Understand Your Rights. Solve Your Legal Problems

SFO specialist journalist Dominic Carman here discusses with Lawyer Monthly the SFO's dire need for new leadership. Discussing the current handover of authority within the organisation, Dominic also touches on the prospects of criticism surrounding the SFO in the near future.

Alongside the bankers, lawyers and wealthy business men, no one from the Serious Fraud Office attended the infamous Presidents Club dinner at the Dorchester Hotel. When David Green, the SFO Director, has his farewell dinner in a few weeks’ time it will undoubtedly be a much more decorous affair. Having told journalists only that he intends to go fishing when he steps down in April, Green has not commented on reports that he has been invited to join the London office of a prominent and extremely profitable US litigation firm, described as one of the most prestigious and selective law firms in the world.

Once appointed, the new SFO Director seems very likely to continue to pursue a similar strategy to Green. That is because the man most likely to be given the job has been his right hand man for the past six years: Alun Milford became General Counsel at the SFO in April 2012 when Green first took up his seat in the Director’s chair.

At first blush, his CV provides a perfect background for the role. After qualifying at a City law firm, Milford joined the Crown Prosecution Service (CPS) in 1992 and became a solicitor-advocate seven years later. In 2004 he joined the Attorney General’s Office before moving to the Revenue and Customs Prosecutions Office in 2007, where he established and led its asset forfeiture division. After returning to the CPS in 2009, he was appointed as head of its organised crime division after its merger with the Revenue and Customs Prosecutions Office.

Some clue as to Milford’s approach to his potential new role as Director can be seen in a speech he delivered in 2016 to an audience of compliance professionals at the European Compliance and Ethics Institute, Prague. He told the audience: ‘Famously, we are a unique part of the UK’s law enforcement community in that we have powers both to investigate and to prosecute cases of top end financial crime. We were set up simply to investigate and to prosecute cases involving serious or complex fraud, bribery and money laundering. We are a law enforcement agency, not a regulator, and we define our relationship with industry accordingly.’

He continued: ‘Our Director also set out the criteria he would take into account when deciding which cases we should accept for investigation: the impact of the case on UK financial plc in general and the City of London in particular; the scale of losses, actual or potential; the extent of the gain, actual or potential; whether we were dealing with a new kind of fraud or whether there was some other public interest reason for taking the case on. That simply accounts for the start of the process. What about results? Not all cases go our way. But over the last two years we have seen convictions for fraud arising from LIBOR fixing.’

He went on to highlight ‘Whilst we cannot, and would never want to, guarantee convictions, we are able to investigate and then to prosecute to conviction genuinely difficult top end financial crime cases.’ And the he set out the criteria for prosecution: ‘First, is there sufficient evidence for a realistic prospect of conviction? Secondly, if so – and only if so – is a prosecution required in the public interest?’

Milford’s phrase ‘not all cases go our way’ was prophetic: the LIBOR trials have resulted in 19 traders being charged with respect to LIBOR and EURIBOR manipulation. But of these, there has been one guilty plea, eight acquittals and only four convictions. After two postponements, the remaining six defendants will be tried for EURIBOR manipulation just as the new Director starts in April: former Deutsche Bank traders Christian Bittar and Achim Kramer and former Barclays traders Colin Bermingham, Carlo Palombo, Philippe Moryoussef and Sisse Bohart, who were originally charged by the SFO in November 2015.

Meanwhile two British former traders at Rabobank had their convictions overturned by a US appeals court last July. Of the four UK convictions, at least two are subject to appeal. The truth is that the LIBOR trials have ended up as ‘a debacle’ – a phrase used by Lord Justice Gross in a recent Court of Appeal hearing by one of the convicted traders, Alex Pabon.

Gross LJ was referring to the conduct and qualifications of Saul Haydon Rowe, who proclaimed himself as an expert witness when giving evidence on behalf of the SFO at four separate Libor trials. As a result of his evidence, four traders were convicted and sent to prison. But in another recent appeal hearing, it emerged that Rowe was definitely not the expert he pretended to be, or the SFO believed him to be - because the agency manifestly failed to check their facts or to carry out proper due diligence before paying him £400,000 for his services.

Milford was integral to the process of selecting Rowe as much as Green. Although the LIBOR debacle has yet to reach its denoument, the full judgment of the Court of Appeal in the case of Alex Pabon seems destined to be heavily critical of the SFO’s top brass and their protracted, costly and poorly managed investigation into LIBOR manipulation. It is inconceivable that Green will escape censure as a result. It is also inconceivable that the clear favourite to replace him, an SFO insider who also endorsed Rowe as a key expert witness for the LIBOR prosecutions, should succeed Green as Director.

