the public transaction ledger called blockchain, many commentators were quick to point out it might be the invention of the latter that would inspire the real change in other sectors. It’s now obvious law is one such sector.

The simple reason for this lies in its potential to transform the level of security that is used to protect evidence during the process of a trial. This is more vital than ever as the UK courts are currently undergoing a £1bn modernisation programme that includes the digitisation of many processes as a means of improving efficiency.

These developments will likely lead to the elimination of paper in the trial environment, as the often-painstaking process of using bundles continues to be digitised and the information more easily accessed, both in and outside of the court by the relevant parties. These systems are already in use in many of the UK’s Supreme, Crown and Family courts, as well as various international arbitration courts such as the UAE.

While modernising the system like this is advantageous from a cost, effort and time perspective, using technology always carries new and unique risks. One such difference between physical paper evidence and digital evidence for example, is that digital evidence can be modified. And judges know that. Take the case of Lorraine v. Markel American Insurance Co.

In this case the judge ruled that neither party had provided admissible evidence and went on to give guidance on the admissibility of Electronically Stored Information (ESI). Amongst the judge’s five separate points he said that one must be able to prove that the ESI present is indeed what one claims it to be, going on to describe methods for authenticating evidence which include hash values and meta-data analysis. In his fourth rule, he said that the evidence provided should either be original or an admissible duplicate.

So clearly courts will be demanding a high bar for the admissibility of electronic evidence. The solution to this therefore requires that there can be no doubt about whether evidence presented in the court room is what was originally submitted to the electronic evidence bundle. Particularly given there is likely to be a long time-span between these two dates, especially if the matter is subject to delay and appeal. Despite this, Judges will be aware however high one sets compliance with security and business processes, there is always a human element risk associated with all electronic data systems.

This is where blockchain will play a vital role. The purpose of blockchain is to store a series of transactions in a way that cannot be changed. This is down to a combination of cryptography which renders the data immutable and then its openness, which is how it is distributed amongst a peer-to-peer set of participants.

This unique way in how it collects and handles data, stores each transaction to ensure the details of each stage in the journey are verified against the document being viewed. So once a piece of evidence is entered into the system, there can be no possibility of records being altered or falsified. Thereby eliminating the possibility that evidential material submitted to court can be repudiated. Crucially, while blockchain is a public artefact, inspection of blockchain wouldn’t reveal evidence, only IDs and hash codes. In this way it becomes an incorruptible digital ledger.

When this technology is applied to evidence management, each transformative action in the handling of digital evidence is stored on the blockchain but the evidence itself remains in a secure environment. It is then not possible to photo-shop a picture or splice a video.

Therefore, evidence management systems that do more than simply provide the original electronic file in the court room will need to answer the simple question: Am I looking at something that is irrefutably the same as the original electronic evidence loaded into this system?

By tying blockchain to digital evidence software, this is an achievable goal. Not only guaranteeing that the validity of the document presented will be irrefutable, but also because it provides a platform for further innovation in the legal sector going forward. With security guaranteed, the global legal sector can then continue to confidently pursue innovation and embrace the new digital age.

HMRC’s consultation into off-payroll working in the private sector has now closed. Gordon Thrower, Senior Tax Manager at accountancy firm MHA MacIntyre Hudson, argues that IR35 has caused confusion and unfairness in the public sector and HMRC needs to develop a clearly defined test for employment status.

Recent events have highlighted fundamental problems with the public sector rules governing the application of IR35. The rules, and their problems, could be extended to the private sector as a result of this consultation.

The responsibility for determining whether an individual is an employee or providing a service through a limited company would shift from the limited company to the body engaging them. This has caused confusion and unfairness in the public sector and HMRC’s Check Employment Status Tool (CEST) still has reliability issues. This led some areas of the public sector to operate IR35 on a “blanket” basis – if you provide services through a limited company you were treated as falling within IR35 by default.

