Understand Your Rights. Solve Your Legal Problems

Intapp recently announced results from a recent survey designed to evaluate how law firms are differentiating to enable growth. The 2018 Law Firm Growth Enablement Survey, conducted in partnership with Calibrate Legal, surveyed marketing and business development professionals at firms ranging in size from less than 50 attorneys to more than 2,500 attorneys in order to learn more about the client lifecycle, the biggest barriers to growth, and the most widely used and effective marketing and business development strategies in today’s increasingly competitive legal market.

The majority of the firms surveyed said that winning new business was the top growth priority for their firm, with cross-selling to existing clients and pursuing potential new clients also providing growth opportunities. More than 70% of new law firm business is via additional business from existing clients, while 10% comes from referrals from existing clients. Other sources of new business, such as referrals from business partners like accounting or venture capital firms, new business from new clients, leads generated from within the firm, and inquiries generated by outbound marketing, all scored less than 10% in terms of new business effectiveness.

The most critical areas where law firms must focus to drive new business can be described in terms of people, process and data. Frequently cited issues include:

The survey shows that for a majority of firms, it is difficult to pursue new business because they spend the bulk of their time being reactive. Furthermore, marketing department accountabilities, programs and budgets are poorly aligned to strategy. A mismatch in accountability for growth also exists, with 51% of Chief Marketing and Business Development officers described as having the “top chair” for growth, but only 11% of those C-level executives actually oversee growth strategy. Other key people issues included the need for lawyers to develop more business development acumen through training, not enough business development resources, and buy-in from other teams to collaborate.

In the area of process, firms are not consistently applying sales methodologies to business development, and some 85% do not track return on investment for pitches or RFP responses, making it difficult to create momentum within firms. Other frequently cited process issues include lead management, pricing to win, chasing poor opportunities, responding quickly to attorney requests for pitch support such as RFP responses and “data dives,” and responding to too many RFPs.

Overall, firms are beginning to track and use data in support of marketing and business development, with more than 90% using data for pitches and cross-selling, website bios, panel participation, and directory submission. Data is being used for marketing-focused activities but is not being leveraged to the same extent in order to support clients’ customer journeys or strategic new business initiatives like cross-selling and client programs. However, ongoing issues around data include capturing relevant internal information, accuracy and completeness of opportunity pipeline data, acquiring market research and intelligence, and data integrity.

“Our data shows that the business development landscape is extremely competitive and that many law firms are struggling to modernize,” observed Jennifer Scalzi, Founder and CEO of Calibrate Legal. “Firms must evolve rapidly to integrate people, process and data to differentiate themselves, showcase specific and relevant expertise, better advocate for clients, and to ultimately grow profitable revenue.”

Integrating People, Process and Data Across the Client Lifecycle

According to Scalzi, addressing people, process and data issues revolves around a deeper understanding of the client lifecycle, as well as integration of today’s data-driven marketing and business development efforts with legacy operational models and ways of doing business.

Today’s leading firms are tasking the CMO with growth strategy and ensuring marketing and business development professionals have a seat at the management table, giving them the power to make strategic impact. Additionally, bifurcating the roles and responsibilities of marketing and business development allows allocation of dedicated resources to sales motions, bringing greater value to cross-selling efforts and developing and cultivating relationships with new clients. This empowers business development professionals to create, develop and expand relationships as a result of both client and cross-firm collaboration. At the point of business acceptance, firms can fine-tune their approach to serving top clients and equip service teams with comprehensive data during the delivery process, ensuring high levels of client service.

Jennifer Roberts, Intapp data scientist, explained: “Modern software is a foundational element of the people, process and data approach, and firms can gather robust data sets, including information on practices, services and case results, to help influence strategic decision-making that allows firms to expand and illustrate key differentiators.” In addition, client nurturing and advocacy are supported by aggregation and analysis of data-driven client feedback and insights. “This combined approach can help a firm create a business development process that is more efficient,” Roberts added, “helping firms better differentiate themselves to enable growth and navigate more effectively in the competitive market for law firm services.”

(Source: Intapp)

New research from Acritas reveals the dramatic growth of the Big Four’s legal brands among alternative legal service providers. This Index has been established to identify the strongest brands within this new and rapidly growing part of the broader global legal industry.

Senior in-house counsel were asked to name organizations that provide legal services, excluding law firms, that first to come to mind, along with those they most favoured. The Index also shows which service suppliers most demonstrate modern innovative practices.

Acritas created the Global Alternative Legal Brand Index to complement its existing Global Elite Law Firm Brand Index which has been published annually for the last nine years, thereby responding to the increasing diversity of legal service providers that in-house departments turn to help them provide legal support to their organizations in the most effective and cost-efficient way.

The Acritas Global Alternative Legal Brand Index portrays the competitive set of alternative legal brands, indexed from the leader at 100 points.

PwC Legal emerges as the strongest alternative legal brand in the second annual Acritas Global Alternative Legal Brand Index. This organization has increased its brand equity in all major regions of the world, including the US, pushing Thomson Reuters, last year’s leader, into second rank.

Lisa Hart Shepherd, CEO of Acritas, commented: “It’s not just PwC Legal that both old law and new law need to fear. All of the Big Four have seen significant increases in brand strength over the last 12 months.”