Given the justified criticism that is going to be unleashed against it in the coming weeks and months, the SFO needs fresh blood at the top.

The Supreme Court has decided in Bancoult (No 3), by 5-2, that a government decision about the Chagos Islands was not made for an improper purpose. In reaching this decision, the Court unanimously held that a Wikileaks document could be admitted into evidence.

The case concerned the decision of the then Secretary of State for Foreign and Commonwealth Affairs, David Miliband, to impose a Maritime Protection Area (MPA) around the Chagos Islands. A Wikileaks document was published, which purported to be a cable from the US Embassy in London summarising a meeting between US and British officials. The Appellants argued that the contents of this cable indicated that the decision about the MPA was undertaken for the improper purpose of preventing the Islanders return to the Chagos Islands.

The main issue concerned whether the Wikileaks document could be used in evidence. This depended on the interpretation of the Vienna Convention on Diplomatic Relations 1969, which provides that a document and archive of a diplomatic mission is “inviolable”. The Court held that this inviolability meant that it was impermissible for a domestic court to use them in evidence, other than in exceptional circumstances. In this instance, the Court held that the Wikileaks document was not part of the US Embassy’s archive or in its control, and it was in the public domain and widely disseminated, so that either no inviolability could attach to it or any inviolability it might have had was lost.

The test for reversing the decision at first instance was whether the admission into evidence of the Wikileaks document, when weighed against other evidence, could have made a difference to the court’s decision. On the facts, that test was not satisfied, and the appeal was dismissed.

The Judgment is here.

Robert McCorquodale appeared for the appellant Bancoult at the Supreme Court and the Court of Appeal, stages, and conducted the advocacy on the Wikileaks argument before both Courts. He was instructed by Clifford Chance LLP.

Maya Lester QC and Daniel Piccinin appeared in the Divisional Court and Court of Appeal on issues of EU law.

(Source: Brick Court Chambers)

Why is the airline industry one of the most heavily regulated and subsidized industries in America? Gary Leff, Mercatus Center CFO and author at ViewFromTheWing.com, explains his point of view.

A recent report demonstrates that almost three quarters of brands (74%) experienced trademark infringement in the last year, with four in 10 saying infringement has increased.

Reporting on the impact of this trademark infringement in The Trademark Ecosystem: Insights from Intellectual Property Professionals around the World, customer confusion was identified as the biggest effect (44%), followed by loss of revenue (40%), reduced customer loyalty (34%) and damage to reputation (33%). One-third of companies said they had to change the name of one of their brands as a result of infringement, while more than half (56%) took legal action against third-party infringements.

“Our report shows that trademark filing is on the increase,” says Jeff Roy, President, CompuMark. “With the ease of doing business on a global scale, the continued emergence of new entrants into the market and the proliferation of additional channels, such as social media, to consider, finding a unique mark to register is harder than ever before.

“Brands will have to work harder than ever to combat infringement and mitigate the risks associated with it. As a result, the process of searching and watching trademarks is becoming increasingly important and will remain so into the future.”

Unsurprisingly, the research shows that the majority of trademark applications took place across products and services, logo and images, and company names. The survey also uncovered interesting international results around unusual trademark applications; trademark professionals in France showed a higher than average interest in trademarks for hashtags and sounds, while German respondents filed for more color and smell trademarks.

Professionals also identified a number of challenges that impact on filing behavior, including time pressures, budgets, globalization and the lack of tools and resources. Bigger budgets (51%), better technology (49%) and more resources (48%) were frequently cited as the solutions to overcome these issues. Brexit was also identified as having an effect, with 22% of the sample saying they were filing more UK marks, and a further 31% filing more European Union (EU) marks.

(Source: CompuMark)

With the potential transfer of the Carillion pension schemes to the Pension Protection Fund (PPF), the PPF has been much in the news recently. Below Philip Woolham, Senior Associate at Bevan Brittan LLP, explains the ins and outs of the fund, touching on some of the challenges faced.

The PPF is an important part of the UK pension landscape, providing significant protection to scheme members. But its existence comes at a cost to occupational pension schemes and their sponsoring employers if they provide defined (final salary-type) benefits. It is not involved with public sector pension schemes.

As well as taking assets from schemes that transfer to it, pension schemes that could enter the PPF themselves pay a levy to support it. Part of the levy is calculated on the likelihood of the scheme actually falling into the PPF because their employer fails - the argument is that greater risk of entry should be reflected in a larger contribution.

