Understand Your Rights. Solve Your Legal Problems

British Airways has been the target of a “sophisticated, malicious criminal attack” on its website and app*. The breach, which took place between 21 August and 5 September, is said to have affected 380,000 transactions and included personal and financial details of customers. British Airways has reached out to all customers affected by the breach, urging them to seek the help of their bank and credit card providers in order to manage the breach of their financial data.

Andrew Bushby, UK director at Fidelis Cybersecurity, offers the following comment: “British Airways’ customers should rightfully be concerned that their financial information has been accessed, as it cannot be ruled out that the hackers might leverage the financial data to cause more damage in the near future. While British Airways has notified those impacted and the authorities within the 72-hour window required by the GDPR, the breach went undetected for a two-week period highlighting once again that organisations need to look at detection and response, as even the best prevention-centric solutions will not suffice. To reduce that infection-to-detection gap, organisations need to revisit their security strategies in the post-breach world we live in today. This must include full visibility across networks, endpoints, clouds and across the kill chain.

“British Airways’ customers should take note of the recommendations made on the incident website, follow their advice and change their passwords as a matter of urgency – especially if they use the same email and password combination on other sites. British Airways now need to playout its post breach strategy and it is key that it ensures the threat has been fully eradicated from the extended infrastructure. Attackers go where organisations are not looking/cannot see and many companies often have a patchwork of disparate tools that rarely talk to one another. This is where blind spots become a problem, but by deploying the latest in deception technology along with full network visibility, organisations can find any ongoing threat activity in their systems.”

*https://www.britishairways.com/en-gb/information/incident/data-theft/latest-information

(Source: Fidelis Cybersecurity)

Employment partner James Froud explores the impact of Artificial Intelligence (AI) in the workplace in a European employment law context.

With Artificial Intelligence (AI) on the rise within the legal sector, could the merging of different sectors through algorithms, such as law implementation and musical composition, increase the application of justice worldwide? Portia Vincent-Kirby, at Hudson McKenzie, explains.

Arguably, the future of the legal sector rests in the developing understanding of algorithms.

As several sectors, such as the financial sector, music and entertainment sector, amongst others, merge with the ever-increasing use of technology, it may be only a matter of time before the algorithms used within one sector become a means of implementing a specific goal within another.

For instance, the ‘laws’ associated with musical composition can be understood as being processed in the same way as current national and international laws. This is because when both 'laws' (although from different sectors, with different understandings) are processed from the perception of computerized algorithms, the impact upon the human psyche may be demonstrated as having the same impact.

Being so, this could mean that two different forms of 'law' can be demonstrated as one, when both are placed into the computerised world of algorithms and its associated technology.

Therefore, could a ‘musical’ composition be algorithmically made, which is able to increase the application of the laws of justice worldwide, such as Human Rights? Furthermore, could musical algorithms effect the behavioral patterns of individuals and be used to decrease criminal behavior and so forth?

With Artificial Intelligence already in use within the application of justice, such as computerized algorithms predicting and preventing any potential criminal activity, the future of the law court from this possible mechanism of merging algorithms could see a whole different decision-making process overall.

For example, the decisions of legal cases could be predominately based upon the re-ordering of algorithms between computer and human instead, rather than the present focus that is solely upon the specific act of a person. This is especially as the legal sector continues to persistently merge with machine-based technology.

Thus, is the justice system of the future simply an algorithmic melody without words? If so, should the ever-pending Brexit of the UK from the EU have a theme-tune, so to ensure its orderly success?

Yesterday, The Court of Appeal overturned a controversial ruling by the High Court from May 2017, which threatened to have significant implications for companies carrying out internal investigations.

At issue were documents generated during an internal investigation conducted by Dechert LLP, led by partner Neil Gerrard, that was first triggered by a whistleblower email. In a thorough vindication of ENRC's position, the Court of Appeal has overturned the original judgment and upheld ENRC's claim to privilege in respect of the overwhelming majority of the documents, including witness interview notes prepared by Dechert as well as a "books and records" review undertaken by forensic accountants.