Deloitte Legal, has made the largest points increase of any of the alternative legal service providers, moving up one rank into third place, ahead of EY and followed by KPMG Legal in fifth place.

Lisa confirmed: “Despite not seeing brand growth this year, Thomson Reuters has retained its clear lead in being recognized as the most innovative legal services supplier in the world.

Its efforts to continually develop its offering, in all areas of the legal ecosystem, places it far ahead of any other legal services organization on innovation, including law firms.”

Looking beyond the top five ranks, Axiom has slipped one rank to sixth, followed by Lexis Nexis in seventh. Along with Thomson Reuters, these brands have not weakened, it is simply that PwC Legal has set a higher bar at the top of the Index.

Lisa added: “Each of the top seven brands have achieved mega brand status in the global legal industry. They have brand equity with senior in-house counsel and key buyers in virtually every major region in the world, including the emerging markets.”

Rounding out the top ten are brands which have more of a domestic focus. Lawyers on Demand, Wolters Kluwer and Gartner take ranks eight, nine and 10.

The findings this year show that more and more clients every day are becoming aware of what these organizations can offer. Clients are liking what they see, and money is moving away from traditional law firms. The legal industry is fixated on distinguishing work delivered by lawyers and non-lawyers but in reality, clients just want effective solutions to their broad portfolio of legal work.

Acritas’ Global Alternative Legal Brand Index 2018 is compiled from analysis of an extract of data from the Sharplegal Global Elite survey dataset. All data is derived from 834 interviews with respondents, in $1 billion+ revenue organizations across the world, who have senior responsibility for buying legal services.

(Source: Acritas)

In jury selection, racial discrimination has historically been tricky. Discrimination isn’t allowed in jury selection, thanks to what’s called a “Batson challenge.” But the problem is — Batson has been widely regarded as a failure at keeping racism out of the jury box. Watch the video above to find out why that is, and why it complicates the prospect of a fair trial by jury.

The Law Commission of England and Wales has announced that electronic legal documents should be considered just as valid as wet signatures for UK property. The news comes amidst The Department of Health moving forward with abolishing the need for doctors’ signatures for paper prescriptions. The Health Secretary, Matt Hancock, said this will improve the delivery of care under the NHS, save time for patients and make the lives of hardworking staff members easier. When You Move is lobbying for similar changes in the property sector given the average six-week delay paper trails and majority offline processing makes to property transactions.

The property industry still insists on manual wet signatures as a vital element of legal transactions. When You Move argues that this further slows what is traditionally a cumbersome and slow-moving conveyancing process of 82 steps. Considering the waiting time for documents to be signed by all parties involved, as well as the time taken to scan each document and then shred – the process needs to be more streamlined.

Simon Bath, CEO of When You Move on the need for digitalisation in the property industry: “If the health and pharmaceutical sectors are welcoming digitalisation into the arena as a way of delivering an effective service, there is no reason why the property sector should not do the same. Given the medial arena is making clear steps to revolutionise an industry steeped in hundreds of years of archaic processes, in addition to the acutely sensitive information handled, the case for the property sector following suit is unequivocally the correct course of action. Property transactions have too long wallowed in unneeded red-tape that stagnates vital momentum in the industry, the technology is already here, we just need to activate it in a relevant manner”

(Source: When You Move)

Authored by Fraser MacLean, Executive Legal Search & Management Consultant at MacLean Legal Search, the below piece looks at partner movement (churn) and retention at the London offices of some of the largest US Law Firms by revenue since 2015. It follows on from Fraser’s recently published detailed summary on the same group over the same period.

The term “revolving door” is used to describe a Law Firm where there is a high or above average turnover of lawyers. This usually underlines a problem within, be it with culture, direction, leadership, management, remuneration structure, strategy, internal processes, personnel and choice of recruiters.

Any reputational or structural damage associated with heavy partner losses is tempered slightly if there are equal numbers moving in both directions. Worst case scenario is when the numbers exiting far exceed those arriving.