The PPF does not always provide 'like for like' benefits for members whose schemes transfer to it. If they have not reached normal retirement age, whether or not they have actually started to draw benefits (for example by retiring early), reductions are imposed, to 90% of what was originally promised. There is an additional cap on all benefits of £38,505.61 (£39,006.18 from April 2018). If the 90% limit also applies then £35,105.56 is the maximum currently payable. So it is possible for people who are already drawing a pension to have their benefits reduced if their scheme enters the PPF. Increases to take account of inflation may also be reduced, amongst other possible changes depending on what the original scheme promised.

This is designed to strike a balance between giving members a reasonable level of pension security and trying to restrain the very high costs of doing so. Transferring schemes' assets will usually not provide anywhere near enough to cover the liabilities, so the limit and cap aim to reduce the amount required from investment growth and scheme levy

There was however a successful legal challenge a few years ago, in which it was decided that for some pension scheme members, especially those with long service, the cap meant that their benefits were not reasonably protected. So the PPF now allows additional payments for those with long service.

From time to time, the PPF must absorb larger schemes. It may take on £900m of extra liabilities when and if the Carillion schemes transfer (the exact amount is still to be confirmed). While it currently has generous reserves, the PPF has a statutory duty to provide the promised benefits to all members of schemes that transfer, even if big schemes continue to impose additional liabilities. And there is a limit to the amount it can levy from solvent schemes before the costs become yet another strain on their resources, and their sponsoring employers', potentially increasing the chances of their also heading towards the PPF.

The Pensions Regulator also works with the PPF in these processes. It has a statutory duty to protect the PPF, by preventing schemes falling into the PPF if at all possible, and also acts as an overseer, able to veto agreements if it feels that it they are not in the longer-term interests of the PPF. This happened a few years ago with Readers Digest, when it vetoed a deal already agreed between the employer and the PPF which would have allowed the scheme to pass to the PPF and the employer to restructure itself. In some cases, however, the Regulator agrees that the transfer can take place, including recently for the British Steel pension scheme.

The PPF is not perfect. Its levy imposes an additional cost on often hard-pressed pension schemes, and it does not replicate all benefits for all members whose pension schemes transfer. Not all of the deals it makes, along with the Regulator, work out as expected, for example when Monarch Airlines collapsed even after it was restructured and its pension scheme passed to the PPF.

However, the PPF provides a significant measure of security for pension scheme members who have often saved for much or all of their working lives into their pension schemes. While it will undoubtedly face further challenges in the future, including no doubt more large-scale insolvencies that mean more liabilities pass to it, its continued existence is surely worthwhile.

Stonewall, the lesbian, gay, bi and trans equality charity, has listed 16 legal firms in its Top 100 LGBT-inclusive employers list.

The top ten includes Pinsent Masons in second place (2 in 2017), Baker & McKenzie at number six (7 in 2017), and Berwin Leighton Paisner (BLP) at number seven (8 in 2017). Each of these legal firms has also received special commendation as one of Britain’s best employers for trans and non-binary staff.

Stonewall’s annual review has this year, for the first time ever, marked employers specifically on trans inclusivity, in addition to their work on lesbian, gay and bi inclusive policies.

Notable performances also come from CMS Cameron McKenna, which moves up five spots to 26 (31 in 2017), Travers Smith LLP, which climbs 32 positions to 26 (58 in 2017), and Slaughter and May, who rise 16 spots to 54 (70 in 2017).

Other entrants include Clifford Chance at number 11 (4 in 2017), Norton Rose Fulbright LLP at 19 (10 in 2017), Hogan Lovells places at 31 (17 in 2017), and Herbert Smith Freehills lands at 33 (24 in 2017).

This year sees four new firms enter the list, including: Taylor Wessing LLP (51), Kirkland & Ellis International LLP (73), Linklaters LLP (75), and Allen & Overy (91).

Rounding out the list are Dentons UKMEA LLP at 58 (17 in 2017) and Eversheds LLP at number 75 (69 in 2017).

Over the past year, Pinsent Masons, Baker & McKenzie, and BLP have all taken numerous steps to improve their workplace policies and practices for trans staff. Pinsent Masons’ work includes introducing training on gender identity and supporting charities like Mermaids. Baker & McKenzie implemented a ‘Transitioning at Work’ policy and partnered with Rachel Reese from Global Butterflies for a Trans 101 session. BLP brought in gender-neutral facilities, removed gendered titles (Mr, Mrs, Miss) from HR and recruitment systems and launched a ‘Transitioning in the Workplace’ policy.