This historic ruling by the Court of Appeal is significant not just for ENRC but for any company faced with undertaking an internal investigation in response to a whistleblower or other allegation of wrongdoing.

As the trial judge had found, ENRC took all the steps that might be expected of a responsible corporation in response to the whistleblower. Crucially, however, the Court of Appeal recognised that the dialogue with the SFO did not preclude the investigation from being privileged. Contrary to the SFO's case, ENRC had never intended or agreed to share materials from the internal investigation with the SFO, and the SFO had never even run an argument based on waiver of privilege.

ENRC maintains that the SFO's approach was fundamentally misconceived and that the proceedings, which have resulted in wholly unnecessary costs (both to ENRC and the taxpayer), should never have been brought. ENRC will now be seeking recovery of millions in fees from the SFO.

Michael Roberts, Partner at Hogan Lovells representing ENRC commented: “This historic ruling by the Court of Appeal is significant not just for ENRC but for any company faced with undertaking an internal investigation in response to a whistleblower or other allegation of wrongdoing. It is critical that companies are not penalised for acting responsibly, and are able to instruct lawyers to conduct investigations without fear that the authorities will later be able to demand all of the lawyers' work product."

ENRC also continues to pursue related legal proceedings against Dechert LLP and Neil Gerrard (the global co-head of Dechert's white collar and securities litigation practice), who conducted the internal investigation and advised on ENRC’s engagement with the SFO between 2011-13.

In the Particulars of Claim, which can be requested through http://www.enrcnews.com/, ENRC claims (amongst other things) that Neil Gerrard deliberately leaked privileged and confidential documents to the press in July 2011 in order to "kick start" an expansion of the investigation. Mr Gerrard arranged for an envelope of confidential and privileged documents to be collected from Dechert's reception. Those documents subsequently formed the basis of an article published in The Times on 9 August 2011, which directly led to the initial approach from the SFO to ENRC the very next day.

Mr Gerrard then described himself as being in "rape mode" and that he wanted to "screw" ENRC for millions of pounds in fees. True to his word, Mr Gerrard went on to bill ENRC over £16 million in fees.

The result is welcome indeed. It amounts to a re-calibration of the law of privilege, moving it in a more realistic and principled direction.

Separately, ENRC has launched disclosure proceedings against the SFO premised on ENRC having civil claims against the SFO for misfeasance in public office as a result of its unlawful collusion with Mr Gerrard, involving numerous unauthorised (and unfounded) disclosures by Mr Gerrard, covert (and subsequently deleted) text messages, and private meetings in "out of the way" places. One internal SFO document even acknowledged at the time that Mr Gerrard might be "up to no good".

Mr Gerrard was also the subject of an anonymous whistleblower letter to David Green QC in July 2012 which raised serious concerns about the unhealthy relationship between Mr Gerrard and a senior official at the SFO. The SFO has now admitted that it failed to take proper steps to investigate the allegations.

Further significant evidence continues to come to light and to support ENRC's claims against both Dechert and the SFO.

Nonetheless, Dechert LLP had commented:

"We stand by the work we did and look forward to the opportunity of defending it in open court. We note that the criminal investigation by the Serious Fraud Office into ENRC is continuing and deplore ENRC’s attempt to discredit that investigation by seeking now to publicise unwarranted allegations against Dechert and its personnel.

"We emphatically reject any suggestion of an improper relationship between Dechert/Neil Gerrard and the SFO or that there was any unauthorised disclosure of information to or from the SFO. The work we did during our investigation was with the authority and knowledge of the members of the independent committee of the board which was instructing us at the time. We shall in the ensuing court proceedings fully address these unfounded allegations”

Further to this, also working on the case was Eoin O’Shea, Partner at Reed Smith, who had advised The Law Society in its intervention in the case; he stated:

“The law of privilege is a vital element of the rule of law and a precondition for proper access to justice. Reed Smith was glad to be able to assist the Law Society with its intervention in this very important case.