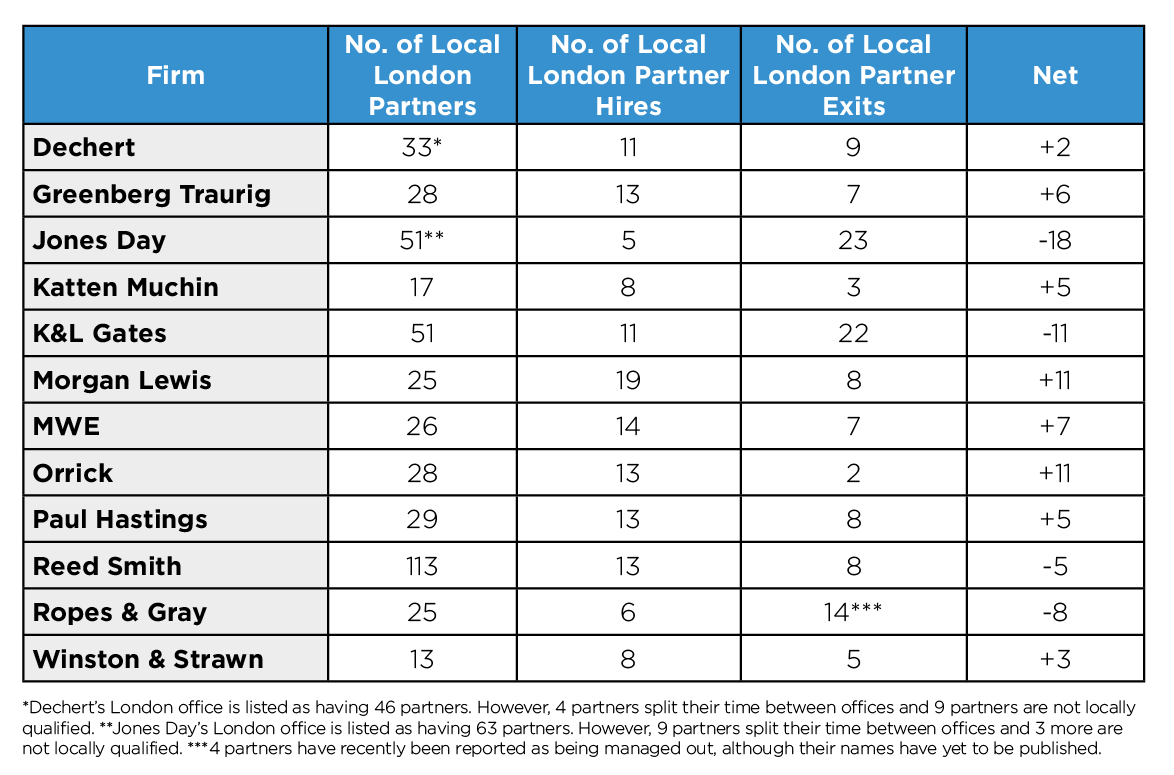

The table below summarises the local lateral partner hires and losses at a selection of US Firms since 2015. I have only compared the movement of locally qualified partners. I have not included partners who split their time between offices, who have retired or who have exited without taking up another position. Obviously the numbers are fluid and relate to publically available data at the time of writing.

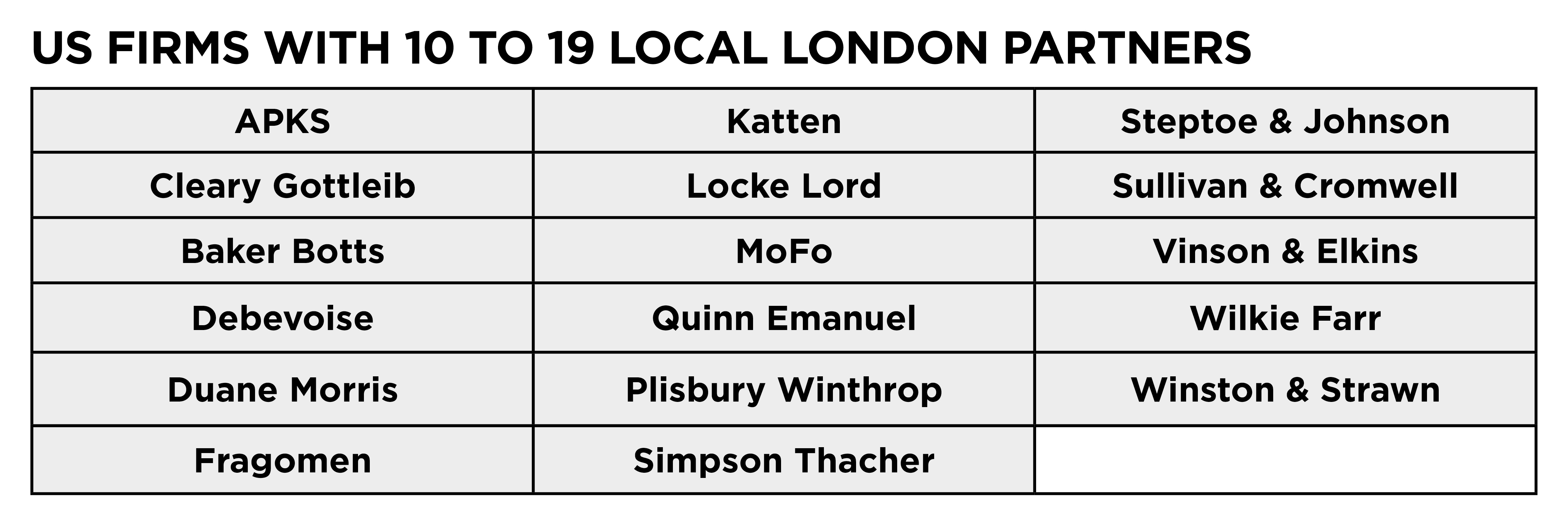

The majority of the seventy-one Am Law 100 Firms with an English-law capability have offices with less than 20 partners. You will see from the list above that several big and highly profitable brands fall into this grouping. Their London offices have shown slow incremental headcount growth over many years and there are no signs that this is going to change in the near future.

The majority of the seventy-one Am Law 100 Firms with an English-law capability have offices with less than 20 partners. You will see from the list above that several big and highly profitable brands fall into this grouping. Their London offices have shown slow incremental headcount growth over many years and there are no signs that this is going to change in the near future.