Kate Fergusson, head of responsible business at Pinsent Masons, said: “At Pinsent Masons we’re so proud to again be the top performing law firm and second overall in the Stonewall Workplace Equality Index. With a new focus in the Index this year on trans equality in the workplace, we’re also delighted to be featured in the inaugural listings of Top Trans Employers.

Over the last few years we’ve been working hard to make sure our firm promotes and encourages trans and non-binary gender equality and have taken steps such as rolling out training for HR and front of house staff, introducing an option for employees and clients to use the gender-neutral Mx title, as well as setting up a working group to consider changes we can make to our facilities and work spaces to be more inclusive of all gender identities. It’s something that will continue to be a focus for our LGBT and Allies network throughout 2018.”

Alex Chadwick, London Managing Partner at Baker McKenzie, said: "We are delighted to be included once again in Stonewall's prestigious listing and thrilled to be ranked in 6th place this year; a record ranking for us. To be recognised for our ongoing support for the LGBT+ community in the workplace is a wonderful reflection of the continued dedication and great work of our people and the culture of Baker McKenzie. We believe that diversity within our firm makes us stronger and that all of our people deserve to be their authentic selves at work."

Harry Small, Chair of Baker McKenzie’s Global LGBT+ Business Resource Group, said: "At Baker McKenzie we strongly believe that sexual orientation, gender identity and expression should form no barrier in the workplace, and we want all employees to feel they are fully supported. So, I am proud that today we are one of only eleven employers to be recognised by Stonewall as being trans inclusive. This index marks a big step in recognising that we all have a responsibility to create an environment which is inclusive for all and this means for the trans community alike."

Daisy Reeves, Partner and LGBT Champion at BLP, said: “I am so proud to see BLP listed, once again, as a top ten LGBT+ inclusive employer nationally. I am also delighted to see BLP being recognised as a top ten employer committed to trans inclusion. Within the last 12 months we have worked very hard to ensure we are trans inclusive employer introducing gender-neutral toilet facilities, a transitioning in the workplace policy and gender identity monitoring. Our placement in both these lists speaks volumes about the efforts of all our people, LGBT+ or otherwise, who work tirelessly to ensure we have a truly inclusive workplace at BLP.”

The Top 100 Employers list, created by Stonewall, is compiled from submissions to the Workplace Equality Index, a powerful benchmarking tool used by employers to assess their achievements and progress on LGBT equality in the workplace.

More than 400 employers were in contention to get a coveted spot in this year’s Top 100 LGBT inclusive list. To mark the new trans-inclusive focus of the Top 100, Stonewall has also named Britain’s top trans-inclusive employers, who have gone above and beyond to ensure trans staff feel accepted.

(Source: Stonewall)

New currencies, ICOs and ambitious FinTechs could be creating more and more cyber risks for the future, and some experts are calling for increased legal regulation in the crypto sphere. Below Alex Larsen, CFIRM, Institute of Risk Management (IRM) subject expert, explains how and why crypto currencies are creating more and more investment risk, with some ideas on how to regulate the markets and avoid disaster.

According to Reuters: “Japan’s financial regulator said on Friday it had ordered all cryptocurrency exchanges to submit a report on their system risk management, following the hacking of over half a billion dollars of digital money from Coincheck.”

Whilst the whole premise of blockchain technology and crypto currencies revolves around it being essentially unhackable, the exchanges that trade these currencies are vulnerable. The introduction of system risk management (which we assume to be risk management of the software/operating systems and servers) checks is a step forward for the cryptocurrency space although it only covers one area of exposure linked to the cryptocurrency market.

History of incidents

Crypto currency has been a booming market with increases in some major coins in the high 1000’s of percent over the last year. This rise, coupled with a lack of regulation, has seen the crypto currency world being hit with a number of negative incidents from Ponzi schemes to fraud, scams and hacking incidents.

Bitconnect, which as of writing of this article, is trading at roughly $8.60, a huge fall from its height of over $300 a month ago, is an example of a potential major Ponzi scheme which has lost $2.4 billion worth of value over 10 days.

The subpoena by US regulators of crypto exchange Bitfinex and its relationship with Tether is another concern to the crypto currency market with many claiming Tether to be a scam. Tethers are tokens backed by US dollar deposits, with each tether always worth one dollar. These tokens should be backed by dollars but thus far the company has yet to provide evidence of its holdings to the public and has not had any successful audits as of yet.