“The result is welcome indeed. It amounts to a re-calibration of the law of privilege, moving it in a more realistic and principled direction. Privilege now clearly applies in circumstances where there is a genuine concern about future prosecution and there is no longer any artificial distinction between civil and criminal proceedings. The Court of Appeal also made clear that the problematic definition of “client” in the law of privilege is in need of review by the Supreme Court, which is another significant move forward.”

(Source: ENRC News)

As a law student you probably need all the help you can get, and online resources can more than often be your best assets. Below Emma Jones, lecturer in law and member of the Open Justice team at the Open University, lists three key online resources you can turn to.

It wasn’t so long ago that law students would spend days sat in the law library leafing through case reports and textbooks. Now many resources can be accessed anywhere, anytime with just an internet connection and smart phone or other device. To study effectively and keep up to date with changes in the law, it’s important to make the most of this information at your fingertips. Here are some hints and tips on using online resources.

The likelihood is your law library gives you access to a range of online legal databases, such as Lexis Library, Westlaw and Lawtel. These are particularly useful for finding legislation and cases. Often they will also show you if a case has been referred to in subsequent cases and its status as a precedent. It is well worth taking up any training available either by your library, or the database providers, to ensure you make the most of these resources.

If for any reason you don’t have access to these, do try the British and Irish Legal Information Institute for cases and legislation and legislation.gov.uk for legislation.

Given the size of law textbooks, the advantages of an e-version are fairly obvious! However, there is also a range of other e-books that can add value to your studies, particularly when you are being asked to evaluate arguments or demonstrate critical thinking. Often, skimming the introduction and/or conclusion will be a good way of identifying the book’s main arguments and working out how relevant it will be. Depending on how you access it, there may also be functions allowing you to search for key words and phrases.

Similarly, don’t forget to use key words and phrases to do a search for any useful journal articles available through your library. Going onto Google scholar can also lead you to different academic books and articles to use. Often at least part of these are openly accessible, making it a good way to find even more sources. You can also use Google Scholar to see when and where a particular article has been cited, ensuring you access the most up-to-date discussions on a topic.

Law firms, chambers, regulators, government bodies, the Westminster and Scottish Parliaments, the Welsh and Northern Irish Assembly, the BBC and many more all offer lots of useful legal information and guidance. Of course, you have to take care that you are using resources that are up-to-date and relevant. A good way to judge this is using the PROMPT criteria and looking at:

Remember, although scanning Wikipedia and Google generally might (but only might) be a starting point for your research, you need to then go on to use academic sources which are appropriate for your level of legal study. Referencing either of these in your assignments is not going to impress your reader or demonstrate any real skills in using online resources.

On the subject of referencing, it’s also worth spending a few minutes checking how to correctly reference resources you find online. It is very frustrating for someone reading your work if they can’t properly trace where you found the various pieces of information.

Overall, using online resources can really help you to develop your legal research and writing and enhance your assignments. It also provides you with valuable skills to put on your C.V. and to use in future employment. However, doing it properly means taking time and care in identifying and evaluating your resources and ensuring you use them appropriately. Getting used to doing this at an early stage in your studies will save time and stress later on. You might even find time to still visit the library once in a while!

In the day and age of the influencer, the Instagram famous and the bedroom earner, there’s never been a better time to find a side hustle that can reap in the rewards for little work you wouldn’t be doing anyway. Advising people on ways to make extra money can be difficult, but there are plenty of legal ways to bring in extra income that makes it easy to generate extra change.

Source: @thedrum via Twitter

Influencer Partnerships

Influencer partnerships work on Instagram and to a lesser extent Twitter and Facebook to promote a post featuring you, that also features a product as per a brief from a brand. For example, an influencer, such as Scarlett London, may post their morning routine gleaming with perfection to advertise that they use a certain mouthwash to assist in making their routine so perfect. The brands pay for the partnership to be featured on the influencer’s channel. Brands choose those who are likely to gain the natural exposure through high follower counts, but also lesser follower counts if the influencer is for something niche that would result in high traffic to the brand’s page.