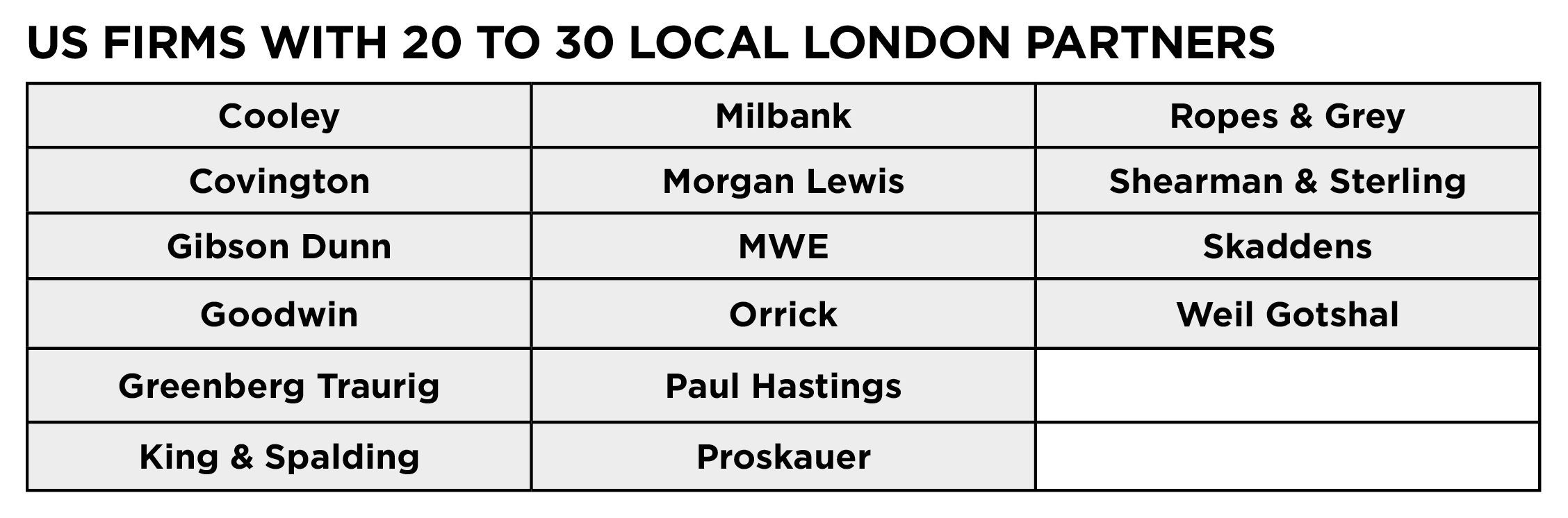

These Firms have generally been far more active in growing their London numbers than the previous grouping. I have already analysed and commented on Cooley, Goodwin, King & Spalding, Proskauer and Ropes & Gray in my previous post.

These Firms have generally been far more active in growing their London numbers than the previous grouping. I have already analysed and commented on Cooley, Goodwin, King & Spalding, Proskauer and Ropes & Gray in my previous post.

Morgan Lewis stands out as one of the most active and ambitious hiring Firms since 2015, with the recent triple corporate partner hires from Herbert Smith confirming the same. Orrick comes a close 2nd. Two of their most recent hires, corporate partners, James Connor and Daniel Wayte, were counsel and special counsel at their previous Firms. Hiring young partner talent may be part of their strategy (although I did read a quote from Erik Dahl describing these hires as opportunistic), but equally it may also be an indication of how difficult and expensive it is to hire experienced corporate and private equity talent. It also has one of the lowest number of partner exits along with Paul Hastings. Their Head of Corporate in London, Hilary Winter, left the partnership earlier this year.

Akin Gump has to date successfully absorbed and integrated twenty-one partners from the dissolved Bingham McCutchen. I believe nineteen are still there. Having opened their London office in 1997, this represented a sea change in their approach to London.

Akin Gump has to date successfully absorbed and integrated twenty-one partners from the dissolved Bingham McCutchen. I believe nineteen are still there. Having opened their London office in 1997, this represented a sea change in their approach to London.

Dechert has seen modest partner growth and steady churn. What does stand out is the quality of the Firms they have hired from including Clifford Chance, Kirkland & Ellis, Ropes & Gray, Skadden and Sidleys.

Sidley has also been through an active lateral hiring period since 2015 with the headlines being the six partner private equity team from Kirkland & Ellis in 2016 and the promotion of private equity lawyers, Till Lefranc and Wim De Vlieger, associate and counsel respectively, at Simpson Thacher to salaried partner. Five of these hires were lawyers who were US-qualified only and very few other full service US Firms in London do the volume or value of work in London which requires this number of US lawyers to be based here.

Jones Day has the worst net churn of any US Firm. Eight of the twenty-three partner exits left within four years of joining.

Jones Day has the worst net churn of any US Firm. Eight of the twenty-three partner exits left within four years of joining.