There have also been a large number of Initial Coin Offerings (ICO’s), used to raise money for startups by issuing tokens/coins, which have raised vast sums of money only for the owners to disappear with all the money, whilst others have been less deliberate but have been just as devastating to investors. A cryptocurrency called Tezos, raised $232 million last year, but suffered internal power struggles which has left the project in disarray.

This brings us to the current concern in Japan of cyber-attacks of exchange platforms. Cyber-attacks and hacking attempts of exchanges have been frequent with Bitfinex, coinbase and kraken amongst others having been closed down for days at a time during 2017 due to a number of hacking attempts. It is the successful hacking incidents which are the most worrying however, with successful hacks such as MT Gox, which cost almost 350 million and two attacks on Youbit which led to its bankruptcy. The most recent coincheck hacking was worth 500 million, a record, and it is this which has caused Japan to act.

Regulation

Last year, China took a definitive stand on regulation on crypto currencies which sent shockwaves through the market. Some feel it was perhaps heavy handed with ICO’s being banned, bank accounts being frozen, bitcoin miners being kicked out and nationwide banning on the internet of cryptocurrency trading related sites. Others however believe that it has been a positive step, and has encouraged other governments to take regulation seriously and hopefully take a more balanced approach. It certainly isn’t in the interest of governments to stop ICO’s, which provide many positives including innovation, but they should certainly regulate them from a consumer protection, taxation and organised crime standpoint.

Implementing regulation also removes uncertainty for investors as well as the companies who are involved in ICO’s. Uncertainty is the source of many risks and often a negative certainty is better than uncertainty as it allows a focus within set parameters.

It’s important to remember that too little regulation doesn’t offer protection and too much stifles innovation.

How to regulate

There are a number of ways to regulate cryptocurrencies and the following are just some examples:

1) Framework for ICOs

New ICO’s are currently not subject to much in terms of regulation globally. One of the problems is determining how they should be treated with some being considered securities. As a fundraising vehicle, there could certainly be a framework that lays out key requirements of an ICO such as a company needing to be registered in order to issue a token, transparency in terms of individual members of the registered company as well as perhaps introducing a few requirements that regular IPO’s require such as implementing risk management. Currently in USA, ICOs are expected to adhere to Anti Money Laundering (AML)/Know Your Customer (KYC) practices.

2) Regulate exchanges

Exchanges, which is where much of the transactions take place in terms of trading coins, is a logical area of focus when it comes to regulations

South Korea’s financial services commission for example, has stated that trading of cryptocurrencies can only occur from real-name bank accounts. This ensures KYC and AML compliance. According to the FSC, the measures outlined were intended to "reduce room for cryptocurrency transactions to be exploited for illegal activities, such as crimes, money laundering and tax evasion,"

Regulators should focus on regulation that encourages transparency and minimises anonymity.

1) Tax Laws

Clarity needs to be brought into the tax laws in terms of when investors should pay capital gains. The USA has been quite quick to ensure that crypto-to-crypto transactions are now taxable and not just crypto to Fiat currency transactions. This is not the case in the UK however, where things are less clear and will become even more so, once crypto currencies start to introduce dividend like behaviour.

2) Reserve requirements of exchanges

Most banks and stock exchanges are required to hold a certain amount in reserves in order to survive any major downturn or crash. This should most certainly be the case for crypto currency exchanges too especially considering the volatility which sees crashes of 60% several times a year with some crypto currencies falling 90% before recovering. This is also known in part as systemic risk which could be what the Japanese financial regulator defines as system risk.

3) System risk management

As we have seen from this Japan story, one way of ensuring more protection and reliability is by ensuring there is regulation around system risk management on exchanges. There should be minimum requirements protecting against hacking, phishing and other cyber related attacks. The requirements could be scaled against value of the exchange, number of users or number of daily transactions.

It’s important to note that much is being done to reduce the risks of hacking incidents such as the concept of a decentralised exchange. This would essentially be a crypto currency exchange on the blockchain, much like the crypto currencies themselves. This would reduce hacking significantly and whilst it is not currently practical, it could be the standard of the future.

Self-Regulation

The Crypto Currency market gets a lot of negative publicity and much of this could be rectified if there was more self-regulation. It would also reduce volatility within the market and bring about positive change. This refers to both exchanges and ICO’s alike.

The Japan Blockchain Association (JBA) for example has established self-regulation standards which includes the use of cold wallets amongst its 15 crypto exchange members (of which Coincheck was one of them) and are now looking to strengthen the standards further following this recent incident.