Affiliate Programs

Affiliate programs work to leverage your digital presence and the power of strong brands to result in a mutually beneficial partnership. Affiliate programs are often free, such as the Mr Green affiliate program, which adds benefit to a website through the banners and adverts placed on it. Financially, the affiliate program pays a percentage of the revenue made from players. Affiliate programs work by sending traffic from one site to another, usually with a common link that would be useful to browsers on the first site.

Source: @whatkatie_did via Twitter

Funding Creativity

Paying for creative works is often seen as an oversight, but given how much we consume in the world that is creative and from the minds of cash-strapped creatives, it’s only right that they earn money from it. Patreon and similar sites offer ways in which poets, writers, artists, designers etc. can be compensated for the work they do. If they build up a big enough following, they can have monthly subscribers or just one-off sales. By offering ways that work can pay that don’t involve charging for hourly labour means that different avenues into otherwise difficult to break into industries can be opened.

Referral Codes

Similar to the way influencers work, referral codes utilise the concept of affiliate partnerships to leverage a social media account of someone with something to say about a topic to drive traffic with a discount code to a site that connects to them. Usually revolving around the health and fitness industries, referral codes can be used by anything from clothing to beauty to services.

Finding ways of earning money legally that can be done alongside hectic jobs and busy lives to free up some spending money is even easier in 2018 than it has ever been. Utilising assets that we take for granted - such as popular websites or social media channels - can end up being a nice little earner that we would have populated with content anyway.

A recent survey by MHA, the national association of independent accountancy firms we are a member of, revealed that total external funding per equity partner in small and mid-sized practices decreased significantly in 2017, ranging from £42,000 in the smallest firms to £228,000 in the largest, compared with £156,000 to £506,000 last year. While reducing external finance may seem to be a positive move, it is more likely to have been driven in part by bankers putting pressure on firms to reduce overall lending. Kate Arnott, Head of Professional Services at MHA MacIntyre Hudson, explains for Lawyer Monthly.

Of the firms surveyed, bank borrowings fell significantly in all firms except sole practitioners, who tend to fully guarantee borrowing in their own names. Bank borrowings per equity partner ranged from £19,000 to £112,000 (in the largest practices) in 2017, compared to £21,000 to £228,000 the year before.

This comes as many regional and high street practices up and down the country saw a reduction in fee income in 2017, painting a different picture to the growth enjoyed by many of the larger national and inner-city firms. These practices have had to look for additional finance streams outside of their traditional banking facilities, partly to replace the fall in bank funding and partly to plug the gap equity partners are unable or unwilling to contribute to. Purchases of new assets tend to come with a finance option, and more short-term finance companies are being utilised to fund the payment of large one-off expenses, such as professional indemnity insurance. This greater funding need over the year has seen the average percentage of external funding to equity partner funding increase across all sizes of firms.

Increasing Reliance on Equity Partners

The lower level of external finance available to small and mid-sized firms has been mopped up by partners drawing less from the practice. In all sized firms, except sole practitioners, the amount of equity partner capital plus undrawn profits has risen over the last year. The range of own finance invested, per equity partner, varies from £64,000 in two to four partner practices, up to £336,000 in firms with over 25 partners.

Although total funding per equity partner has decreased across all firms we surveyed, the actual capital invested has varied depending on the size of the firm. Both the largest firms (with over 25 partners) and the five to ten partner firms saw increased levels of fixed capital being invested by their equity partners.

Many firms also saw reduction in fee income in 2017, which has meant equity capital as a percentage of fee income has risen drastically to concerning levels, and the downturn in income and profitability has left firms with an average of fixed equity capital at 27% of fee income, compared to just 11% last year.

While there’s no ideal level of capital to suit all firms, long term strategy, profitability, capital commitments and lock up can all affect the optimum capital level. This drastic increase of equity funding as a percentage of fee income shows a continued fall in return on capital for law firms across the board.