Despite recent improvements to CEST, private sector contractors should be concerned that the engagers of their services will be similarly tempted to apply IR35 by default, if and when the public sector rules are extended to the private sector. Although incorrect, such a practice is understandable as, under the current public sector rules it’s the engager who faces any potential liability to tax and national insurance (plus interest and penalties,) rather than the worker or the intermediary company.

As for CEST, although the past year has seen a number of updates and improvements, official figures suggest 15% of enquiries to the tool still provide inconclusive results. The tool has also been criticised for omitting any reference within its structure to “mutuality of obligation” or being in business on one’s own account, both major indicators in determining employment status under IR35.

The other problem is that, as recent high-profile court cases involving Uber and Pimlico Plumbers have shown, different definitions of “employment” still apply within employment, social security and tax legislations. Even taking tax legislation in isolation there’s no clearly defined test for employment status.

The current consultation does invite comment regarding the potential to introduce such a test, and wider discussion covering all forms of legislation would be of enormous benefit to both the authorities and taxpayers. HMRC, by concentrating on the narrow area of potential IR35 extension from public to private sector, could merely end up exacerbating the current misalignment between different types of legislation, ultimately making things more complicated for both taxpayers and the authorities.

A smartphone identification system is being developed by the Bar Council to help barristers get into court without having to go through onerous security searches. The new ‘app’ will be used as part of the HM Courts & Tribunals Service (HMCTS) Professional Entry Scheme pilot, announced recently.

Barristers and other legal professionals will be able to enter court buildings without the need to be searched as part of the pilot, which covers five courts. Registration begins in August, with the fast-track entry pilot starting in September.

The HMCTS pilot was developed with the Bar Council after barristers trying to enter courts in England & Wales were held up from representing their clients due to airport-style searches and security measures.

Barristers will soon be able to gain access to their new ID via the Bar Council’s secure MyBar portal, where they will be able to download a photograph and unique barcode onto their smartphones or tablets. Courts taking part in the pilot will be able to scan the barcode and allow the barrister entry without further security checks, other than random screenings (c.10% of users) to verify that restrictions on prohibited items are being complied with.

Solicitors will also be taking part in the pilot, but will be using hard copy ID, and court staff will check their names against a paper list under a process agreed with the Law Society, the solicitors’ representative body. A separate pilot for members of the Criminal Law Solicitors Association will also be operating nationally, but without ‘professional access lanes’.

Andrew Walker QC, Chair of the Bar, said: “Barristers across the country have been telling us about lengthy delays and sometimes intrusive, unnecessary or excessive security measures being imposed on them when trying to enter to court buildings. We were hearing stories of barristers being forced to prove their drinks were not dangerous, having essential electronic devices confiscated, and having their private belongings searched in public. They are there to do their job, playing a key role in the administration of justice. They do not deserve to have that job made more difficult, or to have their time wasted.

“We made the Bar’s views clear to HMCTS, and took up the challenge of trying to find a solution. To HMCTS’s credit, they have worked with us to try to find a way forward that has the support of the judges, and does not jeopardise the need for tight security in our courts.

“The Professional Entry Scheme will not be a panacea for all of the problems barristers encounter in entering our courts, but it is a major step forward. We hope the pilot will help identify any teething problems with the initiative, and also with the new digital Bar Council ID system.

“We will also be encouraging HMCTS to use this opportunity to find every way it can to minimise queuing times for barristers in those courts which do not readily accommodate a ‘professional access lane’, so that we can avoid cases being delayed, and barristers’ time being wasted, in every court. Entry needs to be ‘fast-track’ in every respect if it is to make the difference that is desperately needed.

“We will be encouraging our members to give us (and HMCTS) as much feedback as they can during the pilot.”

Registration for the Bar Council’s smartphone ID is expected to open on MyBar soon. The Professional Entry Scheme pilot will begin on 5 September 2018.

(Source: The Bar Council)

There are four principal types of intellectual property (IP), let's take a look.