Risk Management in the Crypto Currency Space

Risk Management, as with all organisations, plays a vital role in meeting and exceeding objectives whilst providing resilience and stakeholder confidence. Exchanges and companies that are raising/have raised ICO’s should ensure that Risk Management is part of their business. Identifying risks and opportunities, assessing them and implementing response plans should be standard. Cyber risks, reputational risks, operational risks, system risks and strategic risks should all be considered and prepared for, which would minimise market disruption and reduce the likelihood of financial ruin. At the very least they owe it to the investors who have funded them.

For investors, with volatility so high, the rewards are great but so are the risks. Investors should ensure that they only invest what they can afford to lose, do their due diligence on their investments which includes understanding the technology, the team and look for a prototype rather than a wild concept. Additionally, investors should always be on the lookout for phishing scams and suspicious emails.

Finally, even the most optimistic investor should at least consider that cryptocurrencies are a speculative bubble that could burst.

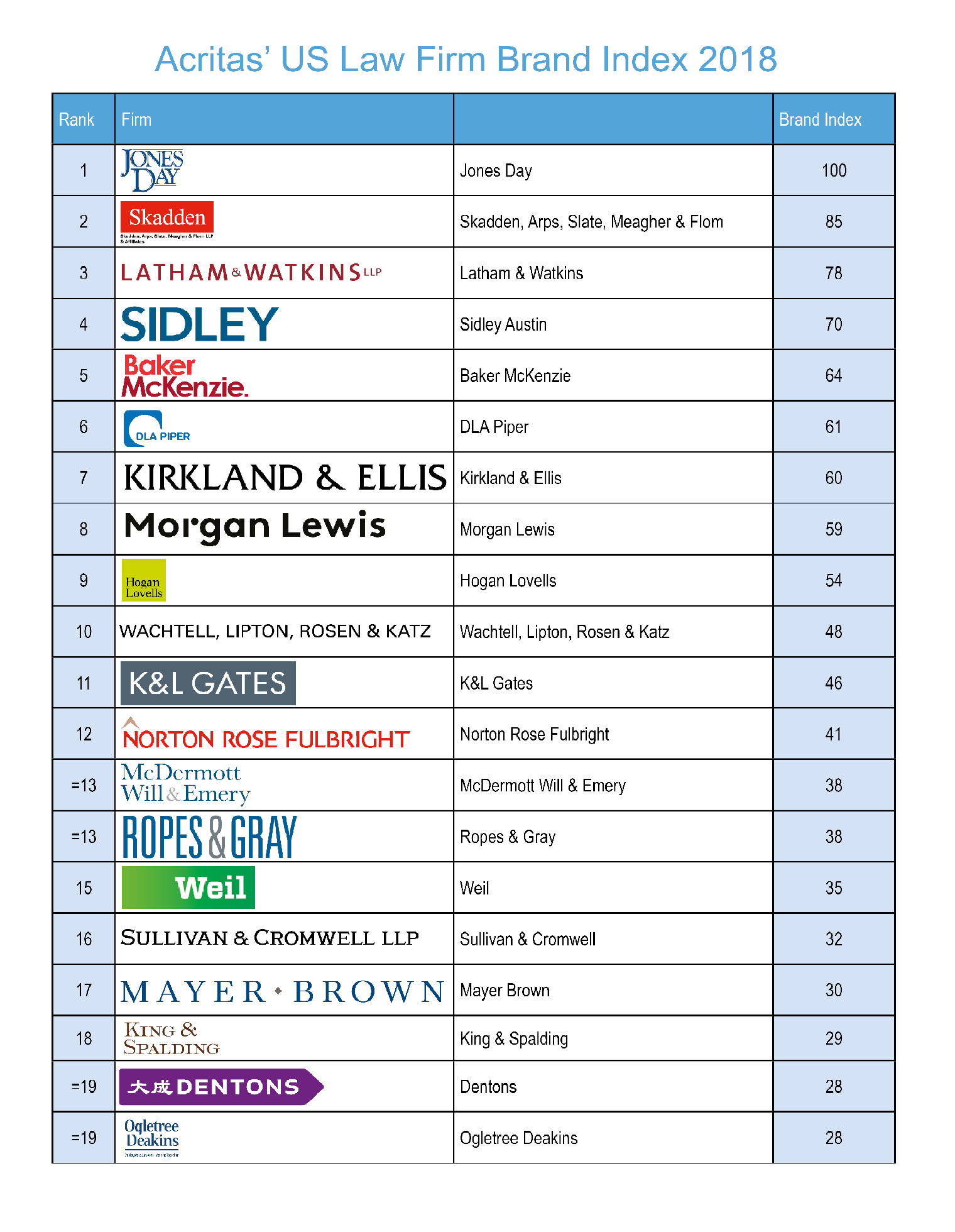

Acritas’ seventh annual US Law Firm Brand Index sees Jones Day extend its lead against the market, increasing the gap against the rest of the leading brands to an extent not seen since 2014.