Long Term Debt

Traditionally, law firms have raised funding from partner capital injections, bank loans and finance leases. Increasingly there is a move towards more of a corporate outlook, especially in larger regional firms, and a move away from short term loan financing and bank overdrafts to an acceptance that longer-term borrowings are becoming par for the course.

The financial stability of law firms is increasingly in the spotlight, and the need to maintain a competitive edge requires investment in both technology and people. Professional practices will not escape the digital revolution and firms will need to future proof their operations sooner rather than later. As a result, firms are looking to more structured debt as a way of funding their businesses.

The current environment for law firms is challenging. Balancing external funding and capital effectively has never been more important. It’s vital to plan and monitor cash flow and funding requirements accurately, both in the short term, with a rolling quarterly cash flow, to an annual projection of cash needs. Every firm needs a strategic plan for at least the next five years to factor in issues such as partner retirements, increased staff costs and IT security risks.

Every firm will have various forms and levels of funding based on its own overall strategy and performance. On its own, the strategy will not point to the financial health or otherwise of the business, but significant funding investments should be monitored closely to ensure the original strategic objectives, such as fuelling growth or expansion are being met.

Further advice

We have developed a comprehensive guide: ‘The Roadmap to your Financial Future’, for professional practices, covering everything from partnership agreements and the financial responsibilities of becoming a partner, through to tax efficient financial management, succession planning and plans for retirement; it is essential reading for both new and established partners.

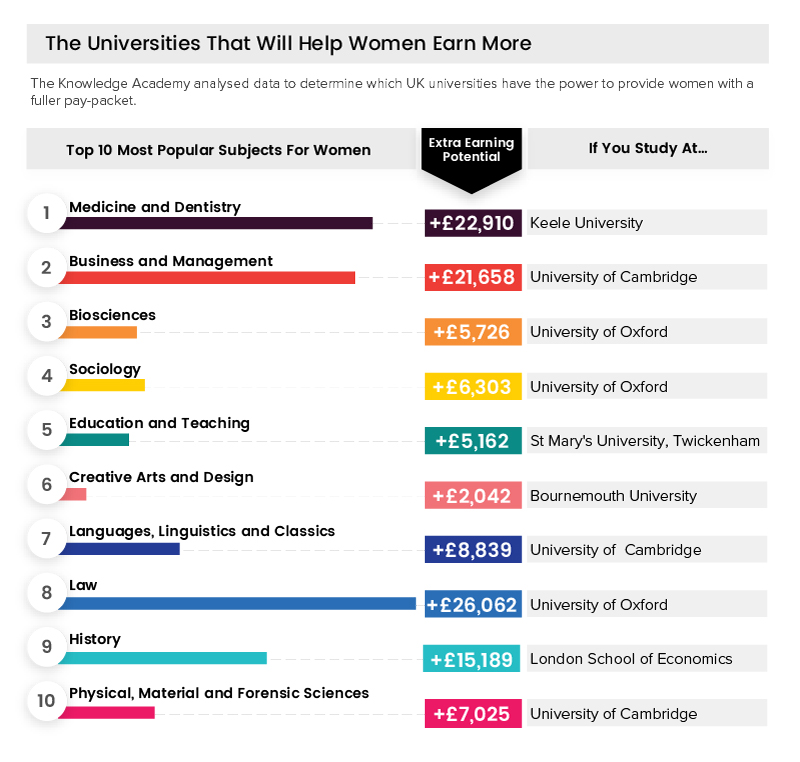

Going to university should mean you earn more over your lifetime. But how much difference does the choice of university make? Well, this has been calculated* for the first time by the Institute for Fiscal Studies as evidenced by a new tool launched by the BBC.

It is data from this tool theknowledgeacademy.com analysed to determine which UK universities have the power to provide women with a fuller pay-packet, five years after graduation.

To accomplish their research, The Knowledge Academy first sourced the most popular subjects for women to study, using HESA’s ‘HE student enrolments by subject of study 2016/17’ report. Then, each subject was selected using the BBC’s ‘Difference in Earnings’ tool. Lastly, data for the university found to have the biggest effect on earnings, five years after graduation, in comparison with the average degree, was recorded.