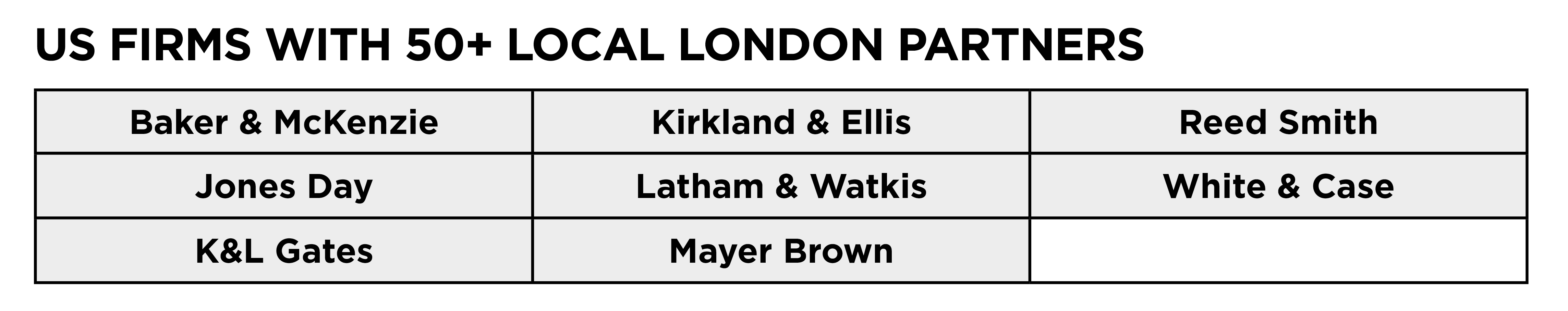

Kirkland has gone from strength to strength. Since 2015, they have promoted twenty-seven of their own associates to partner, laterally hired at least fifteen senior associates as partner, and made at least thirteen partner laterals. Of the forty-two associates either promoted internally or laterally hired, ownly four have left to join other US firms, Dechart (one), Fried Frank (one) and Sidleys (two). Unprecedented numbers but also a large pool of salaried partners for other firms to go after.

K&L Gates has one of the highest negative churn rates. Since 2015, they have lost over twenty partners which amounts to over 40% of their current local London partner headcount. One third of these exits stayed three years or less.

Reed Smith has had over fifty partners coming and going since 2015, the most of any US Firm. Around a quarter of their exits stayed three years or less.

For most of the Firms listed above, a great deal of effort, money and time is spent hiring lawyers. You would therefore hope and expect every practical and professional step is taken, within reason, to ensure that 1) they hire the best lawyers that are available and affordable and 2) they become successful additions to the partnership over many years. Hmm.

It was a generally held view that most laterally hired partners at Law Firms needed to stay put for at least three years to repay the cost to hire and remunerate them. And at least five years to make a positive financial contribution to the partnership. Therefore, any partner who left within three years was generally regarded as a bad lateral hire for the Firm. Short-term stays are also not great for the partner’s CV either.

With Firms now managing out non-performing partners more and more, it's not as easy to determine whether it's the partner or the Law Firm who are cutting their losses.

Most Firms have made and will continue to make a bad hire(s). A fact of life. It’s multiple exits which set the alarm bells ringing. The causes will vary from Firm to Firm and have been well documented. I have referred to several of them in my introduction.

One of the major differences between US Firms and their UK competitors is where the decision makers are based. This has reportedly been a major cause of partner churn over the years. Typically the associated reasons, which I would label under the term “satellite office syndrome” can be summarised as:

This piece summarises several aspects of partner churn. However, it is not exhaustive.

I would hope that all MPs, departmental heads and senior HR appreciate the importance of monitoring and understanding their own partner churn (obviously), but also that of their competitors.

The value of offshore M&A deals in the first half of 2018 nearly matched the total recorded for the entirety of 2017, according to a report released by Appleby.

The latest edition of Offshore-i, an Appleby report that provides data and insight on merger and acquisition activity in the major offshore financial centres, focuses on transactions announced over the first half of 2018. Following a similar pattern to most of the world’s regions, the volume of offshore deals has fallen back from levels seen in the latter half of 2017, while value is on the rise.

“So far this year, there has been more than $215bn spent in the offshore region, with the average deal size of $161M representing almost double that of 2017,” said Cameron Adderley, Partner and Global Head of Corporate at Appleby. “There are echoes of 2015, a remarkable year for offshore.”

The most frequent types of deals were acquisitions, capital increases and minority stakes in other companies. Typically, these three categories have been fairly balanced but the last 18 months have seen acquisitions move notably ahead to where they now make up 40% of all deals.

“Increasingly, firms are choosing to top up an existing stake and secure control of an investment outright,” Adderley said. “This makes sense with the increasing competition for quality targets, a low-risk environment and easy access to finance.”

The M&A Environment Across Jurisdictions

In total, there were 1,344 deals recorded in the first half of 2018, representing a 10% decrease when compared to the last six months of 2017. The total deal value of $216bn, meanwhile, marked a 68% increase over the second half of 2017 and was driven in part by the $62bn acquisition of Jersey-incorporated Shire PLC by Japan’s Takeda Pharmaceutical. Each deal in the offshore region’s top 10 was worth more than $2bn.

Billion-dollar deals have become frequent in the offshore region, with 28 reported in the first half of this year. The surge of big transactions has been bolstered by a desire by boards of major companies to head off disruptive technological threats and accelerate growth, according to the report.

As is typically the case, the Cayman Islands was the busiest jurisdiction for offshore transactions in the first half of 2018, recording 421 deals. It was followed by Hong Kong (334 deals), the British Virgin Islands (236 deals) and Bermuda (146 deals). Jersey was the offshore leader in terms of total value in the first half of 2018 as a result of the Shire PLC acquisition.