Acritas’ US Law Firm Brand Index 2018 is compiled from analysis of an extract of data from the Sharplegal US survey dataset. All data is derived from 601 interviews with respondents, in $1 billion+ revenue organizations across the US, who have senior responsibility for buying legal services. It also includes the views of a further 176 non-US-based senior counsel who were asked which firms they used for their US-based legal needs.

Jones Day is the strongest law firm brand in the US for the second consecutive year after surpassing five-year leader Skadden last year. While Skadden has strengthened its brand this year, Jones Day has seen a larger gain and increased its lead on the market.

Lizzy Duffy, VP of Acritas US said: “Jones Day is more favored this year for its practical style of delivery, along with its global coverage and breadth of services – all areas we know align with clients’ evolving needs especially now that half of legal departments are assigning responsibility for optimizing legal operations.”

Competition in the US is intensifying among the largest and strongest brands. Analysis of the rankings this year highlights the increasing strength of top firms. According to client data from Acritas, almost all of top 10 have strengthened overall or on individual metrics and the top 10 firms most considered for top-level bet the company litigation and M&A have strengthened on these measures.

This year Acritas has also been capturing data on alternative legal service brands for the first time, in addition to law firm brands, and its data is providing evidence for the rising threat of alternative brands in the legal space. While still not yet as strong as the law firm brands in some markets they are seen by legal departments as driving innovation in the sector. Lizzy added: “For now law firms still have a richer brand profile – they are seen as authorities in so many more areas of expertise, the current advantage the alternatives have is centered around technology and process efficiency.

“As clients look for ways to drive value in managing their legal work, the threat from alternatives will continue to rise. Our latest research study shows top of mind awareness of Axiom has almost tripled in four years in the US. Law firms must use this threat as an opportunity to adapt to clients’ current needs.”

Outside the top 20 there are 15 firms withing five Index points of the top 20 which look set to contest for US brand leadership in the near future (in alphabetical order): Baker Botts, BakerHostetler, Cravath, Davis Polk, Eversheds Sutherland, Gibson Dunn, Greenberg Traurig, Littler Mendelson, Orrick, Perkins Coie, Reed Smith, Seyfarth Shaw, Simpson Thacher, Vinson & Elkins, White & Case. Lizzy added: “Firms with both a strong US presence and an international network are reaping rewards in terms of brand equity. However, those with market-leading ambitions will need to ensure they develop their proposition to resonate with clients evolving needs to succeed”

(Source: Acritas)

We cannot underestimate how fundamental the issue of VAT is in Brexit negotiations. If the changes made to the Cross-border trade bill last Monday were to enter the UK’s legal framework after it leaves the customs union, the impact on over 130,000 of the UK’s firms would be catastrophic. Below, Gareth Kobrin, CEO of VAT GLOBAL, explains. The VAT IT group is a global leader in cross-border VAT and tax recovery for companies including De Beers, Ericson and Volvo.

This is because without any more developments, VAT will be required upfront on goods when they cross the UK/EU border, rather than after the final purchase by the customer as is currently the position.

The effect this would have on both UK and EU companies, who are reportedly already struggling based on recent announcements from HMRC, was highlighted by Commons Treasury select committee chair Nicky Morgan, who pointed out the move would be a nightmare for businesses resulting in hefty cash flow implications as payments are moved forward long before tax can be recovered from HMRC.

The current rules companies follow are the result of the UK being in the EU VAT area. This means when goods enter the UK, they aren’t subject to VAT as they are instead treated as intra-community acquisitions, with VAT generally accounted for under a ‘reverse charge’ mechanism.

As suggested by the recent bill however, the UK leaving the single market will mean transported goods are treated as imports and exports and therefore subject to expensive import VAT and custom duties, long before the increase can be passed on to the customer.

It has also been confirmed that there will definitely be no so-called “hard border” separating the Republic of Ireland and Northern Ireland, and so effectively free movement between the two countries will remain. This could open a potential loophole for businesses, who may elect to divert their imports via Ireland, thereby creating a massive temptation for a host of fraudulent transactions.

The good news is the political neutrality of VAT makes it an appealing subject for both sides to leverage as a negotiating tool. It looks the like the UK has taken the first step with this cross-border trade bill and it could be it is just a strategic effort to show Brussels they are prepared to play hardball, despite the obvious negative effects it would have on UK business.