The Knowledge Academy found Medicine and Dentistry is the “most popular” subject to study for women. To earn big in this field, women should consider enrolling at Keele University. Where, five years after graduation, women are expected to earn +£22,910 in comparison with the average degree.

For ladies who favour Business and Management, it may come as no surprise that the University of Cambridge offers candidates the chance to earn an extra £21,658 five years after graduation. Next are degrees in Biosciences (+£5,726; University of Oxford) and Sociology (+£6,303; Oxford), while women who choose to study Education and Teaching at St. Mary’s University, Twickenham, may achieve £5,162 more than the average degree.

In Creative Arts and Design, the biggest boost in post-university earnings can be found at Bournemouth University (+£2,042.) While Cambridge and Oxford (making the list yet again), may increase earnings by £8,839 and £26,062 for women who take the subjects Languages, Linguistics and Classics and Law, respectively.

History and Physical, Material and Forensic Sciences are the last two “most popular” subjects for women to study. For avid historians, the London School of Economics (LSE) could provide +£15,189 in earnings five years after graduation, while Cambridge is the key for enthusiastic scientists, who can expect added earnings of +£7,025 in the same 5-year period.

Joseph Scott, a spokesperson from theknowledgeacademy.com, comments: “Conducting this research was incredibly interesting, not least because it highlights how lifechanging choosing the right university can be. My advice to those contemplating higher education is, throw yourself into research. Choose the best option for you and you alone. Get the brochures, go on campus tours, and don’t be afraid to ask the big questions. It’s a significant opportunity, one can – quite literally – not afford to overlook!”

(Source: theknowledgeacademy.com)

The law of implied terms allows the court to imply a term into a contract to cover a situation which has not expressly been provided for in writing. In this article Ioannis Alexopoulos, Partner, and Jessica Thomas, Associate at Signature Litigation, consider the recent case of Robert Bou-Simon v BGC Brokers LP[1] which warned against the use of hindsight to imply a term into a contract merely because it appears to be fair.

The Facts

Bou-Simon and his employer, BGC Brokers LP ("BGC") entered into an agreement in December 2011 (the "Agreement"). Under the Agreement, Bou-Simon was paid £336,000 (the "Loan"). The Loan was to be repaid from partnership distributions made to Bou-Simon. If Bou-Simon ceased to be a partner, any unpaid amounts would only be written off if he remained in his employment for a minimum of four years.

Bou-Simon commenced his employment for BGC on 1 February 2012 as a "broker" – it was the intention of all parties that he would latterly become a partner. The Loan was paid in full to Bou-Simon on 21 February 2012. Bou-Simon in fact never became a partner and resigned just over a year later.

BGC contended that a term should be implied into the Agreement providing that the Loan would be repayable in full where Bou-Simon failed to serve a full four-year term of employment (the "Implied Term"). Bou-Simon's position was that the payment was a "golden hello" and that he was not obliged to repay it upon resigning from BGC.

The Agreement also contained terms which were deleted as a result of negotiation, and which related to the circumstances in which the Loan would become immediately repayable.

The Court of Appeal's Decision

At first instance the trial judge found in favour of BCG, deciding that the Implied Term should be given effect. Bou-Simon appealed this decision and the Court of Appeal allowed his appeal.

The Court of Appeal found that the trial judge had erred in finding that the Implied Term put forward by BGC should be implied.

In her leading judgment, Lady Justice Asplin noted that the trial judge had approached the question of implying terms from the wrong starting point; he construed the Agreement in order to fit the Implied Term rather than beginning with the express terms themselves. In doing so, he failed to follow the appropriate approach laid down by Lord Neuberger in Marks & Spencer v BNP Paribas Securities[2] (only once the process of construing the express words of a contract is complete can the issue of implied terms then be considered).

The Court of Appeal confirmed that hindsight should thus not be used when considering whether a term should be implied. Instead, the obvious intentions of the parties at the time of contracting must be looked at. Terms may be implied to achieve business efficacy, but only where there is an obvious lacuna in the agreement which must be filled.