Robust IPO Market Continues into 2018

Last year saw new highs for offshore IPOs and that momentum has continued into 2018, with 180 companies announcing their intention to go public in the first half of the year.

“Pent-up investor demand for fast growth investments, including small-cap listings, makes it a good time to go public,” Adderley said. “Economic conditions remain encouraging, equity valuations remain high in many parts of the world and interest rates remain low.”

The top sub-sector for announced offshore IPOs is information service activities, while another popular field is financial services, the report found. Both are benefiting from the positive effects of dramatic change in their underlying industries. Offshore IPOs typically occur on US, London or Hong Kong stock exchanges, with Hong Kong being an especially popular choice for the Cayman Islands, the busiest jurisdiction for IPOs.

Outbound Deal Volume Outpaces Inbound Activity

While the primary focus of Offshore-i is on transactions in which offshore targets are purchased by investors, the report also examines deals in which the acquirer is based offshore. There were 1,640 outbound deals worth a combined $187bn in the first half of 2018, with offshore companies reaching out across some 75 countries outside the region.

China, the US and the UK make up the bulk of the locations targeted while Australia and Singapore have seen a lot of interest as well. Western Europe saw a high concentration of $ billion-dollar deals – Finland, Italy, Luxembourg, Spain, Switzerland and the UK were all recipients of high value offshore attention.

The top 10 outbound deals were each worth over $3bn and included the purchase of Patrón Spirits International AG, maker of the popular Patrón tequila, by global spirits giant Bacardi, which is headquartered in Bermuda. Half of the top 10 targets were data processing companies.

(Source: Appleby)

This week Lawyer Monthly gains expert insight into the subject of how work bonuses are treated by courts post separation. Julie Julie-Ann Harris, Partner and Head of Family at Coffin Mew, delves into the particulars of court treatment of bonuses acquired with spousal support and treatment of a bonus as a capital asset without no spousal support.

Whilst the FCA prefers to think of the ’fat cat’ bonus payments of old as vintage as the Aston Martin DB5, based on its position that remuneration practices were a ‘contributory factor to the market crisis’ during the last recession, many employees, especially those who work in financial services, continue to receive a complicated and dazzling array of salary ’top ups‘ each year.

Bonuses take many forms, being either contractual or discretionary (or a confusing combination of the two). Discretionary bonuses mainly reward success, while non-discretionary bonuses incentivise future performance. Discretionary bonuses are often paid as an annual reward following a successful year and non-discretionary bonuses are paid on an agreed schedule, when employees hit a defined target.

Bonus and reward structures are satisfied in different ways and are mainly dependent upon the business needs at the time. Many bonus schemes pay an annual lump sum via PAYE which is in addition to basic salary. Some businesses seek to reward hard work and encourage loyalty by gifting shares in recognition of an employee’s performance or long service but generally these schemes will have conditions attached that shares cannot be realised for a specific time period.

This means employees do not see the immediate benefit of the value until a certain point in the future. There are many more schemes that range in complexity and as ever it’s the quantification of value the court must establish before distribution.

When relationships are stable, bonus payments, in the main, fall into the family coffers for the family benefit but when the focus shifts to the ’benefit’ of the bonus during divorce or separation, the complex reward structures come under the microscope for examination.

There are two distinct elements to consider here. First, how the court seeks to achieve fairness where spousal support is necessary to satisfy need and the second is where spousal support does not feature.

At the outset and before either position is categorised, how is fairness balanced when it is necessary to recognise the conflict where a bonus is generated, using knowledge and skill built up during the marriage set against post separation industry.

In Miller v Miller; McFarlane v McFarlane [2006] UKHL 24, [2006] 1 FLR 1186 the court sought to strike a balance akin to arguments deployed when considering ’marital acquest’ to reflect that “the marital partnership does not stay alive for the purposes of sharing future resources unless justified by need or compensation.”

If spousal support is necessary and, on the assumption that historical bonus payments are consistent and relatively small, the court will usually add the bonus to salary to calculate a global figure. If past bonus payments have been unpredictable, the current thinking is to determine an amount of maintenance for ’ordinary’ expenses, which are paid from salary with an element of ’discretionary’ spending to be paid from the bonus payment. If the latter applies, then it is essential to put a cap on the sums paid to recognise that the sharing principle does not apply to bonus payments H v W [2-13] EWHC 4105 (Fam).

However, what if the case does not feature spousal maintenance? In consideration of the length of marriage, post separation accrual and the overall size of the bonus including any deferral period in the case where the bonus includes share options, the court has made varying awards from nothing to a proportion for the first-year post separation extending to term payments on a stepped basis. In B v B [2010] EWHC 193 (Fam) the court refused to divide the husbands bonus equally in recognition that a substantial proportion of the bonus was generated post separation and the wife could not establish a claim based on her needs alone.

In each case where a bonus features heavily, keep in mind the difficulty of pinpointing the future value of deferred share options and the difficulties that will arise if the recipient leaves employment before realisation; the suitability of a non-extendable term for the bonus element in order to protect future endeavours; the importance of capping entitlement in monetary terms rather than percentages in order to protect the paying party if they receive a particularly high bonus post separation and always take advice on any future tax implications.