If this bill were to be passed however, it’s almost certain HMRC would introduce a VAT deferment scheme with a similar model to something that currently operates in the Netherlands to help alleviate the cash flow burden. The problem with this for the EU, however, is that UK businesses are currently the biggest net importers in Europe. If the additional costs lead them to start looking elsewhere, exporters on the continent are going to lose valuable business.

The next concern involves the chance that the EU may respond to this bill by imposing VAT imports of its own on goods from the UK. This isn’t as catastrophic for the mostly service-focused UK industry that net imports, but EU businesses may rightly ask why the same cash flow problems are being passed onto them. This would be the worst scenario for all involved though, as all services retained by EU businesses from the UK would suddenly be subject to 20% VAT, which again is likely to mean companies go elsewhere, or at very least face a complex and length VAT reclaim process.

Given how detrimental these scenarios would be, it doesn’t seem likely either side would wish to accept them. It isn’t clear the issue is being resolved by talks as they currently stand though, which means companies need to plan for any eventuality.

Without considerable attention from the government, the way VAT will work post-Brexit is likely to be complex to start with. Practical and technical advice on these matters will be necessary to ensure businesses are compliant with VAT laws, and, so they can take advantage of any simplifications that are hopefully introduced. To not do so may leave businesses coming up short at a time when every saving, and indeed invested penny, matters.

The UK government recently announced an overhaul of employment rights designed to improve conditions for millions of workers, including those in the gig economy. This is in response to last year’s Taylor Review into working practices. The changes are intended to give workers the power to force companies to follow the law, while enabling businesses and workers to embrace new ways of working.

Below Lawyer Monthly has collated several comments and responses to the overhaul announcement, from experts and employment specialists across the nation.

Marian Bloodworth, Employment Partner, Kemp Little LLP:

For employers and gig economy workers, the news that the Government is looking into the issue of worker rights will be welcome, provided that it results in clarity around status, obligations and entitlements. At the moment there is too much uncertainty on both sides, with the law developing through case law, rather than statute.

In addition, there is a tension between employment law, which recognises three distinct categories: employee, worker, self-employed - and tax law which only distinguishes between employee and self-employed. This has not made it any easier for employers and their staff to understand their respective positions and rights.

We will need to see what the promised Consultation papers say however before finding out whether these proposals will lead to real change.

Paul Falvey, Tax Partner, BDO:

Extra protection for gig economy workers in terms of holiday and sick pay will be welcomed by many but it remains to be seen how well this is enforced by an already under-resourced HMRC. The effectiveness of the new measures could also be reduced by planned increases in the minimum wage and in auto-enrolment pension contributions from April this year. This will encourage some businesses to rely on flexible workers to manage their costs, even if they now have to pay them holiday and sick pay.

With Brexit on the horizon, as well as other economic uncertainties impacting business confidence, using employees on zero hours contracts gives firms the flexibility to manage fluctuating demand. In addition, saving NIC at 13.8% of its wage bill is a huge incentive to any business to use gig workers rather than employees.

Until the Government gets such fundamental issues sorted out, adding a bit of extra protection although positive for such workers does not address the fundamental structural problem with our employment tax system. The Government did not allow the original Taylor Review to consider possible changes to the rates of tax or NICs for either employees or the self-employed so it is no surprise that today’s announcements steer clear of this politically sensitive area.

Stephen Cavalier, Chief Executive, Thompsons Solicitors:

It is a limp response to a limp report, which offers nothing but vague platitudes which don’t get to the heart of issue.

We need to see the detail. What workers need are real enforceable rights which provide greater security and protection, backed up by trade union representation.

On the fundamental issue of defining whether someone is an employee, a worker or self-employed, all that is proposed in report is yet more consultation when what is needed, for the sake of millions in insecure employment, is action.

Gautam Sahgal, Chief Operating Officer, Perkbox:

It’s quite bold of the Prime Minister to say that this report will mean substantial progress towards building an economy ‘that works for everyone’. The twists and turns of Brexit will surely translate into a much greater demand for flexibility than what's implied in this report. Perhaps, even the flexibility of relocating to another country, for many.

Government should be focusing its efforts on creating what's now the twice delayed immigration white paper, originally planned for summer 2017 and recently delayed again until autumn. This is what UK firms urgently need, to plan for change and support their employees in the best way possible. It’s also what workers are most eager to hear about in order to figure out what to do with their uncertain futures now that they still have some transition time remaining, during which their rights remain unchanged.

We would also love to hear more of Your Thoughts on this, so feel free to comment below and tell us what you think!