Lady Justice Asplin concluded that the reasonable reader would consider that the Agreement was concerned with a loan to be made in the circumstances in which Bou-Simon became a partner and either served the initial period of four years or ceased to be a partner during that time. The Agreement would have required substantial re-drafting to allow for repayment of the Loan as contended by BGC.

The Court of Appeal also considered, as obiter, the admissibility of deleted words from draft agreements when determining whether a term should be implied into a contract. Lady Justice Asplin found that the deletions from previous drafts were not sufficiently similar to the Implied Term to render them relevant or admissible.

Lord Justice Singh, however, was careful to leave open the question whether such deletions are admissible, noting that deleted terms which negative the implication of a term in the form of deleted words could well have a bearing on the question of whether the test for implication of a term into a contract has been met.

Are we clear?

The decision is a useful reminder on the law of implied terms. Firstly, the correct test for construing implied terms into a contract is whether a reasonable person reading the contract at the time it was made, and not at the time of the dispute, would consider the term to be so obvious as to go without saying or to be necessary for business efficacy. Secondly, the test for implying terms is narrow, objective and separate from interpretation - if parties want something included in a contract, they should do so as explicitly as possible. Finally, Parties should be wary of attempting to imply terms which may have been deleted from previous drafts of an agreement. This issue was deliberately left open in this instance, but the Court's obiter comments are likely to be persuasive.

[1] [2018] EWCA Civ 1525

[2] [2016] AC 742

If the Government wants to use migration to fill unattractive jobs after Brexit, preventing exploitation will be a major challenge, according to a new report by the Migration Observatory at the University of Oxford.

The report Exploiting the opportunity? Low-skilled work migration after Brexit considers the Government’s options for providing low-skilled migrant labour in the UK when freedom of movement comes to an end after the post-Brexit transition period. It argues that the two main options—an expanded youth mobility scheme and a work-permit system that channels workers into specific, low-wage jobs such as farm work or social care — are likely to bring significant costs as well as benefits.

Youth mobility schemes—which the Government has already said it wants to expand to EU nationals—are designed to promote cultural exchange and are attractive to workers because they offer the right to move between jobs. However, they are not always well suited to channelling workers towards less cosmopolitan locations or roles where employers struggle to attract British workers, such as fruit picking or meat processing.

Employer sponsored visas for low-skilled workers enable government to target specific jobs where migrant labour is thought to be needed, but they also have important drawbacks. These schemes tie workers to their employers, which may increase the risk that unscrupulous businesses will exploit vulnerable workers. While this can be overcome by regulating the wages and conditions employers must offer, the rules must be enforced – a significant challenge, especially if the schemes admit a large number of workers.

Employer sponsorship schemes are also, often, considered complex and burdensome by employers – particularly small and medium sized companies.

Madeleine Sumption, Director of The Migration Observatory at the University of Oxford said: “The two most likely ways that future demands for low-skilled labour could be met after Brexit are youth mobility and employer sponsored visas. There’s no guarantee that youth mobility can provide staff for unpalatable roles in out-of-the-way places. That’s because the scheme gives workers lots of options, and people with options often prefer to work in shops and bars rather than muddy fields or food processing plants.

“Employer-sponsored visas give government more control over the work that migrants do, but making sure the visas don’t facilitate abuse is a real challenge. If workers can’t leave a bad job, there’s more responsibility on government to prevent exploitation. In theory this should be possible with careful monitoring and oversight, but enforcing labour standards is not an area where the UK has the best track record.”

The report notes that there is no consensus about whether or how much migration is needed into low-skilled jobs after Brexit at all.

Sumption added: “There’s no objective, evidence-based way to decide exactly how much low-skilled migration the UK ought to have after Brexit. It’s even more difficult to decide which industries should have access to migrant workers and which shouldn’t – but with work permit schemes a fair amount of central planning is unavoidable.”

(Source: University of Oxford)