As ever the court will retain autonomy. In summary, it is always a matter of balance and degree and as for future predictions of value of deferred shares, the most sensible observation is that of William Shakespeare "If you can look into the seeds of time, and say which grain will grow and which will not, speak then unto me.”

We all get nervous at an interview. Whether it’s meeting your other half’s parents, going for a new job, or trying to close an important business deal, getting off on the right foot is crucial. For a law interview, the pressure often feels insurmountable. Did you know that, on average, you have just seven seconds to make a good first impression? That’s not long — especially when there are so many factors to involved.

So, how do you make the perfect opening impression in a business meeting and interview?

It goes without saying, but the clothes you choose the night before can truly make a difference. After all, if the shoe was on the other foot, do you think you would pay attention and sign a contract if the person standing in front of you was unkept? Probably not, so steer clear of those Converse trainers and ripped jeans — it’s important to dress like the professional you are trying to portray yourself as.

Men should be suited up and look clean and well-groomed. A nicely fitted suit with decent formal shoes will give the impression that you are proud of your appearance and are likely to take pride in your client’s needs, too. Women can also benefit from tailored clothing of conservative colours and patterns. Dark grey or navy should be staple colours in your outfit choice.

Being late is many people’s bugbears — don’t get off on the wrong foot. If your meeting is planned, turn up early. America’s former president, Eisenhower, was famous for his ‘when to arrive for a meeting’ philosophy, which meant that if you weren’t 10 minutes early for the meeting, then you were late.

This will also give you time to do last-minute prep and relax prior to the meeting — crucial if you need to present to your potential clients.

How you act and behave are also worth considering. Be sure to smile, shake everyone’s hand who is in the meeting and maintain good eye contact. Smiling will put potential clients at ease, offering a warm impression of yourself, while firmly shaking hands can command respect. Keeping eye contact portrays you as a positive person, while those who avoid eye contact can sometimes be seen as being ‘shifty’ or rude — not ideal for a business meeting!

You don’t have to talk like royalty, but always make sure you don’t mumble and can be clearly understood in interviews and meetings. Nobody likes needing to continuously ask what it was you said. If this happens, your client could become frustrated, which will take away from all the good that may occur in your meeting. Having an accent won’t matter as long as you are clearly annunciating your words.

Clear communication will help your meeting run smoothly with less stops and starts. It also allows you to build a relationship via small talk. Again, speaking clearly enables this to happen, as if they don’t understand you, they won’t engage.

Have you ever considered that first impressions can begin before you even meet the person who is interviewing or meeting with you? We’ve all heard of stereotypes revolving around certain types of car, but did you ever think about how this may affect any potential business deals? Audis are often stereotypically linked to businessmen and women, meaning that those who drive an Audi A3 might create a positive impact on potential clients who see you arrive!

With these tips, you’re sure to land that business deal or job. Remember, don’t drive a ‘boy-racer’ style car to your meeting, arrive early, dress snappy, be open and friendly, and make sure everyone can understand you! Master these points and you’ll have a great chance of getting the result you are looking for.

Sources: http://www.businessinsider.com/only-7-seconds-to-make-first-impression-2013-4?IR=T https://www.forbes.com/consent/?toURL=https://www.forbes.com/sites/yec/2011/11/02/5-ways-to-make-a-killer-first-impression/ http://www.sideroad.com/Business_Etiquette/business-body-language.html https://www.thebalancecareers.com/small-business-attire-for-women-3514813 https://www.bizjournals.com/bizjournals/how-to/growth-strategies/2016/03/10-advantages-to-arriving-early-to-meetings.html

There is a growing ‘sex-for-rent’ scandal currently brewing in the UK and beyond. Increasingly depressing is the proliferation and normalisation of this in many circles. Expert Housing and social welfare barrister Nicholas Nicol from One Pump Court provides Lawyer Monthly his take on the issue.

On 10th September 2018 an investigation by the BBC programme Inside Out West found evidence of landlords offering rent free accommodation in return for sexual favours. Previous investigations by the Guardian, Observer, Cosmopolitan, Sun and Daily Mirror found similar evidence. Four years after the issue was first raised on a blog for Shelter, a cursory look on Craigslist finds ads making similar offers. News reports suggest this is not only an issue in England but also in the USA, Australia, New Zealand and, at least historically, France. While young women appear to be the principal victims, on 18th April 2018 BuzzFeed reported that gay men were being similarly targeted via a Facebook group.

This is obviously the product of the shortage of affordable housing. As one landlord interviewed anonymously on This Morning in April 2018 explained, some claim that there is nothing wrong with such an arrangement between consenting adults. However, this ignores the power imbalance involved when only one of the parties is seeking something essential to sustaining a basic standard of living. It is no coincidence that research by St Mungo’s in 2014 found that a third of their female clients who were their rough sleeping had been involved in prostitution. As the Shelter blog put it:

… there is a specific, unique danger in the proposition made in these adverts. It is that women are being asked to enter a space which is entirely controlled by someone else: a person who always has the right to be there, who can say who else can enter the property and on whom they are entirely dependent for shelter.

When he was Justice Secretary, David Lidington told Hove MP Peter Kyle that “an offence is committed when a person offers accommodation in return for sex, as they are inciting/causing another person to have sex with them in return for ‘payment’”. This appears to be a reference to the offence of causing or inciting prostitution for gain under section 52 of the Sexual Offences Act 2003. However, this has yet to be tested because, according to the BBC, there has yet to be a single prosecution.

If sex actually happens, it may also be debatable whether it constitutes rape or sexual assault. Section 74 of the same Act provides that a person consents if they agree by choice, and have the freedom and capacity to make that choice. “Freedom” in this context can mean economic freedom but it may be difficult in some cases to show that the prospect of homelessness truly deprived the victim of genuine choice.

If a tenant is subject to sexual advances by their landlord after they have taken on a tenancy, then they have the usual remedies available to any tenant subject to harassment. However, a contract to pay for rent in kind by way of sexual favours is unlikely to be enforceable, at least unless there is also some other consideration – some reported arrangements have included housework and dog-walking.

The advantage of an unenforceable contract is the ability to walk away from it but that raises the prospect of homelessness again. Local housing authorities have duties to help the homeless under the Housing Act 1996 but anyone involved in a sex-for-rent arrangement is likely to have difficulties. For example, immigrants who entered such arrangements to avoid the right to rent limitations are unlikely to be eligible for assistance. There may also be the practical difficulty of establishing to the authority’s satisfaction what the arrangement was and that they are not intentionally homeless.

The fact is that vulnerable people with limited finances are subject to economic exploitation in a legal grey area. There has been pressure put on Craigslist and other online services to prevent the ads appearing in the first place but with only partial success. Unfortunately, there seems to be currently no other action aimed at addressing this problem.

Below Lawyer Monthly hears from Nicola Sharp, of award-winning business crime solicitors Rahman Ravelli, who explains why recent fraud statistics cannot be ignored by anyone in business who wants to prevent it happening to them.

It appears that we may be in the midst of an epidemic of fraud cases coming to court. Research carried out by KPMG shows that a record number of fraud cases reached UK courts in the first half of 2018. The research revealed that 252 cases headed for the courts in that time. That is 25% higher than the previous highest six-monthly figure – and only seven below what the total number was for the whole of last year.

Should we be alarmed? Arguably, yes - if the increase in cases going to court can be shown to be a straightforward reflection of an increase in this type of crime. Yet, in the authorities’ defence, it may be the case that fraud is not on the increase – but the detection and prosecution of it is. The degree to which either argument is true will depend largely on the authorities’ ability to keep pace with those looking to commit fraud.

Fraud, by its very nature, evolves with changing circumstances and the opportunities these present.

For example, there will always be those who see the potential for fraud posed by cross-border activity. Large-scale tax evasion and evading customs duties on imported goods have been practices that have gone on for years. And carousel fraud – the systematic abusing of tax laws through complex trading arrangements – has been an issue for the authorities since the late 20th century.

Such fraud is almost traditional compared with more modern methods of carrying out the offence. The fraud that is committed on banks through loan and mortgage applications is less “old school’’. As are the boiler room tactics of those who dangle the promise of huge returns in front of individuals to persuade them to invest in worthless or non-existent shares.

But recent years have seen new developments. Technology has advanced. And so has the use of it by those who are keen to commit fraud. Online fraud, malware and hacking have opened up new possibilities for those wanting to make fraudulent gains. And much of this modern fraud crosses borders, which has prompted greater cooperation between law enforcement agencies in various countries.

Such cooperation by the authorities has to be seen as an attempt to play catch-up with those perpetrating fraud. This need to keep up with those looking for fraudulent gains has also seen many tax loopholes closed, led to financial institutions tightening up their lending procedures and resulted in some major multinational boiler room operations being dismantled.

The question now is whether enough is being done to tackle the latest forms of fraud. The answer to that may help explain whether the increase in fraud cases going to court is an indicator of inroads being made into tackling this type of crime, merely a statistical blip or a sign that the problem of fraud is becoming much bigger.

The honest answer may well be that we never find out. Which is why those in business have to take all appropriate steps to reduce the risk of fraud being committed against them. Hoping to avoid fraud is not an option.

Research earlier this year by another accountancy firm, PWC, found that half of all UK companies may have been affected by fraud or other economic crime in the past two years. Yet only 50% of the firms that responded to the questioning had carried out a fraud risk assessment in that time. That is a dangerous state of affairs.

Fraud harms a company’s finances. But it also causes disruption, lowers staff morale and damages a company’s reputation and its relationships with customers and trading partners. Which is why every firm needs to examine the potential for fraud being committed by its staff, customers, trading partners and anyone else with a detailed knowledge of its workings.

Senior staff need to devise, introduce and maintain procedures that enable fraud to be identified and prevented. The conduct of personnel, record keeping, payment procedures and management and monitoring structures could all be exploited by those looking to commit fraud. If those holding senior positions are unable or unwilling to take the necessary steps to prevent this, they should seek advice from business crime lawyers.

Such lawyers can examine a company’s workings, identify the areas vulnerable to fraud and then introduce measures to design out that risk. For example, an appropriate whistle blowing procedure that encourages staff to report their suspicions of wrongdoing will promote an anti-fraud workplace culture that will boost the chances of a company both detecting and deterring fraud.

Whether the statistics indicating a rise in fraud court cases are good or bad news remains to be seen. We may never know. But at the very least, such figures must serve as a reminder of the scope of fraud and the need to do whatever is possible to prevent it.